Overview

The Turtle Soup Strategy Enhanced is a reversal trading system designed to capture liquidity traps in the market through false breakouts. The core concept is derived from renowned trader Linda Raschke’s “Turtle Soup” philosophy—when turtles (trend-following traders) appear, smart money “cooks” them. Specifically, the strategy identifies fake moves after price breaks recent highs or lows, entering trades when price returns to its original range, leveraging the behavior of large market participants who induce retail traders into breakout positions before reversing the market, providing high-probability entry points for contrarian traders.

This strategy is based on price action analysis, combining multiple advanced indicators including Donchian Channels, Order Blocks, and Fair Value Gaps, offering deep insights into market structure and institutional footprints to provide multi-layered confirmation for trading decisions.

Strategy Principles

The Turtle Soup Strategy’s working mechanism is built upon market psychology and trader behavior patterns. The strategy implements four core trading signal identifications in the code:

Turtle Body Soup Long Signal (TBS Long): When a candle body completely breaks below the recent Donchian low and then closes back within the range. This false breakout typically represents a strong reversal signal.

Turtle Body Soup Short Signal (TBS Short): When a candle body completely breaks above the recent Donchian high and then closes back within the range.

Turtle Wick Soup Long Signal (TWS Long): When a candle’s wick (not the body) breaks below the Donchian low, but the closing price returns within the range. This is considered a weaker but still valid reversal signal.

Turtle Wick Soup Short Signal (TWS Short): When a candle wick breaks above the Donchian high, but the closing price returns within the range.

The strategy also allows for two additional confirmation conditions:

- Order Block (OB) Confirmation: Requires a bullish order block before long entry or a bearish order block before short entry, representing institutional footprints.

- Fair Value Gap (FVG) Confirmation: Looks for gaps in price action, representing imbalances, to provide additional reliability for entries.

When selected conditions are met, the strategy enters at the close of the signal candle, sets a stop loss (SL) below the candle’s low (for longs) or above the high (for shorts), and automatically calculates a profit target (TP) based on a preset risk-reward ratio (default 1.5x).

Strategy Advantages

Captures High-Probability Reversal Points: The main advantage of the Turtle Soup Strategy is its ability to effectively identify “false breakouts” or “stop hunting” areas, which typically represent action points for large market participants. By trading counter to these areas, traders can align themselves with “smart money.”

Multiple Confirmation Mechanisms: The strategy combines various technical indicators and price action signals, enhancing the reliability of trading signals through layered confirmation conditions (TBS/TWS signals + optional OB/FVG filters), significantly reducing false signals.

Automated Risk Management: The strategy has built-in risk management functionality, automatically calculating stop loss and take profit levels for each trade, ensuring limited losses in case of error while allowing for reasonable profits when correct. The risk-reward ratio is adjustable to accommodate different risk tolerances.

Adaptable to Different Market Environments: Although the strategy performs best in oscillating or range-bound markets, it can be adapted to different market conditions by adjusting parameters (such as the Donchian lookback period).

Visually Intuitive: The strategy provides clear visual markers and signal indicators, allowing traders to easily understand market conditions and make quick decisions.

Strategy Risks

False Signal Risk: Even with multiple confirmations, the market may still produce false signals, especially during high volatility or low liquidity periods. To mitigate this risk, it’s recommended to thoroughly backtest before live trading and consider applying the strategy during high liquidity market sessions.

Timeframe Dependency: The strategy’s performance may vary significantly across different timeframes. Lower timeframes (e.g., 15 minutes to 1 hour) may generate more trading signals but also increase noise, while higher timeframes provide fewer but more reliable signals. The solution is to conduct multi-timeframe analysis or select an appropriate timeframe based on trading style.

Strong Trend Market Risk: In strongly trending markets, the effectiveness of false breakout reversal signals may decrease as the probability of true breakouts increases. Avoid counter-trend trading in clearly directional markets, or add additional trend filters to mitigate this risk.

Parameter Sensitivity: The Donchian lookback period (default 20) significantly impacts strategy performance. Too short may lead to excessive signals, while too long may miss opportunities. It’s recommended to find the most suitable parameters for specific markets and timeframes through backtesting.

Stop Loss Setting Risk: The current strategy sets stop losses at the extremes of the signal candle, which may be too tight or too loose in certain situations. Consider adjusting stop loss distance through volatility or ATR to make it more flexible.

Strategy Optimization Directions

Adaptive Donchian Period: The current strategy uses a fixed Donchian lookback period (default 20). Consider implementing an adaptive period that dynamically adjusts based on market volatility or trend strength. For example, use longer periods in high-volatility environments and shorter periods in low-volatility environments to adapt to different market states.

Add Trend Filter: To avoid counter-trend trading in strong trends, add a trend filter such as moving average direction or ADX indicator, enabling reversal signals only in oscillating markets. This can significantly improve strategy stability in long-term applications.

Optimize Stop Loss/Take Profit Strategy: The current strategy uses a fixed risk-reward ratio for take profit. Consider implementing multiple profit targets or trailing stops to better capture large price movements. For example, move the stop loss to breakeven after the first profit target is reached, allowing the remaining position to continue running.

Time Filter: Add time filtering functionality to avoid trading before/after market open/close or during important news releases, periods typically characterized by high and unpredictable volatility.

Volume Confirmation: Integrate volume analysis into the strategy to ensure price action is supported by sufficient trading volume. For example, require low volume during false breakouts and increased volume when returning to the range to confirm the validity of the reversal.

Machine Learning Optimization: Consider applying machine learning techniques to automatically identify optimal parameter combinations based on historical data, or to predict the probability of signal success, further enhancing strategy stability and profitability.

Summary

The Turtle Soup Strategy Enhanced is a carefully designed reversal trading system that provides high-probability trading opportunities by capturing false breakouts and liquidity traps in the market. By combining multiple confirmation tools such as Donchian Channels, Order Blocks, and Fair Value Gaps, the strategy can effectively identify key turning points in market structure.

The uniqueness of this strategy lies in its profound understanding of market psychology, particularly how large market participants use liquidity areas to induce retail traders into unfavorable positions. By standing alongside “smart money,” the strategy can achieve stable returns with controlled risk.

While the strategy performs best in oscillating and range-bound markets, it can be further enhanced in adaptability and robustness through the optimization directions proposed above, maintaining effectiveness across a wider range of market conditions. Most importantly, traders should understand the principles behind the strategy, combine it with risk management techniques, and validate its effectiveness in specific markets through thorough backtesting and simulated trading.

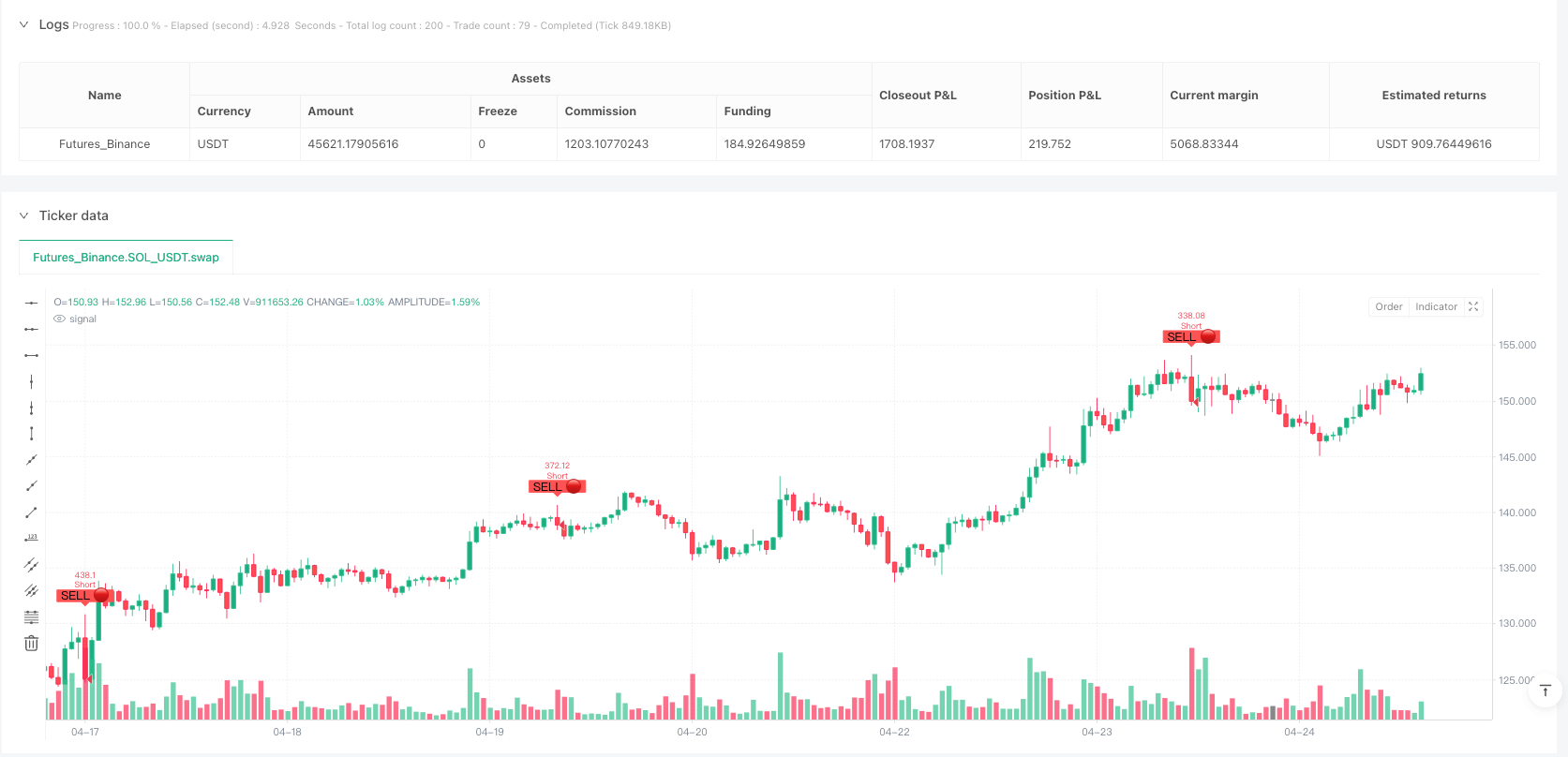

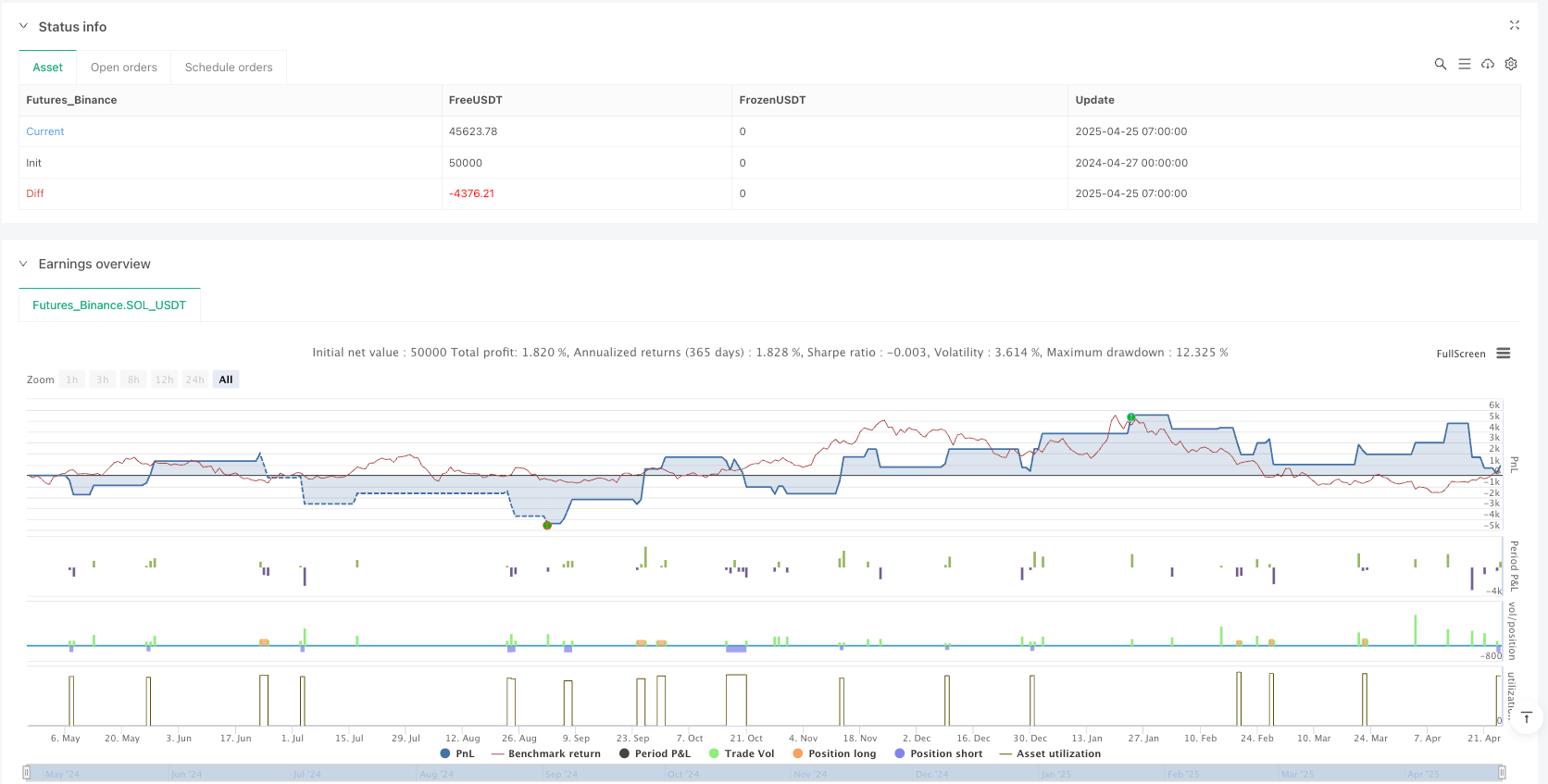

/*backtest

start: 2024-04-27 00:00:00

end: 2025-04-25 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("🐢 Turtle Soup Strategy v1.0 – TBS/TWS + OB/FVG + SL/TP", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

lookback = input.int(20, "Donchian Lookback", minval=5)

rr1 = input.float(1.5, "TP1 Risk-Reward")

useOB = input.bool(true, "Use Order Block Filter")

useFVG = input.bool(false, "Use FVG Filter")

// === DONCHIAN LEVELS ===

highestHigh = ta.highest(high[1], lookback)

lowestLow = ta.lowest(low[1], lookback)

// === ORDER BLOCK LOGIC ===

bullOB = close > open and close > high[1] and open[1] > close[1]

bearOB = close < open and close < low[1] and open[1] < close[1]

// === FVG LOGIC ===

fvgUp = low > high[2]

fvgDn = high < low[2]

// === TURTLE SOUP SETUPS ===

// Body-based reversal (TBS)

tbsLong = close < lowestLow and close > open and open < lowestLow

tbsShort = close > highestHigh and close < open and open > highestHigh

// Wick-based reversal (TWS)

twsLong = low < lowestLow and close > lowestLow

twsShort = high > highestHigh and close < highestHigh

// === CONFLUENCE CHECK ===

longConfluence = (not useOB or bullOB) and (not useFVG or fvgUp)

shortConfluence = (not useOB or bearOB) and (not useFVG or fvgDn)

// === FINAL SIGNAL CONDITIONS ===

longEntry = (tbsLong or twsLong) and longConfluence

shortEntry = (tbsShort or twsShort) and shortConfluence

// === ENTRY + SL/TP LEVEL CALCULATION ===

longSL = low

shortSL = high

longTP = close + (close - low) * rr1

shortTP = close - (high - close) * rr1

// === STRATEGY EXECUTION ===

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", from_entry="Long", limit=longTP, stop=longSL)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", from_entry="Short", limit=shortTP, stop=shortSL)

// === OPTIONAL: PLOT SIGNAL LABELS ===

plotshape(longEntry, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY 🟢")

plotshape(shortEntry, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL 🔴")