Overview

This strategy is an Opening Range Breakout (ORB) trading system designed specifically for futures markets. It monitors price action during a specified time period to establish an initial price range, then generates trading signals when prices break above or below this range. The core concept is to capture momentum continuation after price breaks through a predetermined range, which is particularly effective in intraday trading as it capitalizes on the directional price movements that form after market opening.

Strategy Principles

The strategy operates based on several key steps:

Time Window Definition: The strategy allows users to customize the starting time (hour and minute) of the opening range and the duration (in minutes) for range formation. The default setting is 9:30 AM with a 15-minute duration.

Opening Range Calculation:

- Within the specified time window, the strategy records the highest and lowest prices to form the “opening range.”

- Once the time window ends, the opening range is locked and no longer updated until the next trading day.

- The opening range is reset at the beginning of each new trading day.

Breakout Signal Generation:

- Long Breakout: Triggered when the closing price breaks above the upper limit of the opening range.

- Short Breakout: Triggered when the closing price breaks below the lower limit of the opening range.

Trade Execution:

- Upon confirming a breakout, the strategy automatically generates the corresponding buy or sell signal.

- The strategy employs a one-time trigger mechanism, ensuring signals are not repeatedly issued in the same direction unless market direction changes.

Visualization: The strategy clearly marks the upper and lower boundaries of the opening range on the chart, allowing traders to visually identify potential breakout points.

Strategy Advantages

Simplicity and Effectiveness: The strategy design is straightforward without complex indicators and parameters, reducing the risk of overfitting.

Based on Market Microstructure: It leverages the price range formed during the market opening session, which typically represents the initial consensus of major participants on the day’s price direction.

Flexible Parameter Settings: Allows traders to adjust the opening time and range duration according to different markets and trading instruments, enhancing the strategy’s adaptability.

Prevention of False Signals: Through the design of a one-time trigger mechanism, it avoids generating too many false breakout signals in oscillating markets.

Clear Visualization: Intuitively displays the opening range on the chart, helping traders better understand market structure and possible breakout points.

Real-time Alert Functionality: Integrates an alert system that notifies traders immediately when breakouts occur, improving the timeliness of trading.

Strategy Risks

False Breakout Risk: In highly volatile markets, prices may break through the opening range and then quickly retreat, resulting in false breakout trades.

- Solution: Consider adding confirmation mechanisms, such as requiring prices to maintain a certain duration or reach a specific magnitude after breakout before triggering a trade.

Lack of Market Directionality: In sideways or low-volatility markets, the effectiveness of opening range breakout strategies may significantly decrease.

- Solution: Incorporate volatility indicators to reduce or pause trading in low-volatility environments.

Time Dependency: Strategy performance is highly dependent on the chosen time window, with different markets potentially requiring different optimal time settings.

- Solution: Optimize time parameters for specific markets and instruments through historical data backtesting.

Lack of Stop-Loss Mechanism: The current strategy does not have built-in stop-loss functionality, which may lead to significant losses in strong reversal markets.

- Solution: Add appropriate stop-loss mechanisms, such as ATR-based (Average True Range) stops or fixed-point stops.

Lack of Profit Management: The strategy does not define clear profit-taking conditions, potentially leading to profit giveback.

- Solution: Implement profit targets or trailing stops to lock in profits and manage risk.

Strategy Optimization Directions

Introduce Volatility Filters:

- Add volatility indicators such as ATR or Bollinger Bands to only consider trading signals when market volatility is sufficiently high.

- This can improve strategy performance in high-volatility markets while avoiding false breakouts in low-volatility markets.

Enhance Signal Confirmation Mechanisms:

- Incorporate volume analysis, confirming signals only when breakouts are accompanied by significant volume increases.

- Consider adding price momentum indicators (such as RSI or MACD) as secondary confirmation.

Dynamic Adjustment of Opening Range:

- Automatically adjust the duration of the opening range based on historical volatility, using shorter times in high-volatility markets and longer times in low-volatility markets.

- This adaptive approach can better accommodate different market conditions.

Improve Money Management:

- Add stop-loss and profit target functions, potentially based on the size of the opening range (e.g., 1.5x the range for profit targets, 0.5x for stop-losses).

- Implement dynamic position sizing adjustments based on the width of the opening range and market volatility.

Add Time Filters:

- Restrict trade execution to specific trading sessions, avoiding periods of low market liquidity.

- This can reduce slippage and execution costs, improving overall strategy performance.

Multi-Timeframe Analysis:

- Combine the direction of trends in higher timeframes, only trading opening range breakouts in the direction consistent with the larger trend.

- This approach can reduce the risk of counter-trend trading and improve signal quality.

Summary

The Opening Range Breakout trading strategy is an intuitive and effective trading method particularly suited for capturing intraday market momentum opportunities. It works by monitoring price action within a specific time window, identifying potential breakout points, and executing trades when prices confirm a breakout. The core advantage of this strategy lies in its simplicity and sensitivity to market microstructure, making it a powerful tool for intraday traders.

However, to enhance the robustness of the strategy, it is recommended to further refine signal confirmation mechanisms, add risk management functionalities, and introduce market state filters. Through these optimizations, traders can reduce the risk of false breakouts, increase the proportion of profitable trades, and better manage risk exposure for each trade.

Ultimately, the success of the Opening Range Breakout strategy largely depends on the trader’s understanding of specific market characteristics and reasonable parameter adjustments. Through continuous backtesting and optimization, this strategy can become a stable and valuable component in a trading portfolio.

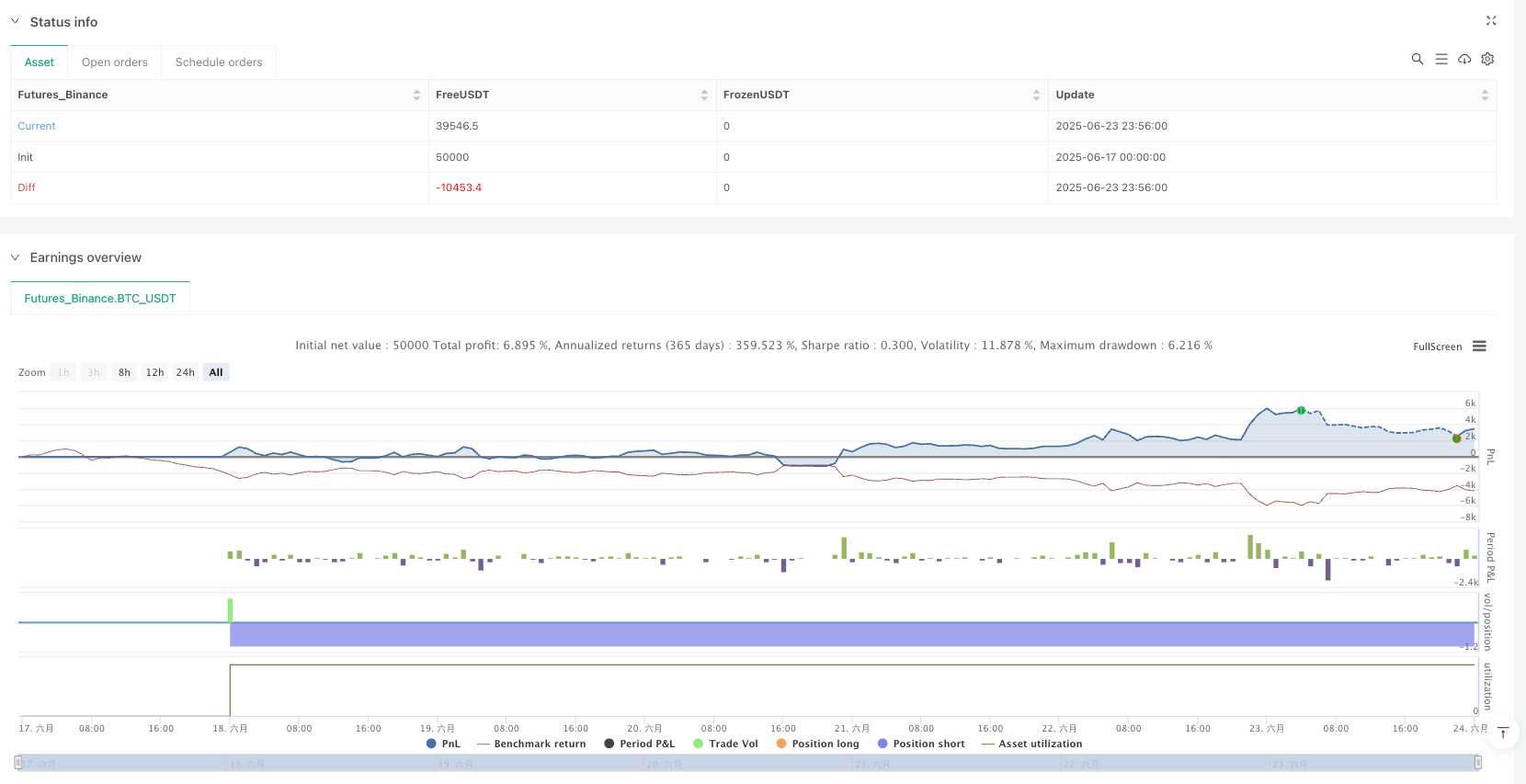

/*backtest

start: 2025-06-17 00:00:00

end: 2025-06-24 00:00:00

period: 4m

basePeriod: 4m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Sanuja nuwan", overlay=true)

// === INPUTS ===

startHour = input.int(9, "Session Start Hour")

startMinute = input.int(30, "Session Start Minute")

rangeMinutes = input.int(15, "Opening Range (min)")

// === TIME WINDOW ===

inSession = (hour == startHour and minute >= startMinute and minute < startMinute + rangeMinutes)

// === OPENING RANGE ===

var float rangeHigh = na

var float rangeLow = na

var bool rangeSet = false

if inSession

rangeHigh := na(rangeHigh) ? high : math.max(rangeHigh, high)

rangeLow := na(rangeLow) ? low : math.min(rangeLow, low)

rangeSet := false

else if not rangeSet and not na(rangeHigh) and not na(rangeLow)

rangeSet := true

// === RESET RANGE NEXT DAY ===

if (hour == startHour and minute == startMinute)

rangeHigh := na

rangeLow := na

rangeSet := false

// === BREAKOUT CONDITIONS ===

longCondition = rangeSet and close > rangeHigh

shortCondition = rangeSet and close < rangeLow

// === ONE-TIME ALERT LOGIC ===

var bool longTriggered = false

var bool shortTriggered = false

if longCondition and not longTriggered

strategy.entry("S.LONG", strategy.long)

alert("🚀 BUY Signal from ZERO FEAR", alert.freq_once_per_bar_close)

longTriggered := true

shortTriggered := false // reset for next signal

if shortCondition and not shortTriggered

strategy.entry("S.SHORT", strategy.short)

alert("🔻 SELL Signal from ZERO FEAR", alert.freq_once_per_bar_close)

shortTriggered := true

longTriggered := false // reset for next signal

// === PLOTTING RANGE ===

plot(rangeSet ? rangeHigh : na, title="Opening Range High", color=color.green, linewidth=2)

plot(rangeSet ? rangeLow : na, title="Opening Range Low", color=color.red, linewidth=2)