Overview

The “Advanced Multi-Dimensional ICT Order Block Dynamic Strategy” is a sophisticated quantitative trading strategy based on the ICT (Inner Circle Trader) methodology, combining multiple technical indicators to identify high-probability trading opportunities. The strategy integrates market information from multiple dimensions including Order Blocks, Exponential Moving Average (EMA), Relative Strength Index (RSI), and Average True Range (ATR) to build a comprehensive trading system. It automatically identifies key price areas in the market, such as Breaker Blocks, Rejection Blocks, and Order Blocks, providing clear entry and exit signals at these zones. Additionally, the strategy incorporates a robust risk management mechanism, dynamically calculating stop-loss positions and profit targets based on risk-reward ratios, ensuring effective risk control for each trade.

Strategy Principles

The core concept of this strategy is based on the Order Block theory from ICT methodology, which posits that the market leaves “order blocks” before forming trends, typically areas where large institutions accumulate positions. The specific operational principles are as follows:

Order Block Identification: The strategy identifies bullish and bearish order blocks by analyzing price dynamics. In the code, a bullish order block is defined as the previous high when price breaks upward, while a bearish order block is defined as the previous low when price breaks downward.

Trend Filtering: A 50-period EMA serves as a trend filter, considering long signals only when price is above the EMA and short signals only when price is below the EMA.

Momentum Confirmation: The RSI indicator provides momentum confirmation, avoiding entries in overbought or oversold market conditions. Long entries are considered when RSI is below 70, and short entries when RSI is above 30.

Entry Conditions: Long entry requirements include: (1) price crossing above the bullish order block, (2) price above the EMA, (3) RSI below overbought levels, and (4) closing price above opening price (confirming candle direction). Short entry conditions are the opposite.

Risk Management: The strategy uses the ATR indicator to dynamically calculate stop-loss levels, placing stops below the order block by multiplying the ATR value by a factor of 1.5. Profit targets are automatically calculated based on a risk-reward ratio of 2.5.

Trade Execution: When all conditions are met, the strategy automatically executes trades and sets appropriate stop-loss and take-profit levels.

Strategy Advantages

Multi-dimensional Analysis Framework: The strategy combines price action (order blocks), trend (EMA), momentum (RSI), and volatility (ATR) analyses, forming a comprehensive trading decision system that effectively reduces false signals.

Adaptive Risk Management: By using the ATR indicator, the strategy can dynamically adjust stop-loss levels according to market volatility, making risk management more flexible and responsive to market changes.

Clear Risk-Reward Framework: The strategy incorporates a fixed risk-reward ratio (2.5:1), ensuring each trade has a positive expected value, beneficial for capital growth in the long term.

Trend Direction Consistency: The EMA filter ensures trading only in the direction of the trend, improving trade success rates and profitability.

Extreme Market Condition Filtering: The RSI indicator helps avoid entries in overbought or oversold market conditions, reducing the risk of counter-trend trading.

Entry Confirmation Mechanism: The strategy requires closing price confirmation of the breakout direction, reducing losses from false breakouts.

Visualization and Alert System: The strategy provides clear chart markings and alert functionality, allowing traders to visually identify trading opportunities and take timely action.

Strategy Risks

Lag Risk: Using indicators like EMA and RSI may result in signal delays, potentially missing optimal entry points or generating delayed signals in rapidly changing markets. Solution: Consider reducing the EMA period or incorporating more sensitive short-term indicators to improve response time.

False Breakout Risk: Price may temporarily break through an order block and immediately reverse, causing false signals. Solution: Add additional confirmation mechanisms, such as volume confirmation or waiting for multiple candles to confirm the breakout.

Parameter Sensitivity: Strategy performance is highly dependent on input parameters (such as ATR multiplier, risk-reward ratio), and different market environments may require different parameter settings. Solution: Conduct backtesting optimization to find the best parameter combinations for different markets and timeframes.

Over-reliance on Historical Patterns: ICT theory is based on historical price patterns, but market conditions frequently change, and historical patterns may no longer be effective. Solution: Regularly evaluate strategy performance and adjust strategy rules according to market changes.

Insufficient Capital Management: Despite including stop-loss and risk-reward ratio settings, the strategy lacks comprehensive capital management rules. Solution: Add maximum risk limits per trade and capital adjustment mechanisms after consecutive losses.

Cross-market Adaptability Issues: The strategy may perform well in certain markets or timeframes but poorly in others. Solution: Add market state recognition components to adjust trading rules or pause trading under different market conditions.

Strategy Optimization Directions

Add Volume Confirmation: The current strategy identifies order blocks based solely on price dynamics. Adding volume analysis to confirm important order blocks would be beneficial, as effective order blocks are usually accompanied by significant volume changes. This would filter out many low-quality signals.

Market State Classification: Introduce market state recognition mechanisms (such as trend, range, high volatility) to dynamically adjust strategy parameters or trading rules based on different market states. This would improve strategy adaptability across different market environments.

Multi-timeframe Analysis: Integrate analysis results from higher timeframes to ensure trade direction aligns with larger trends. For example, adding daily or weekly trend filters to trade only in the direction of the major trend.

Improve Order Block Identification Algorithm: The current order block identification is relatively simplified. More complex algorithms could be adopted to identify higher-quality order blocks, considering price structure, candle patterns, and volatility characteristics.

Dynamic Risk-Reward Ratio: Adjust the risk-reward ratio dynamically based on market volatility or trend strength, using higher ratios in strong trends and more conservative settings in volatile markets.

Add Machine Learning Components: Introduce machine learning algorithms to optimize parameter selection or identify the best trading opportunities by analyzing historical data to learn optimal parameter combinations and entry timing.

Improve Exit Mechanisms: In addition to fixed take-profit and stop-loss levels, add dynamic exit mechanisms such as trailing stops or market structure-based exit signals to better capture trend movements.

Add Seasonality and Time Filters: Analyze performance during different time periods (such as different times of day, different days of the week) to avoid inefficient trading periods and focus on high-probability success timeframes.

Summary

The “Advanced Multi-Dimensional ICT Order Block Dynamic Strategy” is a comprehensive trading system that combines ICT trading theory with modern technical analysis. By identifying key price areas (order blocks) and integrating trend, momentum, and volatility indicators, it creates a comprehensive trading framework. The main advantages of the strategy lie in its multi-dimensional analysis approach and adaptive risk management system, enabling it to adapt to different market conditions.

However, the strategy also faces challenges such as indicator lag, false breakout risks, and parameter sensitivity. To enhance the robustness and profitability of the strategy, several optimizations are recommended, including adding volume confirmation, market state classification, multi-timeframe analysis, and improving the order block identification algorithm.

Through these optimizations, the strategy has the potential to become a more comprehensive and effective trading system capable of producing consistent results across various market environments. Most importantly, traders should validate the strategy’s performance under real market conditions through comprehensive backtesting and simulated trading, making necessary adjustments based on personal risk preferences and trading objectives.

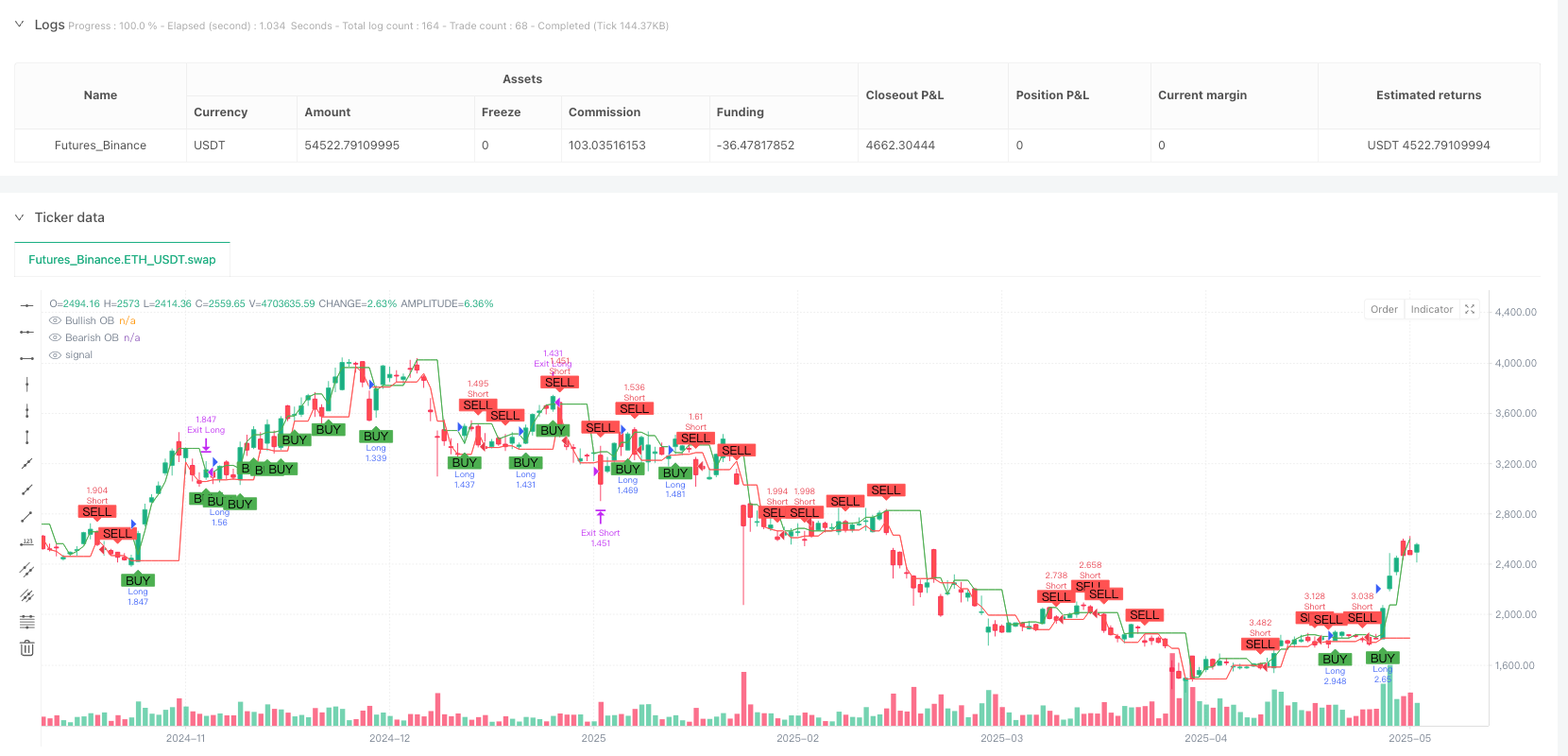

/*backtest

start: 2024-05-16 00:00:00

end: 2025-05-14 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Improved ICT Order Block Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Inputs

atrLength = input.int(14, "ATR Length")

atrMultiplierSL = input.float(1.5, "ATR Multiplier for SL")

riskRewardRatio = input.float(2.5, "Risk/Reward Ratio")

emaLength = input.int(50, "EMA Length (Trend Filter)")

rsiLength = input.int(14, "RSI Length")

rsiOverbought = input.float(70, "RSI Overbought Threshold")

rsiOversold = input.float(30, "RSI Oversold Threshold")

// Indicators

atr = ta.atr(atrLength)

emaTrend = ta.ema(close, emaLength)

rsi = ta.rsi(close, rsiLength)

// Order Blocks (simplified)

bullishOB = (high > high[1]) ? high[1] : na

bearishOB = (low < low[1]) ? low[1] : na

var float lastBullishOB = na

var float lastBearishOB = na

if not na(bullishOB)

lastBullishOB := bullishOB

if not na(bearishOB)

lastBearishOB := bearishOB

// Entry Conditions with filters

longCondition = close > emaTrend and rsi < rsiOverbought and ta.crossover(close, lastBullishOB)

shortCondition = close < emaTrend and rsi > rsiOversold and ta.crossunder(close, lastBearishOB)

// Entry confirmation: wait for candle close in direction

longEntry = longCondition and close > open

shortEntry = shortCondition and close < open

// Entry prices

var float longEntryPrice = na

var float shortEntryPrice = na

// Stop Loss and Take Profit

longStop = lastBullishOB - atr * atrMultiplierSL

longTake = longEntryPrice + (longEntryPrice - longStop) * riskRewardRatio

shortStop = lastBearishOB + atr * atrMultiplierSL

shortTake = shortEntryPrice - (shortStop - shortEntryPrice) * riskRewardRatio

// Execute trades

if (longEntry)

strategy.entry("Long", strategy.long)

longEntryPrice := close

strategy.exit("Exit Long", "Long", stop=longStop, limit=longTake)

if (shortEntry)

strategy.entry("Short", strategy.short)

shortEntryPrice := close

strategy.exit("Exit Short", "Short", stop=shortStop, limit=shortTake)

// Plot signals

plotshape(longEntry, title="Long Entry", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(shortEntry, title="Short Entry", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot Order Blocks

plot(lastBullishOB, title="Bullish OB", color=color.green, style=plot.style_linebr)

plot(lastBearishOB, title="Bearish OB", color=color.red, style=plot.style_linebr)