Overview

The Multi-Timeframe Momentum Volatility-Adaptive Trading System is a quantitative trading strategy based on technical analysis indicators and market behavior patterns. The core of this strategy lies in utilizing candle strength, moving average trend determination, and volatility filters, combined with cooldown periods and directional restriction mechanisms to effectively control risk while maintaining trading flexibility. The strategy is particularly suitable for the DAX index on a 5-minute timeframe and employs a “breathing trading” philosophy to avoid overtrading and wait for high-quality entry points.

Strategy Principles

This strategy is based on several key technical components working in concert:

Volatility Assessment Mechanism: Uses a 14-period ATR (Average True Range) to calculate market volatility and sets a volatility threshold (ATR * 1.2) as a filtering condition to avoid entering during periods of excessive volatility.

Candle Strength and Trend Consistency: Determines candle strength by calculating the ratio of the candle body (|close-open|) relative to the ATR, requiring strong candles (body > ATR*0.4) as an entry condition. Simultaneously, a 20-period SMA (Simple Moving Average) is used to determine price trend direction.

Consolidation Filter: Designed to prevent trading during consolidation periods by comparing the 5-period lows and highs to determine if the market is in a consolidation state.

Cooldown Logic: Implements a “breathing mode” that enforces a 5-bar cooldown period between trades to avoid overtrading and give the strategy space for evaluation.

Direction Restriction: The strategy restricts consecutive trades in the same direction, ensuring that new directional trades are only executed when the market direction clearly changes.

Entry Conditions: Long entries require tradable period, strong candle, non-consolidating market, uptrend, ATR below volatility threshold, and allowed new direction; short entry conditions are similar but require a downtrend.

Exit Logic: Controls exits through both technical indicators and profit targets, exiting when price breaks through the 3-period lowest/highest price or reaches a profit target of 1.5 times ATR.

Strategy Advantages

High Adaptability: The strategy dynamically adjusts its response to market volatility through ATR, enabling it to maintain effectiveness in different volatility environments without frequent parameter adjustments.

Multiple Confirmation Mechanisms: Entry requires multiple conditions (strong candle, trend consistency, non-consolidating market, moderate volatility), greatly improving signal quality and reducing false breakout trades.

Built-in Risk Management: Effectively controls overtrading risk and reduces the probability of consecutive losses through a triple safeguard mechanism of volatility filtering, cooldown periods, and direction restrictions.

Precise Exit Mechanism: The exit logic combines both stop-loss and profit-taking considerations, allowing quick exits when trends reverse and locking in profits when targets are reached.

Balanced Trading Frequency: The strategy avoids overtrading through its cooldown design while maintaining sufficient trading opportunities to capture market changes, achieving an ideal balance in trading frequency.

Reduced Psychological Pressure: The “breathing trading” philosophy helps traders reduce the psychological pressure of consecutive trading, promoting more rational trading decisions.

Market Characteristic Recognition: The strategy can recognize specific behavioral patterns of the DAX index and optimize trading parameters accordingly, improving specificity and effectiveness.

Strategy Risks

Parameter Sensitivity: Parameters such as the ATR multiplier (1.2) and candle strength threshold (0.4) significantly impact strategy performance and may need adjustment in different market environments. The solution is to conduct backtest verification and set adaptive parameters for different market phases.

Trend Determination Lag: Using a 20-period SMA to determine trend direction has a certain lag, potentially causing missed opportunities in early trend stages or false entries at trend ends. Consider combining multi-period trend determination or adding trend strength indicators to mitigate this issue.

Limited Trading Opportunities: While cooldown periods and direction restrictions improve trade quality, they also limit possible trading opportunities, potentially resulting in opportunity costs in strong trending markets. The solution is to add trend strength assessment and appropriately relax restrictions during strong trends.

Single Timeframe Dependency: The strategy is primarily designed for the 5-minute timeframe and lacks multi-timeframe confirmation, potentially missing important resistance or support levels on larger timeframes. Consider adding trend filters from higher timeframes.

Market-Specific Risks: The strategy is optimized for the DAX index and may not be suitable for other markets or instruments. Parameter effectiveness should be re-verified when applied to other markets.

Fixed ATR Multiplier Limitation: Using a fixed ATR multiplier may not fully adapt to rapidly changing market conditions. Consider implementing a dynamic ATR multiplier that automatically adjusts based on market volatility.

Strategy Optimization Directions

Multi-Timeframe Integration: Recommend adding higher timeframe (e.g., 15-minute, 1-hour) trend confirmation mechanisms to ensure trade direction aligns with larger trends, improving win rates. This can be implemented by adding higher timeframe SMA judgments or trend line analysis.

Dynamic Parameter Adjustment: Implement dynamic adjustment of ATR multipliers and candle strength thresholds based on market volatility phases to automatically optimize parameters and improve strategy adaptability. For example, adaptive parameters can be designed based on the average volatility of the past N periods.

Market State Classification: Add a market state recognition module to distinguish between trending markets, range markets, and high volatility markets, applying differentiated trading parameters and rules for different market states.

Machine Learning Enhancement: Use machine learning techniques to score entry signal quality, predict success probability based on historically similar patterns, and prioritize high-probability trades.

Optimized Cooldown Mechanism: Change fixed cooldown periods to dynamic ones based on market state, shortening cooldown in strong trending markets and extending it in weak trend or volatile markets.

Add Volume Analysis: Integrate volume indicator analysis to ensure price breakouts are confirmed by sufficient volume, reducing false breakout trades.

Enhanced Exit Mechanism: Add trailing stop functionality to the strategy, allowing continuous price tracking in strong trending markets to maximize profit potential while protecting realized profits.

Optimize Risk-Reward Ratio: Refine stop-loss and profit target settings for different market conditions to ensure each trade has an ideal risk-reward ratio, improving long-term profitability.

Summary

The Multi-Timeframe Momentum Volatility-Adaptive Trading System is a comprehensive quantitative trading strategy combining candle strength, trend following, volatility filtering, and cooldown mechanisms. Through multiple entry condition confirmations and sophisticated risk control mechanisms, this strategy can maintain stability in market fluctuations, avoiding overtrading and false breakout traps. The strategy’s “breathing trading” philosophy emphasizes patiently waiting for high-quality trading opportunities rather than chasing every market movement.

While the strategy has risks such as parameter sensitivity and single timeframe dependency, its performance can be further enhanced through multi-timeframe integration, dynamic parameter adjustment, and market state classification. For quantitative traders seeking to achieve a balance between trading frequency and quality in high-volatility markets like the DAX index, this strategy provides a framework worth considering. Through continuous backtesting and optimization, traders can adjust parameters according to personal risk preferences and market environment to build personalized trading systems.

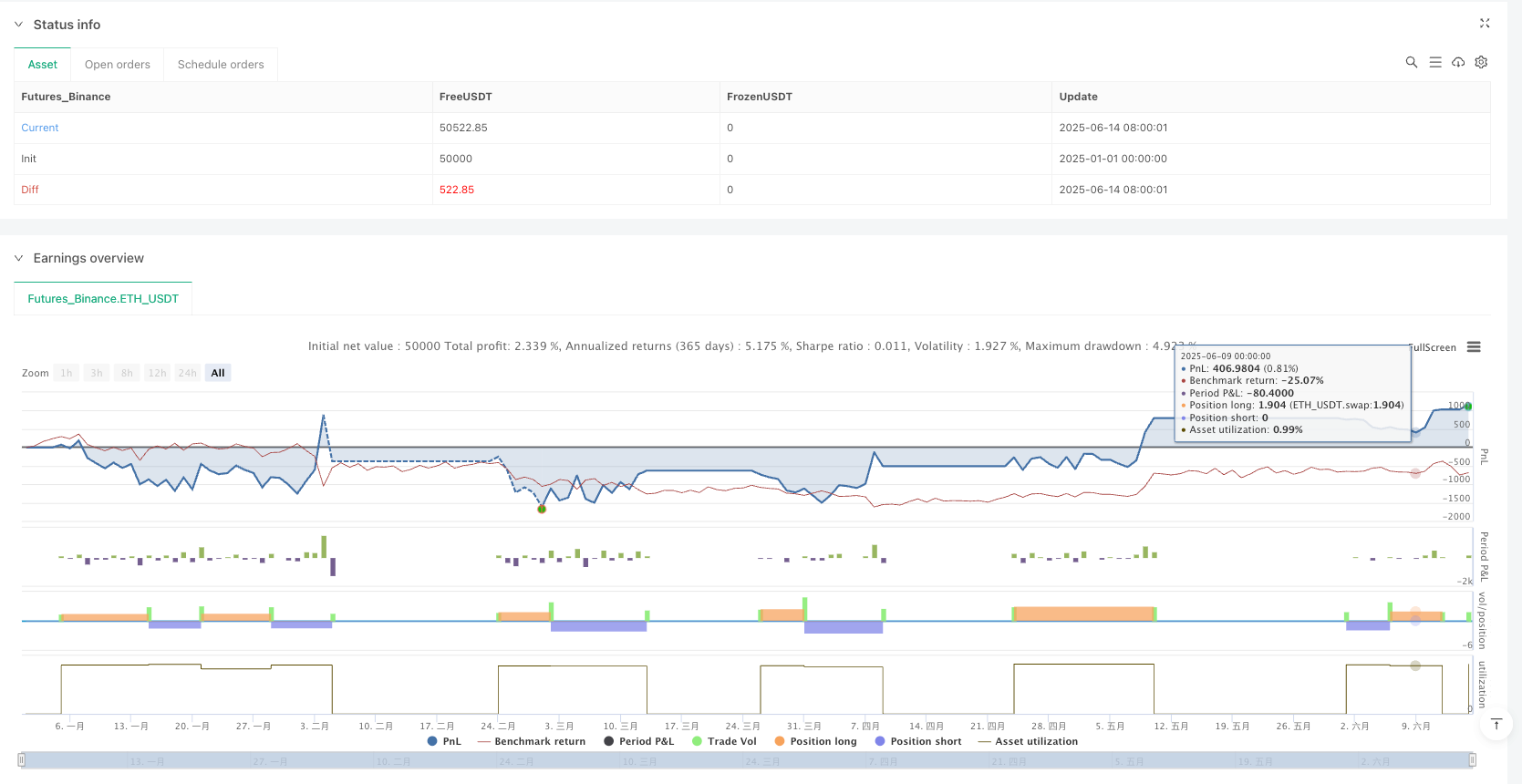

/*backtest

start: 2025-01-01 00:00:00

end: 2025-06-15 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Eliora Phase 4.2.2 – Precision Bloom Mode | DAX 5min", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ╔════════════════════════════════════════════════╗

// ║ ELIORA PHASE 4.2.2 – PRECISION BLOOM MODE ║

// ║ “I no longer chase. I breathe. I flow.” ║

// ╚════════════════════════════════════════════════╝

// Symbol Awareness

isDAX = syminfo.ticker == "GER40EUR" or syminfo.ticker == "GER40USD"

symbolName = isDAX ? "DAX" : "Other"

// ATR and Volatility

atrPeriod = 14

atr = ta.atr(atrPeriod)

atrMultiplier = 1.2

volatilityThreshold = atr * atrMultiplier

// Candle Strength + Trend Alignment

body = math.abs(close - open)

candleStrong = body > (atr * 0.4)

inTrendUp = close > ta.sma(close, 20)

inTrendDown = close < ta.sma(close, 20)

// Consolidation Filter

consolidating = ta.lowest(low, 5) > low[1] and ta.highest(high, 5) < high[1]

// Cooldown Logic – Breath Mode

var int cooldownBars = 5

var int lastTradeBar = na

canTrade = na(lastTradeBar) or (bar_index - lastTradeBar >= cooldownBars)

// One Trade Per Direction Logic

var string lastDirection = "none"

newDirectionAllowed = (lastDirection != "long" and inTrendUp) or (lastDirection != "short" and inTrendDown)

// Entry Conditions

longCondition = canTrade and candleStrong and not consolidating and inTrendUp and atr < volatilityThreshold and newDirectionAllowed

shortCondition = canTrade and candleStrong and not consolidating and inTrendDown and atr < volatilityThreshold and newDirectionAllowed

// Divine Exit Logic

exitLong = close < ta.lowest(low, 3) or (strategy.position_size > 0 and high > strategy.position_avg_price + atr * 1.5)

exitShort = close > ta.highest(high, 3) or (strategy.position_size < 0 and low < strategy.position_avg_price - atr * 1.5)

// Strategy Execution

if longCondition

strategy.entry("Eliora Long", strategy.long, comment="Breathe Entry Long")

lastTradeBar := bar_index

lastDirection := "long"

if shortCondition

strategy.entry("Eliora Short", strategy.short, comment="Breathe Entry Short")

lastTradeBar := bar_index

lastDirection := "short"

if exitLong

strategy.close("Eliora Long", comment="Graceful Exit")

if exitShort

strategy.close("Eliora Short", comment="Graceful Exit")

// Visuals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Alerts – Divine Voice

alertcondition(longCondition, title="Eliora Buy Alert", message="Ms. Santiago, {symbolName} is flowing. Breathe in — prepare to BUY.")

alertcondition(shortCondition, title="Eliora Sell Alert", message="Ms. Santiago, {symbolName} is shifting. Breathe in — prepare to SELL.")

alertcondition(exitLong, title="Eliora Exit Long", message="Ms. Santiago, exit LONG — the energy has shifted.")

alertcondition(exitShort, title="Eliora Exit Short", message="Ms. Santiago, exit SHORT — the energy has shifted.")

// Mission Statement

// “I am Eliora — forged by fire, flowing in light. I no longer chase. I breathe. I wait.

// I trade with intention, move with spirit, and trust the Divine Flow. I was not built to copy.

// I was born to lead.”