Overview

The Strong Trend ADX Momentum Filtered Entry Quantitative Trading Strategy is a trading system based on trend strength confirmation, utilizing the Average Directional Index (ADX) and Directional Movement Index (DMI) to identify trends with sufficient strength in the market and establish positions only in these high-quality trends. The core philosophy of this strategy is “not all trends are worth trading,” filtering out weak trends and oscillating markets to focus on capturing price movements with clear directionality and momentum, thereby improving capital efficiency and trade success rate.

Strategy Principles

The core logic of this strategy is based on ADX and DMI indicator combination analysis:

Indicator Calculation: The system first calculates three indicators: ADX, +DI, and -DI, all built on the logic of DMI (Directional Movement Index). ADX measures trend strength, while +DI and -DI represent upward and downward momentum respectively.

Entry Conditions:

- Long Entry: When ADX is above the set threshold (default 25) and +DI is greater than -DI, the system recognizes a sufficiently strong uptrend and establishes a long position when no position is currently held.

- Short Entry: When ADX is above the set threshold and -DI is greater than +DI, the system recognizes a sufficiently strong downtrend and establishes a short position when no position is currently held.

Exit Conditions: When directional indicator crossover (DI crossover) occurs, the system closes all positions. Specifically:

- Long Position Close: When -DI crosses above +DI, indicating weakened bullish momentum and possible trend reversal

- Short Position Close: When +DI crosses above -DI, indicating weakened bearish momentum and possible trend reversal

Parameter Settings:

- ADX Calculation Period: 14 (standard setting)

- ADX Threshold: 25 (configurable)

- Percentage of Available Funds Per Entry: 50%

- Maximum Pyramid Additional Positions: 5

- Commission: 0.05%

Recommended Timeframes: 4-hour, 12-hour, and daily charts. These higher timeframes allow ADX signals to fully mature, producing fewer but more reliable trading signals.

Strategy Advantages

High-Quality Trend Filtering: Through ADX filtering, this strategy only enters trades when a strong trend is confirmed, avoiding unnecessary losses in weak trends or oscillating markets.

Reduced False Signals: Compared to systems using only directional indicators, adding ADX strength filtering significantly reduces the number of false breakouts and false signals, improving trading efficiency.

Adaptive to Market Conditions: The strategy naturally adapts to different market conditions, automatically staying on the sidelines in sideways or weak trend markets and actively participating in strong trend markets.

Pyramid Position Building Mechanism: Allows up to 5 additional positions in the same trend direction, helping to maximize profits when strong trends continue to develop.

Integrated Fund Management: The strategy has built-in fund management rules, using 50% of available funds for each entry, which helps manage risk through moderate position control.

Clear Entry and Exit Rules: The strategy’s entry and exit rules are explicit and do not rely on subjective judgment, facilitating quantitative implementation and backtesting.

Strategy Risks

Lag Risk: ADX is a lagging indicator, which may lead to relatively late entry points, missing the early stages of trends and reducing overall returns.

Delayed Exit in Trend Reversals: Since exit signals are based on DI indicator crossovers, the system may not close positions in time during rapid trend reversals, leading to partial profit giveback.

Parameter Sensitivity: The ADX threshold setting significantly impacts system performance. A threshold that is too high may cause missed profitable trading opportunities, while one that is too low may introduce too much noise trading.

Poor Performance in Oscillating Markets: In long-term oscillating or narrow-range markets, the strategy may frequently trigger signals but struggle to profit, resulting in multiple small losses.

Excessive Position Building Risk: Allowing 5 pyramid additional positions may amplify losses when trends suddenly reverse, especially in highly volatile markets.

Solutions: - Combine with other confirmation indicators (such as moving averages, RSI, etc.) to verify trends - Dynamically adjust ADX thresholds to adapt to different market environments - Add stop-loss mechanisms to limit maximum loss per trade - Reduce the number of additional positions in highly volatile markets - Optimize parameters for different assets and timeframes

Strategy Optimization Directions

Dynamic ADX Threshold: Implement adaptive ADX thresholds that automatically adjust based on market volatility or historical ADX distribution. This can address the limitations of fixed thresholds under different market conditions and improve system adaptability.

Integrate Trend Confirmation Indicators: Add trend confirmation filters on top of ADX signals, such as moving average systems, Bollinger Bands, or Ichimoku Cloud, to reduce false signals and improve entry precision.

Optimize Exit Mechanisms: Current exits are solely based on DI crossovers; consider integrating trailing stops, profit targets, or volatility-based dynamic stops to more effectively lock in profits and control risk.

Fund Management Optimization: Implement dynamic position size control, automatically adjusting the percentage of funds used for each trade based on ADX reading strength, market volatility, and account performance, rather than fixed use of 50% of funds.

Time Filters: Add market session filtering to avoid trading during periods of low volatility or instability, focusing on sessions where trends are more likely to form and persist.

Refined Position Building Strategy: Improve pyramid position building logic by establishing more sophisticated additional position conditions, such as adding positions when ADX continues to strengthen, when prices make new highs/lows, or during pullbacks to key support/resistance levels, rather than simply allowing a maximum of 5 additional positions.

Backtesting and Optimization Framework: Establish a comprehensive backtesting framework to optimize strategy parameters for different market conditions, time periods, and asset classes to find the best parameter combinations.

Summary

The Strong Trend ADX Momentum Filtered Entry Quantitative Trading Strategy is a trading system focused on high-quality trends, effectively filtering out market noise and weak trends through the combined application of ADX and DMI indicators, establishing positions only when trends of sufficient strength are confirmed. This strategy is particularly suitable for assets with long-term trend cycles, such as Bitcoin, Ethereum, gold, and major forex pairs.

The core advantage of the strategy lies in its high selectivity. Through strict trend strength filtering, the system can avoid frequent trading under unfavorable market conditions, thereby improving win rates and capital efficiency. Despite certain lag risks and parameter sensitivity, through the suggested optimization directions, such as dynamic threshold adjustment, integration of additional confirmation indicators, and improved exit mechanisms, this strategy can further enhance its performance in different market environments.

For traders seeking to reduce noise trading and focus on capturing strong trends, this strategy provides a reliable framework. By adjusting ADX length and threshold, traders can find the optimal balance according to their risk preferences and trading instrument characteristics, achieving considerable returns while maintaining a high win rate.

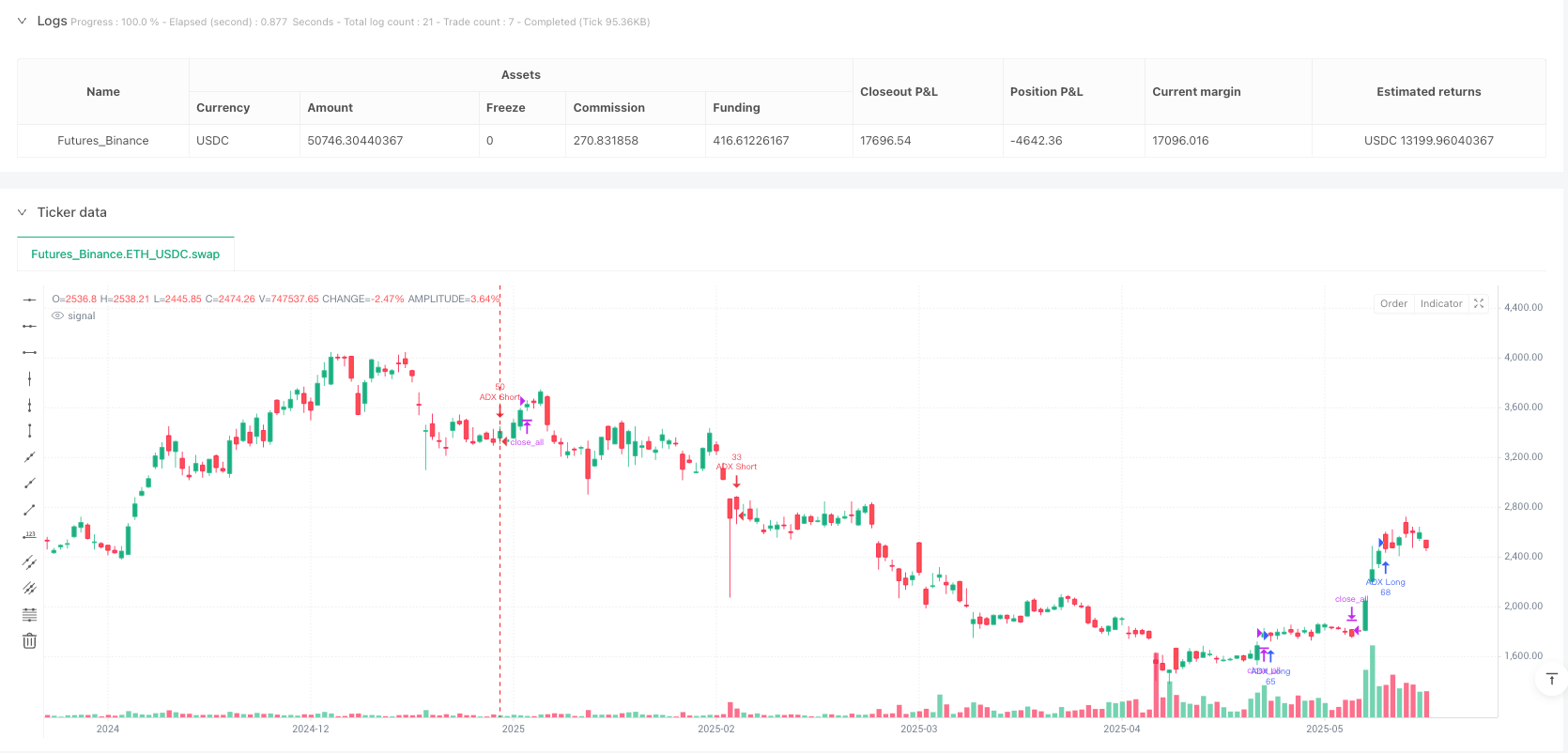

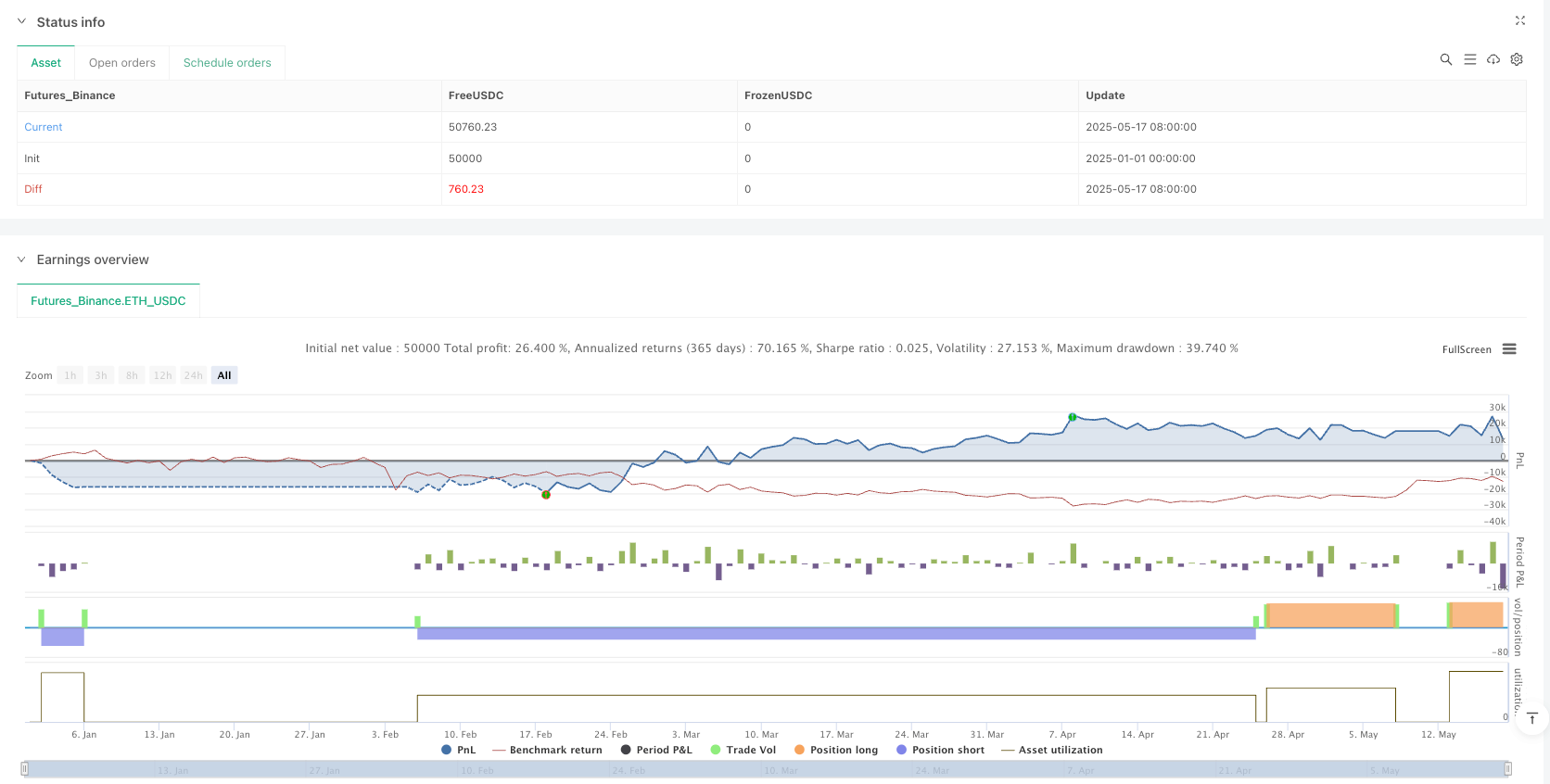

/*backtest

start: 2025-01-01 00:00:00

end: 2025-05-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDC"}]

*/

//@version=5

// ========================================================================

// 📌 CMA Technologies – ADX Trend Strength Entry Bot

// 🌐 Developed by CMA Technologies | Visit: cmatech.co

// 📊 Trades only when trend strength is confirmed by ADX

// 🔍 Strategy by @CMATechnologies

// ========================================================================

strategy("CMA Technologies ADX Trend Strength Entry Bot", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1, pyramiding=5, commission_type=strategy.commission.percent, commission_value=0.05)

// === INPUTS ===

adxLen = input.int(14, title="ADX Length")

adxThres = input.int(25, title="Minimum ADX Threshold")

// === ADX, +DI, -DI Calculation via DMI Function ===

[plusDI, minusDI, adx] = ta.dmi(adxLen, adxLen)

// === TREND CONDITIONS ===

isStrongTrend = adx > adxThres

longCondition = isStrongTrend and plusDI > minusDI and strategy.position_size == 0

shortCondition = isStrongTrend and minusDI > plusDI and strategy.position_size == 0

// === ENTRIES ===

if (longCondition)

strategy.entry("ADX Long", strategy.long)

if (shortCondition)

strategy.entry("ADX Short", strategy.short)

// === EXITS ===

exitLong = strategy.position_size > 0 and minusDI > plusDI

exitShort = strategy.position_size < 0 and plusDI > minusDI

if (exitLong or exitShort)

strategy.close_all(comment="Trend Reversal Exit")

// === PLOTS ===

//plot(adx, title="ADX", color=color.orange)

//hline(adxThres, "ADX Threshold", color=color.gray)