Overview

The Fire Slingshot Quantitative Strategy is a trading system based on EMA (Exponential Moving Average) crossovers with Stochastic Oscillator confirmation, specifically designed for forex markets. This strategy uses the crossover of 15-period EMA and 50-period EMA as the primary signal generator, combined with Stochastic Oscillator (5,3,3) as a confirmation signal, effectively identifying high-probability entry points for both long and short positions. The strategy sets customizable profit targets (default 35 pips) and provides a real-time market bias indicator to help traders quickly assess the current market condition. Its core concept is to capture the initial phase of price trend changes while filtering out low-quality signals through indicator confirmation, thereby improving trading success rates.

Strategy Principles

The Fire Slingshot Quantitative Strategy’s core logic is based on the integrated application of two main technical indicators:

EMA Crossover Signals: The strategy uses 15-period EMA and 50-period EMA as the primary signal generators. When the short-term EMA (15-period) crosses above the long-term EMA (50-period), it generates a “Fire Slingshot” long signal; when the short-term EMA crosses below the long-term EMA, it generates a “Fire Bear Sling” short signal. This mechanism is based on trend-following principles, aiming to capture the formation of new trends.

Stochastic Oscillator Confirmation: The strategy employs a Stochastic Oscillator with parameters (5,3,3) as a confirmation mechanism.

- Long confirmation: Stochastic Oscillator below 20 (oversold region) and moving upward

- Short confirmation: Stochastic Oscillator above 80 (overbought region) and moving downward

The trade execution process is as follows: - Long entry (“Fire Slingshot”): When the 15-period EMA crosses above the 50-period EMA, and the Stochastic Oscillator is in the oversold region and begins to rise, the system generates a buy signal with a profit target set at 25-55 pips (default 35 pips). - Short entry (“Fire Bear Sling”): When the 15-period EMA crosses below the 50-period EMA, and the Stochastic Oscillator is in the overbought region and begins to fall, the system generates a sell signal with a profit target set at 25-55 pips (default 35 pips).

The strategy also includes a real-time status display feature, showing the current market bias (“FIRE SLINGSHOT BUY”, “FIRE BEAR SLING SELL”, or “NEUTRAL”) in the top right corner of the chart, and visually indicates crossover signals through background color changes.

Strategy Advantages

Through in-depth code analysis, the Fire Slingshot Quantitative Strategy demonstrates several significant advantages:

Simple yet effective signal generation mechanism: The strategy uses classic and widely validated EMA crossovers as the primary signals, which are simple, intuitive, easy to understand and execute, while having the ability to capture trend changes.

Dual confirmation mechanism enhances reliability: Combining the Stochastic Oscillator as a confirmation signal significantly reduces the possibility of false breakouts and erroneous signals. Through the

enableStochFilterparameter, users can flexibly choose whether to enable this filtering mechanism.Precise profit target setting: The strategy has built-in customizable profit targets (default 35 pips), suitable for forex market volatility characteristics, helping to secure profits in the early stages of trends and avoiding holding positions too long, which could lead to profit reversals.

Intuitive visual feedback system: The strategy provides clear visual feedback through labels, background color changes, and status tables, helping traders quickly identify signals and current market conditions, reducing operational difficulty.

Built-in alert conditions: The strategy is designed with alert conditions, making it convenient for traders to set up automatic notifications, avoiding missed trading opportunities and enhancing the strategy’s practicality.

Strong adaptability: Through multiple adjustable parameters (EMA periods, Stochastic Oscillator parameters, profit targets, etc.), the strategy can be adjusted according to different market conditions and trading preferences, enhancing its adaptability.

Strategy Risks

Despite the Fire Slingshot Quantitative Strategy’s reasonable design, there are still several potential risks:

Trend false breakout risk: EMA crossover signals may be affected by market noise, producing false breakouts. Although the Stochastic Oscillator confirmation mechanism can partially mitigate this problem, false signals may still occur in highly volatile or range-bound markets. Solution: Consider adding additional filtering conditions, such as volume confirmation or price action pattern recognition, to further reduce false signals.

Limitations of fixed profit targets: The strategy uses fixed pip values as profit targets, which, while simple and intuitive, cannot adapt to changes in volatility across different market environments. In low-volatility markets, the target may be too aggressive; in high-volatility markets, it may exit positions too early, missing out on larger profits. Solution: Consider using dynamic profit targets, such as multiples based on ATR (Average True Range) or trailing stop mechanisms.

Lack of comprehensive risk management mechanisms: The current strategy sets profit targets but lacks clear stop-loss strategies, which may lead to excessive losses during adverse market movements. Solution: Implement clear stop-loss strategies, such as setting fixed pip stop-losses based on entry points or stop-losses based on key technical levels.

Parameter sensitivity: The choice of EMA periods and Stochastic Oscillator parameters significantly impacts strategy performance; inappropriate parameters may lead to overtrading or missed opportunities. Solution: Conduct comprehensive parameter optimization and backtesting to find parameter combinations that perform stably under different market conditions.

Market environment limitations: The strategy performs better in clearly trending markets but may generate numerous false signals in range-bound or highly volatile non-trending markets. Solution: Add market state recognition mechanisms, such as ADX (Average Directional Index), to automatically adjust or disable the strategy in non-trending markets.

Strategy Optimization Directions

Based on in-depth analysis of the code, the Fire Slingshot Quantitative Strategy can be optimized in the following directions:

Enhance risk management mechanisms: Introduce dynamic stop-loss strategies, such as ATR-based stop-losses or trailing stops, to better control risk and adapt to different market environments. This can protect capital while allowing profits more room to grow.

Market environment filtering: Add market environment recognition mechanisms, such as using the ADX indicator to determine whether the market is in a trending state. In non-trending markets, the entry threshold can be automatically raised or the strategy temporarily disabled, avoiding frequent trading under unsuitable market conditions.

Dynamic parameter adjustment: Implement dynamic parameter adjustment mechanisms to automatically optimize EMA periods and Stochastic Oscillator parameters based on market volatility, adapting to the characteristics of different market phases. For example, use longer EMA periods in highly volatile markets to reduce noise impact.

Multiple timeframe confirmation: Introduce multiple timeframe analysis, for example, confirming trend direction on a larger timeframe and then executing trades on the current timeframe. This can improve the accuracy of trading direction and avoid counter-trend operations.

Volume confirmation mechanism: Add volume analysis as an additional confirmation condition, executing trades only when supported by volume. This helps identify true breakouts and trend changes, reducing false breakout risks.

Optimize profit strategies: Implement a scaled profit-taking mechanism, for example, dividing positions into multiple parts and gradually taking profits at different price levels. This ensures a certain level of profit while giving some positions more room for growth.

Enhanced reversal signal handling: When signals contrary to the current position direction appear, implement more intelligent handling logic, such as closing positions and opening reverse positions, rather than simply waiting for profit targets to be reached. This allows for quicker adaptation to market changes.

Summary

The Fire Slingshot Quantitative Strategy is an elegantly designed forex trading system that effectively captures market trend change opportunities through the combination of EMA crossovers and Stochastic Oscillator confirmation. The strategy’s core logic is clear, parameter settings are reasonable, and operation execution is straightforward, making it suitable for medium to short-term forex trading.

The strategy’s main advantages lie in its simple yet effective signal generation mechanism, dual confirmation filtering system, and intuitive visual feedback, making it easy to understand and execute. At the same time, customizable profit target settings and flexible parameter adjustment options provide good adaptability and practicality.

Nevertheless, the strategy still has some potential risks, such as trend false breakout issues, limitations of fixed profit targets, and incomplete risk management mechanisms. To address these issues, optimizations can be made by adding additional filtering conditions, implementing dynamic profit and stop-loss strategies, and adding market environment recognition mechanisms.

Overall, the Fire Slingshot Quantitative Strategy provides forex traders with a trading framework that has solid theoretical foundations and mature technical implementation. With reasonable parameter configuration and necessary strategy optimizations, this strategy has the potential to achieve steady performance in actual trading. However, like all trading strategies, thorough backtesting and simulated trading should be conducted before practical application, combined with sound money management principles, to ensure the strategy’s stability and reliability under different market conditions.

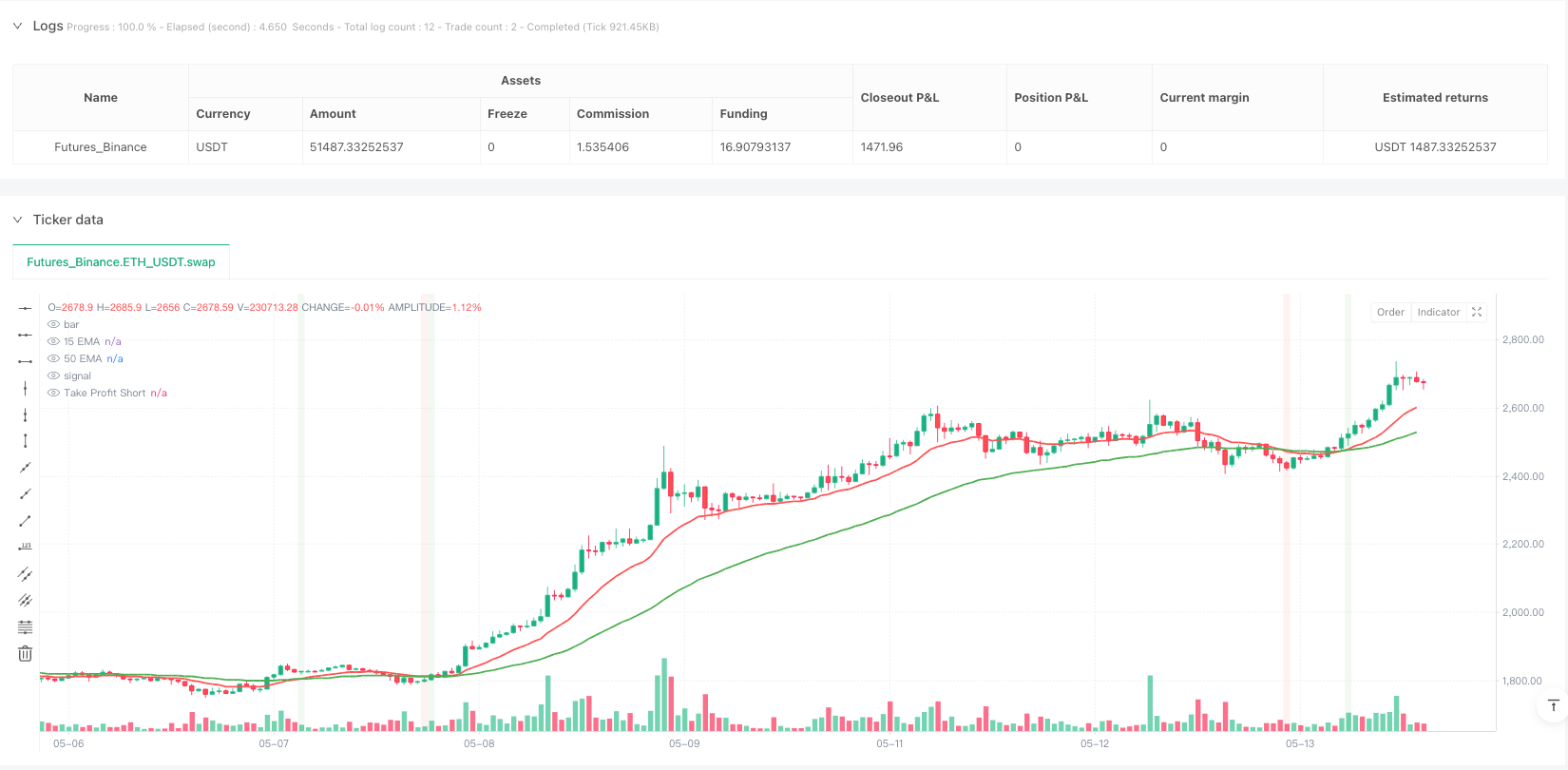

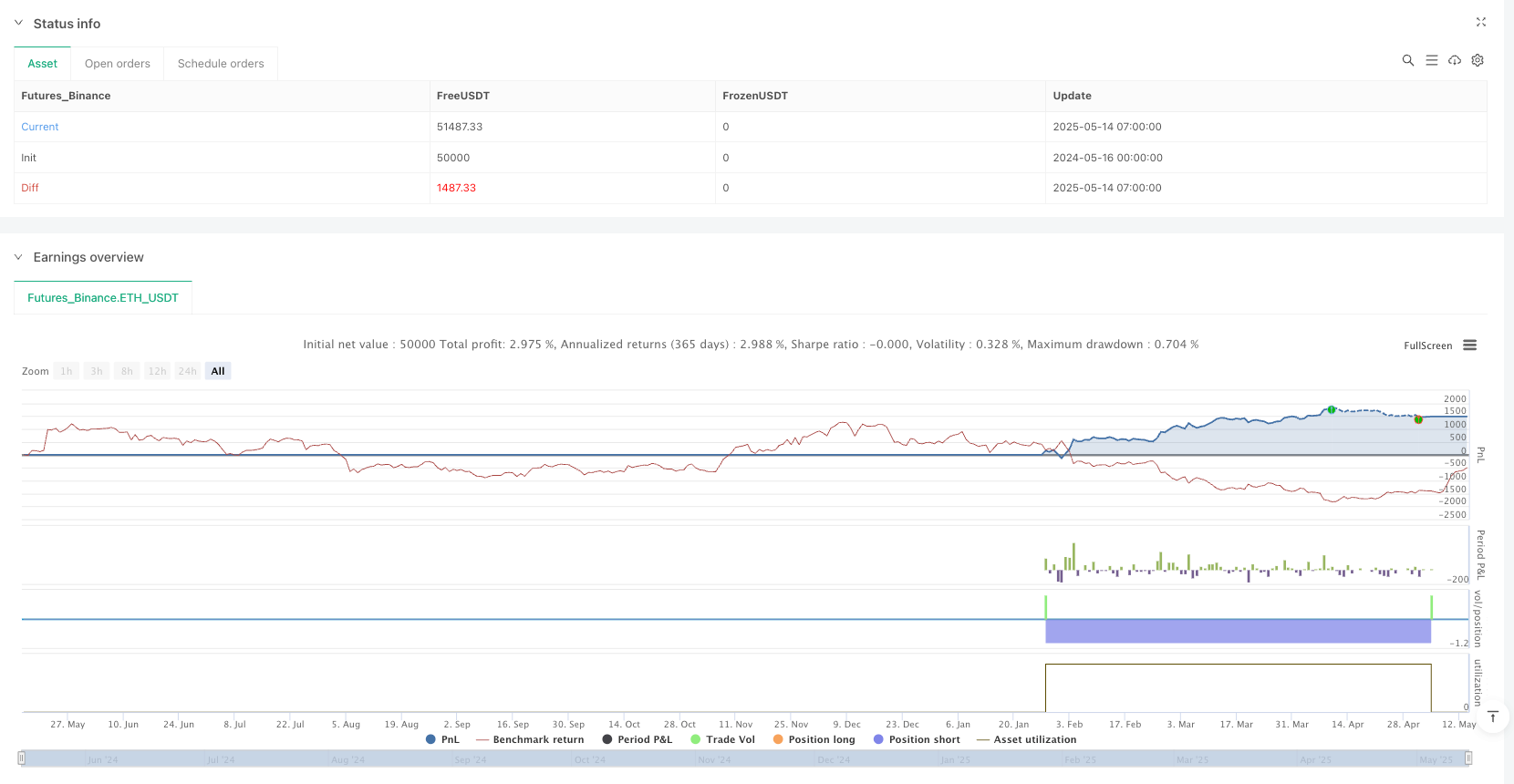

/*backtest

start: 2024-05-16 00:00:00

end: 2025-05-14 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

// ============================================================================

// Forex Fire Sling Shot Strategy

// ============================================================================

//

// This strategy implements a simple yet effective trading system based on EMA

// crossovers with stochastic confirmation. The system identifies high-probability

// entry points for both long and short positions in forex markets.

//

// Features:

// - Uses 15 EMA crossing 50 EMA as primary signal generator

// - Stochastic (5,3,3) provides early confirmation signals

// - Take profit targets set at customizable pip levels (default 35 pips)

// - Visual labels for "Sling Shot" (long) and "Bear Sling" (short) signals

// - Real-time status indicator showing current market bias

// - Alert conditions for easy notification setup

//

// How it works:

// 1. LONG ENTRY ("Sling Shot"): When 15 EMA crosses above 50 EMA

// Stochastic below 20 and moving upward can provide early confirmation

// Target: 25-55 pips (default 35)

//

// 2. SHORT ENTRY ("Bear Sling"): When 15 EMA crosses below 50 EMA

// Stochastic above 80 and moving downward can provide early confirmation

// Target: 25-55 pips (default 35)

//

// DISCLAIMER:

// This script is for educational purposes only. Past performance is not

// indicative of future results. Always test strategies thoroughly before

// trading real capital.

//

// Author: [Your TradingView Username]

// Version: 1.0 (2025-05-06)

//

// ============================================================================

strategy("Forex Fire Sling Shot", overlay=true, margin_long=100, margin_short=100)

// Input parameters

emaShort = input.int(15, "Short EMA Period")

emaLong = input.int(50, "Long EMA Period")

stochK = input.int(5, "Stochastic %K")

stochD = input.int(3, "Stochastic %D")

stochSmooth = input.int(3, "Stochastic Smooth")

overbought = input.int(80, "Overbought Level")

oversold = input.int(20, "Oversold Level")

takeProfitPips = input.int(35, "Take Profit (Pips)", minval=5, maxval=100)

enableStochFilter = input.bool(true, "Enable Stochastic Filter")

// Calculate EMAs

ema15 = ta.ema(close, emaShort)

ema50 = ta.ema(close, emaLong)

// Calculate Stochastic

k = ta.stoch(close, high, low, stochK)

smoothK = ta.sma(k, stochSmooth)

smoothD = ta.sma(smoothK, stochD)

// Define signals

bullCrossEMA = ta.crossover(ema15, ema50)

bearCrossEMA = ta.crossunder(ema15, ema50)

stochOversoldCross = ta.crossover(smoothK, oversold)

stochOverboughtCross = ta.crossunder(smoothK, overbought)

// Entry conditions

longCondition = bullCrossEMA and (not enableStochFilter or (enableStochFilter and (stochOversoldCross[1] or smoothK < oversold)))

shortCondition = bearCrossEMA and (not enableStochFilter or (enableStochFilter and (stochOverboughtCross[1] or smoothK > overbought)))

// Create alertconditions for easier alert setup

alertcondition(longCondition, title="Fire Sling Shot Buy Signal", message="Forex Fire Sling Shot Buy Signal triggered!")

alertcondition(shortCondition, title="Fire Bear Sling Sell Signal", message="Forex Fire Bear Sling Sell Signal triggered!")

// Plot indicators with updated colors

plot(ema15, "15 EMA", color=color.red, linewidth=2) // Changed from purple to red

plot(ema50, "50 EMA", color=color.green, linewidth=2) // Changed from white to green

// Draw sling shot labels

if bullCrossEMA

label.new(bar_index, low - (0.0002 * low), "FIRE SLING SHOT", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.small)

if bearCrossEMA

label.new(bar_index, high + (0.0002 * high), "FIRE BEAR SLING", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.small)

// Calculate take profit price for forex (in pips)

pipMultiplier = syminfo.mintick * 10

takeProfitLong = strategy.position_avg_price + (takeProfitPips * pipMultiplier)

takeProfitShort = strategy.position_avg_price - (takeProfitPips * pipMultiplier)

// Execute strategy

if longCondition

strategy.entry("Fire Sling Shot Long", strategy.long)

strategy.exit("TP Long", "Fire Sling Shot Long", limit=takeProfitLong)

if shortCondition

strategy.entry("Fire Bear Sling Short", strategy.short)

strategy.exit("TP Short", "Fire Bear Sling Short", limit=takeProfitShort)

// Plot take profit levels when in position

plotTakeProfitLong = strategy.position_size > 0 ? takeProfitLong : na

plotTakeProfitShort = strategy.position_size < 0 ? takeProfitShort : na

plot(plotTakeProfitLong, "Take Profit Long", color=color.green, style=plot.style_circles)

plot(plotTakeProfitShort, "Take Profit Short", color=color.red, style=plot.style_circles)

// Plot background for visualization

bgcolor(bullCrossEMA ? color.new(color.green, 90) : bearCrossEMA ? color.new(color.red, 90) : na)

// Display current status

tablePosition = position.top_right

statusTable = table.new(tablePosition, 2, 2, border_width=1)

if barstate.islast

table.cell(statusTable, 0, 0, "Current Signal", bgcolor=color.gray, text_color=color.white)

signalText = longCondition ? "FIRE SLING SHOT BUY" : shortCondition ? "FIRE BEAR SLING SELL" : "NEUTRAL"

signalColor = longCondition ? color.green : shortCondition ? color.red : color.gray

table.cell(statusTable, 1, 0, signalText, bgcolor=signalColor, text_color=color.white)