Overview

The Dual EMA Crossover RSI Confirmation Swing Momentum Strategy is a medium-term trading strategy based on trend following and momentum confirmation. This strategy primarily utilizes crossover signals from fast and slow Exponential Moving Averages (EMA) as the main entry conditions, combined with Relative Strength Index (RSI) for momentum confirmation, and employs Average True Range (ATR) for risk management. Designed for 1-day timeframes, the strategy aims to capture swing movements lasting several days to a week, improving signal reliability and profit potential through multiple technical indicator confirmation mechanisms.

Strategy Principles

The core logic of this strategy is based on the synergistic action of three main technical indicators. First, the strategy uses a 21-period fast EMA and 100-period slow EMA to construct a trend identification system. When the fast EMA crosses above the slow EMA, it indicates a short-term upward trend shift, forming a potential bullish signal; conversely, when the fast EMA crosses below the slow EMA, it indicates a short-term downward trend shift, forming a potential bearish signal.

To improve signal quality, the strategy introduces a 14-period RSI as a momentum confirmation indicator. For long trades, it requires RSI values greater than 55 simultaneously with EMA crossover, ensuring sufficient upward momentum; for short trades, it requires RSI values less than 45, ensuring sufficient downward momentum. This dual confirmation mechanism effectively filters false signals and improves trading success rates.

In terms of risk management, the strategy employs ATR-based dynamic stop-loss and take-profit mechanisms. Stop-loss distance is set at current price minus (for longs) or plus (for shorts) 1 ATR value, ensuring risk control matches market volatility. Take-profit targets are set at 2 ATR distance, achieving a 1:2 risk-reward ratio, which favors long-term profitability maintenance.

Strategy Advantages

The Dual EMA Crossover RSI Confirmation Swing Momentum Strategy possesses multiple technical advantages. First, the EMA crossover system effectively identifies trend reversal points, with the 21-period and 100-period parameter configuration achieving a good balance between sensitivity and stability, capturing trend changes timely while avoiding overly frequent trading signals.

The RSI confirmation mechanism is a major highlight of this strategy. By setting thresholds at 55 and 45, the strategy ensures that when trend signals appear, price momentum is also in corresponding strong or weak states. This multiple confirmation significantly reduces the impact of false breakouts and market noise on trading results, improving signal reliability.

The ATR dynamic risk management system demonstrates the strategy’s professionalism. Unlike fixed-point stop losses, ATR-based stops automatically adjust according to market volatility, providing wider stop-loss space during high volatility periods and tightening risk control during low volatility periods. The 1:2 risk-reward ratio setting ensures profitability even with a 40% win rate, providing good mathematical expectation for the strategy.

The strategy’s swing trading characteristics suit various market environments, capturing main profits in trending markets while gaining returns through quick trend reversal signals in ranging markets. The 1-day timeframe choice balances trading frequency and signal quality, avoiding excessive noise from intraday trading and capital occupation issues from long-term holding.

Strategy Risks

Despite reasonable design, several potential risks require attention. The primary risk is frequent stop-loss issues in ranging markets. When markets are in sideways consolidation, EMA crossover signals may appear frequently, leading to accumulated small losses. While RSI confirmation can reduce some false signals, it cannot completely eliminate this risk.

Lag is an inherent problem with all moving average strategies. EMA crossover signals often appear after trends have already begun, potentially missing optimal entry points. Particularly in rapidly reversing markets, waiting for crossover confirmation may result in missing important trading opportunities or entering at unfavorable positions.

Fixed RSI threshold settings also present risks. The 55 and 45 thresholds may lack flexibility under different market conditions. In some strong trends, RSI may remain in extreme zones for extended periods, causing the strategy to miss sustained trend opportunities. Similarly, in certain markets, these thresholds may be too loose, allowing lower-quality signals to enter.

While ATR-based risk management is advanced, it may be insufficient under extreme market conditions. Gap openings caused by sudden events may exceed ATR-calculated stop levels, causing losses beyond expectations. Additionally, ATR calculations are based on historical volatility and may not accurately reflect current risk levels when market structure changes.

Strategy Optimization Directions

This strategy has multiple optimization dimensions. First, consider introducing dynamic parameter adjustment mechanisms. Using market volatility indicators like ATR or VIX-type indicators to dynamically adjust EMA period parameters, extending periods during high volatility to reduce noise and shortening periods during low volatility to improve sensitivity. This adaptive mechanism enables better strategy adaptation to different market environments.

RSI confirmation mechanism optimization can be achieved through dynamic thresholds. Instead of using fixed 55 and 45 values, thresholds can be dynamically adjusted based on historical RSI distribution or market volatility. For example, appropriately raising thresholds in strongly trending markets and lowering them in ranging markets to improve signal adaptability.

Risk management systems can be enhanced through multi-layer stop-loss mechanisms. Besides ATR-based technical stops, time-based stops (automatic closure after holding for specific days) and floating profit protection mechanisms (adjusting stops near cost after reaching certain profit percentages) can be added. This multi-dimensional risk control better protects trading capital.

Filter condition optimization is another important direction. Additional conditions like volume confirmation, price breakout of previous high/low confirmation, or broad market index trend confirmation can be considered. These filters can further improve signal quality and reduce trading frequency in unfavorable market environments.

Finally, machine learning algorithms can be introduced to optimize parameter selection and signal confirmation. Through historical data training, algorithms can learn optimal parameter combinations under different market conditions and adjust strategy parameters in real-time, making the strategy more adaptive and robust.

Conclusion

The Dual EMA Crossover RSI Confirmation Swing Momentum Strategy is a structurally complete and logically clear medium-term trading strategy. Through the triple mechanism of EMA crossover for trend direction identification, RSI for momentum strength confirmation, and ATR for trading risk management, the strategy theoretically possesses core elements for capturing swing movements. The strategy’s advantages lie in multiple confirmation mechanisms reducing false signal probability, dynamic risk management adapting to market volatility, and swing trading characteristics balancing trading frequency and capital efficiency.

However, the strategy also faces challenges including frequent stops in ranging markets, signal lag, and parameter rigidity. Through improvements such as dynamic parameter adjustment, multi-layer risk management, additional filter conditions, and machine learning optimization, the strategy’s stability and profitability are expected to improve significantly. Overall, this is a practically valuable swing trading strategy suitable for traders with some technical analysis foundation.

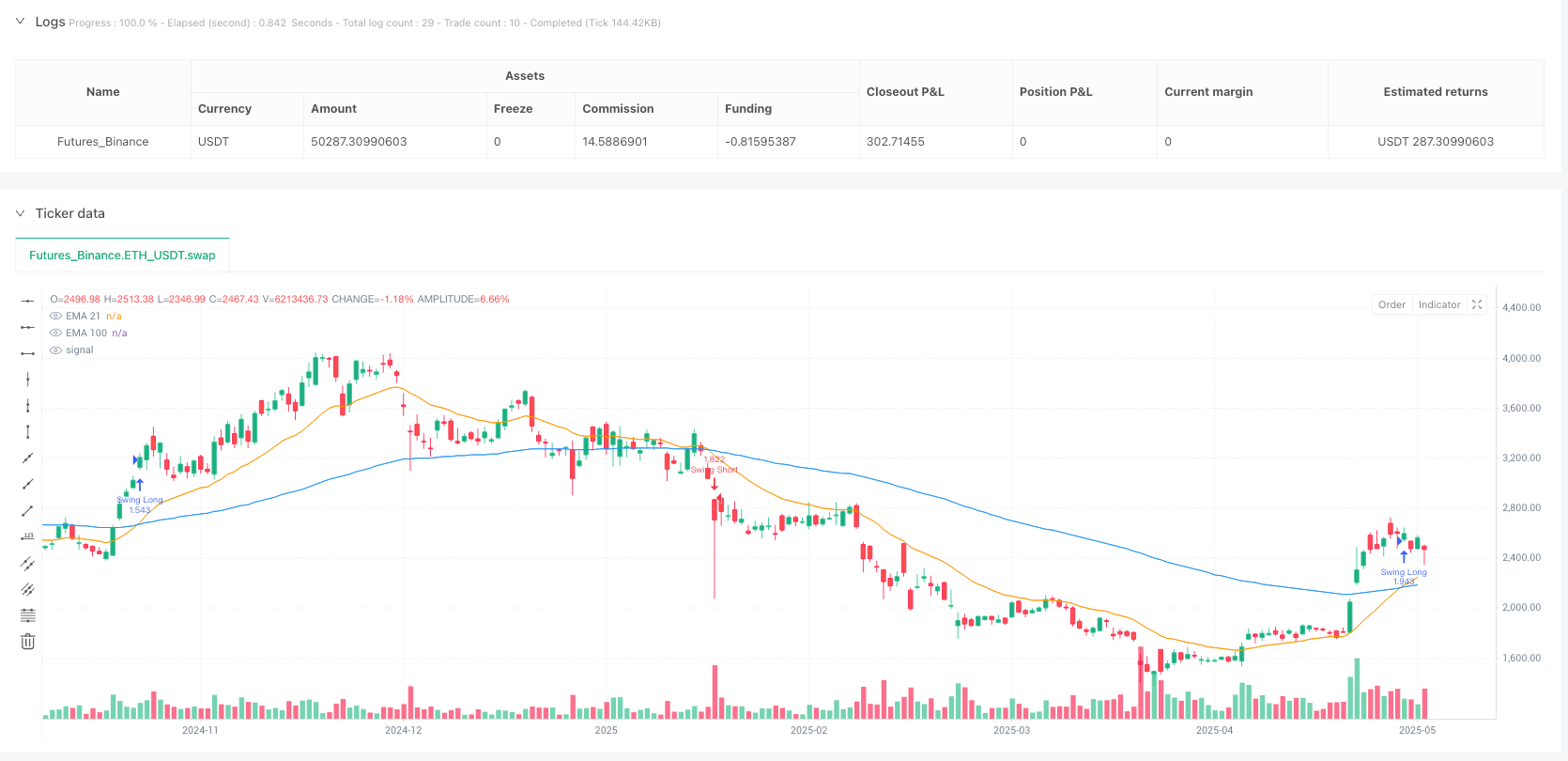

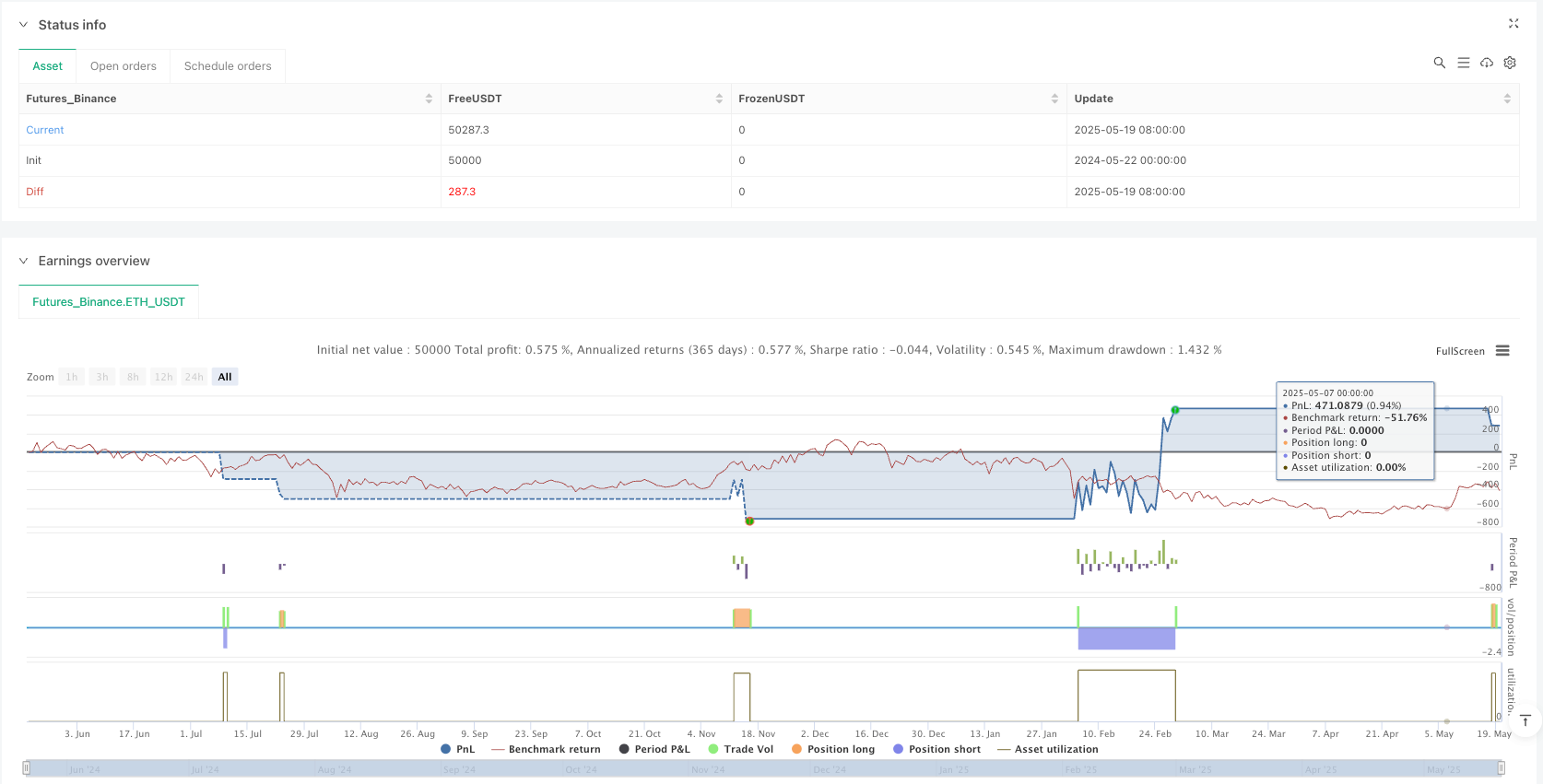

/*backtest

start: 2024-05-22 00:00:00

end: 2025-05-20 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Weekly Swing Momentum Strategy (India)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

emaFastLen = input.int(21, title="Fast EMA (Swing)")

emaSlowLen = input.int(100, title="Slow EMA (Swing)")

rsiPeriod = input.int(14, title="RSI Period")

rsiBuyThresh = input.int(55, title="RSI Buy Threshold")

rsiSellThresh = input.int(45, title="RSI Sell Threshold")

atrPeriod = input.int(14, title="ATR Period")

riskMultiplier = input.float(1.0, title="Stop Loss ATR Multiplier")

rewardMultiplier = input.float(2.0, title="Target ATR Multiplier")

// === INDICATORS ===

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

rsi = ta.rsi(close, rsiPeriod)

atr = ta.atr(atrPeriod)

// === CONDITIONS ===

bullishCrossover = ta.crossover(emaFast, emaSlow)

bearishCrossover = ta.crossunder(emaFast, emaSlow)

longCondition = bullishCrossover and rsi > rsiBuyThresh

shortCondition = bearishCrossover and rsi < rsiSellThresh

// === TRADE EXECUTION ===

if (longCondition)

stopLoss = close - atr * riskMultiplier

takeProfit = close + atr * rewardMultiplier

strategy.entry("Swing Long", strategy.long)

strategy.exit("Swing Exit Long", from_entry="Swing Long", stop=stopLoss, limit=takeProfit)

if (shortCondition)

stopLoss = close + atr * riskMultiplier

takeProfit = close - atr * rewardMultiplier

strategy.entry("Swing Short", strategy.short)

strategy.exit("Swing Exit Short", from_entry="Swing Short", stop=stopLoss, limit=takeProfit)

// === PLOT ===

plot(emaFast, title="EMA 21", color=color.orange)

plot(emaSlow, title="EMA 100", color=color.blue)