Overview

The Multi-Timeframe Trend Following Strategy with Adaptive Risk Management and Market Regime Detection is a comprehensive quantitative trading system designed to identify strong trends while filtering out false signals and unfavorable market environments. The strategy leverages a combination of technical indicators, including fast and slow Exponential Moving Averages (EMAs), Simple Moving Averages (SMAs), MACD indicator, and ATR volatility measurement to form a complete trading system. This system not only automatically identifies entry points but also sets predefined target levels, places automated stop losses, and features capabilities for detecting false signals, identifying trap zones, and sideways market conditions.

Strategy Principles

The core principle of this strategy is based on trend following and multiple confirmation concepts. It is implemented through several key components:

Trend Confirmation System: Uses crossovers between the fast EMA (8-period) and slow EMA (34-period) to determine short-term trend direction. Additionally, price must be above (for longs) or below (for shorts) both the 50-period and 200-period simple moving averages, providing medium and long-term trend confirmation.

Momentum Confirmation: The MACD indicator is used to verify that price momentum aligns with the trend direction. Long signals require the MACD line to be above the signal line and positive, while short signals require the opposite.

Adaptive Risk Management: The strategy employs the 14-period Average True Range (ATR) multiplied by an adjustable factor to set stop loss levels. This approach allows stop loss placement to automatically adapt to market volatility, providing wider stops in volatile markets and tighter stops in calmer conditions.

Predefined Risk-Reward Ratio: Profit targets are automatically calculated based on a set risk-reward ratio (default 2.0). This ensures that each trade has a consistent and expected risk-reward setup.

Market Trap Detection: The strategy can identify potential false breakout patterns, such as when price breaks above the 20-period high but closes below the open (long trap), or when price breaks below the 20-period low but closes above the open (short trap).

Sideways Market Filtering: Identifies ranging markets by calculating the EMA slope and detecting weak MACD values. When the EMA slope is less than a set threshold and MACD is close to zero, the strategy avoids trading in these inefficient market environments.

Strategy Advantages

Comprehensive Trend Confirmation: By combining multiple timeframe moving averages and MACD indicators, the strategy filters out weak trends and reversal signals, only trading in strong trending environments.

Adaptive Risk Control: The ATR-based stop loss setting allows the strategy to automatically adjust protection levels based on current market volatility, providing more precise risk control.

Intelligent Market Regime Recognition: By detecting trap zones and sideways markets, the strategy can avoid trading in unfavorable conditions, significantly reducing losses from false signals.

Visualized Trading Environment: The strategy provides visual markings of trap zones and sideways areas, helping traders better understand market conditions and potential danger zones.

Automated Alert System: The built-in alert functionality provides real-time trade signal notifications, including exact entry points, stop losses, and profit targets, making trade execution more efficient.

Balanced Risk-Reward Setup: The predefined risk-reward ratio ensures that each trade has a consistent expected return, contributing to long-term profitability.

Flexible Parameter Adjustment: All key parameters can be adjusted according to specific markets and personal risk preferences, providing a high degree of strategy customization.

Strategy Risks

Trend Reversal Risk: Despite using a multiple confirmation system, the strategy may not exit quickly enough during sudden market reversals, leading to drawdowns. The solution is to consider adding volatility filters or shorter-term reversal indicators to provide early warnings.

Parameter Optimization Trap: Over-optimizing parameters for specific periods may lead to forward-looking bias and degraded future performance. The solution is to backtest across multiple market cycles and different asset classes, using robust parameter settings.

Sideways Market Performance: Although the strategy attempts to filter sideways markets, the detection mechanism isn’t perfect and may lead to overtrading in inefficient markets. The solution is to add additional range identification indicators such as Bollinger Band Width or ADX.

Reliance on Historical Volatility: ATR-based stops assume that future volatility will be similar to historical volatility, which may be insufficient when volatility suddenly expands. The solution is to consider using dynamic ATR multipliers or combining key price level stop losses.

Limitations of Fixed Risk-Reward Ratio: A fixed risk-reward ratio may not be suitable for all market conditions. The solution is to implement dynamic target setting, adjusting the risk-reward ratio based on support/resistance levels or volatility expectations.

False Signal Detection Limitations: The current trap detection system is relatively simple and may not capture all types of market traps. The solution is to integrate more complex price action pattern recognition or volume confirmation.

Strategy Optimization Directions

Add Volume Confirmation: Integrating volume indicators into entry conditions can improve signal quality. Specifically, confirming that trend moves are accompanied by increasing volume can reduce false breakouts. Consider adding a relative volume indicator (such as the Relative Volume Index) as an additional filter condition.

Implement Dynamic Risk Management: The current fixed ATR multiplier can be upgraded to a dynamic multiplier based on market conditions. For example, using smaller multipliers (tighter stops) in strong trending environments and larger multipliers in volatile markets to adapt to different market conditions.

Enhance Market Regime Classification: The current sideways detection can be expanded into a more comprehensive market regime classification system, including strong trend, weak trend, sideways, and high volatility states. Each regime could have customized entry conditions and risk parameters, significantly improving strategy adaptability.

Integrate Seasonality and Time Filters: Analyzing and incorporating seasonality patterns or optimal trading hours of the day can further enhance strategy performance. This can be done by restricting trading during historically underperforming periods to reduce losses.

Implement Partial Profit-Taking Mechanism: Replacing the single profit target with a multi-tiered profit strategy, allowing partial position closing at different price levels, can lock in profits while maintaining upside potential, improving the strategy’s overall risk-adjusted returns.

Add Correlated Market Filters: Integrating signals from correlated markets (such as indices or leading indicators) as an additional confirmation layer can reduce false signals and improve entry timing.

Implement Machine Learning Optimization: Using machine learning algorithms to dynamically optimize strategy parameters or predict optimal entry points can significantly enhance strategy performance, especially in rapidly changing market environments.

Summary

The Multi-Timeframe Trend Following Strategy with Adaptive Risk Management and Market Regime Detection represents a comprehensive and robust trading system suitable for application across various market conditions. By combining multiple trend confirmations, dynamic risk management, and advanced market regime recognition, the strategy aims to capture high-probability trading opportunities in strong trends while avoiding unfavorable market environments.

The main strengths of the strategy lie in its comprehensive signal confirmation system and intelligent risk management framework, while its limitations primarily relate to the precision of market regime detection and fixed parameter settings. Through implementation of the suggested optimizations, particularly dynamic risk management, enhanced market regime classification, and volume confirmation, the strategy has the potential to further improve its performance and robustness.

For traders and investors seeking a systematic approach to identifying trends, managing risk, and adapting to different market conditions, this strategy provides a powerful framework that can serve as a foundation for building personalized trading systems. Most importantly, the modular design of the strategy allows for customization and extension according to specific needs and market environments, making it a valuable tool for various trading styles.

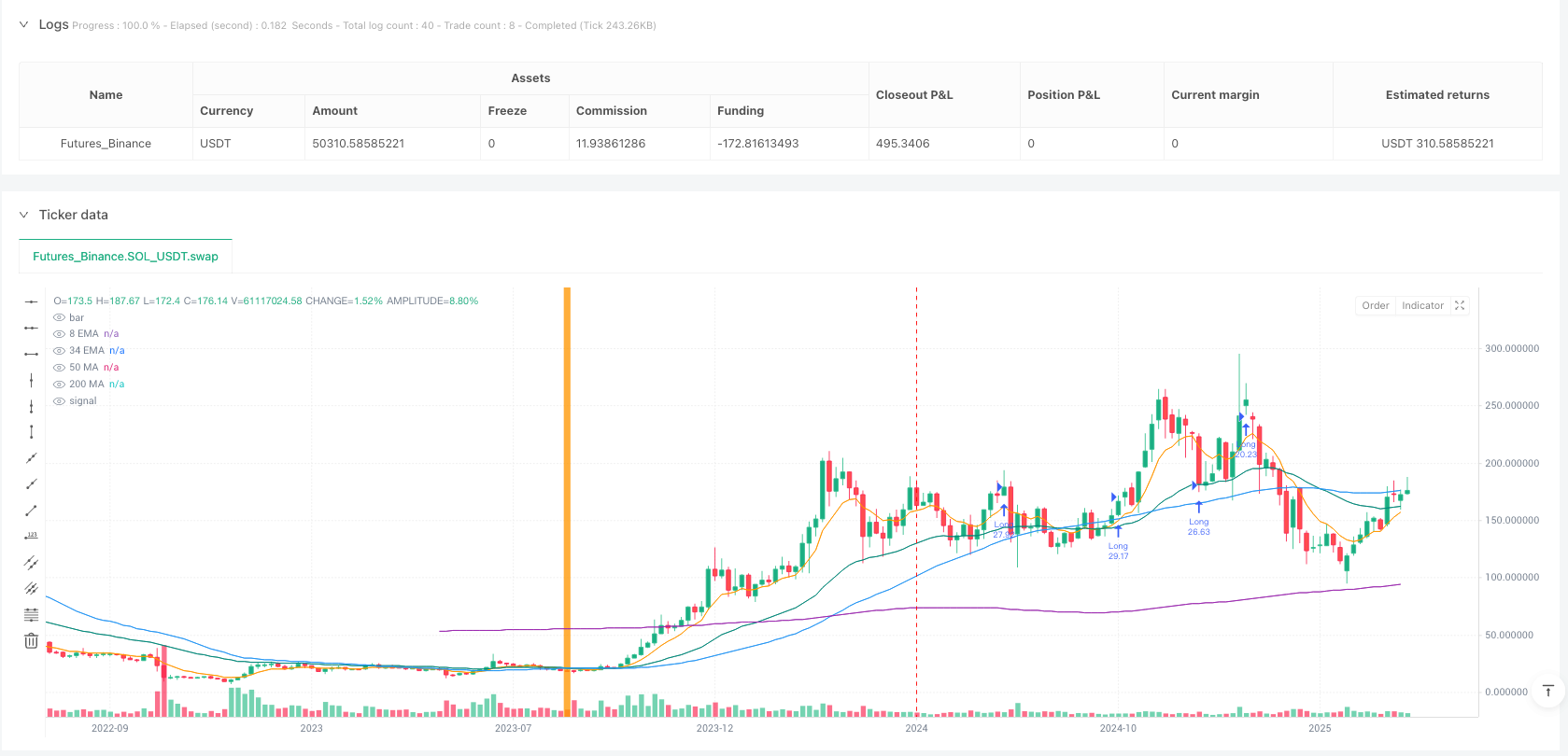

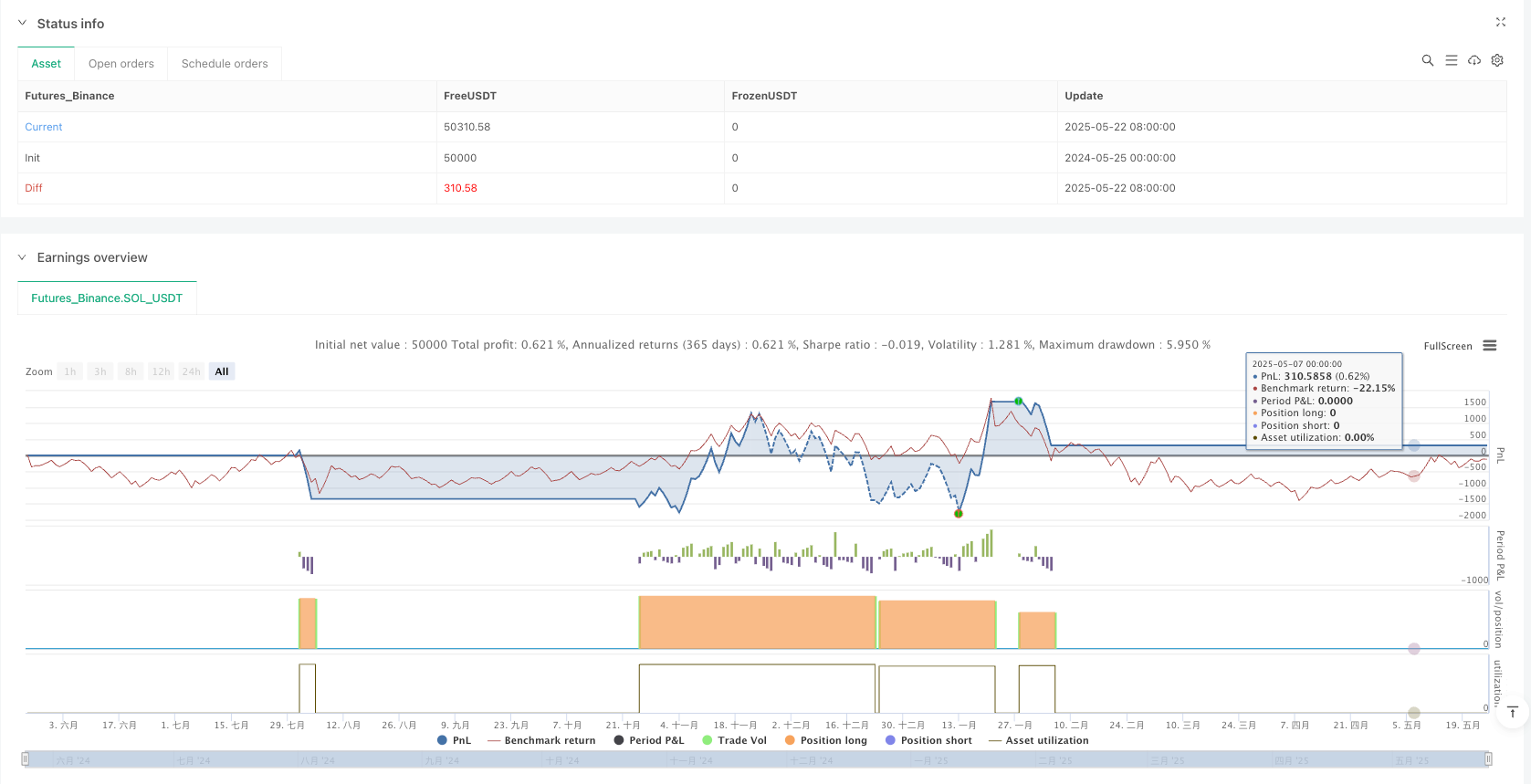

/*backtest

start: 2024-05-25 00:00:00

end: 2025-05-25 00:00:00

period: 5d

basePeriod: 5d

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Auto Trend Bot with Alerts", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS === //

emaFastLen = input.int(8, "Fast EMA")

emaSlowLen = input.int(34, "Slow EMA")

ma50Len = input.int(50, "50 MA")

ma200Len = input.int(200, "200 MA")

atrMult = input.float(1.5, "ATR Multiplier")

riskReward = input.float(2.0, "Risk/Reward")

sidewaysThreshold = input.float(0.2, "Sideways Filter Slope")

showZones = input.bool(true, "Highlight Trap/Sideways Zones")

// === CALCULATIONS === //

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

ma50 = ta.sma(close, ma50Len)

ma200 = ta.sma(close, ma200Len)

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

atr = ta.atr(14)

// === CONDITIONS === //

longCond = emaFast > emaSlow and close > ma50 and close > ma200 and macdLine > signalLine and macdLine > 0

shortCond = emaFast < emaSlow and close < ma50 and close < ma200 and macdLine < signalLine and macdLine < 0

// === FAKE BREAKOUT & TRAP ZONE DETECTION (Simple) === //

trapLong = ta.crossover(high, ta.highest(high, 20)) and close < open

trapShort = ta.crossunder(low, ta.lowest(low, 20)) and close > open

// === SIDEWAYS FILTER === //

emaSlope = math.abs(ta.sma(emaFast - emaSlow, 5))

isSideways = emaSlope < sidewaysThreshold and math.abs(macdLine) < 0.1

// === EXECUTION === //

longSL = close - atr * atrMult

longTP = close + atr * atrMult * riskReward

shortSL = close + atr * atrMult

shortTP = close - atr * atrMult * riskReward

canLong = longCond and not isSideways and not trapLong

canShort = shortCond and not isSideways and not trapShort

if canLong

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

alert("LONG: Buy signal confirmed. SL: " + str.tostring(longSL) + ", TP: " + str.tostring(longTP), alert.freq_once_per_bar_close)

if canShort

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

alert("SHORT: Sell signal confirmed. SL: " + str.tostring(shortSL) + ", TP: " + str.tostring(shortTP), alert.freq_once_per_bar_close)

// === VISUAL ZONES === //

bgcolor(showZones and isSideways ? color.orange : na, transp=85, title="Sideways Zone")

bgcolor(showZones and (trapLong or trapShort) ? color.red : na, transp=90, title="Trap Zone")

// === PLOTS === //

plot(emaFast, color=color.orange, title="8 EMA")

plot(emaSlow, color=color.teal, title="34 EMA")

plot(ma50, color=color.blue, title="50 MA")

plot(ma200, color=color.purple, title="200 MA")