Overview

The Dynamic Breakout Bollinger Band with Adaptive Trailing Stop Strategy is a trend-following system based on price breakouts above the upper Bollinger Band, combining volatility analysis from the Bollinger Bands indicator with dynamic trailing stop functionality using the ATR (Average True Range) indicator. This strategy primarily enters long positions when prices break above the upper Bollinger Band and uses ATR-multiplier-based trailing stops to protect profits and control risk. This design allows the strategy to profit from strong upward trends while adapting to changes in market volatility through dynamically adjusted stop-loss positions.

Strategy Principles

The core principles of this strategy are built upon several key components:

Bollinger Bands Setup: The strategy uses customizable length (default 20) Bollinger Bands with adjustable standard deviation multipliers (default 2.0), while supporting various moving average types (SMA, EMA, SMMA, WMA, VWMA) as the middle band basis. This flexibility allows traders to adjust the sensitivity of the Bollinger Bands according to different market environments.

Entry Logic: When the price breaks above the upper Bollinger Band, the strategy generates a long signal. This entry condition is based on the assumption that after breaking above the upper band, prices may continue to exhibit strong momentum, forming a trending market condition.

Exit Mechanism: The strategy employs two exit methods:

- Direct position closure when the price falls below the lower Bollinger Band

- Use of ATR-based trailing stops, with a distance of the ATR value multiplied by a factor (default 2.0)

Money Management: The strategy defaults to using 25% of account equity for each trade, providing a degree of risk diversification.

Time Filtering: Trades are executed only within a user-defined date range, defaulting from January 1, 2018, to December 31, 2069.

This design combination enables the strategy to capture strong breakout movements while protecting existing profits through dynamically adjusted stop-loss positions, forming a relatively complete trading system.

Strategy Advantages

Through deep analysis of the strategy’s code implementation, the following significant advantages can be summarized:

Strong Adaptability: By combining Bollinger Bands and ATR, the strategy can automatically adapt to changes in market volatility. In high-volatility markets, ATR values increase, providing more relaxed stop-loss distances; in low-volatility markets, stop-loss distances correspondingly decrease. This adaptability allows the strategy to maintain relatively stable performance across different market environments.

Trend Capture Capability: The strategy focuses on capturing strong trends after breakouts, especially when prices break above the upper Bollinger Band, which often indicates stronger upward momentum.

Dynamic Profit Protection: Using ATR-based trailing stops allows the strategy to dynamically adjust stop-loss positions to lock in existing profits while maintaining sufficient profit space, preventing profit drawdowns.

Parameter Adjustability: The strategy provides multiple adjustable parameters, including Bollinger Band length, standard deviation multiplier, moving average type, ATR calculation period, and trailing stop multiplier, allowing traders to optimize according to specific markets and personal risk preferences.

Integrated Money Management: The built-in money management rule (using 25% of account equity) provides certain risk control, avoiding risks associated with excessive leverage.

Strategy Risks

Despite its reasonable design, the strategy still has the following potential risks:

False Breakout Risk: After breaking above the upper Bollinger Band, prices may experience false breakouts, leading to short-term drawdowns. To mitigate this risk, consider adding confirmation indicators or waiting for consolidation after the breakout before entry.

Trend Reversal Risk: During strong trend reversals, ATR trailing stops may not stop losses in time, leading to partial profit drawdowns. Consider combining trend indicators to identify trend turning points earlier.

Parameter Sensitivity: Strategy performance is sensitive to parameter selection, especially Bollinger Band length and standard deviation multiplier. Optimal parameters may vary significantly under different market environments, requiring regular backtesting and adjustment.

Unidirectional Trading Limitation: The current strategy only implements long logic, which may perform poorly in bear markets or ranging markets. Adding short logic can enhance strategy adaptability across different market environments.

Money Management Risk: Using a fixed 25% of account equity may be too risky in certain high-volatility markets. Consider dynamically adjusting position size based on volatility to improve the robustness of money management.

Strategy Optimization Directions

Based on the strategy’s implementation and potential risks, here are several worthwhile optimization directions:

Entry Condition Optimization: Consider adding volume confirmation or pattern confirmation on top of price breakouts above the upper Bollinger Band to reduce losses from false breakouts. For example, require significant volume increases during breakouts, or combine with momentum indicators like RSI to confirm overbought conditions haven’t occurred.

Bidirectional Trading Extension: Add short logic to enter short positions when prices break below the lower Bollinger Band, allowing the strategy to profit in downtrends as well, thereby improving overall profitability.

Dynamic Risk Management: Replace the fixed 25% equity allocation with a position management system that dynamically adjusts based on market volatility. For example, reduce positions in higher volatility and appropriately increase positions in lower volatility to maintain relatively stable risk exposure.

Timeframe Optimization: Consider applying strategy signals across multiple timeframes to form a timeframe confirmation system. For example, only enter when both daily and 4-hour charts simultaneously meet breakout conditions, which can reduce false signals and improve win rates.

Intelligent Parameter Adaptation: Implement a dynamic parameter optimization system that automatically adjusts Bollinger Band length and standard deviation multiplier based on recent market volatility characteristics, allowing the strategy to better adapt to constantly changing market environments.

Adding Filter Conditions: Introduce trading filter mechanisms based on market states (trending, oscillating, or ranging), generating trading signals only in market environments suitable for the strategy’s characteristics, avoiding frequent trading in unfavorable environments.

Summary

The Dynamic Breakout Bollinger Band with Adaptive Trailing Stop Strategy is a well-designed trend-following system that captures strong movements through Bollinger Band breakouts and protects profits using ATR trailing stops. Its core value lies in the organic combination of volatility analysis and dynamic risk management, forming a highly adaptive trading framework.

The strategy’s main advantages are its adaptability to market volatility changes and clear trading logic, while potential risks mainly come from false breakouts and parameter sensitivity. Through the recommended optimization directions, especially enhanced entry confirmation, bidirectional trading extension, and dynamic position management, these risks can be effectively mitigated.

For practical application, traders are advised to conduct thorough backtesting across different market environments and instruments, adjusting parameter settings according to specific situations. Additionally, using this strategy as part of a larger trading system, combined with other strategies or indicators, can further improve overall trading performance. This volatility-based dynamic adaptation system provides a worthwhile implementation framework for trend-following strategies.

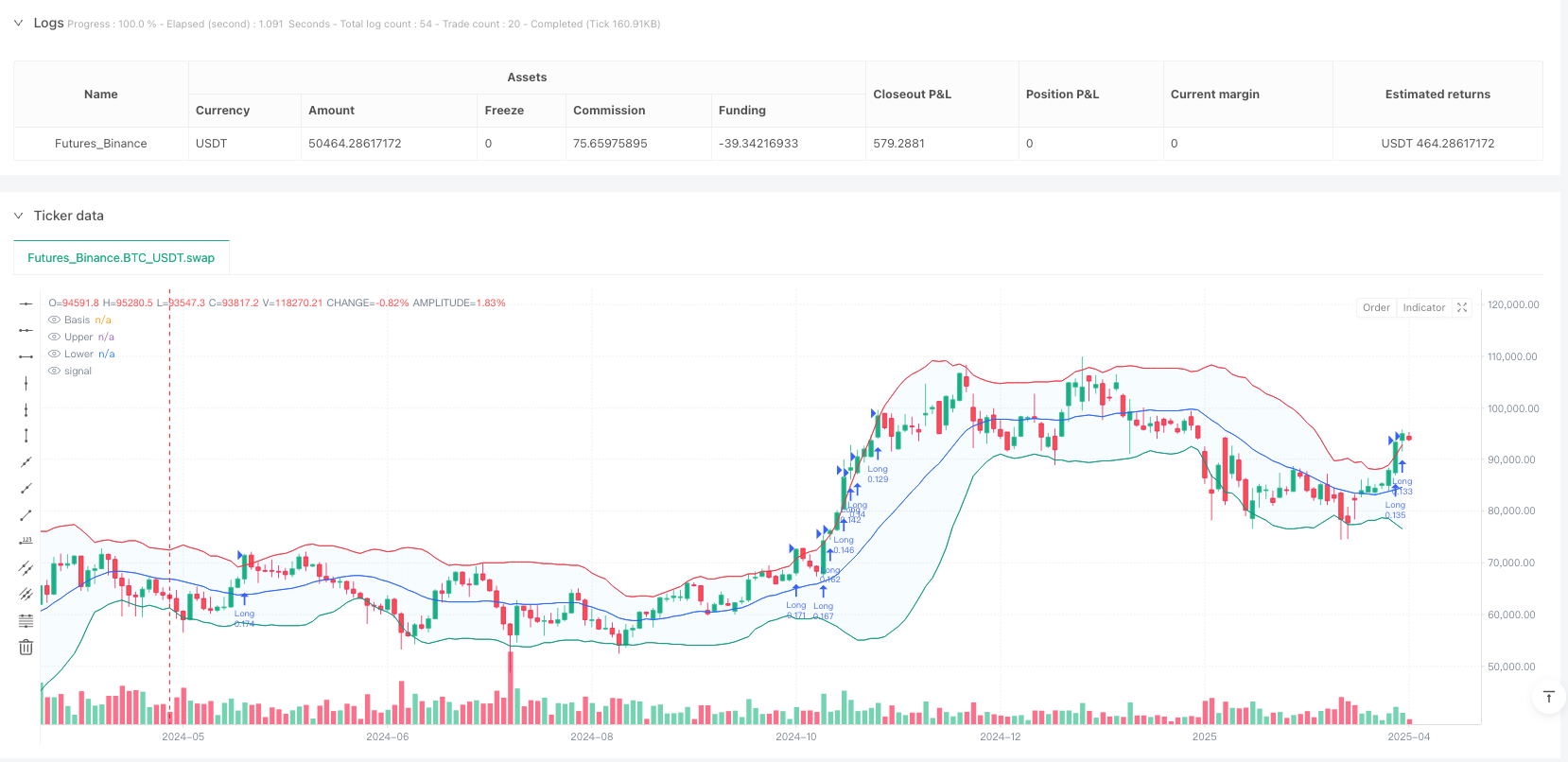

/*backtest

start: 2024-04-29 00:00:00

end: 2025-04-28 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="IMPOSSIBLE IS IN", overlay=true, commission_type=strategy.commission.percent, commission_value=0.0, slippage=0, default_qty_type=strategy.percent_of_equity, default_qty_value=25)

length = input.int(20, minval=1, title="BB Length")

mult = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev")

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

offset = input.int(0, "Offset", minval=-500, maxval=500)

// Bollinger Bands Calculation

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(basis, "Basis", color=#2962FF, offset=offset)

p1 = plot(upper, "Upper", color=#F23645, offset=offset)

p2 = plot(lower, "Lower", color=#089981, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// ATR for Dynamic Trailing Stop

atrLength = input.int(14, minval=1, title="ATR Length")

atrMultTrail = input.float(2.0, minval=0.1, title="ATR Multiplier for Trailing Stop")

atrValue = ta.atr(atrLength)

trailOffset = atrValue * atrMultTrail

longCondition = (strategy.position_size == 0) and (close > upper)

exitCondition = (strategy.position_size > 0) and (close < lower)

if longCondition

strategy.entry("Long", strategy.long)

// Set Trailing Stop based on ATR

strategy.exit("Exit Long", "Long", trail_price=close, trail_offset=trailOffset)

else if exitCondition

strategy.close("Long")