Session-Based Range Breakout Momentum Strategy with Dynamic Risk Management

Moving Average EMA SMA Range Breakout Session Trading Risk-Reward Ratio BREAK-EVEN

Overview

This strategy is a session-based range breakout strategy that targets price breakouts from ranges formed during defined trading sessions. It combines session analysis, momentum breakouts, moving average filtering, and sophisticated risk management to capture trading opportunities as markets transition from low volatility to directional movement. The strategy specifically focuses on price levels established during preset trading sessions (such as Asian, European, or US sessions) and enters the market when price breaks through these key levels.

Strategy Principles

The core principle of this strategy is based on breakouts from support and resistance levels established during specific market sessions. The execution logic works as follows:

Session Definition and Range Formation: The strategy allows users to define specific trading sessions (based on UAE time, GMT+4), during which the system continuously tracks and updates the highest and lowest prices, forming a trading range.

Breakout Condition Identification:

- Long condition: Price closes above the session high

- Short condition: Price closes below the session low

Moving Average Filter: The strategy provides an optional moving average filter, which can be either an Exponential Moving Average (EMA) or Simple Moving Average (SMA). When enabled, the system requires:

- For long trades: Price must be above the moving average

- For short trades: Price must be below the moving average This filter aims to ensure trade direction aligns with the overall trend.

Risk Management Setup:

- Stop Loss (SL) settings have two options:

- Based on high/low points: SL for long trades at session low, SL for short trades at session high

- Based on mid-range: SL at the midpoint of the session price range

- SL positions are further adjusted to account for spread factors

- Take Profit (TP) calculated based on a preset risk-reward ratio

- Break-even functionality that moves the stop loss when the trade reaches a specific risk-reward level

- Stop Loss (SL) settings have two options:

Trade Management:

- Limitation on maximum trades per day

- Reset of counters and range values at the beginning of each session

- Closure of session tracking at session end

This strategy design is based on the principle that markets tend to accumulate energy during low volatility periods and then release it when breaking through key price levels. By waiting for confirmatory closing price breakouts, the strategy attempts to reduce the risk of false breakouts, and the optional moving average filter further enhances signal reliability.

Strategy Advantages

Analyzing the code implementation of this strategy, we can summarize several key advantages:

Objective Entries Based on Market Structure: The strategy utilizes price ranges formed within sessions as an objective reflection of market structure, rather than relying on subjective judgment or fixed parameters. This allows the strategy to adapt to different market conditions and volatility.

Flexible Session Settings: Users can adjust trading sessions according to different market characteristics and personal trading styles, making the strategy applicable to multiple markets and time zones.

Multi-layered Filtering Mechanism: By combining range breakouts and moving average filtering, the strategy significantly improves signal quality and reduces the possibility of false breakouts. Especially in trending markets, the moving average filter can prevent counter-trend trading.

Sophisticated Risk Management:

- Dynamic stop loss settings based on actual market volatility

- Predefined risk-reward ratios ensure consistent trade management

- Break-even functionality reduces the probability of losing trades

- Trade limitations prevent overtrading and risk accumulation

High Adaptability: Strategy parameters can be widely adjusted, making it applicable to different timeframes, markets, and asset classes. Moving average types, lengths, risk-reward ratios, and other key parameters can all be optimized to suit specific conditions.

Easy to Monitor and Optimize: The code implementation includes clear visualization elements (such as graphical representation of range highs/lows and moving averages) and alert conditions, facilitating monitoring and subsequent optimization.

Strategy Risks

Despite its many advantages, the strategy also has some inherent risks and potential drawbacks:

Risk of False Breakout Signals: Markets frequently exhibit false breakouts, where price briefly breaks the range and then quickly retraces. Although the strategy mitigates this risk through closing price confirmation and the optional moving average filter, it cannot eliminate it completely.

- Solution: Consider adding additional confirmation indicators such as volume breakouts or volatility filters, or require price to maintain the breakout for a certain period.

Session Dependency: The strategy’s effectiveness is highly dependent on the characteristics of the chosen session. If the selected session does not consistently form meaningful price ranges, strategy performance may be affected.

- Solution: Conduct detailed session analysis for different markets and assets to identify sessions that most effectively form tradable ranges.

Stop Loss Setting Risks: In highly volatile markets, stop losses based on session highs/lows may be too wide, leading to excessive risk; while in low volatility markets, stops may be too tight, resulting in unnecessary triggering.

- Solution: Implement volatility-based dynamic stop loss adjustments, or add minimum/maximum stop loss range limitations.

Fixed Risk-Reward Ratio Issues: A fixed risk-reward ratio may not be optimal across all market conditions. In strong trending markets, higher ratios might be more appropriate, while in ranging markets, lower ratios might be more suitable.

- Solution: Consider implementing adaptive risk-reward ratios based on market conditions such as volatility or trend strength.

Lack of Market Environment Adaptability: The strategy has no explicit mechanism to differentiate between different market environments (e.g., trending vs. ranging markets) and may generate signals in market conditions not suitable for breakout strategies.

- Solution: Add market environment filters, such as trend strength indicators or volatility analysis, to adjust or disable the strategy under unfavorable conditions.

Trade Frequency Limitation: While the daily trade limit prevents overtrading, it may also miss valid signals, particularly on highly volatile days.

- Solution: Consider implementing more intelligent trade frequency control, such as adaptive limitations based on market volatility or previous trade success rates.

Strategy Optimization Directions

Based on a deep analysis of the strategy code, here are several potential optimization directions:

Adaptive Session Settings:

- The current strategy uses fixed session start and end times. A valuable improvement would be to implement adaptive session identification that automatically determines optimal session settings based on historical volatility patterns.

- This optimization would enable the strategy to adapt to seasonal patterns and changing volatility characteristics in different markets.

Improved Breakout Confirmation:

- Add volume confirmation requirements, ensuring breakouts are accompanied by significant volume increases

- Implement dynamic breakout thresholds, adjusting the required breakout magnitude based on recent volatility

- Add price action confirmation, such as requiring specific candle patterns following the breakout

- These improvements can significantly reduce false breakout trades and improve overall profitability.

Dynamic Risk Management:

- Adjust risk-reward ratios based on market volatility

- Implement more sophisticated trailing stop mechanisms, such as condition-based partial profit taking

- Add time-based stop losses to exit trades that don’t develop after a certain period

- These optimizations can significantly improve the strategy’s risk-adjusted returns.

Market Environment Filtering:

- Implement a market environment classification system, distinguishing between trending, ranging, and transitional market states

- Adjust strategy parameters or completely enable/disable the strategy based on the identified market environment

- Add volatility-based filters to adjust or pause trading during abnormally high volatility periods

- This optimization is crucial for avoiding trading in unfavorable conditions and can dramatically improve long-term performance.

Multi-timeframe Analysis:

- Incorporate trend information from higher timeframes to ensure trade direction aligns with larger trends

- Use price action from lower timeframes for precise entry optimization

- This optimization can improve entry precision and overall success rates.

Machine Learning Enhancements:

- Use machine learning algorithms to optimize strategy parameters

- Implement pattern recognition systems to identify breakout setups most likely to succeed

- Develop predictive models to estimate the probability of success for specific breakouts

- These advanced optimizations can take the strategy to a new level, leveraging data-driven insights to enhance traditional technical analysis.

Summary

The Session-Based Range Breakout Momentum Strategy is a comprehensive trading system that combines elements of session analysis, price breakouts, trend confirmation, and risk management. Its core strengths lie in its identification of entry points based on objective market structure and sophisticated risk control mechanisms.

The strategy is particularly suitable for markets with distinct session characteristics, such as forex markets and global indices with regional trading session features. By defining key price levels and waiting for confirmatory breakouts, the strategy attempts to capture price transitions from accumulation phases to directional moves.

Despite challenges such as false breakout risks and session dependency, these risks can be effectively managed through the suggested optimization directions, such as adaptive parameter settings, improved breakout confirmation, and dynamic risk management.

The strategy’s flexibility and customizability make it applicable to various trading styles and market conditions. Whether for day traders looking to capitalize on specific session volatilities or swing traders seeking to identify key entry points, this framework provides a robust foundation that can be further customized and optimized according to individual needs.

Ultimately, the strategy’s effectiveness will depend on fine-tuning to specific market characteristics and strict trading discipline. Through continued monitoring, backtesting, and optimization, traders can further enhance the performance of this strategy, making it a powerful trading tool.

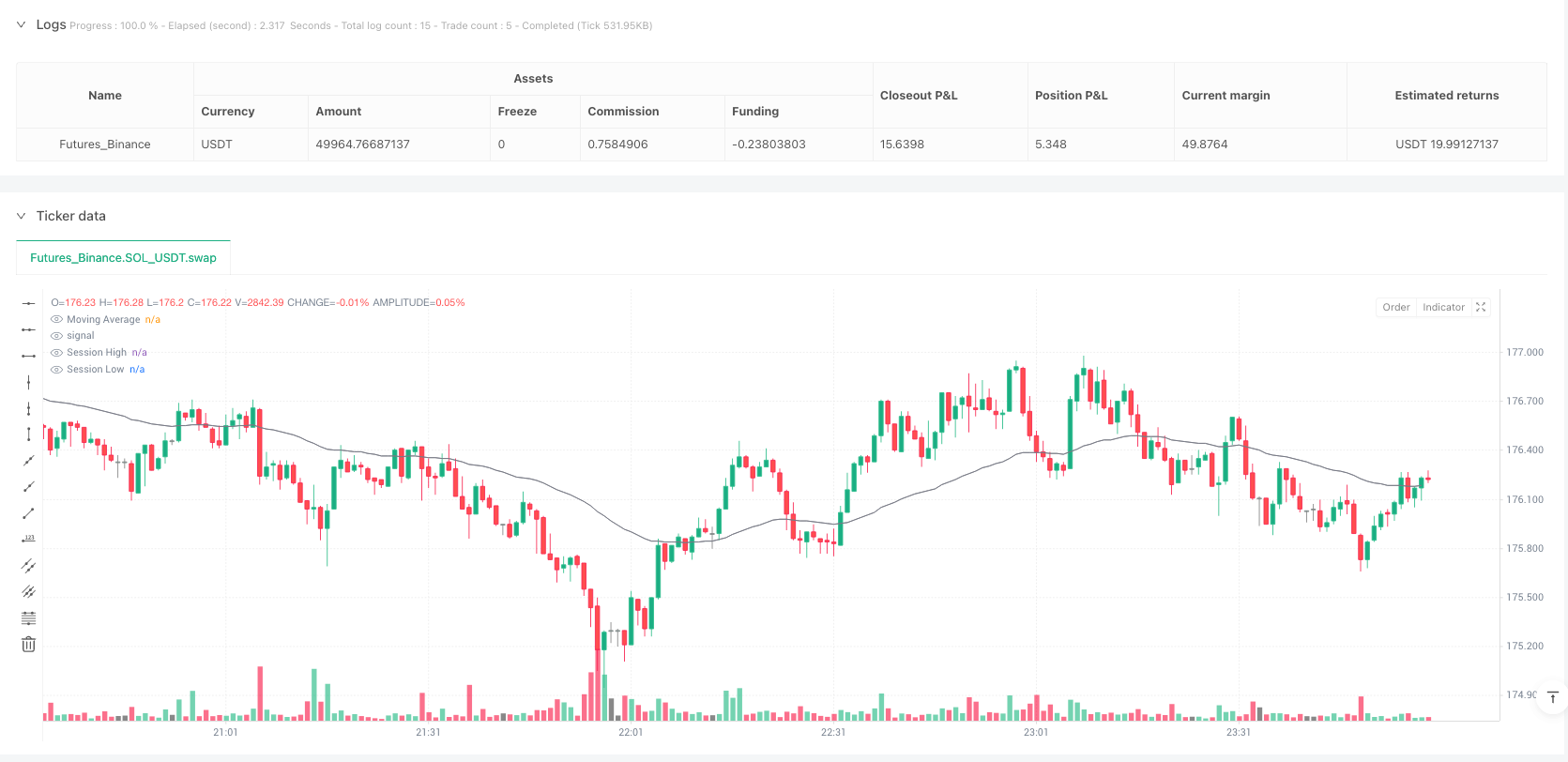

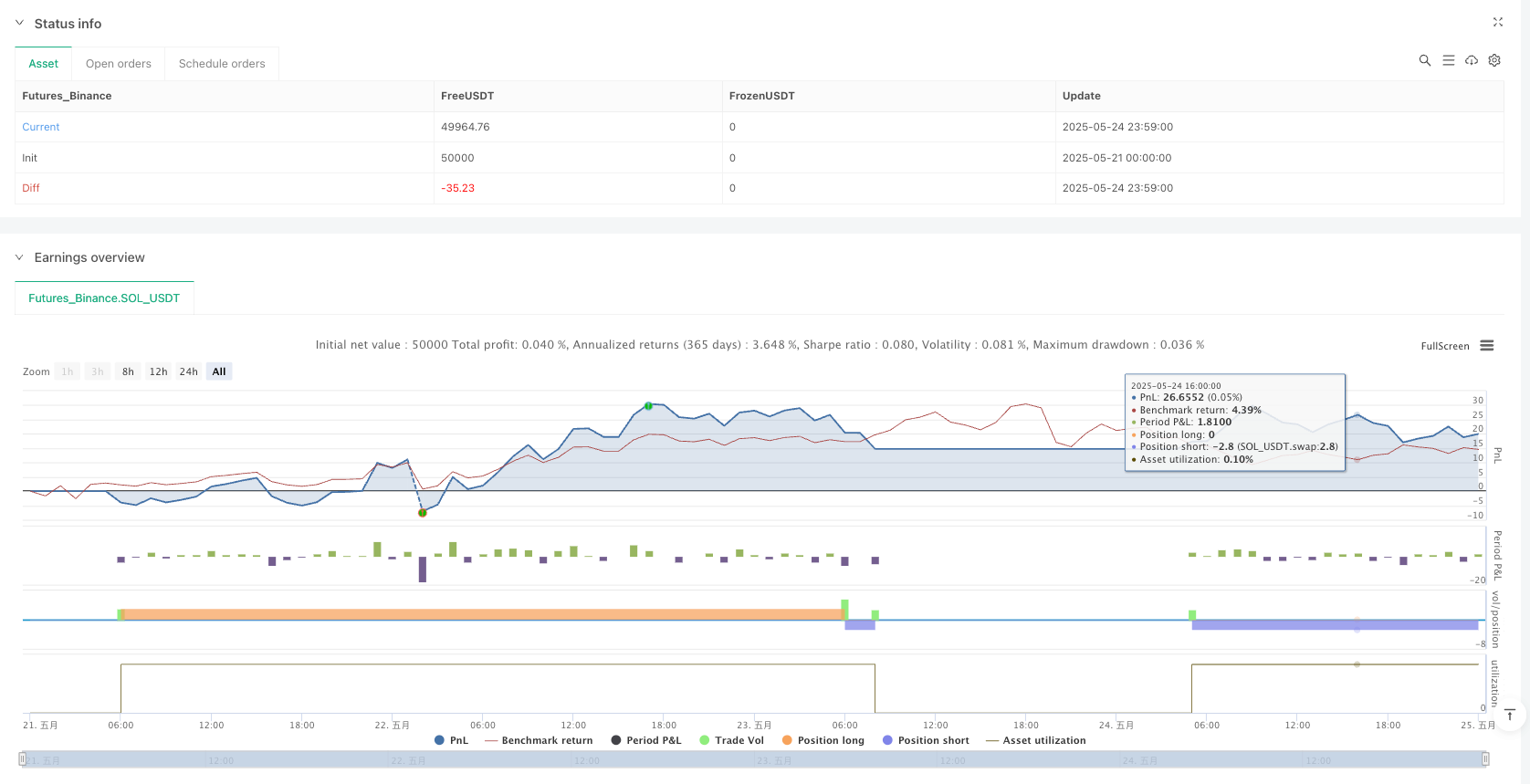

/*backtest

start: 2025-05-21 00:00:00

end: 2025-05-25 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Session Breakout Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// === User Inputs ===

startHour = input.int(2, "Session Start Hour (UAE Time)")

endHour = input.int(4, "Session End Hour (UAE Time)")

useMA = input.bool(true, "Use Moving Average Confluence")

maType = input.string("EMA", "MA Type", options=["EMA", "SMA"])

maLength = input.int(50, "MA Length")

riskReward = input.float(3.0, "Risk-Reward Ratio")

breakEvenRR = input.float(1.0, "Break-even After X RR")

slType = input.string("LowHigh", "SL Type", options=["LowHigh", "MidRange"])

extraPips = input.float(5.0, "Extra Pips for Spread") * syminfo.mintick

maxTrades = input.int(3, "Max Trades per Day")

// === Time Calculations ===

t = time("30", "Etc/GMT-4") // UAE time in GMT+4

tHour = hour(t)

tMin = minute(t)

sessionOpen = (tHour == startHour and tMin == 0)

sessionClose = (tHour == endHour and tMin == 0)

var float sessionHigh = na

var float sessionLow = na

var int tradeCount = 0

var bool inSession = false

if sessionOpen

sessionHigh := high

sessionLow := low

inSession := true

tradeCount := 0

else if inSession and not sessionClose

sessionHigh := math.max(sessionHigh, high)

sessionLow := math.min(sessionLow, low)

else if sessionClose

inSession := false

// === MA Filter ===

ma = maType == "EMA" ? ta.ema(close, maLength) : ta.sma(close, maLength)

// === Entry Conditions ===

longCondition = close > sessionHigh and (not useMA or close > ma)

shortCondition = close < sessionLow and (not useMA or close < ma)

// === SL and TP ===

rangeMid = (sessionHigh + sessionLow) / 2

sl = slType == "LowHigh" ? (shortCondition ? sessionHigh : sessionLow) : rangeMid

sl := shortCondition ? sl + extraPips : sl - extraPips

entry = close

risk = math.abs(entry - sl)

tp = shortCondition ? entry - risk * riskReward : entry + risk * riskReward

beLevel = shortCondition ? entry - risk * breakEvenRR : entry + risk * breakEvenRR

// === Trade Execution ===

canTrade = tradeCount < maxTrades

if longCondition and canTrade

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", from_entry="Long", limit=tp, stop=sl)

tradeCount += 1

if shortCondition and canTrade

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL", from_entry="Short", limit=tp, stop=sl)

tradeCount += 1

// === Plotting ===

plot(inSession ? sessionHigh : na, title="Session High", color=color.blue)

plot(inSession ? sessionLow : na, title="Session Low", color=color.orange)

plot(useMA ? ma : na, title="Moving Average", color=color.gray)

// === Alerts ===

alertcondition(longCondition, title="Long Breakout Alert", message="Session breakout long signal")

alertcondition(shortCondition, title="Short Breakout Alert", message="Session breakout short signal")