Overview

This is a quantitative trading strategy based on New York market opening range breakouts, combined with volume confirmation and Exponential Moving Averages (EMAs) as trend filters. The strategy monitors the price range formed during the first 15 minutes after the New York session opens (adjustable), and once the price breaks above or below this range after formation, while meeting volume and EMA trend confirmation conditions, it triggers corresponding long or short trading signals. The strategy employs ATR (Average True Range) based stop-loss and take-profit settings to control risk and lock in profits.

Strategy Principles

This strategy is based on the market concept that the price range formed during the market opening period has significant psychological support and resistance implications. The specific operating principles are as follows:

- Defining the Opening Range: The strategy records the highest and lowest prices within a specified duration (default 15 minutes) after the New York market opens (9:30 AM), forming the opening range (ORB).

- Post-Formation Breakout: When the price breaks above or below the opening range after its formation, it may indicate the direction of the day’s price movement.

- Trend Confirmation: The strategy uses two EMAs (default 20-period and 50-period) as trend filters to ensure the trading direction is consistent with the overall trend.

- Volume Confirmation: Requires the volume at breakout to be significantly higher than the average level (default 1.3 times the 20-period average volume) to verify the validity of the breakout.

- Risk Management: Uses ATR-based dynamic stop-loss and take-profit levels, automatically adjusting risk parameters based on market volatility.

Trade signal generation logic: - Long Signal: Price breaks above the opening range + Price above both EMAs + Volume confirmation - Short Signal: Price breaks below the opening range + Price below both EMAs + Volume confirmation

Strategy Advantages

Precise Market Timing: By focusing on the market opening session, the strategy can capture important early price movements driven by institutional investors, which often determine the trading direction for the entire day.

Multiple Confirmation Mechanisms: The strategy combines price breakout, trend direction, and volume triple confirmation mechanisms, significantly reducing the risk of false breakouts. The volume confirmation requirement, in particular, ensures trading only occurs when there is sufficient market participation.

Dynamic Risk Management: By using ATR to dynamically adjust stop-loss and take-profit levels, the strategy can intelligently adjust risk parameters based on current market volatility, maintaining a consistent risk-reward ratio in different volatility environments.

Flexible Parameters: The strategy provides multiple adjustable parameters, including opening range duration, volume multiplier requirements, EMA periods, and ATR settings, allowing users to optimize strategy performance based on different trading instruments and market environments.

Trend-Following Characteristics: Through the EMA filter, the strategy ensures trading only in the direction of the overall trend, improving the success rate and sustainability of trades.

Strategy Risks

False Breakout Risk: Despite multiple confirmation mechanisms, the market may still quickly reverse after a breakout, triggering stop-losses. The solution is to add additional filtering conditions, such as breakout confirmation duration or stricter volume requirements.

Market Noise Impact: Especially in highly volatile market environments, the opening range may be too wide or too narrow, affecting strategy performance. Consider using volatility filters, adjusting strategy parameters, or suspending trading on abnormally volatile days.

Specific Time Period Dependency: The strategy heavily relies on price behavior during the opening session, potentially missing trading opportunities at other times. Consider extending to multiple time windows or combining with other trading signals.

Parameter Sensitivity: Strategy performance is sensitive to parameter selection, especially EMA lengths and volume multiplier. Comprehensive parameter optimization and backtesting are recommended to find robust parameter combinations.

Market Environment Adaptability: In markets with unclear trends or range-bound conditions, the strategy may generate more losing trades. Consider introducing trend strength indicators (such as ADX) as additional filters, or dynamically adjusting strategy parameters in different market environments.

Strategy Optimization Directions

Enhanced Trend Filtering: The current strategy uses two EMAs as trend filters; consider adding ADX (Average Directional Index) to assess trend strength and only trade when trends are clear. This will reduce false signals in sideways markets.

Dynamic Volume Thresholds: The current strategy uses a fixed volume multiplier (1.3x); consider dynamically adjusting volume requirements based on market volatility or time periods to maintain appropriate sensitivity in different market environments.

Breakout Confirmation Mechanism: Add post-breakout confirmation conditions, such as requiring the price to maintain direction for a certain period (e.g., 5 minutes) after breakout, or using candlestick patterns for confirmation, which will reduce the risk of false breakouts.

Optimized Take-Profit/Stop-Loss Strategy: The current strategy uses the same ATR multiplier for take-profit and stop-loss; consider using asymmetric risk-reward ratios (such as 1:2 or 1:3), or implementing dynamic take-profit strategies, such as trailing stops or partial profit-taking.

Time Filters: Since different trading sessions have different characteristics, add time filters to avoid sessions with low liquidity or unfavorable volatility, such as lunch hours or end-of-day sessions.

Market State Classification: Develop market state classification models to identify different market environments (such as trend, oscillation, high volatility, etc.) and set different strategy parameters or trading rules for each environment.

Multi-Timeframe Analysis: Introduce trend determination from higher timeframes to ensure trading direction is consistent with larger market trends, enhancing the strategy’s robustness.

Summary

The Opening Range Breakout Strategy with Volume Confirmation and Exponential Moving Averages is a well-designed quantitative trading system that utilizes key price information from the market opening session, combined with technical indicators and volume data, to form a complete trading decision framework. This strategy is particularly suitable for capturing intraday trend movements, effectively reducing false signal risks through multiple confirmation mechanisms.

The core advantage of the strategy lies in its accurate grasp of market opening dynamics and strict trade condition screening, while risks mainly come from dependency on specific time periods and parameter sensitivity. Through the suggested optimization directions, especially enhanced trend filtering and breakout confirmation mechanisms, this strategy has the potential to further improve its robustness and adaptability.

For quantitative traders, this strategy provides a structured framework that can be flexibly adjusted and optimized for different market environments and trading instruments. Most importantly, it emphasizes the importance of combining price action, volume, and trend analysis, which are the cornerstones of successful trading systems.

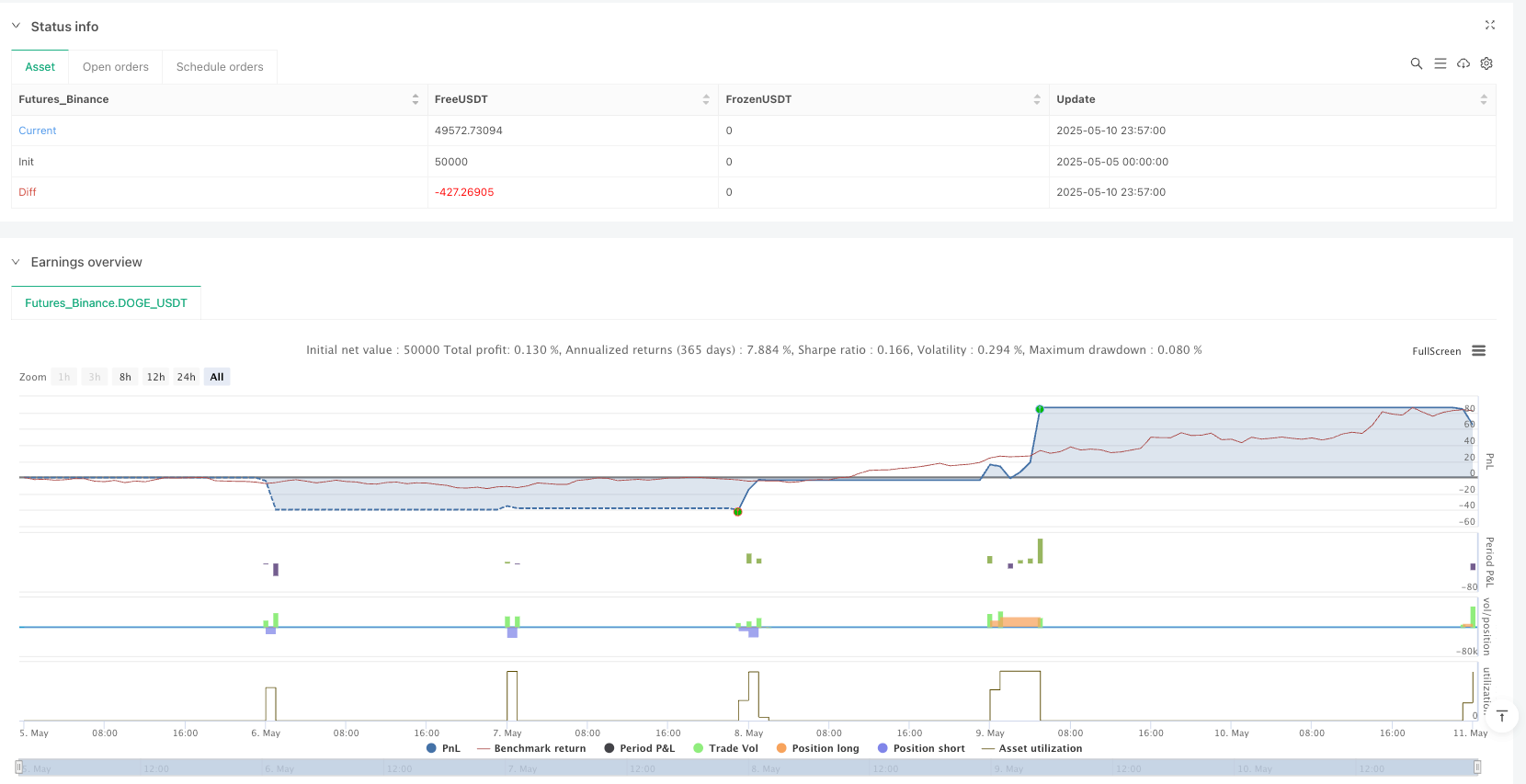

/*backtest

start: 2025-05-05 00:00:00

end: 2025-05-11 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("ORB Strategy w/ Volume Confirmation & EMAs", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// INPUTS

rangeDuration = input.int(15, title="Opening Range Duration (minutes)", minval=1)

volumeMultiplier = input.float(1.3, title="Volume Confirmation Multiplier", minval=1.0)

atrLength = input.int(5, title="ATR Length")

atrMultiplier = input.float(1.5, title="ATR Multiplier for SL/TP")

emaShortLen = input.int(20, title="Short EMA Length")

emaLongLen = input.int(50, title="Long EMA Length")

// TIMESTAMPS FOR NY OPEN RANGE

startTime = timestamp("America/New_York", year, month, dayofmonth, 9, 30)

rangeEndTime = startTime + rangeDuration * 60 * 1000

// TRACK OPENING RANGE

var float orHigh = na

var float orLow = na

if time == startTime

orHigh := high

orLow := low

if time > startTime and time <= rangeEndTime

orHigh := math.max(orHigh, high)

orLow := math.min(orLow, low)

// reset next day

if time > rangeEndTime and ta.change(time("D"))

orHigh := na

orLow := na

// PLOT ORB LINES

plot(orHigh, color=color.green, title="ORB High", linewidth=2)

plot(orLow, color=color.red, title="ORB Low", linewidth=2)

// EMAs FOR TREND FILTER

emaShort = ta.ema(close, emaShortLen)

emaLong = ta.ema(close, emaLongLen)

plot(emaShort, color=color.blue, title="20-period EMA")

plot(emaLong, color=color.purple, title="50-period EMA")

// VOLUME CONFIRMATION

avgVol = ta.sma(volume, 20)

highVolOK = volume > avgVol * volumeMultiplier

// ATR FOR S/L AND T/P

atr = ta.atr(atrLength)

// ENTRY CONDITIONS

longCond = time > rangeEndTime

and close > orHigh

and close > emaShort

and close > emaLong

and highVolOK

shortCond = time > rangeEndTime

and close < orLow

and close < emaShort

and close < emaLong

and highVolOK

if (longCond)

strategy.entry("Long", strategy.long)

if (shortCond)

strategy.entry("Short", strategy.short)

// EXIT (ATR-BASED)

stopDist = atr * atrMultiplier

profitDist = atr * atrMultiplier

strategy.exit("Exit Long", from_entry="Long", stop=close - stopDist, limit=close + profitDist)

strategy.exit("Exit Short", from_entry="Short", stop=close + stopDist, limit=close - profitDist)