Overview

This strategy is a specialized short-only quantitative trading system focused on support level breakouts, designed to capture downward price trends through the identification of effective support level breaches. The strategy combines support-resistance theory from technical analysis, volume confirmation principles, and ATR (Average True Range) dynamic risk management mechanisms. The system features sideways market filtering capabilities that effectively avoid false signals during ranging markets, concentrating on trend-based breakout opportunities. The strategy employs a trailing stop mechanism that maximizes profit potential from downward trends while protecting accumulated gains.

Strategy Principles

The core principle of this strategy is based on support level breakout theory from technical analysis. First, the system determines key support levels by calculating the lowest prices over the past 20 periods, representing important defensive zones for bullish forces. When price breaks below this support level while meeting breakout buffer conditions, it indicates that bullish defenses have been breached and bearish forces have gained dominance. To enhance signal reliability, the strategy incorporates volume confirmation, considering breakouts valid only when volume equals or exceeds the 20-period volume moving average. Additionally, the system integrates sideways market detection by comparing the price range over 20 periods with ATR ratios to determine if the market is in a ranging state. When the price range is less than 1.5 times ATR, the system identifies sideways market conditions and suspends signal generation. For risk management, the strategy employs ATR-based dynamic stop-loss mechanisms, including both initial stops and trailing stops, automatically adjusting risk control parameters based on market volatility.

Strategy Advantages

This strategy possesses multiple technical advantages, beginning with high signal quality achieved through triple filtering conditions: support breakout, volume confirmation, and sideways market filtering, significantly reducing false signal probability. Volume confirmation ensures breakout validity, avoiding false breakouts caused by insufficient liquidity. The sideways market filtering function is a key advantage, effectively identifying ranging markets and suspending trading to avoid consecutive losses in unfavorable market conditions. Dynamic risk management represents the strategy’s core advantage, with ATR-based stop mechanisms automatically adjusting to market volatility, providing more relaxed stop levels during high volatility periods and tightening risk control during low volatility. The trailing stop function maximizes trend profits while protecting existing gains, allowing positions to continue running in favorable directions. The strategy’s parameterized design offers excellent adaptability, enabling traders to adjust key parameters according to different market environments and personal risk preferences. System visualization features provide intuitive market analysis tools by plotting support levels, volume averages, and trading signals on charts.

Strategy Risks

Despite multiple advantages, several potential risks require attention. First is trend reversal risk, where support level breakouts during strong upward trends may represent temporary retracements rather than genuine trend reversals, potentially causing short positions to face rapid stop-outs. Extreme market volatility risk is another important consideration, as major news impacts or market panic may cause price gaps that render ATR-based stop mechanisms ineffective. Single timeframe limitations represent a potential weakness, as the strategy analyzes only one time period, potentially overlooking higher timeframe trend directions. To mitigate these risks, practical application should combine higher timeframe trend analysis to avoid counter-trend operations. Additionally, maximum drawdown limits and daily trade frequency caps should be implemented to prevent excessive losses during extreme market conditions. Regular backtesting under different market environments and timely parameter adjustments are also recommended.

Strategy Optimization Directions

Several optimization directions exist to enhance overall performance. First, multi-timeframe analysis could be introduced, combining higher timeframe trend directions to filter trading signals, such as executing hourly short breakout signals only when daily charts show downward trends. This could significantly improve signal success rates while avoiding counter-trend operations. Second, volume confirmation mechanisms could be optimized by considering not only absolute volume values but also relative volume change rates and distribution characteristics. For example, requiring breakout volume to not only exceed the average but also show significant growth compared to previous periods. Third, market sentiment indicators like VIX fear index or RSI overbought/oversold conditions could be added to further optimize entry timing. For risk management, dynamic position sizing could be implemented, adjusting position sizes based on market volatility and recent strategy performance. Positions could be increased during consecutive profitable periods and reduced during losing streaks. Additionally, adaptive parameter optimization functionality could be developed, allowing the system to automatically adjust key parameters like support lookback periods and ATR multipliers based on historical performance. Finally, fundamental filters should be considered, suspending trading before and after major economic data releases to avoid abnormal volatility from news impacts.

Conclusion

This strategy represents a well-designed support breakout short-only quantitative trading system that achieves high signal quality and risk control through multiple technical indicator combinations. The strategy’s core advantages lie in its comprehensive signal filtering mechanisms and ATR-based dynamic risk management system. Volume confirmation and sideways market filtering effectively enhance trading signal reliability, while trailing stop mechanisms achieve excellent balance between risk control and profit maximization. However, the strategy has room for improvement in handling trend reversal risks and extreme market conditions. Through introducing multi-timeframe analysis, optimizing volume confirmation mechanisms, and adding market sentiment indicators, the strategy’s stability and profitability can be further enhanced. Overall, this strategy provides quantitative traders with a reliable short trading tool, suitable for application in ranging-weak or downtrending market environments.

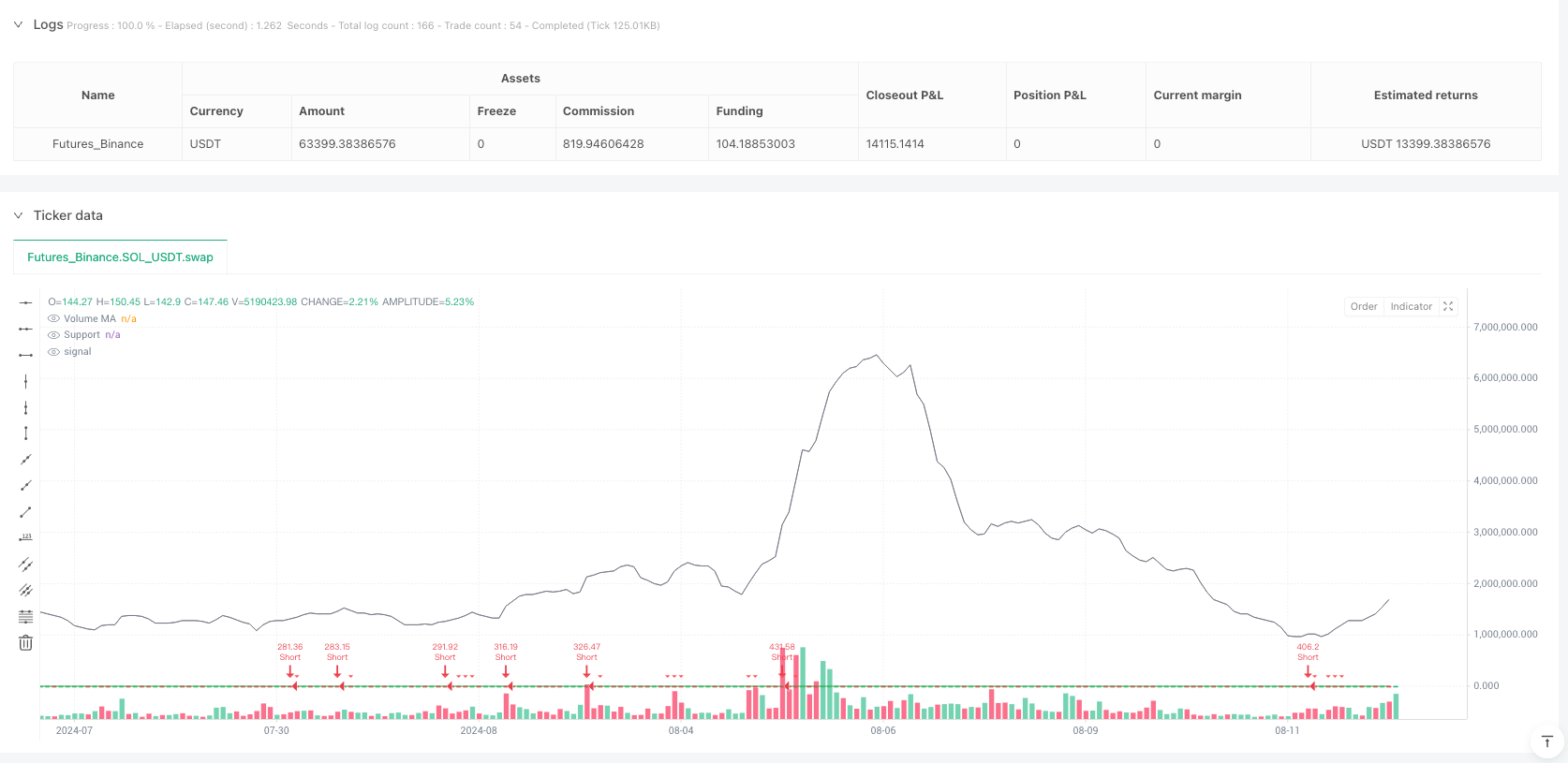

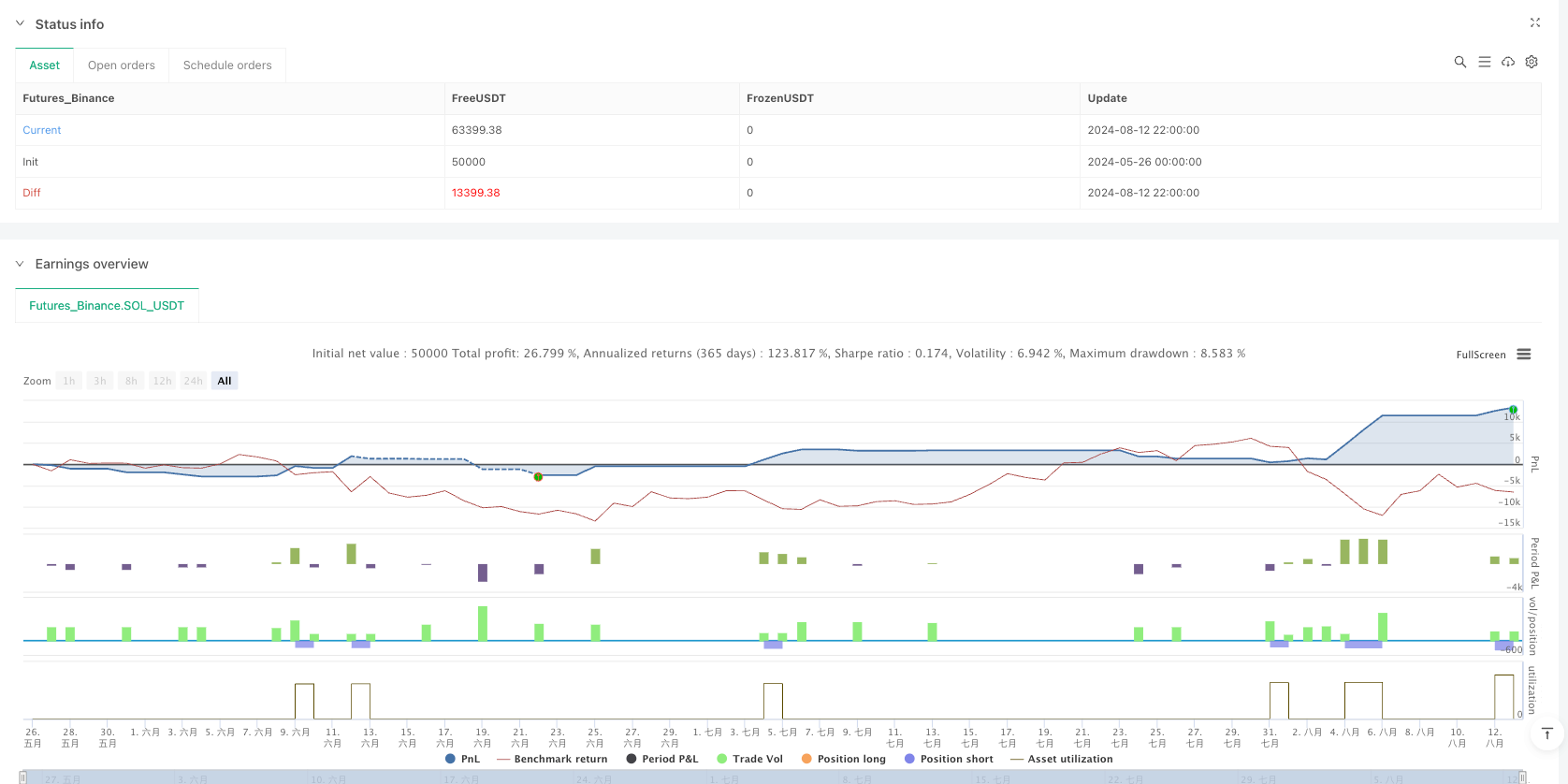

/*backtest

start: 2024-05-26 00:00:00

end: 2024-08-13 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Breakout Strategy Pro [Dubic] - Short Only", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS === //

srRange = input.int(20, "Support Lookback", minval=5)

volMaLength = input.int(20, "Volume MA Length", minval=1)

atrLength = input.int(14, "ATR Period", minval=5)

trailMultiplier = input.float(1.5, "Trailing Stop Multiplier", minval=1.0)

stopMultiplier = input.float(1.0, "Initial Stop-Loss ATR Multiplier", minval=0.5)

breakoutBuffer = input.float(1.005, "Breakout Buffer", step=0.001)

rangeLength = input.int(20, "Range Detector Lookback", minval=5)

rangeThreshold = input.float(1.5, "Sideways Threshold (x ATR)", minval=0.5, step=0.1)

// === CALCULATIONS === //

lowLevel = ta.lowest(low, srRange)[1]

volMA = ta.sma(volume, volMaLength)

atr = ta.atr(atrLength)

trailOffsetTicks = math.max(int(math.round((atr * trailMultiplier) / syminfo.mintick)), 1)

stopLossTicks = math.max(int(math.round((atr * stopMultiplier) / syminfo.mintick)), 1)

// === SIDEWAYS DETECTION === //

highRange = ta.highest(high, rangeLength)

lowRange = ta.lowest(low, rangeLength)

priceRange = highRange - lowRange

isSideways = priceRange <= atr * rangeThreshold

// === ENTRY LOGIC === //

shortCondition = close <= lowLevel * breakoutBuffer and volume >= volMA and not isSideways

// === ENTRY & EXIT === //

if shortCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", trail_price=close, trail_offset=trailOffsetTicks, stop=close + stopLossTicks * syminfo.mintick)

alert("Short Entry Signal - Breakout Strategy Pro [Dubic]", alert.freq_once_per_bar)

// === VISUALS === //

plot(lowLevel, "Support", color=color.new(color.green, 30))

plot(volMA, "Volume MA", color=color.gray)

plotshape(shortCondition, location=location.abovebar, style=shape.triangledown, color=color.red, size=size.small, title="Sell Signal")

bgcolor(isSideways ? color.new(color.orange, 85) : na, title="Sideways Market")