Overview

The Multi-timeframe RSI Oversold Auto Take Profit Strategy is a trading system based on the Relative Strength Index (RSI) that focuses on capturing rebound opportunities in oversold market conditions. The core of this strategy lies in using the 30-minute timeframe RSI indicator to identify oversold areas (RSI<30), while automatically closing positions when the price reaches a preset take-profit target. This strategy is primarily suitable for upward trending market environments, achieving a simple and efficient trading process by setting fixed percentage take-profit levels to secure trading profits.

Strategy Principles

This strategy is based on the oversold rebound principle of the RSI indicator, with the following specific operating mechanisms:

Cross-timeframe Analysis: The strategy uses the 30-minute timeframe RSI indicator to determine entry timing, while the strategy itself runs on a 1-hour timeframe. This cross-timeframe analysis method helps reduce false signals.

Entry Conditions: When the 30-minute RSI indicator falls below 30 (oversold area), the strategy triggers a long entry signal, at which point the system records the current price as the entry price.

Take Profit Setup: After entry, the system automatically calculates the take-profit price, defaulting to a position 3% above the entry price. Users can adjust this parameter according to their risk preferences and market conditions, ranging from 0.5% to 20%.

Exit Mechanism: When the price reaches the preset take-profit level, the strategy automatically closes the position to end the trade. The strategy does not include stop-loss settings, relying solely on take-profit to manage risk and profit.

Position Sizing: The strategy defaults to using 100% of the account funds for each trade to maximize capital efficiency.

Strategy Advantages

Through in-depth code analysis, this strategy has several major advantages:

Simple and Intuitive: The strategy logic is clear, easy to understand and implement, suitable for beginners and traders who prefer simple systems.

High Degree of Automation: From entry signal identification to profit target setting and exit execution, the entire process is automated, reducing human intervention and emotional decision-making.

Flexible Profit Targets: Through adjustable take-profit percentage parameters, traders can optimize strategy performance according to market volatility and personal risk preferences.

Cross-timeframe Analysis: Using 30-minute RSI to guide 1-hour level trading decisions helps reduce noise and false signals.

Visual Assistance Features: The strategy provides visualization of the RSI indicator and oversold line marking, allowing traders to intuitively monitor market conditions.

Focus on Rebound Opportunities: By capturing rebounds from oversold areas, the strategy can effectively utilize short-term price correction opportunities.

Strategy Risks

Despite the strategy’s simple and clear design, there are still the following potential risks:

Lack of Stop-Loss Mechanism: The strategy has no built-in stop-loss function, which may lead to significant losses in continuously declining markets. It is recommended to implement additional stop-loss mechanisms, such as time-based or price-based stop-loss conditions.

Trend Dependency: According to the code comments, this strategy is mainly applicable to upward trends and may perform poorly in sideways or downward trends. The overall market trend should be confirmed before applying the strategy.

Limitations of Fixed Take-Profit Percentages: Using fixed percentage take-profits may not adapt to changes in market volatility, potentially closing positions too early during high volatility periods or setting targets too high during low volatility periods.

Single RSI Indicator Dependency: The strategy relies solely on the RSI indicator for trading decisions, lacking multi-indicator confirmation mechanisms, which may increase the risk of false signals.

Lack of Re-entry Mechanism: Once take-profit is triggered and the position is closed, the strategy has no explicit re-entry mechanism, potentially missing continued uptrend opportunities.

Strategy Optimization Directions

Addressing the above risks, the strategy has several possible optimization directions:

Add Stop-Loss Mechanism: Implement time-based or price-based stop-loss conditions, such as automatically closing positions when the price falls below a certain percentage of the entry price, or setting maximum position holding time limits.

Add Trend Filters: Add trend identification components, such as moving average systems or ADX indicators, to ensure positions are only opened in uptrends, improving the strategy’s overall win rate.

Dynamic Take-Profit Targets: Dynamically adjust take-profit percentages based on market volatility, for example, combining with the ATR indicator to set more reasonable profit targets.

Multi-indicator Confirmation: Combine other technical indicators such as MACD, Bollinger Bands, or volume indicators to build a more robust entry signal confirmation system.

Partial Position Closing Mechanism: Implement a partial position closing strategy, gradually reducing positions as different profit targets are reached, both securing partial profits and retaining the possibility of continued gains.

Improved Re-entry Rules: Develop more comprehensive re-entry rules to allow re-entry when the market continues to be favorable after position closure.

Backtesting Period Extension: Conduct more extensive backtesting under different market environments to optimize parameter settings to adapt to different market conditions.

Summary

The Multi-timeframe RSI Oversold Auto Take Profit Strategy is a simple and practical trading system, particularly suitable for capturing short-term rebound opportunities after market oversold conditions. Its core advantages lie in simple and clear operation, high automation, and flexible take-profit settings. However, the strategy also has limitations such as lack of stop-loss mechanisms, over-reliance on a single indicator, and applicability limited to upward trends.

By adding stop-loss mechanisms, trend filters, multi-indicator confirmation systems, and dynamic take-profit settings, the robustness and adaptability of this strategy can be significantly improved. For traders looking to build simple automated trading systems, this strategy provides a good starting point that can be further customized and refined according to personal risk preferences and market conditions.

Overall, this is an entry-level quantitative trading strategy with high scalability and optimization potential. In practical application, it is recommended to first conduct thorough testing in a simulated environment and combine more comprehensive risk management measures to ensure the strategy maintains stable performance across various market environments.

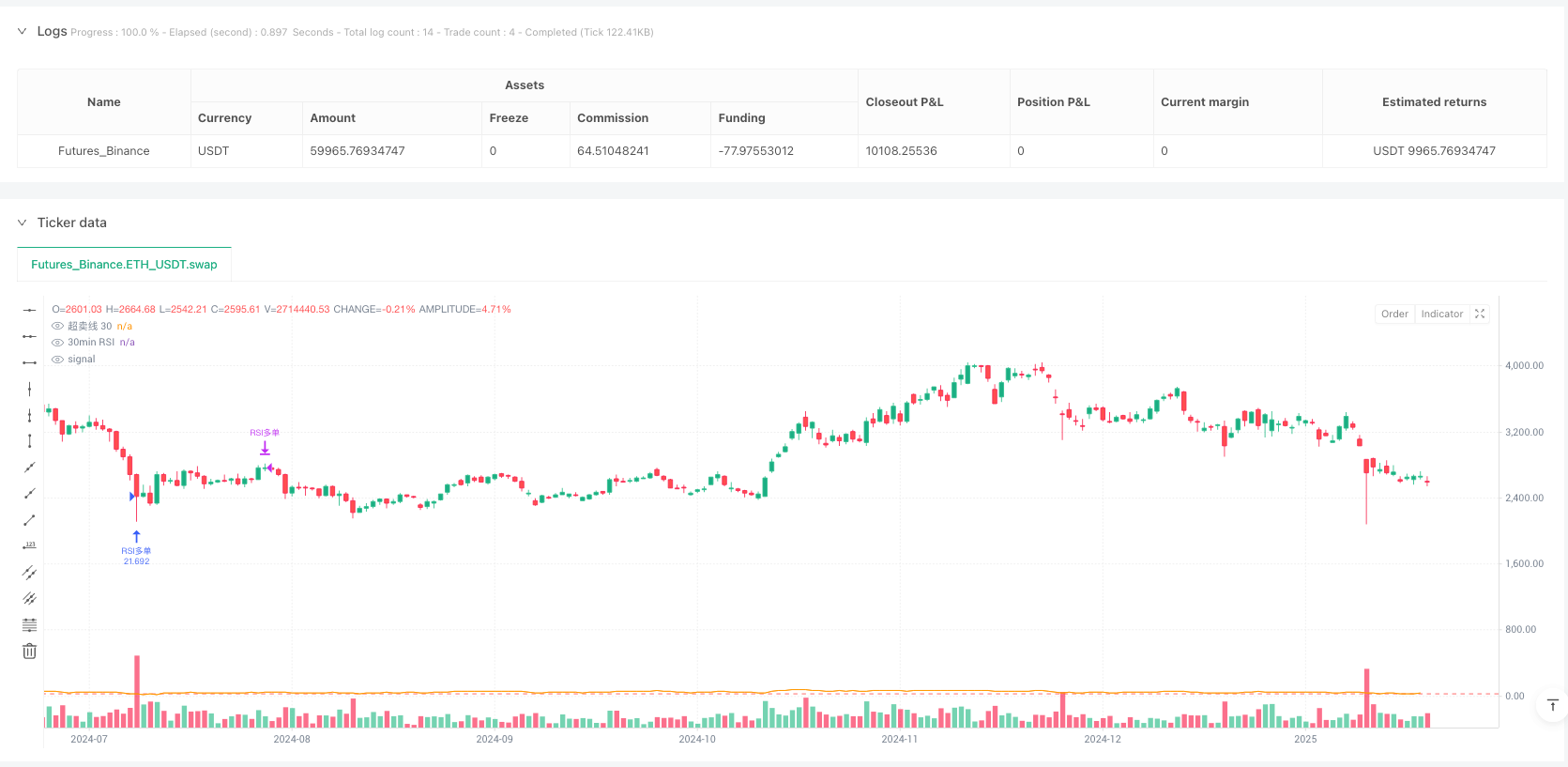

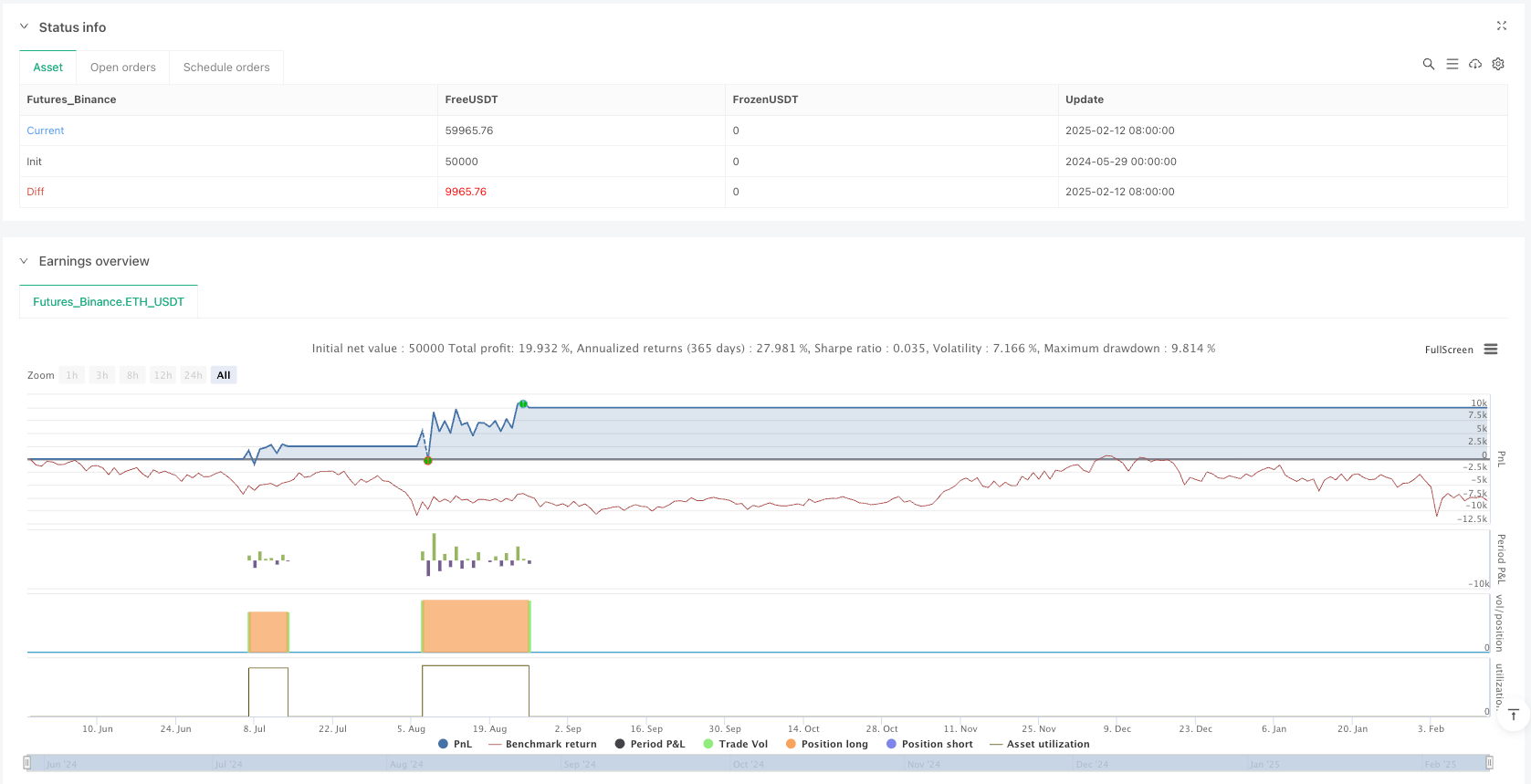

/*backtest

start: 2024-05-29 00:00:00

end: 2025-02-13 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nvbembsee784

//@version=6

strategy("RSI + 止盈比例策略 修正版", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === 参数设定 === //

rsiSource = close

rsiLength = 14

takeProfitPerc = input.float(title="止盈比例 (%)", defval=3.0, minval=0.5, maxval=20.0, step=0.1) / 100

// RSI 30分钟级别

rsi_tf = "30"

rsiValue = request.security(syminfo.tickerid, rsi_tf, ta.rsi(rsiSource, rsiLength))

// === 入场条件 === //

longCondition = (rsiValue < 30)

// === 入场、止盈价定义 === //

var float entryPrice = na

var float takeProfitPrice = na

// === 开仓 === //

if (longCondition)

strategy.entry("RSI多单", strategy.long)

entryPrice := close

takeProfitPrice := close * (1 + takeProfitPerc)

// === 保持开仓价不变,防止被覆盖 === //

if (strategy.position_size > 0 and na(entryPrice))

entryPrice := close

takeProfitPrice := close * (1 + takeProfitPerc)

// === 平仓条件:止盈 === //

if (strategy.position_size > 0)

if (close >= takeProfitPrice)

strategy.close("RSI多单", comment="止盈")

// === 可视化辅助 === //

plot(rsiValue, title="30min RSI", color=color.orange)

hline(30, "超卖线 30", color=color.red)