Overview

This quantitative trading strategy represents a comprehensive momentum trading system that combines multiple technical indicators to identify market trends and entry points. The strategy is built upon three core elements: volume spikes, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), while using a Slow Moving Average (Slow MA) as an overall trend filter. This multi-indicator collaborative approach aims to capture price trend changes with strong momentum and increased volume, thereby enhancing signal quality and trading success rates.

Strategy Principles

The strategy operates based on a multi-layered signal confirmation system, with each component serving a specific function:

Trend Identification: The overall market trend is determined through a slow moving average (SMA 200). When price is above the SMA, it’s considered an uptrend; below the SMA is considered a downtrend. This provides a basic market environment filter for all other signals.

Volume Confirmation: The strategy requires current volume to exceed 1.2 times the 20-day (adjustable) moving average volume. This ensures trades are only executed when there’s sufficient market participation, helping to confirm the validity of price movements.

Momentum Assessment: The RSI indicator (default 14 periods) is used to measure market momentum direction. RSI above 50 indicates upward momentum, below 50 indicates downward momentum. This provides a confirmatory signal for price direction.

Precise Entry: MACD indicator crossovers (fast line with signal line) determine precise trading timing. MACD crossing above the signal line generates long signals, crossing below generates short signals.

Trade Control Logic: The strategy implements an intelligent trade control system that prevents consecutive entries in the same direction, ensuring each signal represents a transition from one direction to another. This mechanism helps reduce false signals and overtrading.

For long signals, the requirements are: price above slow MA + RSI above midline + MACD crossing up + volume spike. For short signals, the requirements are: price below slow MA + RSI below midline + MACD crossing down + volume spike.

Strategy Advantages

Multiple Confirmation Mechanism: Reduces false signals by requiring consistency across multiple indicators; this “consensus” approach improves trading reliability.

Trend Following and Momentum Combination: The strategy considers both long-term trends (via slow MA) and short-term momentum (via RSI and MACD), providing a balanced perspective across different timeframes.

Volume Validation: Using volume as a confirmatory factor helps identify genuine market movements rather than random fluctuations in low-liquidity environments.

Prevention of Overtrading: Through the alternating signal control logic, the strategy avoids consecutive signals in the same direction, reducing unnecessary trades and associated costs.

Comprehensive Market Adaptability: The adjustable parameters allow the strategy to adapt to different markets and time periods, from high-volatility markets to low-volatility ones.

Clear Visual Feedback: The strategy provides intuitive chart markings, allowing traders to easily identify signals and trend changes.

Strategy Risks

Parameter Sensitivity: The strategy relies on multiple adjustable parameters such as RSI length, MACD parameters, and volume multiplier. Inappropriate parameter settings may lead to suboptimal results or over-optimization. To mitigate this risk, parameter robustness testing should be conducted across multiple market environments.

Lag Issues: All strategies using moving averages face some degree of lag. Particularly when using a 200-period slow MA, this may result in delayed signals near trend inflection points. Consider using shorter MA periods or dynamically adjusting MA length to reduce this lag.

Market Environment Dependency: The strategy performs best in markets with clear trends and may underperform in consolidating or highly volatile but directionless markets. It’s advisable to add a market environment recognition mechanism to reduce or pause trading during unfavorable market conditions.

Trading Frequency Issues: Under certain market conditions, the strategy may generate too many or too few signals. Trading frequency can be optimized by adding time filters or signal confirmation mechanisms.

False Breakout Risk: Even with volume confirmation, markets can still exhibit false breakouts. Consider adding additional confirmation mechanisms, such as price pattern or support/resistance level analysis, to reduce the impact of false breakouts.

Strategy Optimization Directions

Dynamic Parameter Adjustment: The current strategy uses fixed parameter settings; consider implementing a dynamic parameter adjustment mechanism based on market volatility or trend strength. For example, RSI thresholds could be increased or volume multiplier requirements reduced in high-volatility environments.

Add Stop-Loss and Take-Profit Mechanisms: The current strategy relies on signal reversals to exit positions; add risk management-based stop-losses and profit target-based take-profits to better control the risk-reward ratio of individual trades.

Optimize Signal Filtering: Time filters (such as avoiding trading during specific market sessions) or price pattern filters (such as considering candlestick formations) can be added to improve signal quality.

Integrate Market Regime Recognition: Add a mechanism to identify whether the market is in a trending state or a range-bound state, and adjust strategy behavior accordingly. More conservative trading or complete avoidance of trading could be adopted in range-bound markets.

Machine Learning Enhancement: Consider using machine learning algorithms to optimize parameter selection or the signal generation process. Models could be trained to identify optimal parameter combinations or directly predict the probability of the next price direction.

Risk Exposure Management: Implement dynamic position sizing based on market volatility or recent strategy performance, increasing exposure in favorable conditions and reducing it during higher uncertainty.

Summary

This Multi-Factor Momentum Crossover Trend Strategy represents a comprehensive technical analysis approach that seeks high-quality trading opportunities by integrating volume, RSI momentum, and MACD signals against a trending background. Its core strengths lie in its multi-layered confirmation mechanism and trend filtering system, which help reduce false signals and improve trading success rates.

While the strategy has inherent risks such as parameter sensitivity and market environment dependency, through the suggested optimization directions (such as dynamic parameter adjustment, stop-loss/take-profit mechanisms, and market state recognition), its adaptability and robustness can be significantly enhanced. In particular, incorporating machine learning techniques and risk exposure management can elevate the strategy to a more advanced level.

Overall, this strategy provides a structured framework for medium to long-term trend traders while combining multiple key elements of technical analysis. With appropriate parameter adjustments and suggested optimizations, it can adapt to various market environments and serve as an effective component in quantitative trading systems.

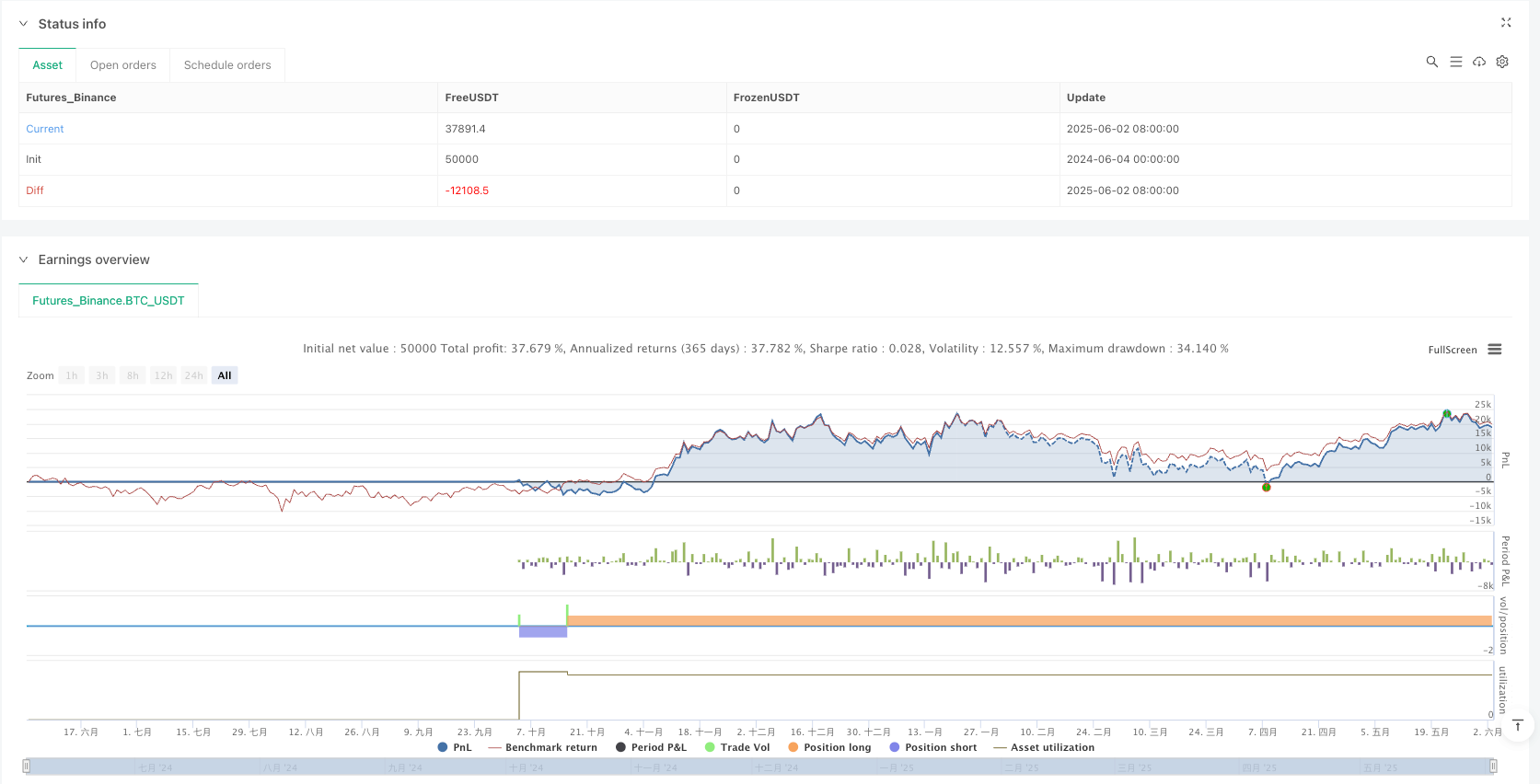

/*backtest

start: 2024-06-04 00:00:00

end: 2025-06-03 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Robert van Delden

//@version=5

strategy("Momentum Strategy", overlay=true, margin_long=100, margin_short=100, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// === INPUT PARAMETERS ===

volLookback = input.int(20, title="Volume MA Lookback")

volMultiplier = input.float(1.2, title="Volume Spike Threshold", minval=0.0)

rsiLength = input.int(14, title="RSI Length")

rsiMidline = input.int(50, title="RSI Midline Level")

macdFast = input.int(12, title="MACD Fast Length")

macdSlow = input.int(26, title="MACD Slow Length")

macdSignal = input.int(9, title="MACD Signal Length")

slowMALen = input.int(200, title="Slow MA Length")

// === CALCULATIONS ===

volMA = ta.sma(volume, volLookback)

rsiValue = ta.rsi(close, rsiLength)

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

slowMA = ta.sma(close, slowMALen)

// === SIGNAL CONDITIONS ===

bullTrend = close > slowMA

bearTrend = close < slowMA

volCondition = volume > volMA * volMultiplier

bullMomentum = rsiValue > rsiMidline

bearMomentum = rsiValue < rsiMidline

macdCrossUp = ta.crossover(macdLine, signalLine)

macdCrossDown = ta.crossunder(macdLine, signalLine)

longSignalRaw = bullTrend and bullMomentum and macdCrossUp and volCondition

shortSignalRaw = bearTrend and bearMomentum and macdCrossDown and volCondition

// === ALTERNATING SIGNAL CONTROL ===

var string lastSignal = "NONE" // can be "LONG", "SHORT", or "NONE"

// Entry only if last signal was opposite

longSignal = longSignalRaw and (lastSignal != "LONG")

shortSignal = shortSignalRaw and (lastSignal != "SHORT")

// Exit opposite position if needed

if (shortSignal and strategy.position_size > 0)

strategy.close("Long", comment="Exit Long")

if (longSignal and strategy.position_size < 0)

strategy.close("Short", comment="Exit Short")

// Execute entries and update lastSignal

if (longSignal and strategy.position_size <= 0)

strategy.entry("Long", strategy.long)

lastSignal := "LONG"

if (shortSignal and strategy.position_size >= 0)

strategy.entry("Short", strategy.short)

lastSignal := "SHORT"

// === VISUALIZATION ===

plot(slowMA, color=color.gray, linewidth=2, title="Slow MA (Trend Filter)")

plotshape(longSignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, text="Buy")

plotshape(shortSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, text="Sell")