Overview

The Volatility Compression Momentum Breakout Tracking Strategy is a quantitative trading system based on the TTM Squeeze indicator, designed specifically to capture strong breakout movements following volatility compression. This strategy cleverly combines volatility compression (Bollinger Bands inside Keltner Channels) with momentum confirmation to build a long-only trading system. Its core concept is to identify “energy accumulation” phases in the market—periods of significant volatility contraction—and then enter positions when momentum confirms to capture the subsequent explosive price movements. The strategy employs a 21-period simple moving average as a trailing stop loss, which both protects capital and allows profits to run. This approach is particularly effective for capturing significant gains in breakout scenarios following low volatility periods.

Strategy Principles

The core principle of this strategy is based on the cyclical nature of market volatility—”volatility contraction is inevitably followed by volatility expansion.” Specifically, the strategy works through the following key components:

Squeeze State Determination:

- Calculate 20-period Bollinger Bands (BB) with a 2.0 multiplier

- Calculate 20-period Keltner Channels (KC) with a 1.5 multiplier, using True Range (ATR)

- Define “Squeeze ON” when the entire Bollinger Band is inside the Keltner Channel

Momentum Histogram:

- Calculate the midpoint of the recent high/low range and the 20-period SMA of close

- Measure the price’s deviation from this blended average

- Apply a 20-period linear regression to that deviation to generate the histogram

- Use color coding based on momentum changes: green/lime for uptrends, red/maroon for downtrends

Visual Indicators:

- Navy blue dot = Squeeze ON (ready to pop)

- Steel blue dot = Squeeze just released

- Sky blue dot = Neutral (no squeeze)

Trading Logic:

- Entry condition: Three consecutive bars in “Squeeze ON” state (three consecutive navy blue dots)

- Exit condition: Price crosses below the 21-period simple moving average

- Long-only, one trade at a time, no short positions

Code analysis reveals that the strategy strictly follows this logic and provides user-configurable parameters, including BB and KC length and multipliers, the option to use True Range, and settings for the trading time window.

Strategy Advantages

After deep analysis of the code, this strategy demonstrates several significant advantages:

Captures Major Trend Beginnings: Volatility compression often precedes major market moves, and this strategy focuses on capturing these high-probability breakout points, helping to establish positions at the beginning of trends to maximize profit potential.

Filters Low-Quality Signals: By requiring three consecutive bars in squeeze state, it effectively filters out brief “fake squeezes,” reducing false signals and improving trade quality.

Intelligent Dynamic Stop Loss: Using the 21-period moving average as a trailing stop allows trends to fully develop while exiting promptly when momentum fades, balancing profit potential with risk control.

Strong Visual Intuitiveness: The strategy retains all visual elements of the original TTM Squeeze indicator, including the momentum histogram and color-coded squeeze dots, allowing traders to visually understand the trigger for each trade.

Wide Adaptability: The strategy design can be applied to any timeframe from 1-minute to weekly charts, suitable for various trading instruments, demonstrating strong versatility.

Customizable Parameters: Offers flexible parameter settings, allowing traders to adjust Bollinger Bands and Keltner Channel sensitivity based on the volatility characteristics of specific instruments.

Built-in Backtesting Capability: The strategy includes backtesting support with commission and slippage simulation, enabling more realistic performance evaluation.

Strategy Risks

Despite its well-designed nature, the strategy presents the following potential risks:

False Breakout Risk: Even with the three-bar filter, the market may still produce false breakouts, causing prices to quickly fall below the moving average after the breakout, triggering stops. Consider adding additional confirmation indicators, such as volume confirmation or trend filters.

Poor Performance in Ranging Markets: In prolonged sideways, ranging market environments, the strategy may enter and exit frequently, resulting in consecutive small losses. This can be addressed by adding trend identification conditions to pause trading in clearly ranging markets.

Stop Loss Lag: The 21-period moving average may react too slowly in rapidly reversing markets, leading to larger drawdowns. Consider adjusting to shorter-period moving averages in high-volatility environments or adding volatility-adaptive components.

Long-Term Downtrend Risk: As a purely long strategy, it will face challenges in prolonged bear markets. Consider adding market trend filters or developing complementary short strategies to hedge this risk.

Parameter Sensitivity: The parameter settings for Bollinger Bands and Keltner Channels significantly impact strategy performance, and inappropriate parameters may lead to excessive signals or missed opportunities. It’s recommended to optimize parameter settings through backtesting under different market conditions.

Liquidity Risk: As noted in the code comments, extremely low-volume instruments or illiquid intraday timeframes may experience wider drawdowns. Avoid applying this strategy in markets with insufficient liquidity.

Strategy Optimization Directions

Based on code analysis, here are directions for optimizing this strategy:

Add Volume Confirmation: The current strategy makes decisions based solely on price and volatility, without considering volume factors. Adding volume confirmation conditions would ensure breakouts occur with substantial volume support, improving breakout validity. This optimization could significantly reduce false breakout risk.

Adaptive Parameter Mechanism: Currently, parameters are fixed values. Consider implementing a historically volatility-based adaptive parameter system that automatically adjusts Bollinger Bands and Keltner Channel multipliers based on market conditions, enhancing strategy adaptability across different volatility environments.

Integrate Market Structure Analysis: Introduce market structure recognition algorithms, such as support/resistance levels, trend lines, or key price levels. Squeeze signals near critical structural points may have higher success rates.

Multi-Timeframe Analysis: Implement a multi-timeframe confirmation mechanism requiring entry signals to meet conditions in both longer and shorter timeframes simultaneously. This could improve signal quality and reduce false breakouts.

Risk Management Optimization: The strategy currently uses a fixed moving average as a stop loss. Consider ATR-based dynamic stops or volatility-based position sizing adjustments to improve risk-adjusted returns.

Add Short Logic: Consider designing complementary short logic to make the strategy effective in bear markets as well, improving adaptability across full market cycles.

Seasonality and Time Filters: Analyze strategy performance across different seasons, months, or times of day to potentially discover better-performing time periods and add time filters to improve overall performance.

Conclusion

The Volatility Compression Momentum Breakout Tracking Strategy is an elegant and practical quantitative trading system that successfully transforms the classic TTM Squeeze indicator into a testable strategy framework. Its core strength lies in capturing explosive price movements following volatility compression, while protecting profits through moving average trailing stops. The strategy design is both simple and effective, while providing rich visual feedback that allows traders to easily understand the formation process of each trading signal.

Although there are potential risks, such as false breakouts and poor performance in ranging markets, these can be effectively mitigated through the suggested optimization directions. In particular, adding volume confirmation, adaptive parameter mechanisms, and multi-timeframe analysis are likely to significantly enhance the strategy’s robustness and adaptability.

For traders seeking to capture market volatility breakouts, this strategy provides a solid starting point that can either be applied directly or used as a foundational component for more complex systems. Most importantly, the design philosophy of this strategy aligns with a fundamental market principle—volatility contraction will eventually lead to volatility expansion—and identifying and leveraging this principle is one of the keys to successful trading.

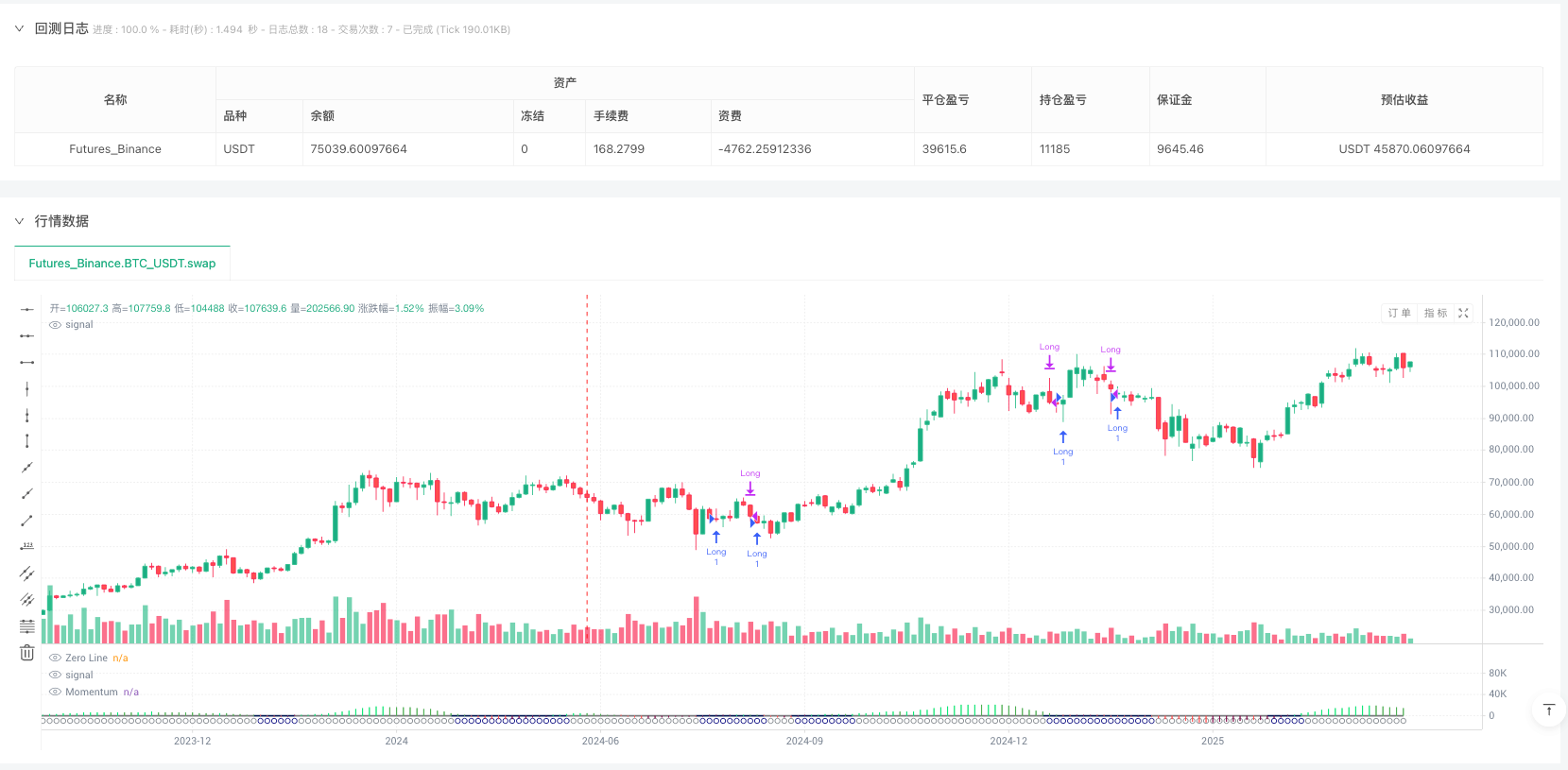

/*backtest

start: 2024-06-19 00:00:00

end: 2025-06-17 08:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("NA GPT - TTM Squeeze Strategy", overlay=false, commission_type=strategy.commission.percent, commission_value=0.01, slippage=3)

// === Inputs ===

length = input.int(20, title="BB & KC Length")

multBB = input.float(2, title="BB MultFactor")

lengthKC = input.int(20, title="KC Length")

multKC = input.float(1.5, title="KC MultFactor")

useTrueRange = input.bool(true, title="Use TrueRange (KC)")

// === Core data ===

source = close

// --- Bollinger Bands ---

basis = ta.sma(source, length)

dev = multBB * ta.stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// --- Keltner Channels ---

ma = ta.sma(source, lengthKC)

kcRange = useTrueRange ? ta.tr : (high - low)

kcRangeAvg = ta.sma(kcRange, lengthKC)

upperKC = ma + kcRangeAvg * multKC

lowerKC = ma - kcRangeAvg * multKC

// --- Squeeze states ---

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = not sqzOn and not sqzOff

// --- Momentum histogram (same as indicator) ---

midpoint = (ta.highest(high, lengthKC) + ta.lowest(low, lengthKC)) / 2

average = (midpoint + ta.sma(close, lengthKC)) / 2

val = ta.linreg(source - average, lengthKC, 0)

// Histogram colours

bcolor = val > 0 ?

(val > nz(val[1]) ? color.lime : color.green) :

(val < nz(val[1]) ? color.red : color.maroon)

// Zero-line colour

scolor = noSqz ? color.new(color.blue, 0) :

sqzOn ? color.new(#031753, 0) :

color.new(#78797c, 0)

// === Plotting (visuals preserved) ===

plot(val, title="Momentum", style=plot.style_histogram, linewidth=4, color=bcolor)

plot(0, title="Zero Line", style=plot.style_line, linewidth=2, color=scolor)

// --- Blue-dot theme ---

dotColor = sqzOn ? color.new(#000080, 0) : // Navy Blue

sqzOff ? color.new(#7f858a, 0) : // Steel Blue

color.new(#87CEEB, 0) // Sky Blue

plotshape(true, title="Squeeze Dot", location=location.bottom, style=shape.circle, color=dotColor, size=size.tiny)

// === Trading logic ===

// 3 consecutive “blue-dot” squeeze bars

threeSqz = sqzOn and sqzOn[1] and sqzOn[2]

// 21-period SMA

sma21 = ta.sma(close, 21)

// Entry: go long when threeSqz appears inside window

if strategy.position_size == 0 and threeSqz

strategy.entry("Long", strategy.long)

// Exit: close long when price crosses below SMA-21

if strategy.position_size > 0 and ta.crossunder(close, sma21)

strategy.close("Long")