Overview

This strategy combines support/resistance (S/R) breakout/reversal, volume filtering, and alert systems to capture key market turning points. It identifies price breakout/reversal signals validated by abnormal volume activity to improve reliability. The strategy employs a fixed 2% stop loss and adjustable take profit (default 3%) for risk management.

Strategy Logic

- S/R Identification: Uses

ta.pivothigh()andta.pivotlow()to detect key price levels within a specified period (pivotLen). Signals trigger when price breaks resistance (upward >1%) or bounces from support (false breakdown recovery).

- Volume Filter: Calculates volume SMA (volSmaLength periods). A valid signal requires current volume exceeding SMA by volMultiplier (default 1.5x).

- Long/Short Logic:

- Long Condition: Price breaks resistance (close > resZone*1.01) with high volume, or shows false breakdown near support (±1% range) with volume confirmation.

- Short Condition: Price breaks support (close < supZone*0.99) with high volume, or shows false breakout near resistance (±1% range) with volume confirmation.

- Long Condition: Price breaks resistance (close > resZone*1.01) with high volume, or shows false breakdown near support (±1% range) with volume confirmation.

- Risk Management: Fixed 2% stop loss and adjustable take profit (default 3%) via

strategy.exit().

Advantages

- Multi-Factor Validation: Combines price structure (S/R), volume, and market behavior (false breaks), significantly reducing false signals.

- Dynamic Adaptation: Auto-updates S/R levels to adapt to market changes.

- Strict Risk Control: Fixed stop loss prevents excessive losses; adjustable take profit suits varying market conditions.

- High Visibility: Real-time S/R plotting and clear signal labels.

- Alert Integration: Compatible with automated trading systems.

Risks

- Range-Bound Risk: Frequent false breakouts in choppy markets. Solution: Add trend filters like ADX or EMA.

- Parameter Sensitivity: pivotLen and volMultiplier require market-specific tuning. Solution: Parameter optimization and Walk-Forward testing.

- Volume Lag: Abnormal volume may follow price moves. Solution: Incorporate order book data or reduce volSmaLength.

- Gap Risk: Opening gaps may skip stop levels. Solution: Use limit orders or avoid high-volatility sessions.

Optimization Directions

- Trend Filtering: Add ADX>25 or 200EMA direction filters to avoid counter-trend trades.

- Dynamic Parameters: Auto-adjust pivotLen and volMultiplier based on volatility (e.g., ATR).

- Scaled Take Profit: Implement two-tier exits (e.g., close 50% at 2%, trail remainder).

- Machine Learning: Train models to optimize volMultiplier and tpPerc historically.

- Multi-Timeframe Confirmation: Validate signals with higher timeframe S/R levels.

Conclusion

This strategy establishes a high-probability framework through triple validation (price position, volume, price action), ideal for capturing early trend phases. Its transparency and controlled risk are key strengths, though range-bound performance requires caution. Future enhancements should focus on parameter self-adaptation and trend filtering for greater robustness.

Strategy source code

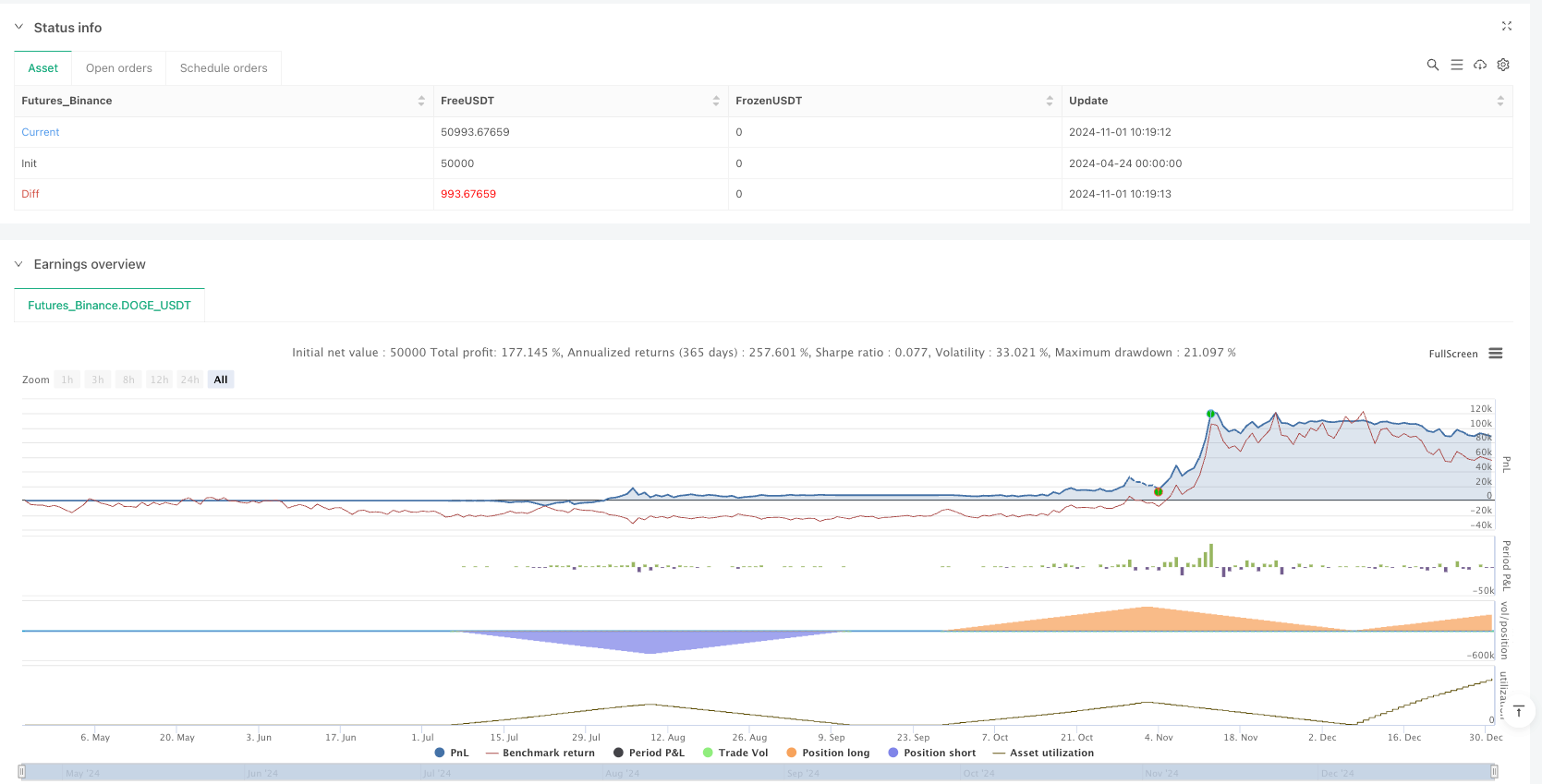

/*backtest

start: 2024-04-24 00:00:00

end: 2024-12-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("S/R Breakout/Reversal + Volume + Alerts", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

pivotLen = input.int(10, "Pivot Lookback for S/R")

volSmaLength = input.int(20, "Volume SMA Length")

volMultiplier = input.float(1.5, "Volume Multiplier")

tpPerc = input.float(3.0, "Take Profit %", step=0.1)

slPerc = 2.0 // Stop Loss fixed at 2%

// === S/R ZONES ===

pivotHigh = ta.pivothigh(high, pivotLen, pivotLen)

pivotLow = ta.pivotlow(low, pivotLen, pivotLen)

var float resZone = na

var float supZone = na

if not na(pivotHigh)

resZone := pivotHigh

if not na(pivotLow)

supZone := pivotLow

plot(supZone, title="Support", color=color.green, linewidth=2, style=plot.style_linebr)

plot(resZone, title="Resistance", color=color.red, linewidth=2, style=plot.style_linebr)

// === VOLUME FILTER ===

volSma = ta.sma(volume, volSmaLength)

highVolume = volume > volSma * volMultiplier

// === LONG LOGIC ===

priceAboveRes = close > resZone * 1.01

nearSupport = close >= supZone * 0.99 and close <= supZone * 1.01

rejectSupport = low <= supZone and close > supZone

longBreakoutCond = priceAboveRes and highVolume

longReversalCond = nearSupport and rejectSupport and highVolume

longCondition = longBreakoutCond or longReversalCond

// === SHORT LOGIC ===

priceBelowSup = close < supZone * 0.99

nearResistance = close >= resZone * 0.99 and close <= resZone * 1.01

rejectResistance = high >= resZone and close < resZone

shortBreakoutCond = priceBelowSup and highVolume

shortReversalCond = nearResistance and rejectResistance and highVolume

shortCondition = shortBreakoutCond or shortReversalCond

// === ENTRIES WITH LABELS ===

if (longCondition)

strategy.entry("Long", strategy.long)

label.new(bar_index, low * 0.995, "BUY", style=label.style_label_up, color=color.green, textcolor=color.white)

if (shortCondition)

strategy.entry("Short", strategy.short)

label.new(bar_index, high * 1.005, "SELL", style=label.style_label_down, color=color.red, textcolor=color.white)

// === TP/SL ===

longTP = close * (1 + tpPerc / 100)

longSL = close * (1 - slPerc / 100)

shortTP = close * (1 - tpPerc / 100)

shortSL = close * (1 + slPerc / 100)

strategy.exit("Long TP/SL", from_entry="Long", limit=longTP, stop=longSL)

strategy.exit("Short TP/SL", from_entry="Short", limit=shortTP, stop=shortSL)

// === ALERT CONDITIONS ===

alertcondition(longCondition, title="Buy Alert", message="🔔 BUY signal: S/R + Volume breakout/reversal")

alertcondition(shortCondition, title="Sell Alert", message="🔔 SELL signal: S/R + Volume breakout/reversal")