Strategy Overview

The RSI Parabolic Trend Reversal Momentum Strategy is an advanced quantitative trading system that combines multiple technical indicators. The core concept applies the Parabolic SAR indicator to the Relative Strength Index (RSI) rather than directly to price, creating a mechanism that effectively captures market momentum reversals. Additionally, this strategy cleverly incorporates a moving average filter to ensure trades are executed only in the direction of the dominant trend, and automatically calculates Take Profit (TP) and Stop Loss (SL) levels based on a fixed risk-reward ratio, providing traders with clear visual risk guidance and consistent trade planning.

Through in-depth code analysis, we can see that this strategy is particularly suitable for application in 5-minute to 30-minute timeframes, applicable to financial products such as forex pairs, gold, crude oil, and stock indices with certain volatility. The strategy performs best in trending markets and remains responsive even in moderate ranging markets.

Strategy Principles

The core logic of this strategy can be broken down into three key components:

RSI-Based Parabolic SAR Momentum Detection: Traditional Parabolic SAR indicators are typically applied to price data to identify reversal points in price trends. In this strategy, the author innovatively applies the Parabolic SAR to the RSI indicator, enabling it to capture momentum reversals, not just price fluctuations. The code defines a custom function

pine_sarthat takes RSI values as the input source rather than price and calculates the corresponding SAR values.Moving Average Directional Filter: The strategy uses a moving average (either Exponential Moving Average EMA or Simple Moving Average SMA) as a trend direction filter. This ensures that trades are executed only in the trend direction: long positions are only allowed when price is above the moving average, and short positions are only allowed when price is below the moving average. This mechanism is implemented in the code through the

ma_filtervariable, which can be either SMA or EMA depending on the user’s choice.Automatically Calculated TP/SL Levels: Each trade includes automatically calculated Take Profit (TP) and Stop Loss (SL) lines based on the configured risk-reward ratio. The code calculates the TP/SL positions using the

risk_rewardparameter andbuffer_pipsparameter, and draws these horizontal lines on the chart using theline.newfunction, providing traders with intuitive visual references for risk management.

The entry condition code implementation is very precise:

- Long condition (longCondition): When the RSI’s Parabolic SAR flips from above to below (indicating a bullish signal), the current RSI value is below the oversold line (30), and the price is above the moving average.

- Short condition (shortCondition): When the RSI’s Parabolic SAR flips from below to above (indicating a bearish signal), the current RSI value is above the overbought line (70), and the price is below the moving average.

When these conditions are met, the strategy closes any existing opposite positions, opens new positions, and sets the corresponding take profit and stop loss levels.

Strategy Advantages

Dual Confirmation of Momentum and Trend: This strategy combines momentum indicators (RSI’s Parabolic SAR) and trend indicators (moving average), providing a dual confirmation mechanism for trading signals that significantly reduces the risk of false signals. This combination allows traders to execute trades at the precise moment of momentum reversal, but only in the direction of the dominant trend.

Visual Risk Management: The strategy automatically draws take profit and stop loss level lines on the chart, providing traders with clear visual guidance. This approach not only helps maintain disciplined trading plans but also reduces the impact of emotional decision-making.

Strong Adaptability: By adjusting parameters, this strategy can adapt to different market conditions and trading styles. Users can adjust parameters such as risk-reward ratio, stop loss buffer, RSI length, etc., according to their risk tolerance.

Quick Signal Generation: The RSI-based Parabolic SAR can quickly capture changes in momentum, enabling the strategy to identify potential trend reversals at an early stage.

Clear Logic: The strategy’s logical structure is clear, easy to understand and execute, suitable for traders of all levels.

Continuous Risk Control: Through fixed risk-reward ratios and predefined stop loss positions, this strategy ensures consistency of risk for each trade, which is crucial for long-term trading success.

Strategy Risks

Overtrading Risk: In highly volatile markets lacking clear trends, this strategy may generate too many trading signals, leading to frequent position reversals and potentially increased trading costs. The solution is to add additional filtering conditions, such as volatility thresholds or longer timeframe confirmations.

Parameter Sensitivity: The performance of the strategy is highly dependent on parameter selection, such as RSI length, SAR parameters, and moving average length. Inappropriate parameter settings may lead to performance degradation or over-optimization. Detailed parameter testing and robustness checks are recommended.

False Breakout Risk: In ranging markets or high volatility environments, the RSI’s Parabolic SAR may produce misleading reversal signals. Solutions may include adding additional confirmation indicators or increasing the strictness of entry conditions.

Slippage Risk in Rapid Market Conditions: The code uses a fixed stop loss buffer (calculated in points), but in extreme market conditions, the actual execution price may far exceed the expected stop loss position. It is recommended to add a dynamically adjusting slippage protection mechanism.

Difference Between Backtest and Actual Performance: Backtest results do not include broker-specific execution factors such as actual slippage and spreads. These factors should be considered in actual trading and the strategy adjusted accordingly.

Reliance on Continuity of Historical Patterns: Like all technical analysis strategies, this strategy assumes that historical price patterns will continue to be effective in the future. Fundamental changes in market conditions may affect the effectiveness of the strategy.

Strategy Optimization Directions

Dynamic Parameter Adjustment: The current strategy uses fixed parameter settings such as RSI length, SAR parameters, and risk-reward ratio. Implementing dynamic parameter adjustments based on market volatility or trend strength can improve the adaptability of the strategy. For example, increasing RSI length and SAR maximum value in high volatility environments to reduce false signals.

Multi-Timeframe Analysis Integration: Adding higher timeframe trend confirmation can improve the reliability of the strategy. For example, only allowing trades in the direction of the daily trend on 4-hour and 1-hour charts. This approach can be implemented with the following code extension:

higher_tf_trend = request.security(syminfo.ticker, "240", close > ma_filter)

longCondition := longCondition and higher_tf_trend

shortCondition := shortCondition and not higher_tf_trend

Volume Analysis Integration: Incorporating volume confirmation into the strategy can enhance the reliability of signals. Volume typically increases at trend reversal points, which can serve as an additional filtering condition.

Adaptive Stop Loss Positioning: The current strategy uses fixed points as the stop loss buffer. Implementing adaptive stops based on ATR (Average True Range) can better reflect current market volatility and improve the precision of risk management.

Partial Profit Taking and Trailing Stops: Introducing partial profit-taking and trailing stop mechanisms can optimize the long-term profit structure. For example, taking 50% of profits when reaching 1x the risk-reward ratio and moving the stop loss for the remaining portion to breakeven.

Indicator Divergence Confirmation: Adding detection of RSI divergence with price can improve the quality of reversal signals. When RSI diverges from price movement, it usually indicates a potential trend reversal, which can serve as an additional entry filtering condition.

Machine Learning Optimization: Utilizing machine learning techniques, such as random forests or neural networks, can optimize strategy parameter selection and signal generation processes, identifying the most effective parameter combinations and market conditions based on historical data.

Summary

The RSI Parabolic Trend Reversal Momentum Strategy is a carefully designed trading system that cleverly combines momentum detection (by applying Parabolic SAR to RSI), trend filtering (through moving averages), and visual risk management (through automatically drawn TP/SL levels). This combination creates a clear and responsive trend-following system suitable for various markets and timeframes.

The core advantage of the strategy lies in its ability to execute trades at the precise moment of momentum reversal, but only in the direction of the dominant trend, thereby reducing false signals and improving trading success rates. At the same time, through predefined risk-reward ratios and automatically calculated take profit and stop loss levels, it provides traders with a consistent and disciplined risk management framework.

Although the strategy has some potential risks, such as parameter sensitivity and false breakout risk, these risks can be effectively managed through reasonable optimization and additional filtering mechanisms. Future optimization directions should focus on dynamic parameter adjustment, multi-timeframe analysis, volume confirmation, and smarter risk management techniques.

Overall, this is a clear-concept, logically rigorous trading strategy that combines multiple key elements of technical analysis, providing traders with a structured decision-making framework. Whether used for automated system trading or as a tool to assist manual trading, it can provide traders with valuable market insights and strict risk control.

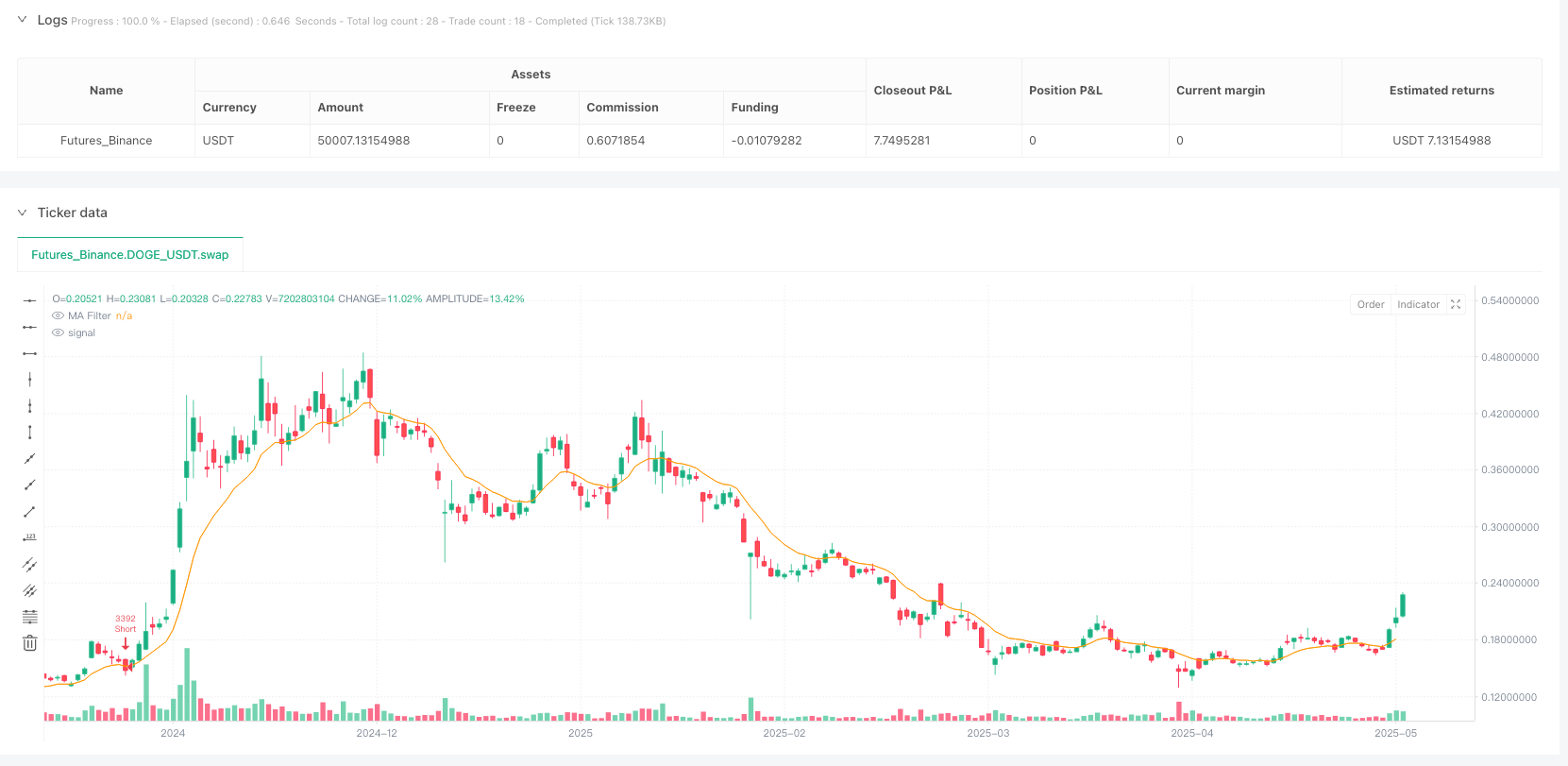

/*backtest

start: 2024-05-13 00:00:00

end: 2025-05-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PakunFX

//@version=6

strategy("Parabolic RSI Strategy + MA Filter + TP/SL 【PakunFX】", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// === Inputs ===

rsi_len = input.int(14, "RSI Length")

upper_ = input.int(70, "RSI Overbought")

lower_ = input.int(30, "RSI Oversold")

sar_start = input.float(0.02, "SAR Start", step=0.01)

sar_inc = input.float(0.02, "SAR Increment", step=0.01)

sar_max = input.float(0.2, "SAR Maximum", step=0.01)

risk_reward = input.float(2.0, "Risk Reward Ratio", step=0.1)

buffer_pips = input.float(100.0, "Stop Buffer (pips)", step=0.1)

ma_length = input.int(11, "MA Length")

use_sma = input.bool(false, "Use SMA (if false, uses EMA)")

pip_size = syminfo.mintick

pip_buffer = pip_size * buffer_pips

// === Indicators ===

rsi = ta.rsi(close, rsi_len)

ma_filter = use_sma ? ta.sma(close, ma_length) : ta.ema(close, ma_length)

// === Custom Parabolic SAR on RSI ===

pine_sar(src, start, inc, max) =>

src_high = src + 1

src_low = src - 1

var float result = na

var float maxMin = na

var float acceleration = na

var bool isBelow = false

bool isFirstTrendBar = false

if bar_index <= rsi_len + 2

if src > src[1]

isBelow := true

maxMin := src_high

result := src_low[1]

else

isBelow := false

maxMin := src_low

result := src_high[1]

isFirstTrendBar := true

acceleration := start

result := result + acceleration * (maxMin - result)

if isBelow

if result > src_low

isFirstTrendBar := true

isBelow := false

result := math.max(src_high, maxMin)

maxMin := src_low

acceleration := start

else

if result < src_high

isFirstTrendBar := true

isBelow := true

result := math.min(src_low, maxMin)

maxMin := src_high

acceleration := start

if not isFirstTrendBar

if isBelow and src_high > maxMin

maxMin := src_high

acceleration := math.min(acceleration + inc, max)

if not isBelow and src_low < maxMin

maxMin := src_low

acceleration := math.min(acceleration + inc, max)

if isBelow

result := math.min(result, src_low[1])

if bar_index > 1

result := math.min(result, src_low[2])

else

result := math.max(result, src_high[1])

if bar_index > 1

result := math.max(result, src_high[2])

[result, isBelow]

[sar_rsi, isBelow] = pine_sar(rsi, sar_start, sar_inc, sar_max)

// === Entry Conditions ===

longCondition = isBelow != isBelow[1] and isBelow and barstate.isconfirmed and sar_rsi <= lower_ and close > ma_filter

shortCondition = isBelow != isBelow[1] and not isBelow and barstate.isconfirmed and sar_rsi >= upper_ and close < ma_filter

// === Entry Execution + Persistent TP/SL Lines ===

if (longCondition)

stopLoss = low - pip_buffer

takeProfit = open + (open - stopLoss) * risk_reward

strategy.close("Short")

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", "Long", stop=stopLoss, limit=takeProfit)

if (shortCondition)

stopLoss = high + pip_buffer

takeProfit = open - (stopLoss - open) * risk_reward

strategy.close("Long")

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", "Short", stop=stopLoss, limit=takeProfit)

// === Plotting ===

plot(ma_filter, title="MA Filter", color=color.orange)