Overview

The EMA Trend Momentum Tracking Strategy is a quantitative trading system designed to capture medium and long-term uptrends. At its core, the strategy relies on crossover signals between fast and slow Exponential Moving Averages (EMA), combined with multi-dimensional confirmation using Directional Movement Index (DMI), Relative Strength Index (RSI), and Average Directional Index (ADX) to filter high-quality entry points. Additionally, the strategy employs a dynamic stop-loss mechanism based on Average True Range (ATR) for effective risk control. This strategy is particularly suitable for trend-following trading on the daily timeframe, aiming to maximize the capture of major trend movements while maintaining a high win rate through strict entry conditions and clear exit mechanisms.

Strategy Principles

The core principles of this strategy revolve around three dimensions: trend identification, momentum confirmation, and risk management:

Trend Identification Mechanism:

- The strategy uses the crossover between 20-period EMA and 50-period EMA as the primary trend signal

- When the fast EMA(20) crosses above the slow EMA(50), a long entry signal is triggered

- An additional minimum EMA separation filter is set to avoid false signals when EMAs are too close together

Multi-Indicator Confirmation System:

- DMI indicator: Requires +DI to be greater than -DI, confirming upward price momentum

- RSI indicator: Requires RSI value to be above 40, verifying sufficient upward market strength

- ADX indicator: Requires ADX to be greater than 5, filtering out market environments with insufficient trend strength

Precise Entry and Exit Logic:

- Entry condition: Establish a long position when all indicator conditions are met simultaneously

- Exit condition: Close the position when the 20-period EMA crosses below the 50-period EMA

- Stop-loss setting: Set a dynamic stop-loss at 4 times ATR below the entry price

The strategy execution process is as follows: first, determine the EMA crossover signal, then verify the confirmation conditions of DMI, RSI, and ADX indicators, and finally check the EMA separation. A long position is opened when all conditions are met, with an ATR-based stop-loss. The position is automatically closed when the fast EMA crosses below the slow EMA. This multi-layered condition screening ensures that the strategy only enters during high-probability trend initiation phases and reduces false signal risk through the complementary use of technical indicators.

Strategy Advantages

High-Quality Trend Capture Capability:

- Identifies primary trend direction through EMA crossovers, effectively capturing medium and long-term movements

- Multi-indicator confirmation mechanism significantly improves entry signal quality, reducing false breakout trades

- Focus on long-only strategy aligns with the statistical characteristic of long-term appreciation in most assets

Comprehensive Risk Control Design:

- ATR-based dynamic stop-loss mechanism adaptively adjusts stop-loss distance according to market volatility

- Clear technical indicator exit signals avoid hesitation caused by subjective judgment

- Multiple filtering conditions reduce trading frequency, minimizing unnecessary trading costs

Flexible Parameter Optimization Space:

- Provides multiple adjustable parameters, including EMA periods, RSI threshold, ADX minimum value, etc.

- Allows traders to customize the strategy according to different market environments and personal risk preferences

- Can adapt to different timeframes and trading instruments, demonstrating good adaptability

Clear and Understandable Strategy Logic:

- Based on a combination of classic technical indicators with simple and clear concepts

- Explicit entry and exit conditions that are easy to understand and execute

- No complex calculation formulas, reducing the difficulty of strategy implementation and maintenance

Strategy Risks

Trend Reversal Risk:

- In strong consolidating markets, EMA crossovers may produce frequent false signals

- Rapid market reversals may prevent the strategy from exiting in time, causing significant drawdowns

- Mitigation method: Consider increasing trend confirmation periods or adding volatility filters

Parameter Sensitivity Risk:

- Parameter choices such as EMA periods, RSI threshold, and ADX minimum value significantly impact strategy performance

- Excessive optimization may lead to poor strategy performance on out-of-sample data

- Mitigation method: Conduct robustness testing and select parameter combinations that perform stably across various market environments

Stop-Loss Control Risk:

- The 4x ATR stop-loss setting may be too wide in highly volatile markets, leading to excessive single-trade losses

- Overly tight stops may be triggered during normal volatility, missing major trends

- Mitigation method: Dynamically adjust the ATR multiplier based on different market environments, or combine with fixed percentage stops

Long-term Oscillating Market Risk:

- The strategy performs best in clear trending markets but may trade frequently and generate losses in long-term oscillating markets

- Mitigation method: Add trend strength filtering conditions or pause strategy operation when oscillating markets are identified

Strategy Optimization Directions

Enhance Trend Determination Mechanism:

- Add longer-period trend judgment indicators, such as 200-day moving average position judgment

- Integrate price pattern recognition algorithms, such as head and shoulders, triangle patterns, etc.

- Why optimize this way: Multi-level trend determination can reduce false signals and improve entry quality

Introduce Volatility Adaptive Components:

- Dynamically adjust EMA periods and filtering conditions based on market volatility states

- Raise entry thresholds in high-volatility environments and appropriately relax conditions in low-volatility environments

- Why optimize this way: Adaptive mechanisms can better respond to different market environments, improving strategy stability

Optimize Profit-Taking and Stop-Loss Mechanisms:

- Implement dynamic trailing stops based on market volatility to lock in partial profits

- Add partial profit-taking mechanisms to realize gains at different price targets

- Why optimize this way: Improved profit-taking mechanisms can enhance the strategy’s risk-reward ratio and profitability

Integrate Market Environment Classification System:

- Develop a market environment classifier to identify trending, oscillating, and reversal phases

- Adopt different parameter settings or trading logic in different market environments

- Why optimize this way: Market adaptability can improve strategy performance across various market conditions

Add Fundamental Filtering Conditions:

- Incorporate macroeconomic indicators or market sentiment indicators as additional entry filtering conditions

- Reduce position size or pause trading before important economic data releases

- Why optimize this way: Fundamental factors often drive long-term trends; combining technical and fundamental approaches can enhance strategy effectiveness

Summary

The EMA Trend Momentum Tracking Strategy is a trend-following system based on multiple technical indicators, identifying trend direction through EMA crossovers, confirming with DMI, RSI, and ADX indicators, and controlling risk using ATR dynamic stop-losses. This strategy is particularly suitable for medium and long-term trend following and performs best in clearly trending market environments.

The strategy’s main advantages lie in its multi-layered signal confirmation mechanism and clear risk control system, but it also faces risks from trend reversals, parameter sensitivity, and oscillating markets. Performance can be further enhanced through optimization directions such as strengthening trend determination, introducing volatility adaptive components, optimizing profit-taking and stop-loss mechanisms, integrating market environment classification systems, and adding fundamental filtering conditions.

For investors pursuing medium and long-term trend trading, this strategy provides a clearly structured and logically rigorous trading framework. Through reasonable parameter settings and risk management, the strategy can help traders effectively capture major market trend opportunities while controlling risk. Most importantly, the strategy avoids excessive complexity, maintaining understandability and operability, making it a practical tool for trend traders.

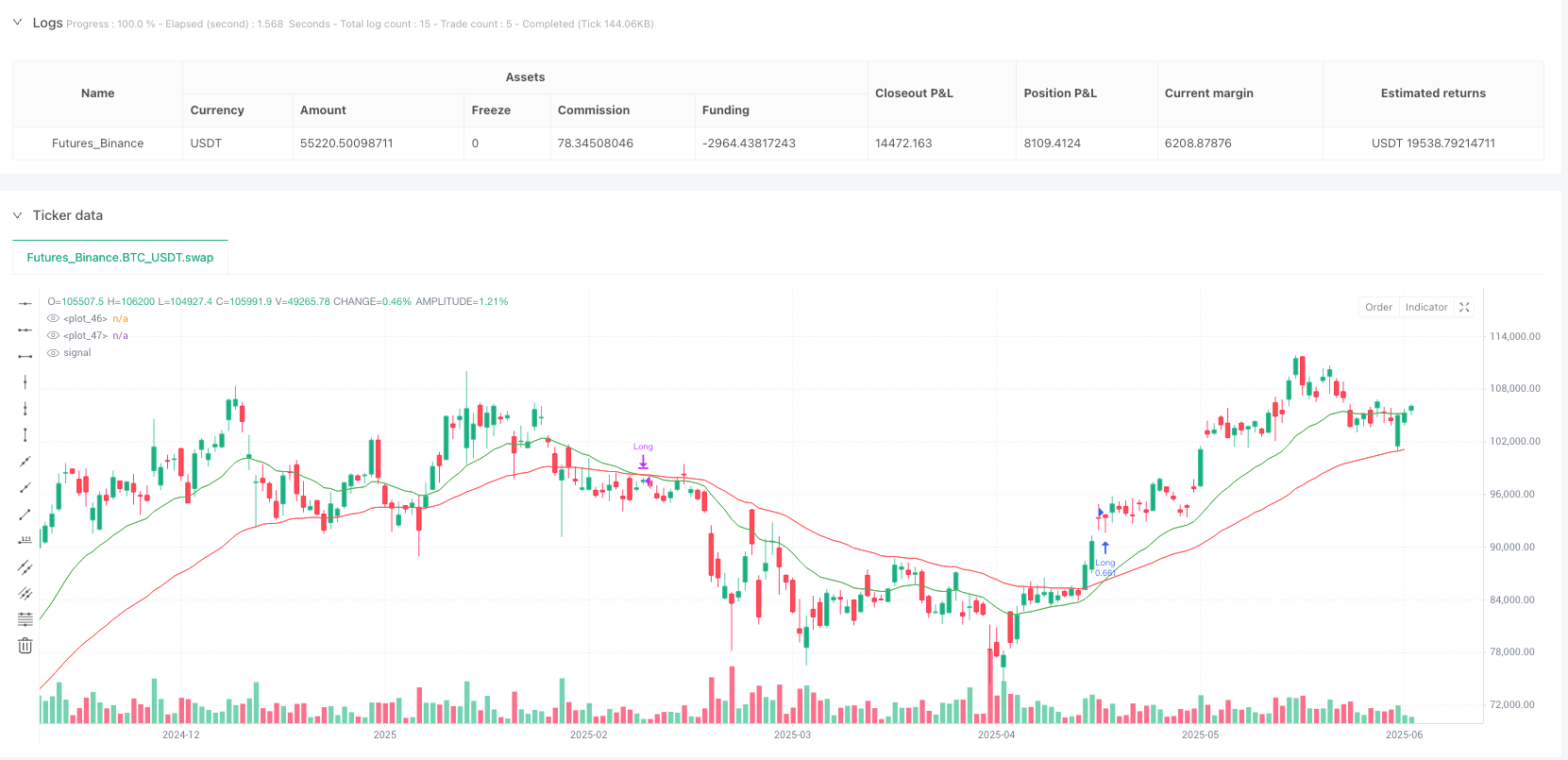

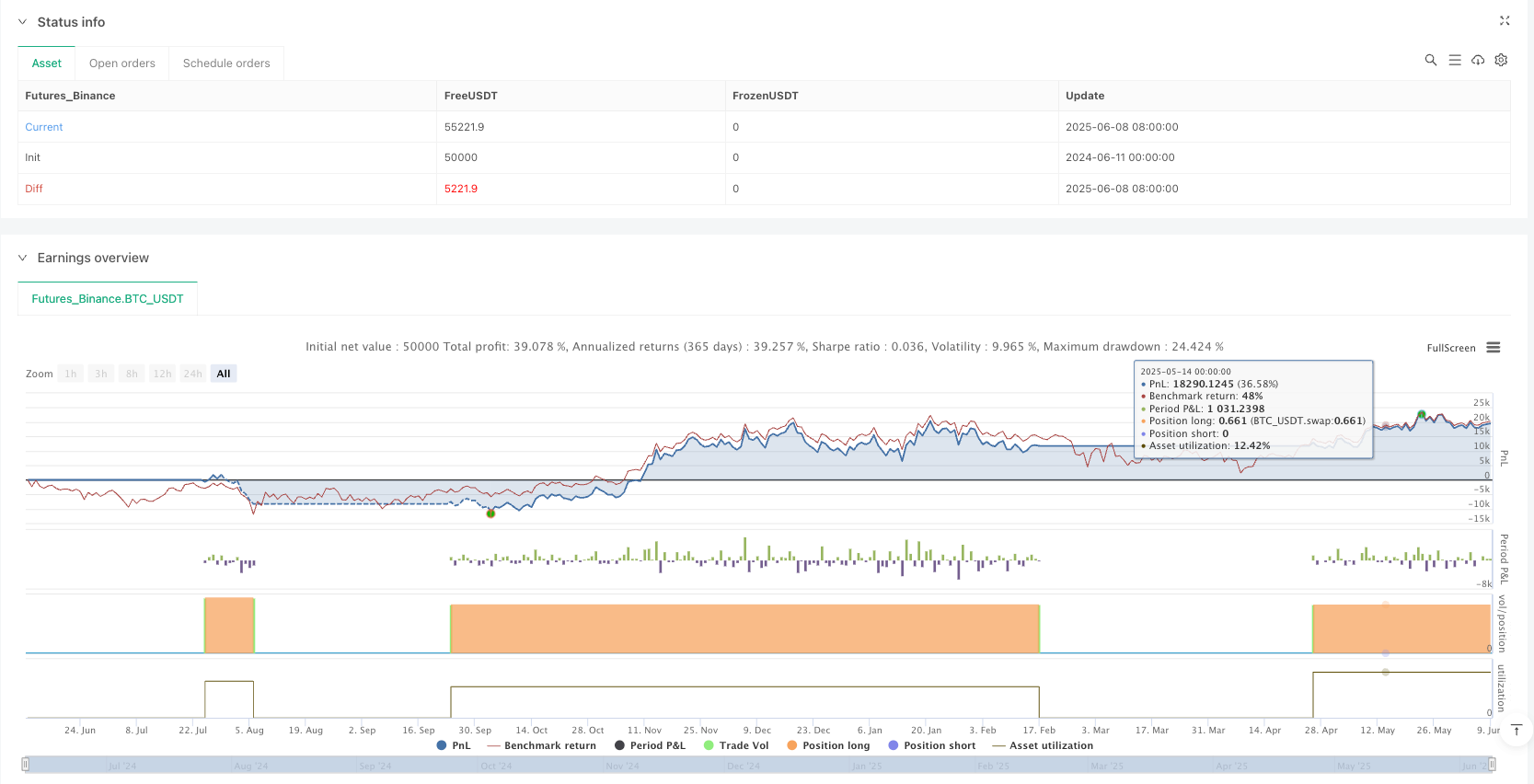

/*backtest

start: 2024-06-11 00:00:00

end: 2025-06-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Trend (Long Only) - ATR Stop, No Trailing", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === Inputs ===

fastLen = input.int(20, title="Fast EMA Length")

slowLen = input.int(50, title="Slow EMA Length")

atrLen = input.int(14, title="ATR Length")

atrMult = input.float(4.0, title="ATR Multiplier for Stop Loss")

diLen = input.int(14, title="DI Length")

diSmoothing = input.int(14, title="DI Smoothing")

rsiPeriod = input.int(14, title="RSI Period")

rsiLongMin = input.int(40, title="Min RSI for Long")

adxLen = input.int(14, title="ADX Length")

adxSmoothing = input.int(14, title="ADX Smoothing")

adxMin = input.int(5, title="Min ADX")

emaSeparationPct = input.float(0.0, title="Min EMA Distance (% of Price)", step=0.1)

// === Indicators ===

fastEMA = ta.ema(close, fastLen)

slowEMA = ta.ema(close, slowLen)

emaDistance = math.abs(fastEMA - slowEMA) / close * 100

atr = ta.atr(atrLen)

[plusDI, minusDI, adx] = ta.dmi(diLen, adxSmoothing)

rsi = ta.rsi(close, rsiPeriod)

// === Entry & Exit Logic ===

longCondition =

ta.crossover(fastEMA, slowEMA) and

plusDI > minusDI and

rsi > rsiLongMin and

adx > adxMin and

emaDistance > emaSeparationPct

exitLong = ta.crossunder(fastEMA, slowEMA)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("SL Long", "Long", stop=close - atr * atrMult)

if (exitLong)

strategy.close("Long")

// === Plotting ===

plot(fastEMA, color=color.green)

plot(slowEMA, color=color.red)