Overview

The High-Frequency Swing Trading Supertrend Strategy (Daily) is a trading system developed based on the Supertrend indicator, moving averages, and RSI, specifically designed to capture frequent swing movements on daily charts. The strategy optimizes Supertrend parameters (ATR period 10, factor 3.0) and a 10-period Simple Moving Average (SMA) to increase sensitivity to daily price movements, generating more trading signals. It relaxes entry conditions while maintaining necessary risk filtering mechanisms, balances trading frequency with quality, and sets a 3% profit target to encourage faster profit-taking, freeing up capital for new trading opportunities.

Strategy Principles

The core principles of this strategy are based on the synergistic effect of multiple technical indicators to generate efficient trading signals:

Supertrend Indicator Application: The strategy employs a Supertrend indicator with an ATR period of 10 and a factor of 3.0 as the primary trend determination tool. Compared to traditional parameters, these settings increase the indicator’s sensitivity to price movements.

Signal Triggering Mechanism: The system generates trading signals through two methods:

- Supertrend Direction Change: Buy signals are generated when the Supertrend direction changes from downward to upward, and sell signals are generated when the reverse occurs

- Price and Moving Average Crossover: Buy signals are generated when the price crosses above the 10-period SMA, and sell signals are generated when it crosses below

RSI Filtering: A 14-period RSI indicator is used for filtering, avoiding buying in overbought conditions (RSI>70) or selling in oversold conditions (RSI<30), enhancing the rationality of trades.

Dynamic Stop-Loss and Profit Strategy:

- Uses the Supertrend line as a dynamic trailing stop-loss point

- Sets a 3% profit target as the profit-taking point, promoting rapid capital turnover

This design enables the strategy to adapt to different market conditions, both following price trends in trending markets and profiting from swing operations in oscillating markets.

Strategy Advantages

Through in-depth analysis of the code, this strategy demonstrates the following significant advantages:

High-Frequency Trading Opportunities: By reducing Supertrend parameters and moving average periods, the strategy can capture more short-term fluctuations, increasing trading frequency and profit opportunities.

Flexible Entry Mechanism: The strategy employs both Supertrend reversals and moving average crossovers as entry signals, significantly expanding the trading opportunity window and enabling the system to operate under a wider range of market conditions.

Intelligent Risk Management: Although trading conditions have been relaxed, the RSI filtering mechanism still effectively prevents entry under extreme market conditions, maintaining necessary risk control.

Efficient Capital Utilization: The 3% profit target setting encourages short-term profit-taking, improves capital turnover rate, and avoids missing other opportunities due to long-term holdings.

Adaptive Stop-Loss Design: The dynamic trailing stop-loss based on the Supertrend line automatically adjusts stop-loss positions according to market volatility, both protecting profits and giving prices sufficient room to fluctuate.

Visualized Trading Environment: The strategy clearly displays Supertrend lines and trend backgrounds on charts, helping traders intuitively understand market conditions and strategy signals.

Strategy Risks

Despite having multiple advantages, this strategy still has the following potential risks in practical application:

Excessively Frequent Signals: Lower parameter settings may lead to overly frequent signals, causing “whipsaws” - multiple reverse trades in a short period, increasing trading costs and potentially resulting in consecutive small losses.

- Solution: If signals are found to be too frequent, the ATR period can be increased to 12 or the factor increased to 3.5 to reduce false signals.

Market Volatility Mutation Risk: During severe market fluctuations, high-sensitivity settings may cause the strategy to overreact, generating incorrect signals.

- Solution: Consider adding a volatility filter to pause trading or adjust parameters during abnormal fluctuations.

Fixed Profit Target Issue: The fixed 3% profit target may lead to premature closing of positions in strong trending markets, resulting in missed larger returns.

- Solution: Consider implementing a partial closing strategy or dynamically adjusting profit targets based on market volatility.

RSI Parameter Sensitivity: The 70⁄30 RSI threshold settings may not be optimal in certain market environments.

- Solution: Adjust RSI thresholds based on historical backtest data for specific trading instruments, or consider using adaptive RSI.

Lack of Market Environment Adaptability: The strategy does not consider the macro market environment and may perform differently across various market phases.

- Solution: Add market environment recognition mechanisms to apply different parameter settings in different market states.

Strategy Optimization Directions

Based on code analysis, this strategy can be optimized in the following directions:

Parameter Adaptive Mechanism: The strategy currently uses fixed parameters. Consider implementing a parameter adaptive mechanism based on market volatility, allowing Supertrend factors and ATR periods to automatically adjust according to market conditions. This can reduce false signals in high-volatility environments while maintaining sensitivity in low-volatility environments.

Multi-Timeframe Confirmation: Introduce a trend confirmation mechanism from higher timeframes (such as weekly), only entering positions when the larger trend direction is consistent, improving trade success rates. This optimization can significantly reduce the risk of trading against the major trend.

Dynamic Profit Targets: Change the fixed 3% profit target to an ATR-based dynamic profit target that can automatically adjust according to market volatility. This allows for setting higher targets in more volatile markets while maintaining lower targets in calm markets.

Volume Filter: Add a volume confirmation mechanism requiring significant volume increases when signals appear, improving signal quality. Volume is an important confirming factor for price movements, and incorporating it into the strategy can reduce false signals.

Machine Learning Optimization: Consider using machine learning techniques to optimize parameter selection and signal generation processes, such as using historical data to train models to predict which signals are more likely to succeed. This direction represents the frontier development trend in quantitative trading.

Summary

The High-Frequency Swing Trading Supertrend Strategy (Daily) is a carefully designed trading system that achieves a balance between high-frequency signal generation and risk control through optimized Supertrend parameters, moving average crossovers, and RSI filtering. This strategy is particularly suitable for high-volatility market environments and can effectively capture short-term price fluctuations. Its core value lies in increasing trading frequency while maintaining reasonable risk control through multiple technical indicators working in concert and dynamic stop-loss mechanisms.

Although the strategy has potential risks such as excessively frequent signals and fixed profit targets, these issues can be optimized through parameter adjustments, adaptive mechanisms, and multi-timeframe analysis. With further development, this strategy has the potential to become a more comprehensive and robust trading system, adapting to a wider range of market environments and trading needs.

For investors pursuing high-frequency trading opportunities, this strategy provides a clearly structured and logically sound trading framework that, combined with personal risk preferences and market experience, can serve as an effective tool for daily swing trading.

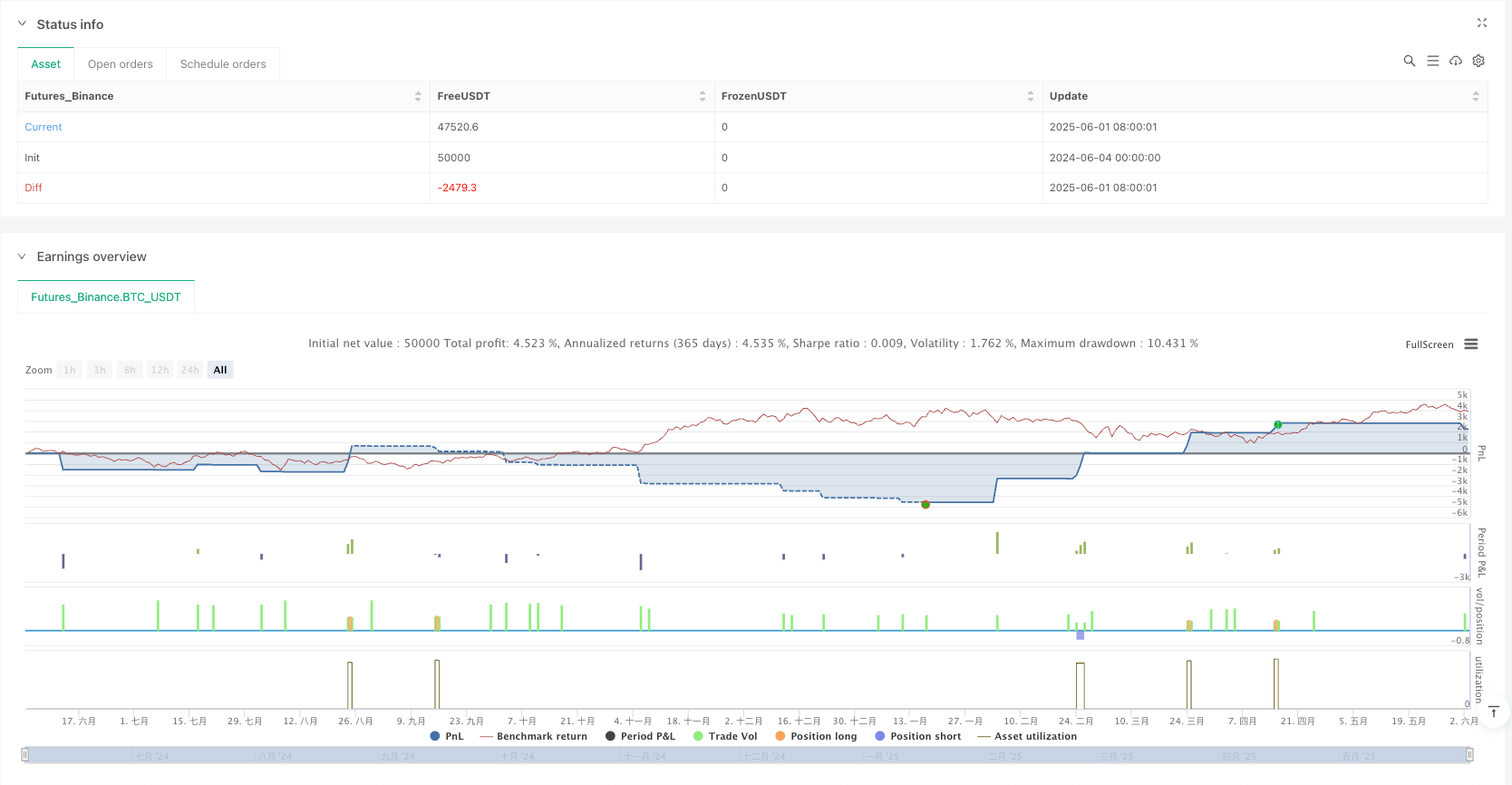

/*backtest

start: 2024-06-04 00:00:00

end: 2025-06-03 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Frequent Swing Trading Supertrend Strategy (Daily)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input parameters for Supertrend (adjusted for more frequent signals)

atrPeriod = input.int(10, "ATR Length", minval=1) // Reduced for more sensitivity

factor = input.float(3.0, "Factor", minval=0.01, step=0.01) // Reduced for more sensitivity

rsiPeriod = input.int(14, "RSI Length", minval=1) // Reduced for more trades

rsiOverbought = input.int(70, "RSI Overbought", minval=0, maxval=100) // Relaxed

rsiOversold = input.int(30, "RSI Oversold", minval=0, maxval=100) // Relaxed

maPeriod = input.int(10, "MA Length for Early Entry", minval=1) // Reduced for more frequent entries

profitTarget = input.float(3.0, "Profit Target %", minval=0.1, step=0.1) // Reduced for quicker exits

// Calculate Supertrend (aligned with daily chart timeframe)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

supertrend := barstate.isfirst ? na : supertrend

// Calculate additional indicators

rsi = ta.rsi(close, rsiPeriod)

ma = ta.sma(close, maPeriod)

// Define trend change conditions

uptrendCondition = direction[1] > direction // Downtrend to Uptrend

downtrendCondition = direction[1] < direction // Uptrend to Downtrend

// Early entry conditions with price action

earlySellSignal = close < ma and close[1] >= ma[1] // Close crosses below MA

earlyBuySignal = close > ma and close[1] <= ma[1] // Close crosses above MA

// Confirmation with RSI

isNotOverbought = rsi < rsiOverbought

isNotOversold = rsi > rsiOversold

// Combined entry conditions (more frequent: either Supertrend or MA crossover)

buySignal = (uptrendCondition or earlyBuySignal) and isNotOversold

sellSignal = (downtrendCondition or earlySellSignal) and isNotOverbought

// Strategy logic: Enter long on buy signal, short on sell signal

if (buySignal)

strategy.entry("Long", strategy.long)

if (sellSignal)

strategy.entry("Short", strategy.short)

// Dynamic exit with trailing stop and profit target

strategy.exit("Long Exit", "Long", trail_points=0, trail_offset=supertrend - close, profit=profitTarget * 10000, comment="Trailing Stop/Profit Target")

strategy.exit("Short Exit", "Short", trail_points=0, trail_offset=close - supertrend, profit=profitTarget * 10000, comment="Trailing Stop/Profit Target")

// Plot Supertrend for visualization

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color=color.green, style=plot.style_linebr)

downTrend = plot(direction >= 0 ? supertrend : na, "Down Trend", color=color.red, style=plot.style_linebr)

bodyMiddle = plot(barstate.isfirst ? na : (open + close) / 2, "Body Middle", display=display.none)

// Add background fill for trends

fill(bodyMiddle, upTrend, title="Uptrend background", color=color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, title="Downtrend background", color=color.new(color.red, 90), fillgaps=false)

// Alerts for trend changes

alertcondition(buySignal, title="Downtrend to Uptrend", message="Frequent Supertrend: Buy Signal (Daily)")

alertcondition(sellSignal, title="Uptrend to Downtrend", message="Frequent Supertrend: Sell Signal (Daily)")

alertcondition(buySignal or sellSignal, title="Trend Change", message="Frequent Supertrend: Trend Change Detected (Daily)")