Strategy Overview

The RSI Crossover ATR Dynamic SL/TP Dual Position Loop Trading Strategy is a scalping strategy specifically designed for the NASDAQ 100 index (US100) on the 3-minute timeframe. This strategy employs a “1 Buy 2 Sell” loop logic, with each trade managed through ATR (Average True Range) based dynamic stop-loss and take-profit levels.

The strategy utilizes RSI (Relative Strength Index) crossovers with the 50 level as entry signals, combined with an EMA (Exponential Moving Average) as a trend filter to ensure trade direction aligns with the overall trend. Additionally, the strategy leverages the ATR indicator to calculate dynamic stop-loss and take-profit points, effectively adapting to changing market volatility.

Strategy Principles

The operating principles of this strategy can be divided into several key components:

Signal Generation Mechanism:

- Long signal: Triggered when the RSI indicator crosses above the 50 level and price is above the 200-period EMA

- Short signal: Triggered when the RSI indicator crosses below the 50 level and price is below the 200-period EMA

Trend Filtering System:

- Uses 200-period EMA as a trend determination tool

- Only considers long trades when price is above the EMA

- Only considers short trades when price is below the EMA

Position Management Logic:

- Employs a “1 Buy 2 Sell” model, establishing one unit position at each entry

- Exit is divided into two parts: one part for quickly securing minimal profit or loss, the other held until stop-loss or take-profit is triggered

Dynamic Risk Control:

- Calculates dynamic stop-loss and take-profit levels based on 14-period ATR

- Stop-loss is set at entry price minus (ATR × 1.5)

- Take-profit is set at entry price plus (ATR × 1.5)

Contrary Signal Handling:

- When a contrary signal appears, existing positions are closed before establishing new ones

- Ensures no simultaneous holding of both long and short positions

Strategy Advantages

Dynamic Risk Management:

- Uses ATR as a volatility benchmark, allowing stop-loss and take-profit levels to adapt to current market volatility

- Automatically widens stop-loss range during high volatility periods and narrows it during low volatility periods, improving capital efficiency

Trend Confirmation Mechanism:

- Combines RSI signals with EMA trend filtering to avoid counter-trend trading

- Reduces losses from false breakouts and fake signals

Dual Position Exit Strategy:

- One portion of the position can quickly lock in profits, reducing trading risk

- The other portion can fully capture trends, increasing profit potential

Strong Market Adaptability:

- Particularly suitable for trading the highly volatile NASDAQ 100 index

- 3-minute timeframe can capture short-term price movements, suitable for high-frequency trading

Clear and Concise Logic:

- Entry and exit conditions are clear, easy to understand and execute

- Flexible parameter settings that can be adjusted for different market environments

Strategy Risks

High-Frequency Short-Term Trading Risk:

- 3-minute cycle trading frequency is high, potentially leading to overtrading and increased commission costs

- Solution: Consider adding additional filtering conditions, such as trading time filters or minimum volatility thresholds

RSI Signal Lag:

- RSI as an oscillator may produce lagging signals in rapidly trending markets

- Solution: Consider combining price action analysis or more sensitive technical indicators as auxiliary confirmation

Fixed ATR Multiplier Limitations:

- The fixed 1.5x ATR multiplier may be too large or too small in specific market environments

- Solution: Consider dynamically adjusting the ATR multiplier, or optimizing this parameter based on historical volatility data

Trend Reversal Risk:

- During sudden trend reversals, the EMA filter reacts slowly, potentially causing delayed exits

- Solution: Add more sensitive reversal indicators, such as Chande Momentum Oscillator (CMO) or Bollinger Bands

Specific Market Dependency:

- The strategy is optimized for the NASDAQ 100 index and may not be suitable for other markets with different volatility characteristics

- Solution: Before applying to other markets, parameters need to be retested and optimized

Strategy Optimization Directions

Introduce Adaptive Parameter System:

- Dynamically adjust RSI periods and ATR multipliers based on market volatility states

- Rationale: The effectiveness of fixed parameters varies in different volatility environments; an adaptive system can improve strategy stability

Add Time Filtering Function:

- Add trading session restrictions, only trading during high liquidity sessions

- Rationale: The NASDAQ index has significantly different volatility characteristics in different sessions; time filtering can avoid inefficient trading periods

Implement Trailing Stop Mechanism:

- Convert fixed stop-loss to ATR-based trailing stop-loss

- Rationale: Trailing stops can lock in more profits while giving price sufficient room to fluctuate

Integrate Volume Indicators:

- Introduce volume confirmation mechanisms, only entering when supported by volume

- Rationale: High volume typically represents stronger market confirmation and can reduce false breakouts

Develop Multi-Indicator Integration System:

- Combine RSI, Bollinger Bands, MACD, and other indicators for comprehensive judgment

- Rationale: Single indicators can easily produce misleading signals; multi-indicator integration can improve signal reliability

Summary

The RSI Crossover ATR Dynamic SL/TP Dual Position Loop Trading Strategy is a short-term quantitative trading system that combines technical indicators with dynamic risk management. It generates trading signals through RSI crossover signals and an EMA trend filter, while employing ATR-based dynamic stop-loss and take-profit mechanisms to control risk.

The core advantage of this strategy lies in its ability to dynamically adapt to market volatility, and its balance of risk and reward through the “1 Buy 2 Sell” model. Although there are potential risks such as high short-term trading frequency and lagging RSI signals, through the suggested optimization directions—such as adaptive parameter systems, time filtering, and trailing stops—the stability and profitability of the strategy can be further enhanced.

This strategy is particularly suitable for traders who prefer high-frequency trading, are familiar with the characteristics of the NASDAQ 100 index, and possess the discipline to execute short-term trades. However, before real-world application, it is recommended to conduct thorough backtesting and simulated trading to ensure the strategy parameters match the current market environment.

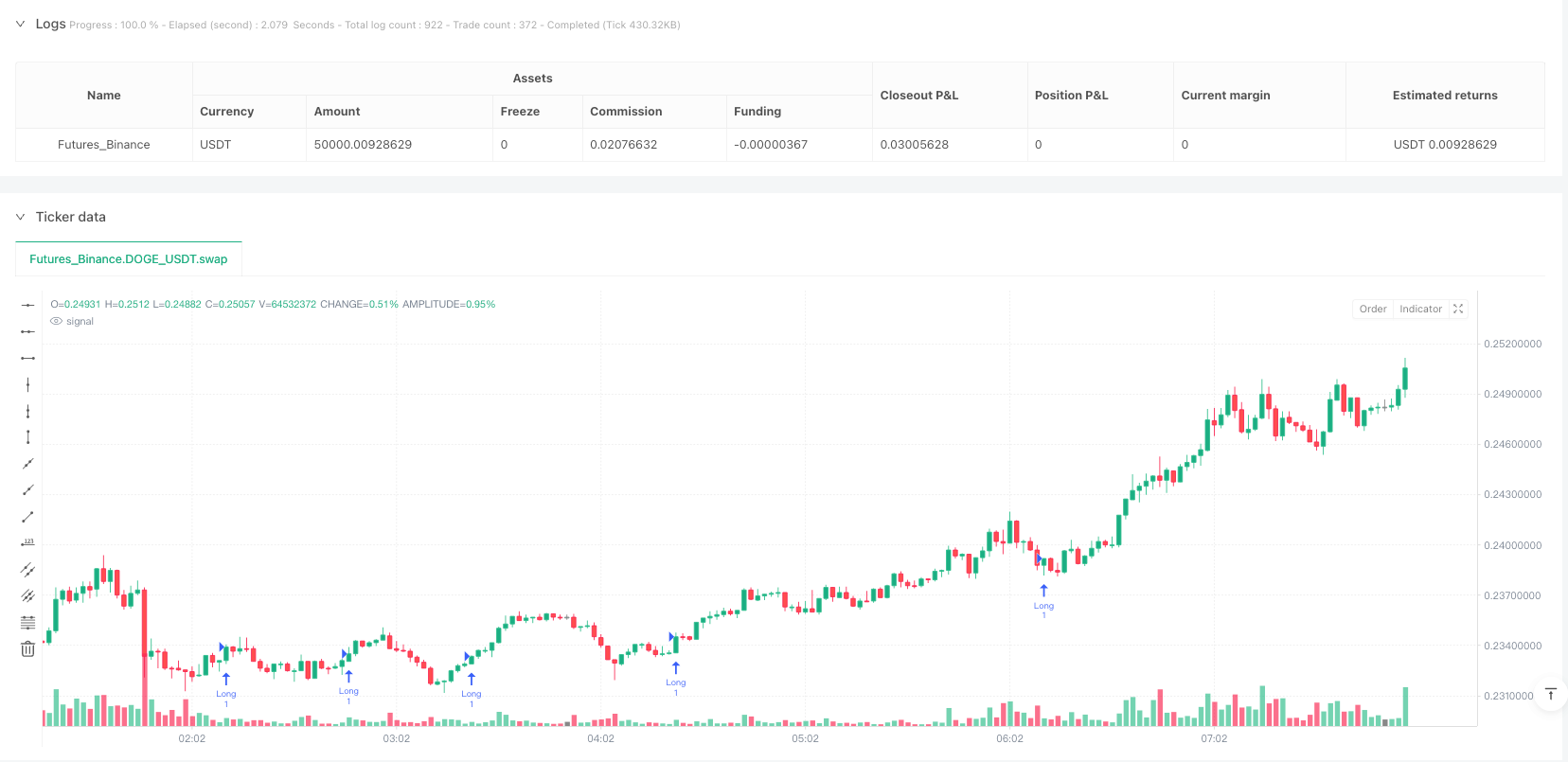

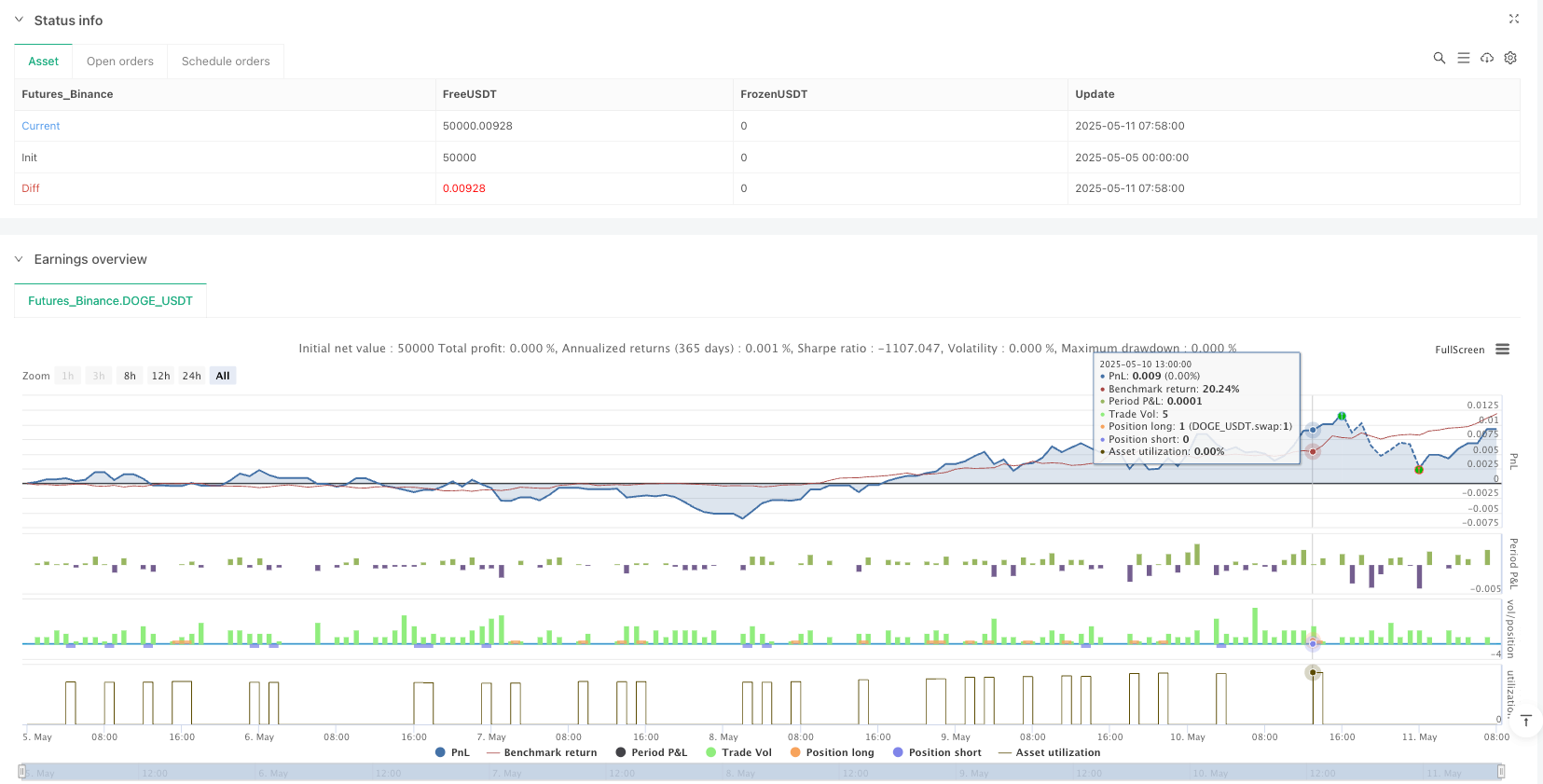

/*backtest

start: 2025-05-05 00:00:00

end: 2025-05-11 08:00:00

period: 2m

basePeriod: 2m

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("1 BUY 2 SELL Loop – With ATR-Based SL/TP", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// === Parametreler ===

rsiLength = input.int(14, "RSI Periyodu")

emaFilterLen = input.int(200, "Trend Filtresi için EMA")

atrLen = input.int(14, "ATR Periyodu")

atrMultiplier = input.float(1.5, "ATR Katsayısı (SL ve TP için)")

// === İndikatörler ===

rsi = ta.rsi(close, rsiLength)

ema = ta.ema(close, emaFilterLen)

atr = ta.atr(atrLen)

// === Trend Filtresi ===

isUptrend = close > ema

isDowntrend = close < ema

// === Giriş Sinyalleri ===

longSignal = ta.crossover(rsi, 50) and isUptrend

shortSignal = ta.crossunder(rsi, 50) and isDowntrend

// === SL ve TP Hesaplama ===

longSL = close - atr * atrMultiplier

longTP = close + atr * atrMultiplier

shortSL = close + atr * atrMultiplier

shortTP = close - atr * atrMultiplier

// === LONG Pozisyon Açma ===

if (longSignal)

if (strategy.position_size < 0)

strategy.close("Short")

strategy.entry("Long", strategy.long, qty=1)

strategy.exit("Long TP/SL", from_entry="Long", stop=longSL, limit=longTP)

// === SHORT Pozisyon Açma ===

if (shortSignal)

if (strategy.position_size > 0)

strategy.close("Long")

strategy.entry("Short", strategy.short, qty=1)

strategy.exit("Short TP/SL", from_entry="Short", stop=shortSL, limit=shortTP)