Overview

The Multi-Timeframe Dynamic Volatility Tracking Strategy is a short-term trading system that combines fast/slow exponential moving average (EMA) crossovers with a relative strength index (RSI) filter. The strategy focuses on finding pullback opportunities within a dominant short-term trend, using multiple confirmation mechanisms to reduce noise trading. Its core features include risk control based on Average True Range (ATR), adaptive trailing stops, volume-based stop-loss adjustments, and three-level partial profit targets. Additionally, the strategy incorporates a higher timeframe RSI check as an early warning exit mechanism to avoid staying in unfavorable trends too long.

Strategy Principles

This strategy operates on a multi-layered signal stack architecture: 1. Trend Identification: Uses fast EMA and slow EMA crossovers to determine micro-trend direction. When the fast EMA is above the slow EMA, it identifies a bullish trend; otherwise, it’s a bearish trend. 2. Momentum Health Filter: Prevents chasing overextended markets. Long positions are only permitted when RSI is below the overbought level; short positions only when RSI is above the oversold level. 3. Candle Confirmation Mechanism: Requires signal conditions to remain valid for multiple consecutive candles, effectively filtering market noise. 4. Entry Trigger: Issues a market order when the candle completing the confirmation window appears. 5. Initial Stop-Loss: Based on ATR volatility adjustment, dynamically adjusted according to relative trading volume. 6. Trailing Stop Logic: Combines pivot points and ATR-based stops for an optimized approach to securing profits. 7. Higher Timeframe RSI Monitoring: Provides market context exit signals to avoid counter-trend trading. 8. Tiered Profit Targets: Sets three ATR-based target positions for gradual position reduction. 9. Trade Limiter: Restricts maximum trades per trend phase to prevent overtrading.

The key innovation of the strategy lies in organically combining multiple technical indicators with market behavior metrics (such as volume and volatility) to form a highly adaptive trading system that can automatically adjust parameters under different market conditions.

Strategy Advantages

- Strong Adaptability: Through ATR-adjusted stops and targets, the strategy can adapt to different market volatility conditions without frequent parameter re-optimization.

- Multi-layered Risk Management: Combines initial stops, trailing stops, partial profits, and multi-timeframe RSI filtering to form a comprehensive risk control system.

- Noise Filtering Mechanism: The consecutive candle confirmation requirement effectively reduces false signals, improving trade quality.

- Liquidity Awareness: Adjusts stop levels through volume ratio, automatically tightening risk exposure in low liquidity environments.

- Trend Maturity Monitoring: Automatically reduces allowed trades as a trend develops, avoiding overtrading in late trend phases.

- Flexible Profit Mechanism: The three-tier partial profit strategy allows securing partial profits when price moves favorably while maintaining upside potential.

- Cross-timeframe Analysis: Higher timeframe RSI monitoring provides a broader market context perspective, avoiding micro signal fixation during major trend reversals.

- Execution Convenience: Through PineConnector integration, strategy automation can be easily achieved, reducing human intervention and emotional influence.

Strategy Risks

- Drawdown Risk: Despite multiple layers of risk control, the strategy may still face greater than expected drawdowns in extreme market conditions (such as gaps or flash crashes). The solution is to appropriately reduce position size or increase ATR multipliers.

- Parameter Sensitivity: Some key parameters such as EMA length and RSI thresholds significantly impact strategy performance. Excessive optimization may lead to overfitting risk. Step-forward testing rather than in-sample optimization is recommended.

- High-frequency Trading Costs: As a short-term strategy, trading frequency is relatively high, and cumulative trading costs (spreads, commissions) may significantly affect actual returns. Real trading costs should be considered in backtesting.

- Latency Risk: PineConnector’s execution delay (approximately 100-300 milliseconds) may lead to increased slippage in highly volatile markets. Not recommended for extremely volatile or illiquid markets.

- Pivot Point Repainting: On ultra-short timeframe charts below the minute level, pivot points may repaint during real-time candle formation, affecting stop-loss accuracy.

- Trend Identification Lag: Trend identification based on EMA crossovers has inherent lag, potentially missing part of the initial trend movement.

- Excessive Leverage Risk: Setting too large a position multiplier may lead to excessively high risk per trade, rapidly depleting account funds.

Strategy Optimization Directions

- Machine Learning Optimization: Introduce machine learning algorithms to dynamically adjust EMA and RSI parameters, adapting to different market conditions. This can solve the problem of fixed parameters having insufficient adaptability across different market phases.

- Market State Classification: Add volatility clustering analysis to classify markets into high, medium, and low volatility states, adopting differentiated trading parameters for different states. This will improve strategy adaptability in transitioning markets.

- Multi-indicator Consensus Mechanism: Integrate other momentum and trend indicators (such as MACD, Bollinger Bands, KDJ) to form an indicator consensus system, generating signals only when most indicators agree. This helps reduce false signals.

- Intelligent Time Filtering: Add analysis of market sessions and volatility patterns to avoid inefficient trading periods and known high-volatility events (such as important economic data releases).

- Dynamic Partial Profit Ratios: Automatically adjust partial profit percentages and target distances based on market volatility and trend strength, retaining more positions in strong trends and taking profits more aggressively in weak trends.

- Enhanced Drawdown Control: Introduce a risk-adaptive mechanism based on historical drawdown patterns, automatically reducing trading frequency or increasing stop distances when detecting similar historical major drawdown precursors.

- High-frequency Data Enhancement: Where conditions allow, integrate tick-level data for entry optimization, reducing slippage and improving entry prices.

- Cross-market Correlation Analysis: Add analysis of linkages with related markets, leveraging lead-lag relationships between markets to enhance signal quality.

Summary

The Multi-Timeframe Dynamic Volatility Tracking Strategy is a short-term trading system that combines classic technical analysis tools with modern quantitative risk management methods. Through its multi-layered signal stack architecture, it integrates EMA trend identification, RSI momentum filtering, consecutive candle confirmation mechanisms, ATR volatility adjustment, and multi-timeframe analysis to build a comprehensive trading decision framework. The most significant feature of this strategy is its adaptability—the ability to automatically adjust trading parameters and risk control measures based on market volatility, trading volume, and trend maturity.

Despite some inherent risks, such as parameter sensitivity, high-frequency trading costs, and latency risks, these can be effectively controlled through proper money management and continuous optimization. Future optimization directions mainly focus on machine learning parameter optimization, market state classification, multi-indicator consensus mechanisms, and dynamic risk management.

For traders looking to capture pullback opportunities within trends in short-term markets, this strategy provides a structured framework that balances opportunity capture with risk control. However, as with all trading strategies, it should be thoroughly tested on demo accounts before actual application and parameters should be adjusted according to individual risk tolerance and capital size.

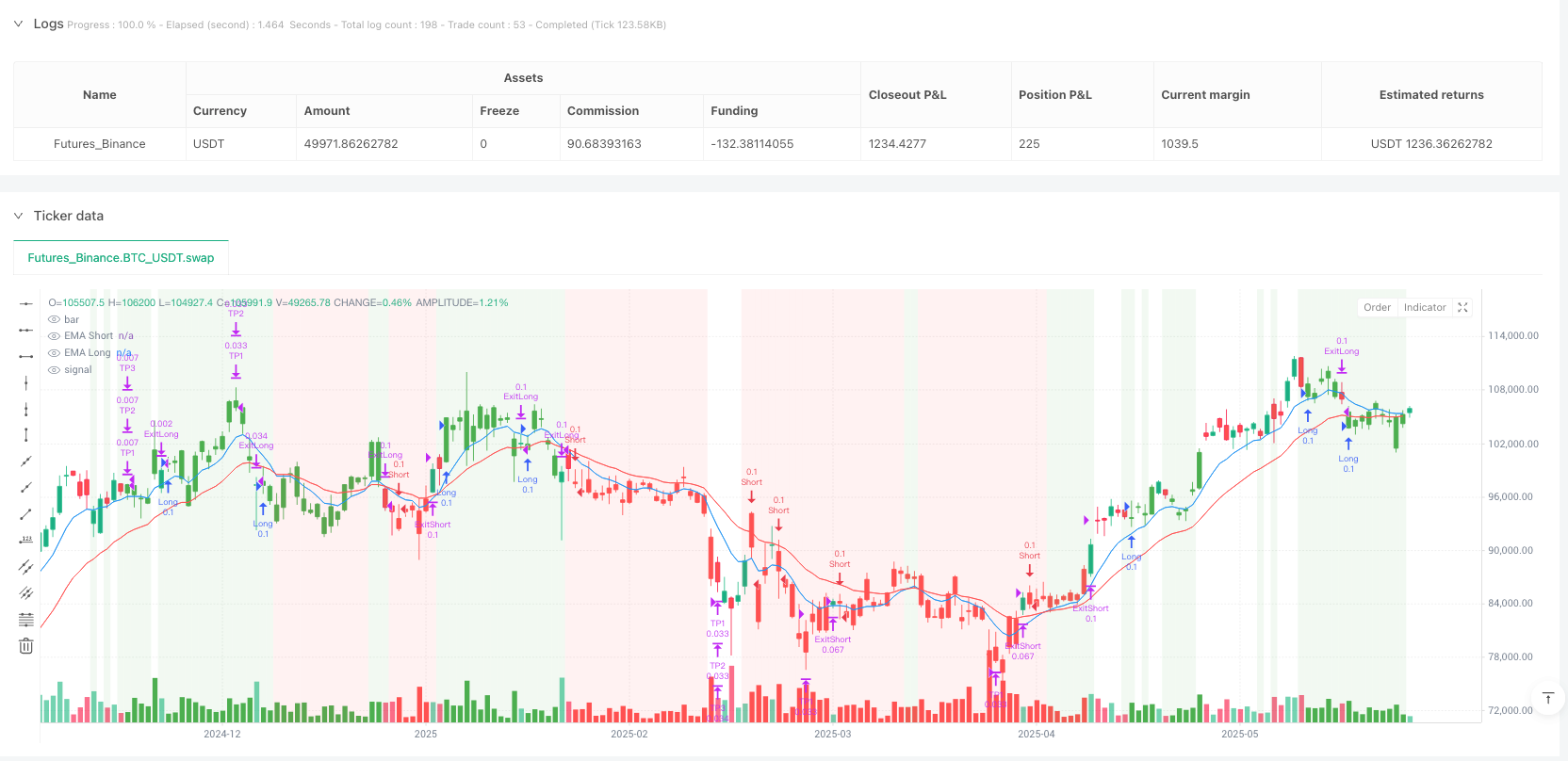

/*backtest

start: 2024-09-15 00:00:00

end: 2025-06-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.comment}}

// © AlgoSystems

strategy("Scalping Trend Power for MT5 - Updated", overlay=true, calc_on_every_tick=false)

//-------------------------------------------------------------------

// Function: confirm a condition for N consecutive bars

//-------------------------------------------------------------------

f_confirm(cond, bars) =>

_ok = true

for i = 0 to bars - 1

_ok := _ok and cond[i]

_ok

//-------------------------------------------------------------------

// Inputs: strategy parameters & PineConnector

//-------------------------------------------------------------------

lotSize = input.float(0.1, title="Lot Size")

lotMultiplier = input.float(1.0, title="Lot Multiplier", minval=0.1, step=0.1)

contractType = input.string("FX", title="Contract Type", options=["FX", "CFD", "Futures"])

// (kept for potential future use)

riskPercentage = input.float(1.0, title="Risk per Trade (%)")

riskRewardRatio = input.float(1.2, title="Risk/Reward Ratio", step=0.1)

trailingStopMultiplier = input.float(1.2, title="Trailing-Stop Multiplier", step=0.1)

emaShortLength = input.int(9, title="EMA Short Length")

emaLongLength = input.int(21, title="EMA Long Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

higherTF = input.timeframe("30", title="Higher Time-Frame for Exit")

higherRsiOverbought = input.int(70, title="Higher-TF RSI Overbought", minval=50)

higherRsiOversold = input.int(30, title="Higher-TF RSI Oversold", minval=10)

pivotLookback = input.int(5, title="Pivot Look-Back Period", minval=2, step=1)

volumeLookback = input.int(20, title="Volume Look-Back Period", minval=5, step=1)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1, step=0.1)

enablePartialExit = input.bool(true, title="Enable Partial Exit")

tp1ProfitMult = input.float(1.0, title="TP1 Profit Multiplier", step=0.1)

tp2ProfitMult = input.float(1.5, title="TP2 Profit Multiplier", step=0.1)

tp3ProfitMult = input.float(2.0, title="TP3 Profit Multiplier", step=0.1)

tp1ExitPercentage = input.float(33, title="TP1 Exit (%)", minval=1, maxval=100, step=1)

tp2ExitPercentage = input.float(33, title="TP2 Exit (%)", minval=1, maxval=100, step=1)

tp3ExitPercentage = input.float(34, title="TP3 Exit (%)", minval=1, maxval=100, step=1)

confirmBars = input.int(2, title="Confirmation Bars", minval=1, step=1)

baseLongTrades = 5

tradeDecreaseFactor = input.int(0, title="Trade Decrease Factor", minval=0)

maxLongTradesPerTrend = math.max(1, baseLongTrades - tradeDecreaseFactor)

activatePineConnector = input.bool(false, title="Activate PineConnector")

pineConnectorLicense = input.string("", title="PineConnector License Code")

//-------------------------------------------------------------------

// Indicator calculations

//-------------------------------------------------------------------

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

rsiValue = ta.rsi(close, rsiLength)

atrValue = ta.atr(atrLength)

// ATR-based TP & SL

dynamicTP = atrValue * riskRewardRatio

dynamicSL = atrValue * trailingStopMultiplier

rawLongSignal = emaShort > emaLong and rsiValue < rsiOverbought

rawShortSignal = emaShort < emaLong and rsiValue > rsiOversold

longSignal = f_confirm(rawLongSignal, confirmBars)

shortSignal = f_confirm(rawShortSignal, confirmBars)

//-------------------------------------------------------------------

// Dynamic ticker symbol (remove exchange prefix if any)

//-------------------------------------------------------------------

var string dynSymbol = na

if bar_index == 0

parts = str.split(syminfo.tickerid, ":")

dynSymbol := array.size(parts) > 1 ? array.get(parts, 1) : syminfo.tickerid

//-------------------------------------------------------------------

// PineConnector messages (no "lots=" or "contract=" – updated syntax)

// The value after risk= is interpreted as LOTS if EA’s VolumeType = "Lots".

//-------------------------------------------------------------------

prefix = activatePineConnector and (pineConnectorLicense != "") ? pineConnectorLicense + "," : ""

calculatedLot = lotSize * lotMultiplier // actual order volume

// ENTRY messages

riskValue = str.tostring(calculatedLot) // risk= interpreted as lots

txtBuy = prefix + "buy," + dynSymbol + ",risk=" + riskValue

txtSell = prefix + "sell," + dynSymbol + ",risk=" + riskValue

// CLOSE FULL messages

txtCloseLong = prefix + "closelong," + dynSymbol

txtCloseShort = prefix + "closeshort," + dynSymbol

// Helper to compute risk= for partial exits

f_partialRisk(pct) => str.tostring(calculatedLot * pct / 100)

// PARTIAL EXIT messages

msgTP1Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Long = prefix + "closelongvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

msgTP1Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp1ExitPercentage)

msgTP2Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp2ExitPercentage)

msgTP3Short = prefix + "closeshortvol," + dynSymbol + ",risk=" + f_partialRisk(tp3ExitPercentage)

//-------------------------------------------------------------------

// Higher-time-frame RSI request

//-------------------------------------------------------------------

higherRsi = request.security(syminfo.tickerid, higherTF, ta.rsi(close, rsiLength))

//-------------------------------------------------------------------

// State variables

//-------------------------------------------------------------------

var bool inLongTrade = false

var bool inShortTrade = false

var int longTradeCount = 0

var float trailingStopLevel = na

var bool tp1_exited = false

var bool tp2_exited = false

var bool tp3_exited = false

//-------------------------------------------------------------------

// Entry/Exit logic

//-------------------------------------------------------------------

if barstate.isconfirmed

avgVol = ta.sma(volume, volumeLookback)

volRatio = avgVol != 0 ? volume / avgVol : 1.0

adjSL = dynamicSL / (volRatio * volumeMultiplier)

pivotH = ta.pivothigh(high, pivotLookback, pivotLookback)

pivotL = ta.pivotlow(low, pivotLookback, pivotLookback)

// LONG entry

if longSignal and not inLongTrade and not inShortTrade and longTradeCount < maxLongTradesPerTrend

strategy.entry("Long", strategy.long, qty=calculatedLot, comment="Long Entry")

if activatePineConnector

alert(txtBuy, alert.freq_once_per_bar)

inLongTrade := true

inShortTrade := false

longTradeCount += 1

trailingStopLevel := low - adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// SHORT entry

if shortSignal and not inShortTrade and not inLongTrade

strategy.entry("Short", strategy.short, qty=calculatedLot, comment="Short Entry")

if activatePineConnector

alert(txtSell, alert.freq_once_per_bar)

inShortTrade := true

inLongTrade := false

trailingStopLevel := high + adjSL

tp1_exited := false

tp2_exited := false

tp3_exited := false

// Trailing-stop update

if inLongTrade

baseStop = close - adjSL

trailingStopLevel := (not na(pivotL) and pivotL > trailingStopLevel) ? pivotL : math.max(trailingStopLevel, baseStop)

if inShortTrade

baseStop = close + adjSL

trailingStopLevel := (not na(pivotH) and pivotH < trailingStopLevel) ? pivotH : math.min(trailingStopLevel, baseStop)

// Dynamic TPs & partial exits

if enablePartialExit and strategy.position_size != 0

avgPrice = strategy.position_avg_price

direction = strategy.position_size > 0 ? 1 : -1

tp1 = avgPrice + direction * dynamicTP * tp1ProfitMult

tp2 = avgPrice + direction * dynamicTP * tp2ProfitMult

tp3 = avgPrice + direction * dynamicTP * tp3ProfitMult

// TP1

if not tp1_exited and f_confirm(direction > 0 ? close >= tp1 : close <= tp1, confirmBars)

strategy.exit("TP1", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp1ExitPercentage, limit=tp1, comment=direction>0 ? msgTP1Long : msgTP1Short)

if activatePineConnector

alert(direction>0 ? msgTP1Long : msgTP1Short, alert.freq_once_per_bar)

tp1_exited := true

// TP2

if not tp2_exited and f_confirm(direction > 0 ? close >= tp2 : close <= tp2, confirmBars)

strategy.exit("TP2", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp2ExitPercentage, limit=tp2, comment=direction>0 ? msgTP2Long : msgTP2Short)

if activatePineConnector

alert(direction>0 ? msgTP2Long : msgTP2Short, alert.freq_once_per_bar)

tp2_exited := true

// TP3

if not tp3_exited and f_confirm(direction > 0 ? close >= tp3 : close <= tp3, confirmBars)

strategy.exit("TP3", from_entry=direction>0 ? "Long" : "Short", qty_percent=tp3ExitPercentage, limit=tp3, comment=direction>0 ? msgTP3Long : msgTP3Short)

if activatePineConnector

alert(direction>0 ? msgTP3Long : msgTP3Short, alert.freq_once_per_bar)

tp3_exited := true

// FULL exit (trailing stop or opposite signals)

exitCondLong = inLongTrade and (close < trailingStopLevel or rsiValue > rsiOverbought or higherRsi > higherRsiOverbought)

exitCondShort = inShortTrade and (close > trailingStopLevel or rsiValue < rsiOversold or higherRsi < higherRsiOversold)

if exitCondLong and f_confirm(exitCondLong, confirmBars)

strategy.exit("ExitLong", from_entry="Long", stop=trailingStopLevel, comment=txtCloseLong)

if activatePineConnector

alert(txtCloseLong, alert.freq_once_per_bar)

inLongTrade := false

if exitCondShort and f_confirm(exitCondShort, confirmBars)

strategy.exit("ExitShort", from_entry="Short", stop=trailingStopLevel, comment=txtCloseShort)

if activatePineConnector

alert(txtCloseShort, alert.freq_once_per_bar)

inShortTrade := false

// Reset counter when the bullish trend ends

if not rawLongSignal

longTradeCount := 0

//-------------------------------------------------------------------

// Plot & styling

//-------------------------------------------------------------------

plot(emaShort, color=color.blue, linewidth=1, title="EMA Short")

plot(emaLong , color=color.red , linewidth=1, title="EMA Long")

barcolor(inLongTrade ? color.new(color.green,0) : inShortTrade ? color.new(color.red,0) : na)

bgcolor(rawLongSignal ? color.new(color.green,90) : rawShortSignal ? color.new(color.red,90) : na)

// Signal arrows disabled (user request):

// plotshape(longSignal , title="Long signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

// plotshape(shortSignal, title="Short signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

//-------------------------------------------------------------------

// HOW TO USE with PineConnector (quick checklist):

// 1. Attach this script to the chart.

// 2. Click the “Alert” bell → Create Alert.

// 3. Condition: “Scalping Trend Power … (Any alert() call)” (or “Order fills only”).

// 4. Webhook URL: https://webhook.pineconnector.com

// 5. Leave the Message box empty – the script fills it.

// 6. On MT5, run the PineConnector EA on the same symbol (dynSymbol) and keep VolumeType = Lots.

// 7. Enter your License ID in the input and tick “Activate PineConnector”.

//-------------------------------------------------------------------