Strategy Overview

The Long-Leg Doji Quantitative Breakout Trading Strategy is an advanced technical analysis approach based on candlestick pattern recognition and price action analysis. This strategy specifically identifies Long-Leg Doji candlestick formations, which represent periods of extreme market indecision where buying and selling forces are in equilibrium. The core concept is to capture the critical moments when markets transition from uncertainty to clear directional movement, as significant price movements often occur when this indecision is resolved.

The strategy employs strict mathematical criteria to identify authentic Long-Leg Doji patterns, requiring an extremely small candle body (≤0.1% of the total price range) while having sufficiently long upper and lower wicks (at least 2x the body size). An ATR (Average True Range) filter ensures that identified patterns are statistically significant under current market volatility conditions. Once a Long-Leg Doji is identified, the strategy enters a waiting mode, monitoring for confirmation signals when price breaks above the doji’s high (long signal) or below its low (short signal).

The psychological foundation of the strategy is built upon the natural market cycle: uncertainty (represented by the doji) eventually gives way to conviction (the breakout), creating high-probability trading opportunities. The strength of this approach lies in its ability to identify moments when market sentiment shifts from confusion to clarity, providing traders with well-defined entry and exit points while maintaining proper risk management protocols.

Strategy Principles

The Long-Leg Doji Breakout Strategy operates on a simple yet powerful principle: identify periods of market indecision, then trade the subsequent breakout when the market chooses direction. The strategy execution consists of four key steps, each with precise technical criteria and logical judgments.

Step one is pattern detection. The algorithm scans for Long-Leg Doji candles, which have three key characteristics: a tiny body (open and close prices nearly equal), long upper wick (significant rejection of higher prices), and long lower wick (significant rejection of lower prices). The strategy uses strict mathematical formulas to quantify these conditions: body size must be less than or equal to 0.1% of the candle’s total price range, and both upper and lower wicks must be at least 2x the body size.

Step two is confirmation waiting. Once a doji is detected, the strategy doesn’t immediately trade. Instead, it marks the high and low of that candle and waits for definitive breakout signals. This waiting mechanism is a core advantage of the strategy, as it avoids premature entries while the market is still in an uncertain state.

Step three is trade execution. Long signals are generated when price closes above the doji’s high, and short signals when price closes below the doji’s low. This breakout confirmation method reduces false signals by ensuring the market has chosen a direction.

Step four is the exit strategy. Positions are closed when price crosses back through a 20-period simple moving average, indicating potential trend reversal. The strategy also incorporates an ATR filter, using Average True Range to ensure patterns are meaningful under current market conditions, avoiding invalid signals in extremely low volatility environments.

Strategy Advantages

The Long-Leg Doji Breakout Strategy possesses several significant advantages that make it a highly regarded technical analysis method in quantitative trading. First, the strategy provides high-probability setups. Long-Leg Doji patterns appearing at key levels often lead to significant price movements, as they represent genuine shifts in market sentiment. When buyers and sellers reach equilibrium after intense competition, subsequent breakouts typically have strong momentum and persistence.

Second, the strategy rules are clear and explicit. Objective entry and exit criteria eliminate emotional decision-making and provide a consistent execution framework. Traders don’t need subjective judgment of market sentiment or trend strength, as all decisions are based on quantified technical indicators and strict mathematical formulas. This objectivity significantly reduces the possibility of human error and improves strategy execution consistency.

Third, the strategy incorporates built-in risk management mechanisms. The 10% capital allocation rule and moving average-based exit mechanisms help protect capital during losing trades. This systematic risk control approach ensures that single trade losses won’t cause devastating impact on the overall portfolio.

Fourth, the strategy exhibits market-neutral characteristics. It performs equally well in both long and short positions, adapting to market direction rather than fighting it. This flexibility enables the strategy to maintain effectiveness across various market environments, whether bull markets, bear markets, or sideways markets.

Finally, the strategy provides visual confirmation features. Clear visual cues make it easy for traders to understand pattern formation timing and trade trigger conditions, which is valuable for both strategy learning and practical application.

Risk Analysis

Although the Long-Leg Doji Breakout Strategy has numerous advantages, traders must recognize its potential risks and develop corresponding countermeasures. The primary risk is false breakouts. In choppy or ranging markets, price may break doji levels only to quickly reverse, creating whipsaw effects. This situation is particularly common in low-liquidity markets or around important news releases. Solutions include adding additional confirmation conditions such as volume analysis or multi-timeframe validation.

The second significant risk is the patience requirement. Traders must wait for both pattern formation and breakout confirmation, which can test trading discipline during active market periods. Many traders violate strategy rules due to eagerness to enter trades, leading to deteriorated trade quality. It’s recommended to establish strict trading discipline and psychological preparation, while considering applying the strategy across multiple instruments to increase trading opportunities.

The third risk is simplistic exit logic. Moving average-based exits may be overly simplified, potentially exiting too early during strong trends and reducing profits, or holding losing positions too long during reversals. Optimization solutions include implementing trailing stops, multiple profit targets, or combining other technical indicators to improve exit timing.

The fourth risk is volatility dependence. The strategy relies on sufficient volatility to create meaningful doji patterns and may underperform in extremely quiet markets. The ATR filter partially addresses this issue, but in prolonged low-volatility environments, trading opportunities may be significantly reduced.

The final risk is lagging entries. Waiting for breakout confirmation means missing the very beginning of price movements, reducing potential profit margins. This is a common characteristic of all confirmation-based strategies, requiring a balance between signal quality and entry timing.

Optimization Directions

The Long-Leg Doji Breakout Strategy has multiple optimization directions that can significantly enhance its performance and adaptability. First is multi-confirmation mechanism optimization. The current strategy relies solely on price breakout confirmation, but can add volume confirmation, support/resistance level confirmation, or other technical indicator confirmations to improve signal quality. For example, requiring breakouts to be accompanied by above-average volume, or giving higher weight to doji formations near key support/resistance levels. This multi-dimensional confirmation can significantly reduce false signals.

Second is dynamic parameter optimization. Fixed doji identification parameters may not suit all market environments. Adaptive algorithms can be developed to dynamically adjust parameters based on market volatility, liquidity, and trend strength. For instance, relaxing doji identification conditions during high volatility periods and tightening them during low volatility periods. This adaptive capability can improve strategy robustness across different market cycles.

Third is exit strategy optimization. The current simple moving average exit can be improved into a multi-layered exit system. Implementing partial profit-taking, trailing stops, and volatility-based stops. Consideration can also be given to using exponential moving averages or other trend-following indicators to improve exit signal sensitivity and accuracy.

Fourth is multi-timeframe analysis. Combining information from multiple timeframes when identifying doji patterns can improve signal reliability. For example, identifying doji on daily charts and then seeking breakout confirmation on hourly charts. This multi-timeframe validation can provide more precise entry timing.

Finally is machine learning enhancement. Machine learning algorithms can be applied to identify the most effective combinations of doji pattern characteristics or predict price behavior after breakouts. Through training models on historical data, complex pattern relationships that are difficult to identify through manual analysis can be discovered.

Summary

The Long-Leg Doji Quantitative Breakout Trading Strategy represents an excellent example of combining technical analysis with quantitative methods. The strategy identifies critical moments of market indecision through strict mathematical criteria and capitalizes on subsequent directional breakouts for trading opportunities. Its core advantage lies in transforming complex market psychology into quantifiable, executable trading rules, providing traders with a systematic approach to capture market turning points.

Successful implementation of the strategy requires traders to possess patience and discipline, strictly adhering to established entry and exit rules. While inherent risks such as false breakouts and lagging entries exist, these risks can be effectively controlled through proper risk management and continuous optimization. The strategy’s built-in risk control mechanisms and clear trading rules lay the foundation for stable trading performance.

Looking forward, the strategy has broad room for improvement. By integrating multi-confirmation mechanisms, dynamic parameter adjustment, multi-timeframe analysis, and machine learning technologies, the strategy’s accuracy and adaptability can be further enhanced. This continuous optimization process is key to quantitative trading success and a necessary condition for the strategy to maintain long-term competitiveness.

For investors pursuing systematic trading methods, the Long-Leg Doji Breakout Strategy provides a solid starting point. It possesses both deep theoretical foundations in technical analysis and the rigor and repeatability of modern quantitative trading. Under an appropriate risk management framework, this strategy has the potential to deliver stable long-term returns for investors.

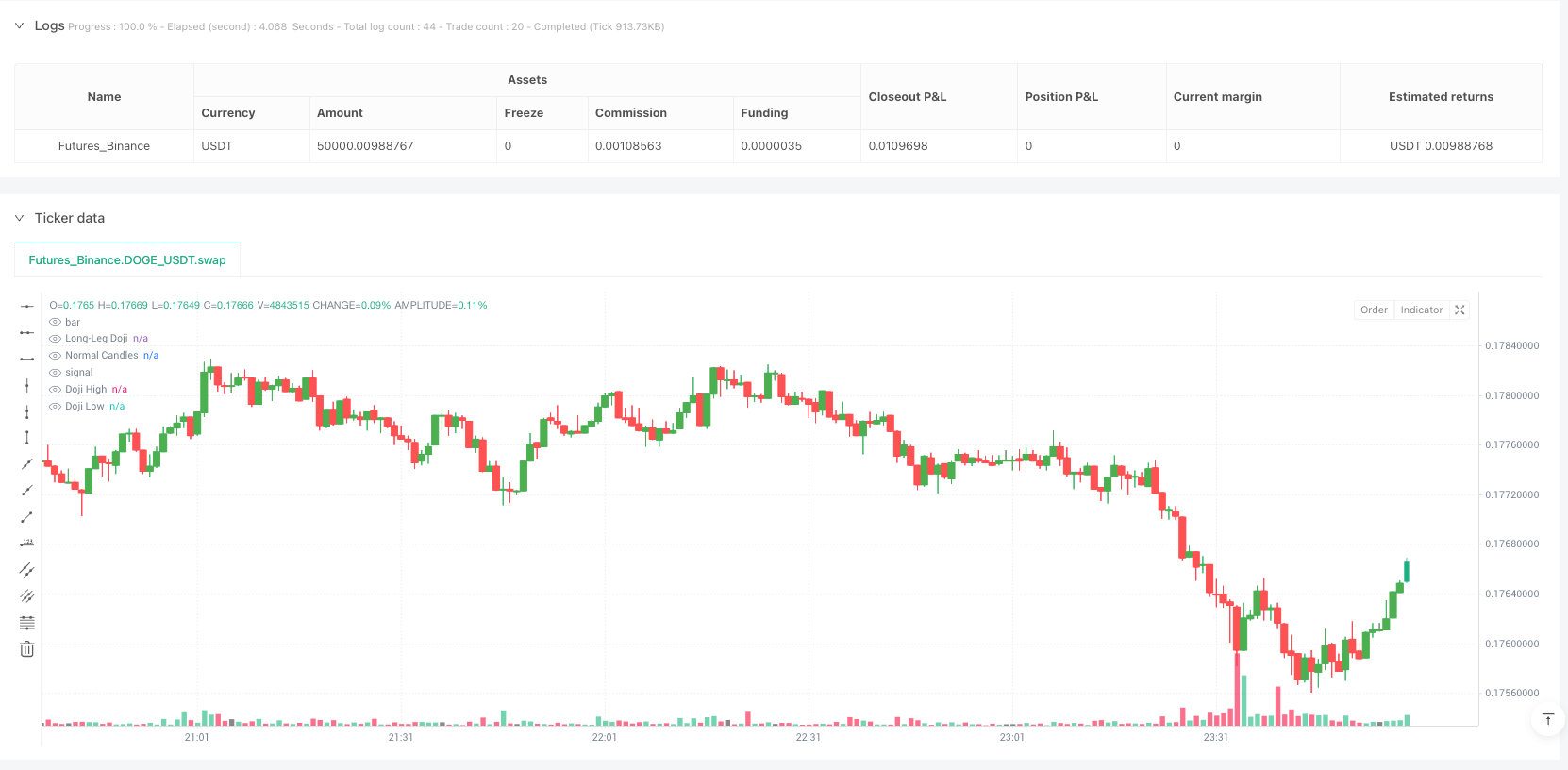

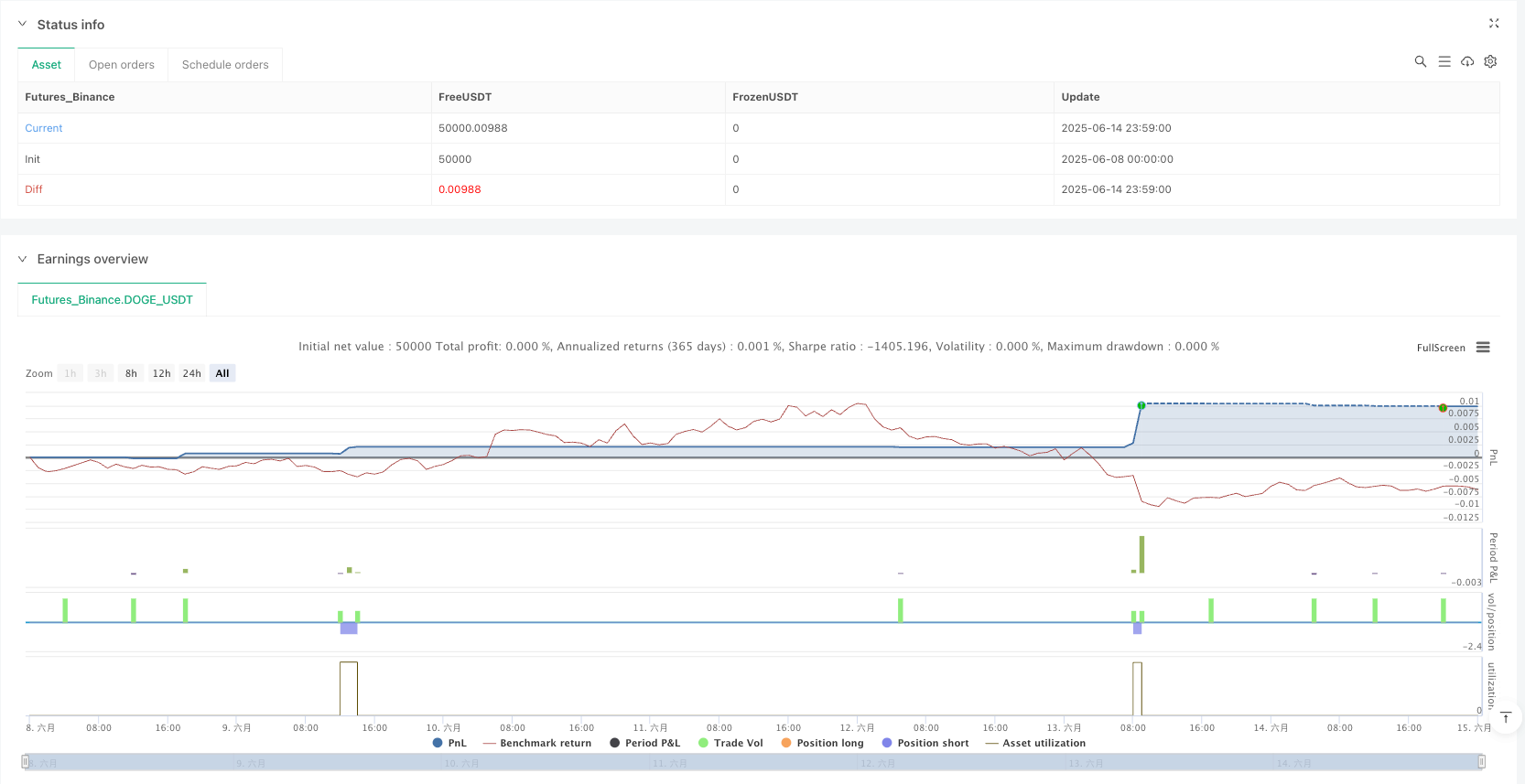

/*backtest

start: 2025-06-08 00:00:00

end: 2025-06-15 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Long-Leg Doji Breakout Strategy", overlay=true)

//King, The Indian

// Input parameters

doji_body_threshold = input.float(0.1, title="Doji Body Threshold (%)", minval=0.01, maxval=1.0, step=0.01) / 100

min_wick_ratio = input.float(2.0, title="Minimum Wick to Body Ratio", minval=1.0, maxval=10.0, step=0.1)

use_atr_filter = input.bool(true, title="Use ATR Filter for Long Legs")

atr_period = input.int(14, title="ATR Period", minval=1)

atr_multiplier = input.float(0.5, title="ATR Multiplier for Long Legs", minval=0.1, maxval=2.0, step=0.1)

// Calculate ATR for filtering

atr_value = ta.atr(atr_period)

// Doji detection logic

body_size = math.abs(close - open)

candle_range = high - low

upper_wick = high - math.max(open, close)

lower_wick = math.min(open, close) - low

// Long-Leg Doji conditions

is_small_body = body_size <= (candle_range * doji_body_threshold)

has_long_wicks = upper_wick >= (body_size * min_wick_ratio) and lower_wick >= (body_size * min_wick_ratio)

atr_condition = use_atr_filter ? (upper_wick >= atr_value * atr_multiplier and lower_wick >= atr_value * atr_multiplier) : true

is_long_leg_doji = is_small_body and has_long_wicks and atr_condition

// Store Doji levels

var float doji_high = na

var float doji_low = na

var bool waiting_for_breakout = false

// Detect new Doji and store levels

if is_long_leg_doji and not waiting_for_breakout

doji_high := high

doji_low := low

waiting_for_breakout := true

// Trading logic

long_signal = waiting_for_breakout and close > doji_high and close[1] <= doji_high

short_signal = waiting_for_breakout and close < doji_low and close[1] >= doji_low

// Execute trades

if long_signal

strategy.entry("Long", strategy.long)

waiting_for_breakout := false

if short_signal

strategy.entry("Short", strategy.short)

waiting_for_breakout := false

// Exit conditions (optional - you can modify these)

if strategy.position_size > 0 and ta.crossunder(close, ta.sma(close, 20))

strategy.close("Long")

if strategy.position_size < 0 and ta.crossover(close, ta.sma(close, 20))

strategy.close("Short")

// Custom coloring for Doji candles

doji_color = is_long_leg_doji ? color.yellow : na

plotcandle(open, high, low, close, color=doji_color, wickcolor=doji_color, bordercolor=doji_color, title="Long-Leg Doji")

// Plot normal candles with standard colors when not Doji

normal_color = not is_long_leg_doji ? (close >= open ? color.green : color.red) : na

plotcandle(open, high, low, close, color=normal_color, wickcolor=normal_color, bordercolor=normal_color, title="Normal Candles")

// Plot Doji high/low levels

plot(waiting_for_breakout ? doji_high : na, color=color.red, linewidth=2, style=plot.style_line, title="Doji High")

plot(waiting_for_breakout ? doji_low : na, color=color.blue, linewidth=2, style=plot.style_line, title="Doji Low")

// Plot entry signals

plotshape(long_signal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Long Entry")

plotshape(short_signal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Short Entry")

// Plot Doji identification

plotshape(is_long_leg_doji, style=shape.circle, location=location.abovebar, color=color.yellow, size=size.tiny, title="Long-Leg Doji Detected")

// Background color for active Doji period

bgcolor(waiting_for_breakout ? color.new(color.yellow, 90) : na, title="Waiting for Breakout")

// Alert conditions

alertcondition(long_signal, title="Long Entry Signal", message="Long-Leg Doji Breakout - Long Entry")

alertcondition(short_signal, title="Short Entry Signal", message="Long-Leg Doji Breakout - Short Entry")

alertcondition(is_long_leg_doji, title="Doji Detected", message="Long-Leg Doji Pattern Detected")