Overview

The Dynamic EMA Crossover Strategy with RSI Filter and ATR-Based Stop Management is a comprehensive quantitative trading strategy that skillfully combines three powerful technical indicators: Exponential Moving Average (EMA), Relative Strength Index (RSI), and Average True Range (ATR). The core concept of this strategy is to utilize EMA crossovers to identify market trend direction, filter extreme market conditions through RSI, and implement precise risk management using dynamic ATR-based stop-loss and take-profit targets. The strategy design features clear logic, emphasizing both quality of entry signals and strict exit discipline, making it particularly suitable for markets with distinct trends.

Strategy Principles

The operating mechanism of this strategy is based on several key components:

EMA Crossover Signal System: The strategy employs two exponential moving averages with different periods (default 20 and 50 periods). A long signal is generated when the fast EMA crosses above the slow EMA; a short signal occurs when the fast EMA crosses below the slow EMA. The smoothing characteristics of EMAs effectively filter price noise while preserving trend information.

RSI Filtering Mechanism: To avoid entering trades during overbought or oversold market conditions, the strategy incorporates RSI as a filter. The specific rules are: no long positions when RSI exceeds 70, and no short positions when RSI falls below 30. This effectively prevents the risk of counter-trend trading after prices have become overextended.

ATR-Based Dynamic Stop-Loss and Take-Profit: The strategy uses a 14-period ATR to calculate stop-loss and take-profit levels that adapt to market volatility. Stop-loss is set at entry price ±(ATR×1.5), while take-profit is set at entry price ±(ATR×3.0). This dynamic adjustment mechanism allows risk parameters to be calibrated according to actual market volatility, making the strategy more adaptable.

Execution Logic: When long conditions are met (fast EMA crosses above slow EMA and RSI<70), the strategy enters a long position; when short conditions are met (fast EMA crosses below slow EMA and RSI>30), the strategy enters a short position. For each open position, the strategy dynamically sets stop-loss and take-profit targets based on ATR and strictly adheres to these exit rules.

In the code implementation, the strategy first calculates the necessary technical indicator values, then defines entry conditions and exit rules, and finally executes trading operations and sets visualization elements. The overall logic flows smoothly, with components working together cohesively to form a complete trading system.

Strategy Advantages

Comprehensive Signal Confirmation: By combining EMA crossovers and RSI filtering, the strategy produces more reliable trading signals, reducing the occurrence of false breakouts and erroneous signals. This multi-confirmation mechanism improves trading accuracy.

Adaptive Risk Management: The ATR-based stop-loss and take-profit target setting is a major highlight of this strategy. It allows risk control parameters to automatically adjust according to actual market volatility, expanding protection range when volatility increases and tightening it when volatility decreases, achieving truly dynamic risk management.

Strong Parameter Adjustability: The strategy offers multiple adjustable parameters, including EMA periods, RSI thresholds, ATR period, and stop-loss and take-profit multipliers, allowing traders to customize settings based on different market environments and personal risk preferences.

Comprehensive Trading Rules: The strategy not only defines clear entry conditions but also includes complete exit rules, forming a closed-loop trading system. This systematic design helps eliminate emotional factors in the trading process and improves trading discipline.

Cross-Market Applicability: The design principles of this strategy are applicable to various financial markets, including stocks, cryptocurrencies, and forex, performing particularly well in markets with obvious trends.

Strategy Risks

False Signals in Oscillating Markets: In sideways or trendless market environments, EMA crossovers may generate frequent false signals, leading to consecutive losing trades. To mitigate this risk, consider adding additional trend confirmation indicators or adjusting EMA parameters to reduce the number of crossovers.

RSI Filter May Miss Strong Trends: In continuously strong trends, RSI may remain in overbought or oversold territory for extended periods, causing the strategy to miss potentially favorable trading opportunities. To address this, consider relaxing RSI thresholds or introducing trend strength indicators to adjust RSI filtering rules.

ATR Stops Insufficient During Volatility Spikes: Although ATR can adapt to general market volatility, during sudden high-volatility events (such as major news releases), the preset ATR multipliers may not provide adequate protection. It is advisable to proactively adjust risk parameters before major market events or temporarily exit the market.

Parameter Sensitivity: Strategy performance is relatively sensitive to parameter selection, with different parameter combinations potentially leading to drastically different results. It is recommended to conduct comprehensive backtesting and parameter optimization to find the most suitable parameter combinations for specific markets and timeframes.

Insufficient Capital Management: Although the strategy includes stop-loss mechanisms, it does not explicitly define position sizing adjustment rules. It is recommended to dynamically adjust the proportion of funds for each trade based on volatility and account risk tolerance to achieve more comprehensive risk control.

Strategy Optimization Directions

Introduce Trend Strength Confirmation: Add ADX (Average Directional Index) or similar indicators to assess trend strength, executing EMA crossover signals only when trends are sufficiently strong, thereby reducing false signals in oscillating markets. This will make the strategy more selective and improve signal quality.

Dynamic Adjustment of RSI Thresholds: Dynamically adjust RSI overbought and oversold thresholds based on market environment, such as raising the overbought threshold during strong uptrends and lowering the oversold threshold during strong downtrends. This adaptive mechanism will help the strategy maintain effectiveness across different market environments.

Optimize Capital Management System: Add dynamic position sizing logic based on ATR or historical volatility, reducing position size in high-volatility markets and increasing it in low-volatility markets to achieve consistency in risk exposure. This will make the strategy’s risk management more comprehensive.

Add Risk-Reward Ratio Adaptive Mechanism: Dynamically adjust ATR multipliers for stop-loss and take-profit targets based on market characteristics, such as increasing profit targets when trends are strong and reducing them when trends weaken. This will help the strategy better adapt to different market phases.

Incorporate Time Filters: Consider market time characteristics, avoiding trading during periods of lower volatility or insufficient liquidity. For example, add a time filter that only executes signals during specific trading sessions. This will help avoid trading under unfavorable market conditions.

Implement Machine Learning Optimization: Utilize machine learning algorithms to automatically identify the most suitable parameter combinations for the current market environment, achieving adaptive optimization of the strategy. This approach can help the strategy continuously adapt to changing market conditions.

Summary

The Dynamic EMA Crossover Strategy with RSI Filter and ATR-Based Stop Management is a well-designed, logically clear quantitative trading strategy. By integrating the EMA crossover signal system, RSI filtering mechanism, and ATR-based dynamic risk management, it forms a comprehensive trading solution. The main advantages of the strategy lie in its multiple signal confirmation mechanisms and adaptive risk management system, enabling it to maintain stability across different market environments.

However, the strategy also has some potential risks, such as false signals in oscillating markets and sensitivity to parameter selection. By introducing trend strength confirmation, dynamically adjusting RSI thresholds, optimizing the capital management system, and other improvements, the robustness and adaptability of the strategy can be further enhanced.

Overall, this is a trading strategy with solid fundamentals and rigorous logic, suitable for traders with a certain foundation in technical analysis. With appropriate parameter adjustments and optimizations, it can become an effective trading tool, especially in markets with obvious trends. Most importantly, the strategy emphasizes the importance of risk management, which is one of the key elements of successful trading.

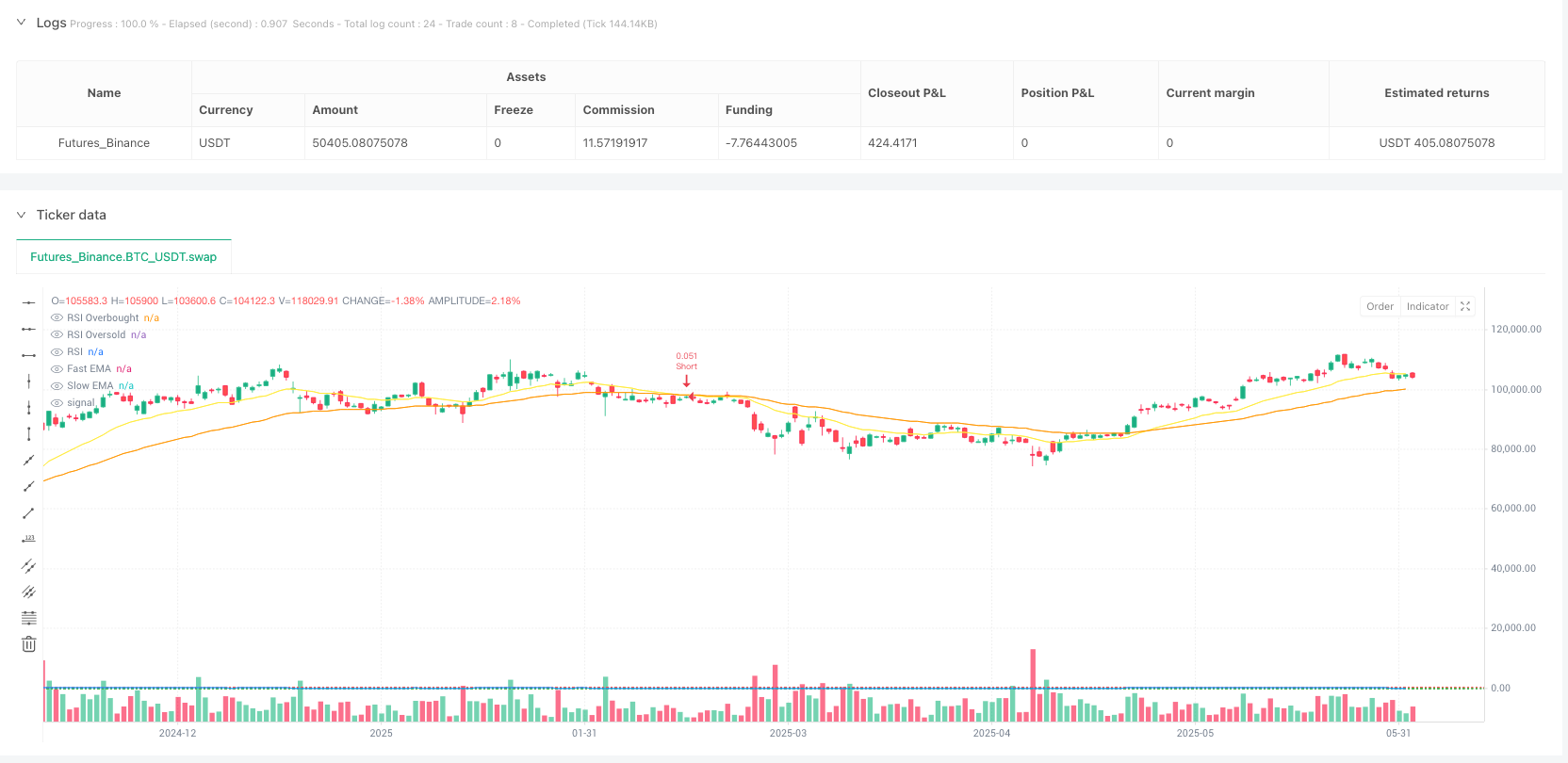

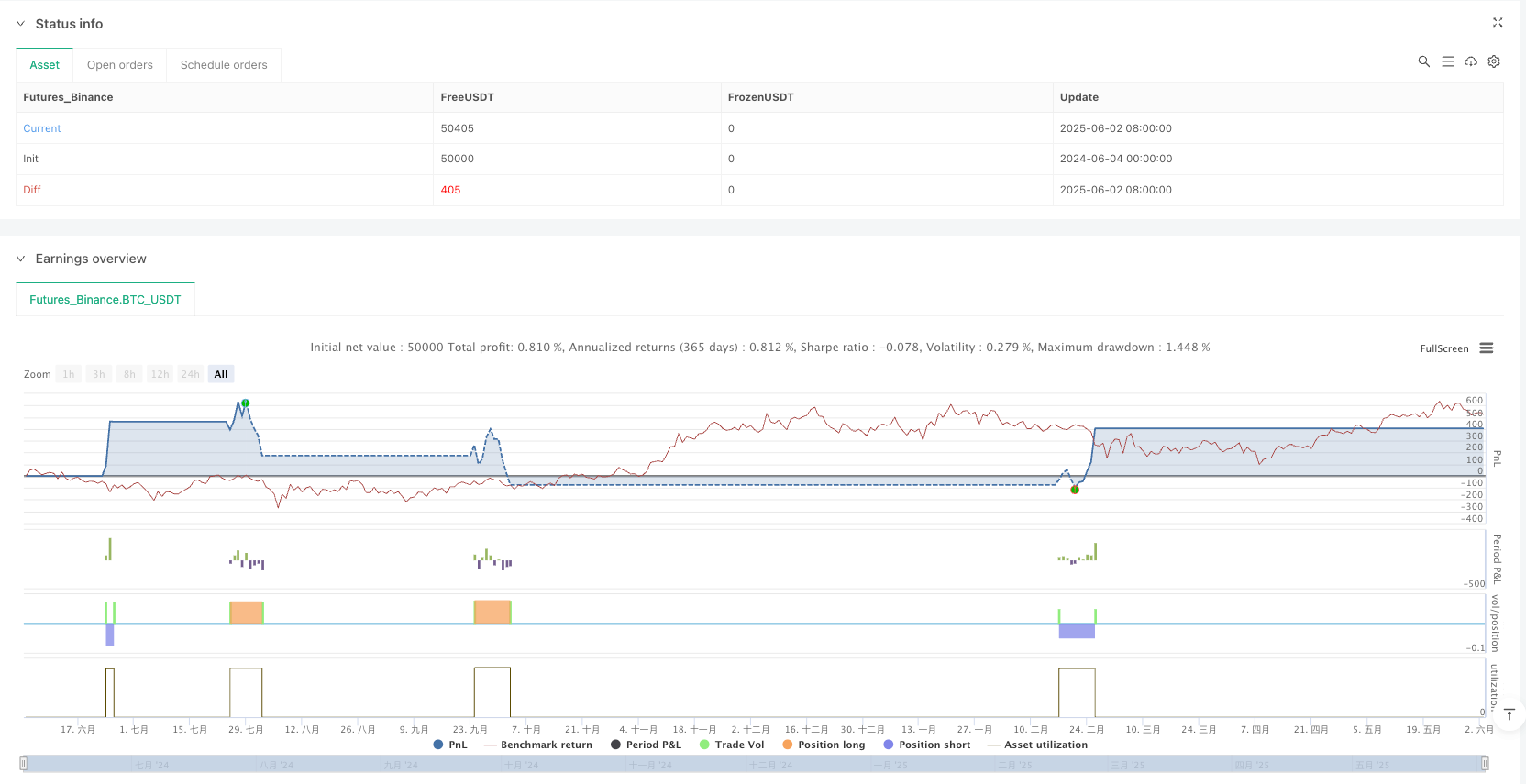

/*backtest

start: 2024-06-04 00:00:00

end: 2025-06-03 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover + RSI Filter with ATR Stops", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ─── Inputs ─────────────────────────────────────────────────────────────────a

fastLen = input.int(20, title="Fast EMA Length")

slowLen = input.int(50, title="Slow EMA Length")

rsiLen = input.int(14, title="RSI Length")

rsiOB = input.int(70, title="RSI Overbought Threshold")

rsiOS = input.int(30, title="RSI Oversold Threshold")

atrLen = input.int(14, title="ATR Length")

stopMult = input.float(1.5, title="Stop-Loss = ATR × Multiplier")

tpMult = input.float(3.0, title="Take-Profit = ATR × Multiplier")

// ─── Calculations ────────────────────────────────────────────────────────────

// Exponential moving averages

emaFast = ta.ema(close, fastLen)

emaSlow = ta.ema(close, slowLen)

// RSI

rsiValue = ta.rsi(close, rsiLen)

// ATR (for stops)

atrValue = ta.atr(atrLen)

// Detect crossovers

bullCross = ta.crossover(emaFast, emaSlow)

bearCross = ta.crossunder(emaFast, emaSlow)

// ─── Entry Conditions ────────────────────────────────────────────────────────

// Long entry: fast EMA crosses above slow EMA, and RSI is below overbought

longCondition = bullCross and (rsiValue < rsiOB)

// Short entry: fast EMA crosses below slow EMA, and RSI is above oversold

shortCondition = bearCross and (rsiValue > rsiOS)

// Place entries

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// ─── Exit Rules (Stop-Loss & Take-Profit) ─────────────────────────────────────

// For each entry, calculate stop and take targets based on ATR

longStop = strategy.position_avg_price - (atrValue * stopMult)

longTP = strategy.position_avg_price + (atrValue * tpMult)

shortStop = strategy.position_avg_price + (atrValue * stopMult)

shortTP = strategy.position_avg_price - (atrValue * tpMult)

// Attach stops and targets to the open position

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop=longStop, limit=longTP)

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop=shortStop, limit=shortTP)

// ─── Plotting ────────────────────────────────────────────────────────────────

plot(emaFast, color=color.yellow, title="Fast EMA")

plot(emaSlow, color=color.orange, title="Slow EMA")

hline(rsiOB, "RSI Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOS, "RSI Oversold", color=color.green, linestyle=hline.style_dotted)

plot(rsiValue, color=color.blue, title="RSI", offset=0, display=display.none)