Supertrend Volume Spike Dynamic Trailing Stop Strategy

ATR supertrend SMA VOLUME Trailing Stop

Overview

The Supertrend Volume Spike Dynamic Trailing Stop Strategy is a quantitative trading system specifically designed for medium to short-term trading, ingeniously combining the trend identification capabilities of the Supertrend indicator with volume breakout confirmation mechanisms. By introducing a dynamic ATR-based trailing stop system, this strategy effectively controls risk while maintaining high win rates. Optimized for 45-minute timeframes, the strategy is particularly suitable for financial assets with good liquidity and trending characteristics. The strategy employs an intelligent cooldown mechanism to avoid overtrading while using volume amplification to confirm signal authenticity, providing investors with a robust and efficient automated trading solution.

Strategy Principles

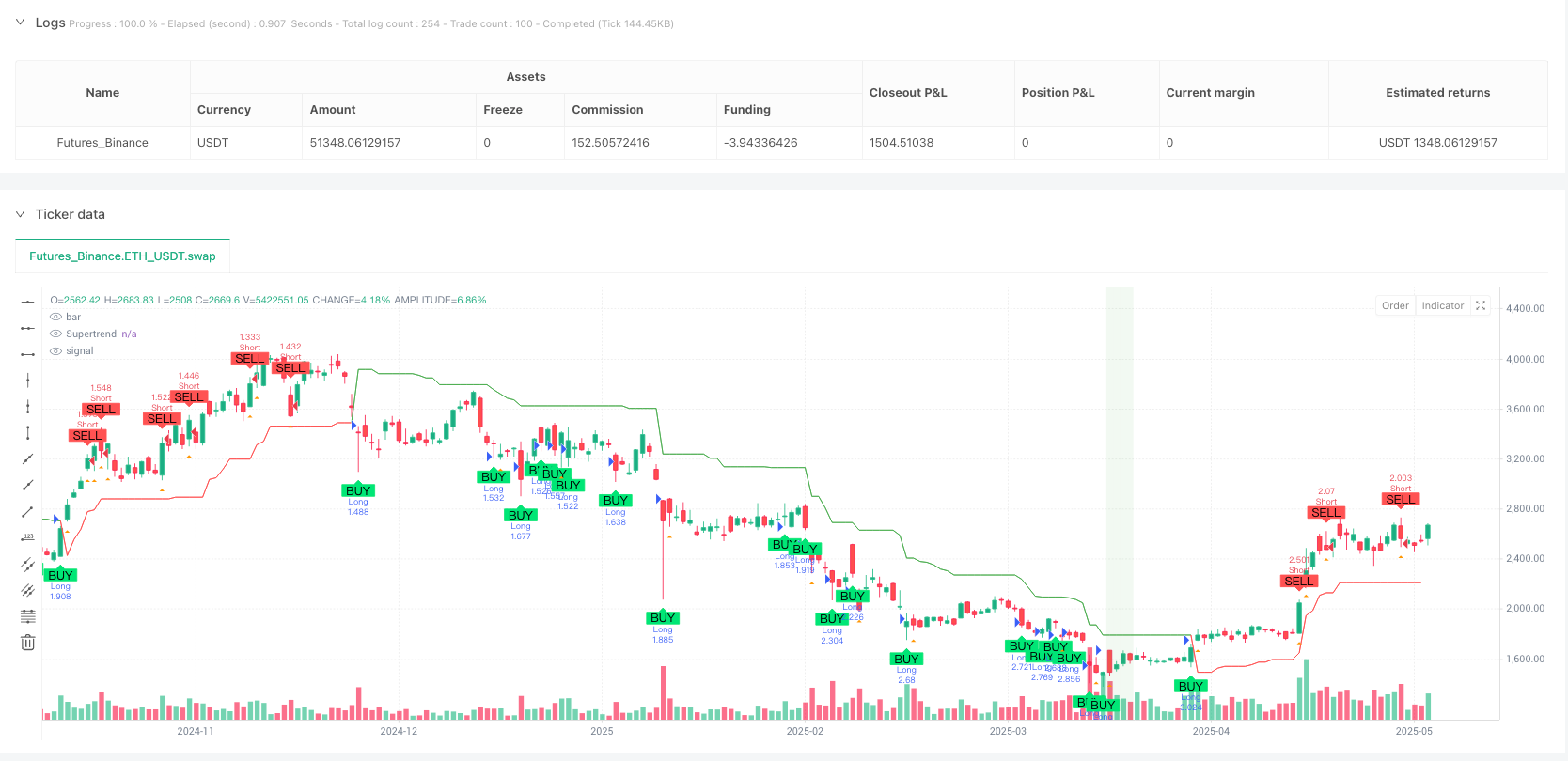

The core logic of this strategy is built upon the synergistic effect of multiple technical indicators. First, the Supertrend indicator serves as the primary trend judgment tool, identifying market directional changes through ATR period 10 and factor 3.0 parameter settings. When the Supertrend line changes from red to green, it indicates the market has entered a bullish trend; conversely, it enters a bearish trend. Second, the volume breakout confirmation mechanism requires current volume to exceed 1.3 times the 20-period simple moving average, ensuring the effectiveness and authenticity of price breakouts. To prevent noise interference from frequent trading, the strategy introduces a 2-bar cooldown mechanism, suspending new trading signals for a specified time after the last trade. The dynamic trailing stop system sets stop losses based on 1.2 times the ATR value and automatically adjusts stop levels as prices move favorably, protecting profits while allowing trends sufficient development space. Additionally, the strategy includes a reverse signal closing mechanism that can terminate current positions early when strong opposite signals appear, locking in profits or reducing losses.

Strategy Advantages

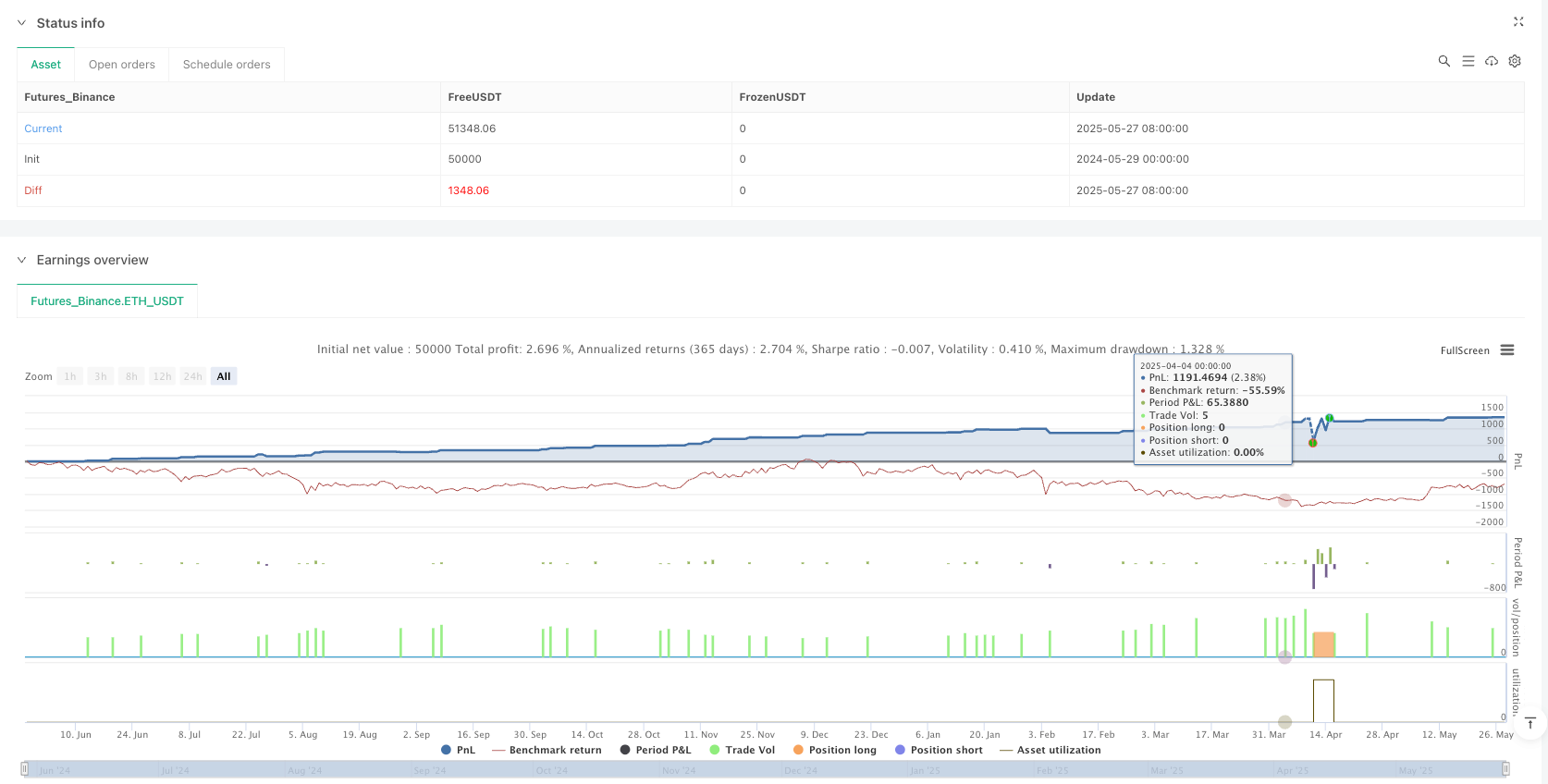

This strategy demonstrates several significant technical advantages. First, the multiple confirmation mechanism significantly improves trading signal reliability, with dual verification from Supertrend indicators and volume breakouts substantially reducing false signal probability. The dynamic trailing stop system automatically adjusts based on market volatility, neither being stopped out by normal fluctuations due to overly tight stops nor bearing excessive risk from overly loose stops. The introduction of cooldown mechanisms effectively avoids frequent position opening during market consolidation periods, reducing trading costs and unnecessary risk exposure. The strategy’s parameterized design provides good adaptability, allowing investors to adjust key parameters according to different asset characteristics and market environments. Backtesting data shows the strategy achieved an impressive 98.72% win rate under specific conditions, with a profit factor of 7.384 and maximum drawdown of only 1.15%, indicating excellent risk control performance. The strategy’s visual design helps traders intuitively understand market conditions and trading signals, reducing execution difficulty.

Strategy Risks

Despite the strategy’s excellent performance, several potential risks require attention. First, the strategy is highly dependent on trending markets and may face consecutive stop-loss risks in sideways consolidation or high-frequency oscillating market environments. The Supertrend indicator tends to produce frequent directional changes in choppy markets, and even with cooldown mechanism protection, trading effectiveness may decline. While volume breakout confirmation improves signal quality, it may miss some valid trading opportunities under certain market conditions, particularly during periods of relatively low volume. Although backtesting data appears impressive, there may be overfitting risks, and actual trading performance may differ from backtesting results. During insufficient market liquidity, large trades may face slippage risks affecting actual execution prices. To mitigate these risks, investors are advised to conduct thorough paper trading tests under different market conditions, appropriately adjust parameters to suit current market characteristics, and establish reasonable capital management rules to avoid excessive single-trade risk.

Strategy Optimization Directions

This strategy has multiple directions for further optimization. First, a market condition identification module could be introduced, calculating market volatility indicators or trend strength indicators to determine whether current market conditions are suitable for strategy operation, suspending trading during unfavorable conditions. Second, multi-timeframe analysis could be considered, combining higher timeframe trend directions to filter trading signals, only trading when major trend directions align. Volume analysis could be further refined, such as introducing price-volume divergence analysis or abnormal volume detection to improve volume confirmation accuracy. The stop-loss mechanism could be upgraded to adaptive stops, dynamically adjusting ATR multiples based on market volatility changes, appropriately loosening stops during high volatility periods and tightening them during low volatility periods. Fundamental or sentiment filters could be added to avoid trading during major news releases. Machine learning algorithms could be introduced to optimize parameter selection, finding optimal parameter combinations through historical data training. For risk management, position management modules could be added to dynamically adjust trading size based on strategy performance, moderately increasing positions during consecutive profits and reducing positions during consecutive losses to control drawdowns.

Summary

The Supertrend Volume Spike Dynamic Trailing Stop Strategy represents excellent practice in modern quantitative trading technology, providing investors with both practical and reliable trading tools through organic combination of multiple technical indicators and intelligent risk control mechanisms. The outstanding performance demonstrated in backtesting proves the correctness of its design philosophy and effectiveness of technical implementation. However, investors should maintain a cautious attitude in practical application, fully understanding the strategy’s applicable conditions and potential limitations, and making reasonable allocations based on their risk tolerance and investment objectives. Through continuous monitoring, testing, and optimization, this strategy has the potential to create stable returns for investors in dynamically changing financial markets. Investors are advised to conduct sufficient simulated trading before formal use and appropriately adjust parameters according to actual market conditions to ensure the strategy can adapt to constantly changing market environments.

/*backtest

start: 2024-05-29 00:00:00

end: 2025-05-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("📈 Supertrend + Volume Spike Strategy (AAPL Optimized)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

atrPeriod = input.int(10, title="ATR Period")

supertrendATR = input.int(10, title="Supertrend ATR Period")

supertrendFactor = input.float(3.0, title="Supertrend Factor")

volumeSpikeMult = input.float(1.3, title="Volume Spike Multiplier") // Looser for more trades

cooldownBars = input.int(2, title="Cooldown Bars Between Trades")

trailingMult = input.float(1.2, title="Trailing ATR Multiplier")

// === INDICATORS ===

atr = ta.atr(atrPeriod)

[supertrend, direction] = ta.supertrend(supertrendFactor, supertrendATR)

bullish = direction == 1

bearish = direction == -1

volMA = ta.sma(volume, 20)

volSpike = volume > volMA * volumeSpikeMult

// === COOLDOWN CONTROL ===

var int lastTradeBar = na

inCooldown = na(lastTradeBar) ? false : (bar_index - lastTradeBar < cooldownBars)

// === ENTRY CONDITIONS ===

longCondition = bullish and volSpike and not inCooldown

shortCondition = bearish and volSpike and not inCooldown

// === ENTRIES + TRAILING EXIT ===

if (longCondition)

strategy.entry("Long", strategy.long)

lastTradeBar := bar_index

strategy.exit("Trail Long", from_entry="Long", stop=low - atr * trailingMult, trail_points=atr * trailingMult, trail_offset=atr)

if (shortCondition)

strategy.entry("Short", strategy.short)

lastTradeBar := bar_index

strategy.exit("Trail Short", from_entry="Short", stop=high + atr * trailingMult, trail_points=atr * trailingMult, trail_offset=atr)

// === EXIT ON OPPOSITE SIGNAL ===

if (strategy.position_size > 0 and shortCondition)

strategy.close("Long")

if (strategy.position_size < 0 and longCondition)

strategy.close("Short")

// === VISUALS ===

plot(supertrend, color=bullish ? color.green : color.red, title="Supertrend")

plotshape(volSpike, location=location.belowbar, color=color.orange, style=shape.triangleup, title="Volume Spike")

plotshape(longCondition, location=location.belowbar, style=shape.labelup, color=color.lime, text="BUY")

plotshape(shortCondition, location=location.abovebar, style=shape.labeldown, color=color.red, text="SELL")

bgcolor(strategy.position_size > 0 ? color.new(color.green, 90) : na)

bgcolor(strategy.position_size < 0 ? color.new(color.red, 90) : na)