Overview

The Advanced Opening Range Breakout Strategy is a quantitative trading system based on price action during market opening hours, focusing on capturing trading opportunities created by breakouts from the price range formed after market open. This strategy uses the price range formed by the first 5-minute candle after 9:30 (market open) as its foundation, combining volume confirmation, key level validation, and retest mechanisms to build a multi-filtered trading system. The strategy employs a clear risk management framework, controlling stop-loss and take-profit levels for each trade through a preset risk-reward ratio, ensuring systematic and disciplined trading. This strategy is particularly suitable for markets with high volatility and trading instruments with distinct opening characteristics, effectively capturing directional opportunities in the early trading session.

Strategy Principles

The core principle of this strategy is based on the price range (Opening Range) formed by the first 5-minute candle after market open as a key reference point. The specific execution logic is as follows:

- Opening Range Definition: The system automatically identifies the candle during the 9:30-9:35 time period, recording its high and low to form the day’s opening range.

- Breakout Signal Generation: When the price first breaks above or below the opening range, the system marks the potential trading direction.

- Retest Confirmation: The system waits for the price to retest the opening range boundary after the breakout, filtering out false breakouts.

- Volume Verification: Trade execution requires volume to exceed a preset multiple of the day’s average volume, ensuring sufficient market participation to support the breakout.

- Key Level Validation: The system checks whether the opening range has sufficient distance from the previous trading day’s high or low to avoid trading near key resistance or support levels.

- Entry Execution: When all conditions are met, the system enters a trade when the price confirms the breakout direction after retesting.

- Risk Management: The system automatically sets the stop-loss on the opposite side of the opening range (below the low for long entries above the high, above the high for short entries below the low), and calculates the take-profit position based on the preset risk-reward ratio.

The entire strategy logic emphasizes the importance of “confirmation,” improving the quality of trading signals through multiple filtering mechanisms while employing a systematic approach to risk management.

Strategy Advantages

- Capturing High-Probability Trends: Opening range breakouts often represent the establishment of intraday trading direction, and this strategy effectively captures these high-probability trends through multiple confirmation mechanisms.

- Volume-Price Integrated Analysis: The strategy focuses not only on price breakouts but also requires volume confirmation, avoiding false breakouts in low-liquidity environments.

- Systematic Risk Management: Preset risk-reward ratios and stop-loss mechanisms ensure that the risk of each trade is controllable, preventing emotional decision-making.

- Intelligent Key Level Recognition: By comparing the relationship between the opening range and the previous trading day’s high and low points, the strategy can avoid potential key resistance or support levels, reducing the probability of trading at unfavorable positions.

- Retest Confirmation Mechanism: Requiring price to retest after breakout, this mechanism effectively filters out many false breakout signals, improving the win rate of trades.

- Intraday Trading Flexibility: The strategy focuses on the opening session, with short trading cycles and high capital utilization efficiency, suitable for intraday traders.

- Alert System Integration: The strategy has built-in trade signal alert functionality, allowing traders to track potential opportunities in real-time, enhancing the practicality of the strategy.

Strategy Risks

- Rapid Reversal Risk: The market opening period is highly volatile, and sometimes there may be rapid reversals after false breakouts, which can still pose a risk even with the retest confirmation mechanism. The solution is to consider adding additional confirmation indicators or extending the observation time.

- Overtrading Risk: In high-volatility environments, the system may generate too many trading signals. It is recommended to control this by adding filtering conditions or limiting the number of trades per day.

- Liquidity Risk: Although the strategy requires volume confirmation, in certain trading instruments or special market environments, volume may suddenly dry up, making it impossible to exit at the expected price. Consider adding liquidity monitoring indicators.

- Stop-Loss Slippage Risk: In volatile markets, stop-loss orders may face slippage risk. The solution is to appropriately increase the stop-loss buffer or consider using trailing stops.

- Key News Impact: The opening session is often heavily influenced by overnight news or early morning announcements, which may cause abnormal volatility. It is recommended to use this strategy cautiously on days when important economic data or company news is released.

- Parameter Optimization Overfitting: Excessive optimization of strategy parameters may lead to overfitting historical data. It is recommended to use forward testing or cross-market testing to verify parameter robustness.

- Market Adaptability Limitations: This strategy is mainly aimed at markets with clear opening times and significant opening volatility, and may not perform well in markets with less volatility or continuous trading. Market characteristics need to be evaluated before use.

Strategy Optimization Directions

- Dynamic Risk-Reward Ratio Adjustment: The current strategy uses a fixed risk-reward ratio; consider dynamically adjusting this parameter based on market volatility or historical statistical performance to optimize the return-risk ratio in different market environments.

- Opening Range Duration Adaptation: The strategy currently uses a fixed 5-minute candle to define the opening range; research could be done on automatically adjusting the duration of the opening range based on the characteristics of different trading instruments or daily volatility conditions to adapt to different market environments.

- Multi-Timeframe Confirmation: Add analysis of longer timeframe trends to ensure that the trading direction is consistent with larger degree trends, improving the success rate of trades.

- Intelligent Volume Threshold: Design the volume confirmation threshold as an adaptive parameter based on historical volume distribution, rather than a fixed multiple, to adapt to the liquidity characteristics of different markets.

- Add Market Sentiment Indicators: Integrate volatility, price momentum, or sentiment indicators as additional filtering conditions to adjust trading strategy or pause trading during extreme market sentiment.

- Optimize Entry Timing: Research the optimal entry timing, such as whether to enter immediately after retest confirmation or wait for the formation of the next candle, to reduce noise trades.

- Take-Profit Optimization Strategy: Consider implementing partial take-profit or trailing take-profit mechanisms to capture more profit when trends are strong, rather than being limited to preset fixed take-profit levels.

- Integrate Seasonal Analysis: Study performance differences across different trading days (Monday to Friday) or different months, and adjust strategy parameters or trading frequency accordingly.

Summary

The Advanced Opening Range Breakout Strategy is an intraday trading system that integrates multiple confirmation mechanisms, improving the quality of trading signals by capturing price breakouts after market open and combining multi-dimensional analysis including volume, key levels, and retest confirmation. This strategy not only focuses on generating entry signals but also controls the risk exposure of each trade through a systematic risk management framework, embodying the core concepts of modern quantitative trading.

Despite having clear logic and multiple advantages, traders still need to pay attention to potential issues such as changing market environments, liquidity risks, and parameter optimization. Through continuous monitoring and optimization, especially improvements in volume threshold setting, dynamic risk management, and market adaptability, this strategy has the potential to maintain stable performance across different market environments.

Ultimately, successful application of this strategy requires traders to have a deep understanding of market opening characteristics and to personalize strategy parameters based on their own risk preferences and capital management principles in order to fully leverage its advantages in intraday trading.

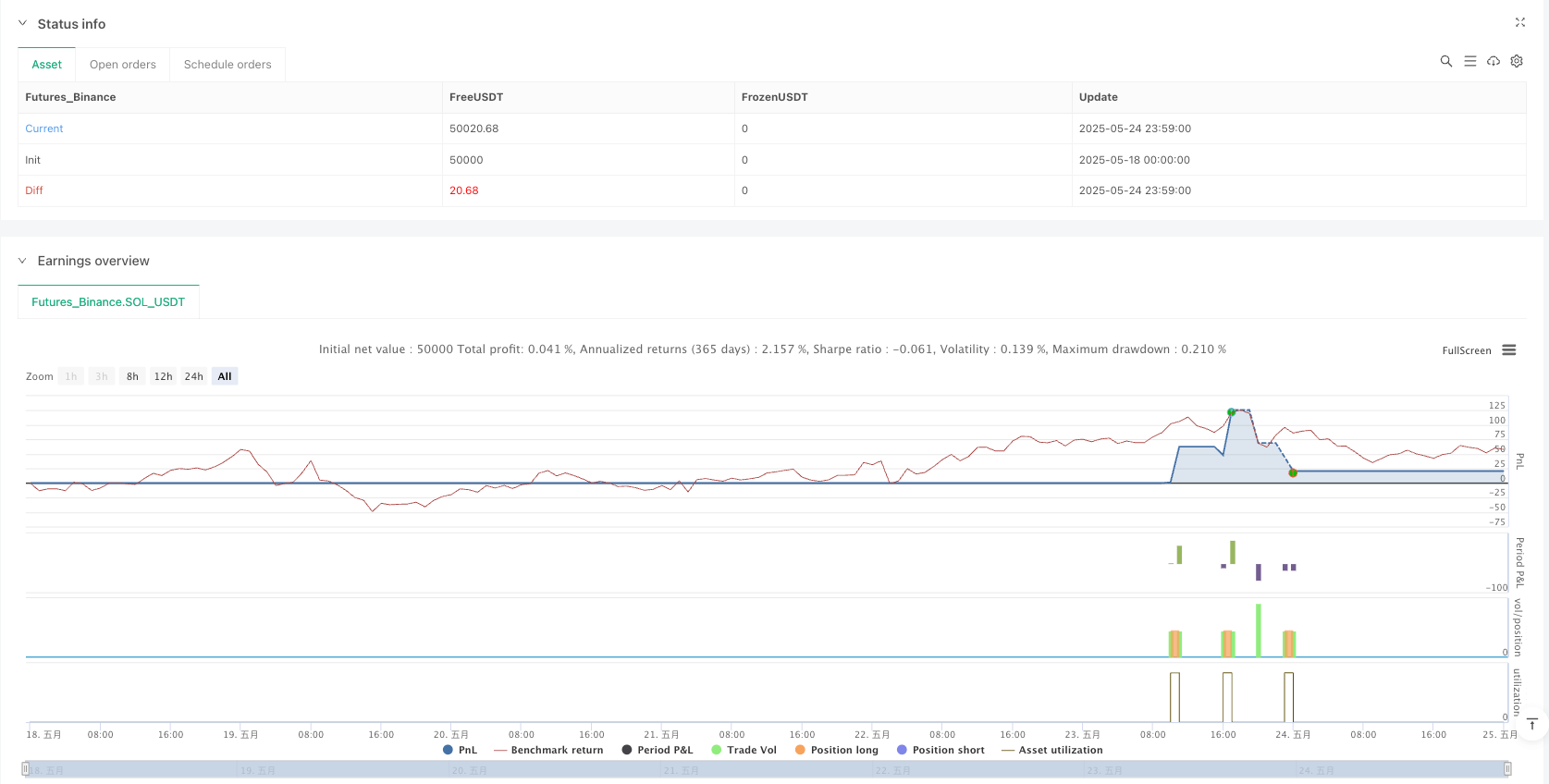

/*backtest

start: 2025-05-18 00:00:00

end: 2025-05-25 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("9:30 Candle ORB Break + Retest + Volume & Key Levels + Alerts", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

rr_ratio = input.float(2.0, "Reward-to-Risk Ratio", step=0.1)

sl_buffer = input.float(0.01, "Stop Loss Buffer (%)", step=0.01)

volMultiplier = input.float(1.0, "Volume Threshold (x Avg Volume)", step=0.1)

keyLevelBuffer = input.float(0.10, "Key Level Buffer (points/ticks)", step=0.01)

// === ORB Logic ===

var float orbHigh = na

var float orbLow = na

var bool orbDefined = false

var int lastDay = na

var int lastMonth = na

isNewDay = (dayofmonth != lastDay or month != lastMonth)

if isNewDay

orbHigh := na

orbLow := na

orbDefined := false

lastDay := dayofmonth

lastMonth := month

is930Candle = (hour == 9 and minute >= 30 and minute < 35)

if is930Candle

orbHigh := na(orbHigh) ? high : math.max(orbHigh, high)

orbLow := na(orbLow) ? low : math.min(orbLow, low)

orbDefined := true

plot(orbHigh, "ORB High", color=color.new(color.green, 0), linewidth=2)

plot(orbLow, "ORB Low", color=color.new(color.red, 0), linewidth=2)

// === Volume Tracking ===

var float dayVolume = 0.0

var int dayBars = 0

if isNewDay

dayVolume := volume

dayBars := 1

else

dayVolume += volume

dayBars += 1

avgVolume = dayVolume / dayBars

// === Key Levels ===

prevHigh = request.security(syminfo.tickerid, "D", high[1])

prevLow = request.security(syminfo.tickerid, "D", low[1])

keyLevelOkLong = (orbHigh - prevHigh) > keyLevelBuffer

keyLevelOkShort = (prevLow - orbLow) > keyLevelBuffer

// === Breakout Triggers ===

longBreak = orbDefined and close > orbHigh

shortBreak = orbDefined and close < orbLow

var bool longTriggered = false

var bool shortTriggered = false

if longBreak and not longTriggered

longTriggered := true

if shortBreak and not shortTriggered

shortTriggered := true

// === Retest Confirmation with Volume + Key Levels ===

confirmLong = longTriggered and low <= orbHigh and close > orbHigh and volume > avgVolume * volMultiplier and keyLevelOkLong

confirmShort = shortTriggered and high >= orbLow and close < orbLow and volume > avgVolume * volMultiplier and keyLevelOkShort

// === Entry / Exit ===

if confirmLong and not na(orbLow)

entryPrice = close

stopLoss = orbLow * (1 - sl_buffer / 100)

takeProfit = entryPrice + (entryPrice - stopLoss) * rr_ratio

strategy.entry("Long", strategy.long, comment="ORB Long")

strategy.exit("TP/SL Long", from_entry="Long", stop=stopLoss, limit=takeProfit)

longTriggered := false

if confirmShort and not na(orbHigh)

entryPrice = close

stopLoss = orbHigh * (1 + sl_buffer / 100)

takeProfit = entryPrice - (stopLoss - entryPrice) * rr_ratio

strategy.entry("Short", strategy.short, comment="ORB Short")

strategy.exit("TP/SL Short", from_entry="Short", stop=stopLoss, limit=takeProfit)

shortTriggered := false

// === Alerts ===

alertcondition(confirmLong, title="ORB Long Entry", message="ORB Long Entry Confirmed")

alertcondition(confirmShort, title="ORB Short Entry", message="ORB Short Entry Confirmed")