Strategy Overview

This strategy is a high-probability scalping method that combines momentum indicators, trend alignment, and time filtering to generate clear entry signals for fast-moving financial assets. The core mechanism is based on the crossover between fast EMA(8) and slow EMA(34), supplemented by a 200-period moving average as a major trend filter, while using a time window to restrict trading to active market periods, further improving signal quality. The strategy employs ATR-based (Average True Range) stop loss and take profit settings, allowing risk management to dynamically adapt to changes in market volatility. The overall design features clear logic and explicit rules, making it particularly suitable for high-frequency trading of volatile assets on a 5-minute timeframe.

Strategy Principles

After in-depth code analysis, it’s evident that the strategy’s operating principles include the following key components:

Momentum Trigger Mechanism: The strategy uses the crossover of fast EMA(8) and slow EMA(34) as the basic entry signal. When the fast EMA crosses above the slow EMA, a long signal is generated; when the fast EMA crosses below the slow EMA, a short signal is generated. This mechanism captures short-term price momentum changes.

Trend Filter: The strategy incorporates a 200-period moving average as the main trend confirmation tool. Long trades are only allowed when price is above the 200 MA, and short trades only when price is below the 200 MA. This ensures that the trading direction aligns with the larger market trend, avoiding counter-trend trading.

Time Filter: By default, the strategy only trades between 9:00 and 14:00 UTC, which typically corresponds to the overlap between London and New York sessions, when many financial assets experience their highest volatility. This setting can be customized according to trader preferences.

Dynamic Risk Management: Using ATR(14) as a volatility measurement tool, stop loss is set at 1.5 times ATR and take profit at 2.5 times ATR. This approach allows risk control to automatically adjust to current market conditions, maintaining a consistent risk-reward ratio in different volatility environments.

Visualization and Alert Functions: The strategy plots all relevant moving averages on the chart and uses triangular markers to indicate entry signals (upward triangles for long, downward triangles for short), while also providing trade alert functionality for real-time tracking.

In terms of code implementation, the strategy uses Pine Script 5, ensuring that trading signals are only generated when all conditions are met through explicit condition combinations (canLong = longSignal and inSession), reflecting strict trading discipline and a systematic decision-making process.

Strategy Advantages

Through in-depth code analysis, the following significant advantages of this strategy can be summarized:

Systematic with Clear Rules: Each component of the strategy has explicit rules and logic, reducing subjective judgment and helping maintain trading discipline, suitable for systematic execution.

Multiple Filtering Mechanisms: By combining EMA crossovers, trend direction, and time filtering, the strategy significantly reduces false signals, improves trading quality, and avoids frequent trading under unfavorable market conditions.

Adaptive Risk Management: ATR-based stop loss and take profit settings can automatically adjust according to market volatility, maintaining consistent risk control in different market environments, avoiding the problem of fixed-point stops being too small in highly volatile markets or too large in low volatility markets.

Focus on Efficient Time Periods: Through the time filter, the strategy concentrates trading in highly active market sessions, improving capital utilization efficiency and avoiding unnecessary risks during low liquidity periods.

Intuitive Visualization: The strategy clearly marks entry signals and key moving averages on the chart, allowing traders to intuitively understand market conditions and strategy logic, facilitating real-time decision making.

Flexible and Customizable: The code design allows users to adjust key parameters such as EMA length, ATR multipliers, and trading sessions, making the strategy adaptable to different trading instruments and personal risk preferences.

Suitable for Automation: The strategy’s clear rules and alert functionality make it highly suitable for automated execution, which can be implemented through APIs or third-party tools to achieve fully automated trading, reducing manual intervention.

Strategy Risks

Despite its well-designed nature, code analysis also reveals the following potential risks and limitations:

Poor Performance in Ranging Markets: In sideways markets without clear trends, EMA crossover signals may appear frequently but lack follow-through momentum, leading to multiple stop losses being triggered, forming a “sawtooth effect” loss. The solution could be to add additional oscillator indicators for filtering, such as RSI or Bollinger Band width.

Lag Issues: As a moving average derivative indicator, EMA has certain lag, especially at sharp market turning points, which may cause delayed entry signals, missing optimal entry points or triggering signals when trends are nearing their end.

Missing Major Moves: Strict time filters may cause the strategy to miss important market moves occurring outside the specified time window, especially during global significant events. The solution is to consider adding exception handling mechanisms for important news events.

Parameter Sensitivity: Strategy performance is relatively sensitive to EMA parameters and ATR multiplier settings, and different market environments may require different parameter combinations. Determining the optimal parameter combination is a challenge.

Lack of Money Management: The current code uses a fixed percentage position (10%), lacking a mechanism to dynamically adjust position size based on market conditions, which may lead to excessive exposure in high-risk environments.

Backtest vs. Real Trading Differences: The backtest environment does not consider slippage and trading cost factors, which in actual trading may significantly impact profitability, especially for high-frequency trading strategies.

Strategy Optimization Directions

Based on code analysis, here are potential optimization directions for this strategy:

Introduce Ranging Market Filter: An ADX indicator could be added to identify trend strength, only allowing trades when ADX is above a specific threshold (such as 25), avoiding excessive trading in weak trend or ranging markets. This optimization can significantly reduce false signals and improve win rates.

Multi-Timeframe Confirmation: Add higher timeframe (such as 15-minute or 1-hour) trend confirmation, ensuring that the trading direction is consistent with the larger timeframe trend. This optimization can improve signal quality and reduce the risk of trading against the major trend.

Dynamic Position Management: Dynamically adjust position size based on market volatility, account equity, and recent strategy performance, increasing positions in favorable market conditions and reducing risk exposure in highly uncertain environments.

Add Volume Filter: Incorporate volume confirmation in entry conditions, such as requiring volume to be higher than the average of the previous N candles when a signal appears, ensuring sufficient market participation to support price movements.

Optimize Time Filtering Mechanism: Adjust trading sessions based on different trading day characteristics (e.g., Monday vs. Friday) or seasonal patterns, or even implement adaptive time filtering that automatically identifies optimal trading sessions based on historical data.

Add Take Profit and Stop Loss Optimization: Consider implementing a partial position closing mechanism, such as closing part of the position at 1x ATR to secure capital, and closing the remaining position at 2.5x ATR to capture profits, balancing risk and drawdown control.

Market State Classification: Use machine learning or statistical methods to classify the market into different states (such as trending, ranging, breakout, etc.), optimizing different parameter settings for each state to improve the strategy’s environmental adaptability.

These optimization directions are important because they can significantly enhance the strategy’s robustness, adaptability, and profitability, enabling it to maintain stable performance across more diverse market environments.

Conclusion

The “Momentum-Trend Combined Exponential Moving Average Scalping Strategy” is a well-designed short-term trading system that provides high-quality entry signals for volatile assets by integrating EMA crossover signals, trend filtering, and time window restrictions. The strategy’s core advantages lie in its clear rule system, multiple filtering mechanisms, and adaptive risk management methods, making it particularly suitable for investors pursuing disciplined, systematic trading.

However, like any strategy, it has its limitations. This strategy may not perform well in ranging markets and has issues with parameter sensitivity and money management. To address these limitations, improvements can be made by introducing ranging market filters, multi-timeframe confirmation, dynamic position management, and other methods to further enhance the strategy’s robustness and adaptability.

Overall, this strategy represents an excellent practice in balancing the simplicity of technical indicators with the rigor of trading rules. With appropriate parameter adjustments and optimization upgrades, it has the potential to become a long-term stable trading system. For traders seeking to capture short-term opportunities in volatile markets, this strategy provides a solid starting point and reliable framework.

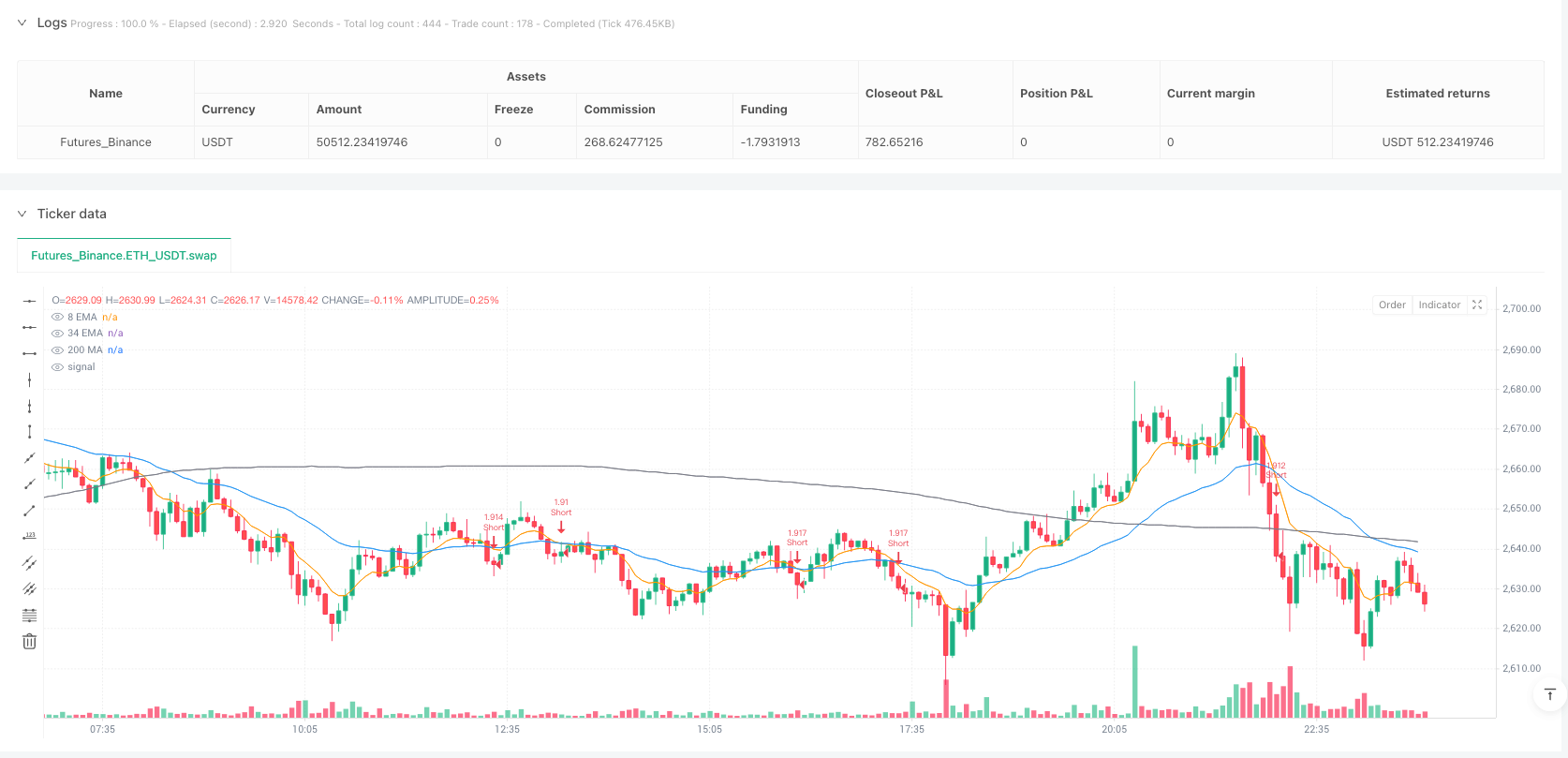

/*backtest

start: 2025-05-13 00:00:00

end: 2025-05-29 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Lucy XAU/USD – EMA Scalping Strategy (5m Optimized)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Input Parameters === //

fastEmaLen = input.int(8, title="Fast EMA")

slowEmaLen = input.int(34, title="Slow EMA")

trendMaLen = input.int(200, title="Trend MA")

atrLen = input.int(14, title="ATR Length")

atrSL = input.float(1.5, title="Stop Loss (x ATR)", step=0.1)

atrTP = input.float(2.5, title="Take Profit (x ATR)", step=0.1)

startHour = input.int(9, title="Session Start Hour (UTC)", minval=0, maxval=23)

endHour = input.int(14, title="Session End Hour (UTC)", minval=0, maxval=23)

enableAlerts = input.bool(true, title="Enable Alerts")

// === Indicators === //

fastEMA = ta.ema(close, fastEmaLen)

slowEMA = ta.ema(close, slowEmaLen)

trendMA = ta.sma(close, trendMaLen)

atr = ta.atr(atrLen)

// === Conditions === //

longSignal = ta.crossover(fastEMA, slowEMA) and close > trendMA

shortSignal = ta.crossunder(fastEMA, slowEMA) and close < trendMA

// === Final Conditions === //

canLong = longSignal

canShort = shortSignal

// === Entries and Exits === //

if (canLong)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL Long", from_entry="Long", stop=close - atr * atrSL, limit=close + atr * atrTP)

if (canShort)

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL Short", from_entry="Short", stop=close + atr * atrSL, limit=close - atr * atrTP)

// === Plotting === //

plot(fastEMA, title="8 EMA", color=color.orange)

plot(slowEMA, title="34 EMA", color=color.blue)

plot(trendMA, title="200 MA", color=color.gray)

// === Signal Labels === //

plotshape(canLong, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(canShort, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// === Alerts === //

alertcondition(canLong and enableAlerts, title="Long Alert", message="Lucy Long Signal on {{ticker}} at {{close}}")

alertcondition(canShort and enableAlerts, title="Short Alert", message="Lucy Short Signal on {{ticker}} at {{close}}")