Overview

The Trend Structure Breakout Enhanced Order Block Trading Strategy is a quantitative trading system that combines several key elements of technical analysis. This strategy is built on market structure breakouts, order block identification, and engulfing pattern confirmation to create a comprehensive trading decision framework. The core concept revolves around identifying momentum after price breaks through historical highs or lows, combined with previously formed order block support/resistance zones, and using engulfing patterns as final confirmation signals to capture high-probability trading opportunities. Additionally, the strategy incorporates a fixed risk-reward management mechanism to ensure clear risk control and profit targets for each trade.

Strategy Principles

The core principles of this strategy are based on the following key elements:

Trend Structure Identification: The strategy uses a lookback parameter (default 20) to calculate the highest high (HH) and lowest low (LL) over the past N periods. When price closes above the previous high, an uptrend is confirmed; when price closes below the previous low, a downtrend is confirmed. This mechanism ensures the strategy only enters trades in clear trend directions.

Order Block (OB) Identification: Order blocks are important support/resistance areas in the market, typically formed by footprints left by large traders. In this strategy:

- Bullish Order Block (Bull OB): When an uptrend is confirmed, the low of the previous bearish candle is recorded

- Bearish Order Block (Bear OB): When a downtrend is confirmed, the high of the previous bullish candle is recorded

Engulfing Pattern Confirmation: The strategy uses engulfing candle patterns as additional confirmation signals:

- Bullish Engulfing: Current candle is bullish, previous candle is bearish, current close is higher than previous open, and current open is lower than previous close

- Bearish Engulfing: Current candle is bearish, previous candle is bullish, current close is lower than previous open, and current open is higher than previous close

Entry Conditions:

- Long Entry: Confirmed uptrend + Bullish engulfing pattern + Price closes above the bullish order block

- Short Entry: Confirmed downtrend + Bearish engulfing pattern + Price closes below the bearish order block

Risk Management: The strategy employs a fixed point stop loss (default 20 points) and automatically calculates take profit targets based on the set risk-reward ratio (default 3.0).

Strategy Advantages

Structured Market Analysis Framework: This strategy combines trend analysis, price structure, order block support/resistance, and candle pattern confirmation to form a comprehensive trading decision framework, avoiding false signals that might arise from using a single indicator.

High-Probability Trading Signals: By requiring multiple confirmation conditions to be met simultaneously, the strategy significantly increases the reliability of trading signals. Only when the trend is clear, order block support/resistance is effective, and an engulfing pattern is confirmed will the strategy generate a trading signal.

Built-in Risk Management Mechanism: The strategy adopts a default 3:1 risk-reward ratio, ensuring each trade has clear profit targets and stop-loss levels, helping traders maintain positive expectancy in long-term trading.

High Adaptability: By adjusting the lookback parameter, the strategy can adapt to different timeframes and market volatilities. In highly volatile markets, the lookback value can be increased, while in less volatile markets, it can be decreased.

Visualized Trading Signals: The strategy marks buy/sell signals and order block positions on the chart, providing intuitive visual feedback that helps traders understand and evaluate the trading logic.

Strategy Risks

False Breakout Risk: Markets often experience false breakouts, where price briefly breaks through historical highs/lows before quickly retreating. This can lead to incorrect signals, especially in volatile markets without clear trends.

Engulfing Pattern Reliability Issues: The reliability of engulfing patterns varies under different market conditions. In some low-liquidity markets or during high-volatility periods, engulfing patterns may generate more false signals.

Fixed Stop Loss Risk: The strategy uses a fixed point stop loss setting rather than a dynamic stop loss based on market volatility. In suddenly increasing volatility environments, fixed stop losses may be too small and easily triggered.

Parameter Sensitivity: Strategy performance is highly dependent on parameter settings, such as lookback period, risk-reward ratio, and stop-loss points. Different markets and timeframes may require different parameter combinations for optimal performance.

Insufficient Trend Reversal Adaptability: The strategy performs well in clear trends but may generate consecutive losses during trend reversal phases, as it lacks built-in trend reversal warning mechanisms.

Optimization Directions

Introduce Volatility Adaptive Mechanism: Consider using indicators like ATR (Average True Range) to dynamically adjust stop-loss and take-profit levels, allowing the strategy to better adapt to different market volatility conditions. This can be implemented by replacing fixed point stop losses with multiples of recent N-period ATR values.

Add False Breakout Filters: Reduce false signals caused by false breakouts by adding volume confirmation or waiting for price to remain in the breakout zone for a certain period (e.g., closing price staying above/below the breakout level for N consecutive periods).

Order Block Zone Extension: The current order block definition is relatively simple. Consider extending it to a zone rather than a single price point, for example, using the entire high-low range of the previous reverse candle, or adding a certain buffer zone.

Multiple Timeframe Confirmation: Introduce multi-timeframe analysis to ensure trade direction aligns with higher timeframe trends, thereby increasing trade success rates. This can be implemented by checking structure breakout status on higher timeframes.

Dynamic Risk-Reward Ratio: Automatically adjust risk-reward ratios based on market environment (such as volatility, trend strength), adopting higher risk-reward ratios in strong trend environments and lower ratios in ranging or weak trend environments.

Add Market Cycle Filtering: Introduce market cycle recognition mechanisms to apply different trading logic and parameter settings in different market cycles (trending, ranging, volatile), enhancing strategy adaptability.

Summary

The Trend Structure Breakout Enhanced Order Block Trading Strategy is a comprehensive trading system that combines multiple elements of technical analysis. Through trend structure identification, order block positioning, and engulfing pattern confirmation, this strategy can capture high-probability trend continuation trading opportunities. The built-in risk management mechanism ensures controllable risk in trading, while the flexibility of strategy parameters provides the ability to adapt to different market conditions.

Although the strategy has certain false breakout risks and parameter sensitivity issues, by introducing volatility adaptive mechanisms, multiple timeframe confirmation, and dynamic risk management optimization measures, the robustness and adaptability of the strategy can be further enhanced. For traders pursuing technically driven, rule-based, and risk-controlled trend-following trading, this is a strategy framework worth considering.

This strategy is particularly suitable for use in market environments with clear trends. At the same time, traders should make necessary adjustments and optimizations to strategy parameters based on the characteristics of specific trading instruments and market conditions to achieve optimal trading results.

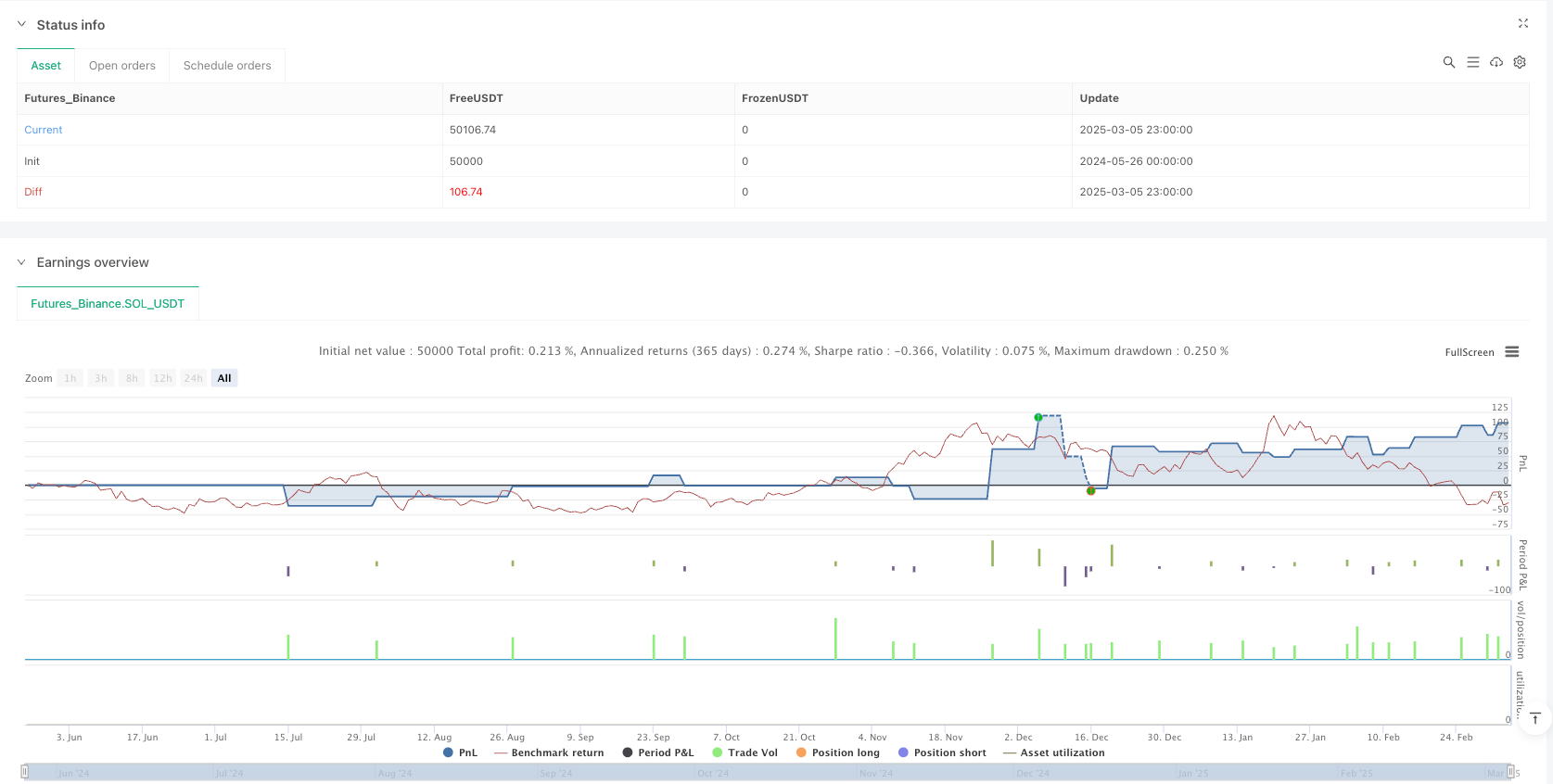

/*backtest

start: 2024-05-26 00:00:00

end: 2025-03-06 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("Aman Singh OB Strategy v6", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

lookback = input.int(20, "Structure Lookback", minval=1)

rr_ratio = input.float(3.0, "Risk Reward Ratio", step=0.1)

risk_pips = input.int(20, "Stop Loss (in pips)", minval=1)

// === TREND STRUCTURE ===

hh = ta.highest(high, lookback)

ll = ta.lowest(low, lookback)

upTrend = close > hh[1]

downTrend = close < ll[1]

// === ORDER BLOCKS (Last opposite candle) ===

bullOB = ta.valuewhen(upTrend and close[1] < open[1], low[1], 0)

bearOB = ta.valuewhen(downTrend and close[1] > open[1], high[1], 0)

// === ENGULFING CANDLE PATTERN ===

bullishEngulf = close > open and close[1] < open[1] and close > open[1] and open < close[1]

bearishEngulf = close < open and close[1] > open[1] and close < open[1] and open > close[1]

// === ENTRY CONDITIONS ===

longCondition = upTrend and bullishEngulf and close > bullOB

shortCondition = downTrend and bearishEngulf and close < bearOB

// === STOP LOSS AND TAKE PROFIT ===

slPoints = risk_pips * syminfo.mintick

tpPoints = slPoints * rr_ratio

// === EXECUTE TRADES ===

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL Buy", from_entry="Buy", stop=close - slPoints, limit=close + tpPoints)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL Sell", from_entry="Sell", stop=close + slPoints, limit=close - tpPoints)

// === PLOTS ===

plotshape(longCondition, title="Bull Entry", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(shortCondition, title="Bear Entry", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

plot(bullOB, title="Bull OB", color=color.green, linewidth=1, style=plot.style_linebr)

plot(bearOB, title="Bear OB", color=color.red, linewidth=1, style=plot.style_linebr)