Overview

The OBV Oscillator Crossover Strategy with No Same-Bar Exit Mechanism is a quantitative trading system based on the On Balance Volume (OBV) indicator. This strategy monitors the difference between the OBV indicator and its EMA to capture key moments of market momentum shifts. The core of the strategy lies in identifying crossover signals between the OBV oscillator and the zero line, while implementing a mechanism to prevent same-bar exits, avoiding premature exits caused by rapid price fluctuations and effectively improving trade execution quality. The strategy also integrates comprehensive risk management mechanisms, including fixed percentage stop-loss, target profit, and trailing stops, enabling effective risk control while maintaining profit potential.

Strategy Principles

This strategy generates trading signals based on the oscillator formed by the difference between the On Balance Volume (OBV) indicator and its Exponential Moving Average (EMA). The core calculation process is as follows:

- First, calculate the standard OBV indicator: when price rises, add the day’s volume to the cumulative value; when price falls, subtract the day’s volume from the cumulative value; when price remains unchanged, the cumulative value stays the same.

- Calculate the Exponential Moving Average (EMA) of OBV, with a default period of 20.

- Calculate the OBV Oscillator, which is the difference between OBV and its EMA (obv_osc = obv - obv_ema).

- Generate trading signals:

- Long signal: when the OBV oscillator crosses above the zero line from below and there is currently no position

- Short signal: when the OBV oscillator crosses below the zero line from above and there is currently no position

A key innovation of the strategy is the implementation of a “No Same-Bar Exit Mechanism,” which records the bar index of entry and ensures that exits are only allowed after subsequent new bars are formed. This mechanism effectively prevents premature triggering of stop-loss or take-profit due to rapid price fluctuations within the same time unit, improving the strategy’s stability.

In terms of risk management, the strategy sets up a triple protection mechanism: - Fixed percentage stop-loss (default 1%) - Target profit take-profit (default 2%) - Trailing stop (default 0.5%), which provides dynamic protection of profits

Strategy Advantages

Precise Momentum Capture: By identifying crossovers between the OBV oscillator and the zero line, the strategy can detect inflection points in market momentum, allowing entry during the early stages of trends and capturing most of the trend movements.

Volume Confirmation: The OBV indicator itself integrates price changes and volume information, providing volume confirmation for trading signals and reducing the risk of false breakouts.

No Same-Bar Exit Protection: The mechanism that records entry bar indices and prohibits same-bar exits effectively avoids premature stops caused by short-term fluctuations, improving trading stability and completion rates.

Comprehensive Risk Management System: The strategy integrates triple protection mechanisms of fixed stop-loss, target profit, and trailing stops, effectively controlling risk exposure while securing profits.

High Adaptability: Through parameterized design (OBV EMA period, stop-loss percentage, target profit percentage, trailing stop percentage), the strategy can be flexibly adjusted according to different market environments and trading instruments.

Automated Execution and Alerts: The strategy has built-in JSON format alert strings, which can seamlessly connect to automated trading systems for fully automated trading.

Visualization Aids: The strategy plots the OBV oscillator and trade labels on the chart, providing intuitive visual feedback for strategy backtesting and real-time monitoring.

Strategy Risks

Overtrading in Ranging Markets: In sideways markets, the OBV oscillator may frequently cross the zero line, resulting in excessive trading signals and unnecessary transaction costs. The solution is to add additional filtering conditions, such as only enabling the strategy in clear trend environments or adding signal confirmation mechanisms.

Parameter Sensitivity: The period setting of OBV EMA has a significant impact on strategy performance, and different market environments may require different parameter settings. It is recommended to find optimal parameter combinations for specific market environments through backtest optimization.

Slippage and Execution Risk: The strategy uses market orders to execute trades, which may face significant slippage in markets with insufficient liquidity. The solution is to consider using limit orders or trading during periods of sufficient liquidity.

Balance of Stop-Loss Settings: Fixed percentage stop-losses may be too tight in high-volatility markets or too loose in low-volatility markets. It is recommended to dynamically adjust the stop-loss percentage based on the historical volatility of the underlying asset.

Signal Dependency: The strategy relies entirely on crossover signals from the OBV oscillator, which may lag in certain market conditions. Consider adding other technical indicators as confirmation to improve signal quality.

Disregard for Fundamental Factors: As a pure technical analysis strategy, it does not consider fundamental factors that may affect the market, such as economic data or policy changes. Consider reducing positions or pausing the strategy before major fundamental events.

Strategy Optimization Directions

Add Trend Filters: Introduce ADX or other trend strength indicators to execute trades only in confirmed trend environments, avoiding frequent trading in oscillating markets. This can significantly improve the strategy’s win rate and risk-reward ratio.

Dynamic Parameter Adjustment: Automatically adjust OBV EMA periods, stop-loss, and target profit percentages based on market volatility. For example, use longer EMA periods and wider stop-loss ranges in high-volatility environments, and opposite settings in low-volatility environments.

Multi-Timeframe Confirmation: Add analysis of higher timeframes and execute trades only when signals across multiple timeframes are consistent, improving signal quality and reliability.

Volume Quality Filtering: Add quality assessment of volume, for example, confirming signals only when volume is higher than the N-day average volume, avoiding false breakouts in low-volume environments.

Optimize Entry Timing: After the OBV oscillator crosses the zero line, wait for price pullbacks to key support/resistance levels before entering, improving entry price advantage.

Incorporate Machine Learning Algorithms: Use machine learning techniques to automatically identify optimal trading parameters for the OBV oscillator in different market environments, achieving adaptive optimization of the strategy.

Add Time Filters: Avoid trading during high-volatility periods at market open and close, or pause the strategy before and after important economic data releases to reduce unpredictable risks.

Conclusion

The OBV Oscillator Crossover Strategy is a quantitative trading system that combines classic technical analysis indicators with modern risk management techniques. By capturing crossover signals between the OBV oscillator and the zero line, while implementing a no same-bar exit protection mechanism, the strategy can identify changes in market momentum while effectively controlling trading risks.

The core advantage of the strategy lies in incorporating volume factors into the trading decision process, ensuring signals are effectively confirmed by volume, while improving trade execution quality through the no same-bar exit mechanism. The comprehensive risk management system and parameterized design give the strategy high adaptability and stability.

Although there are potential risks such as overtrading in ranging markets and parameter sensitivity, there is still significant room for performance improvement through optimization directions such as adding trend filters, dynamic parameter adjustment, and multi-timeframe confirmation. Particularly, introducing machine learning techniques for adaptive parameter optimization is expected to further improve the strategy’s performance in different market environments.

Overall, the OBV Oscillator Crossover Strategy provides an effective framework for quantitative trading based on volume analysis. With reasonable parameter settings and continuous optimization, it has the potential to achieve stable risk-adjusted returns in various market environments.

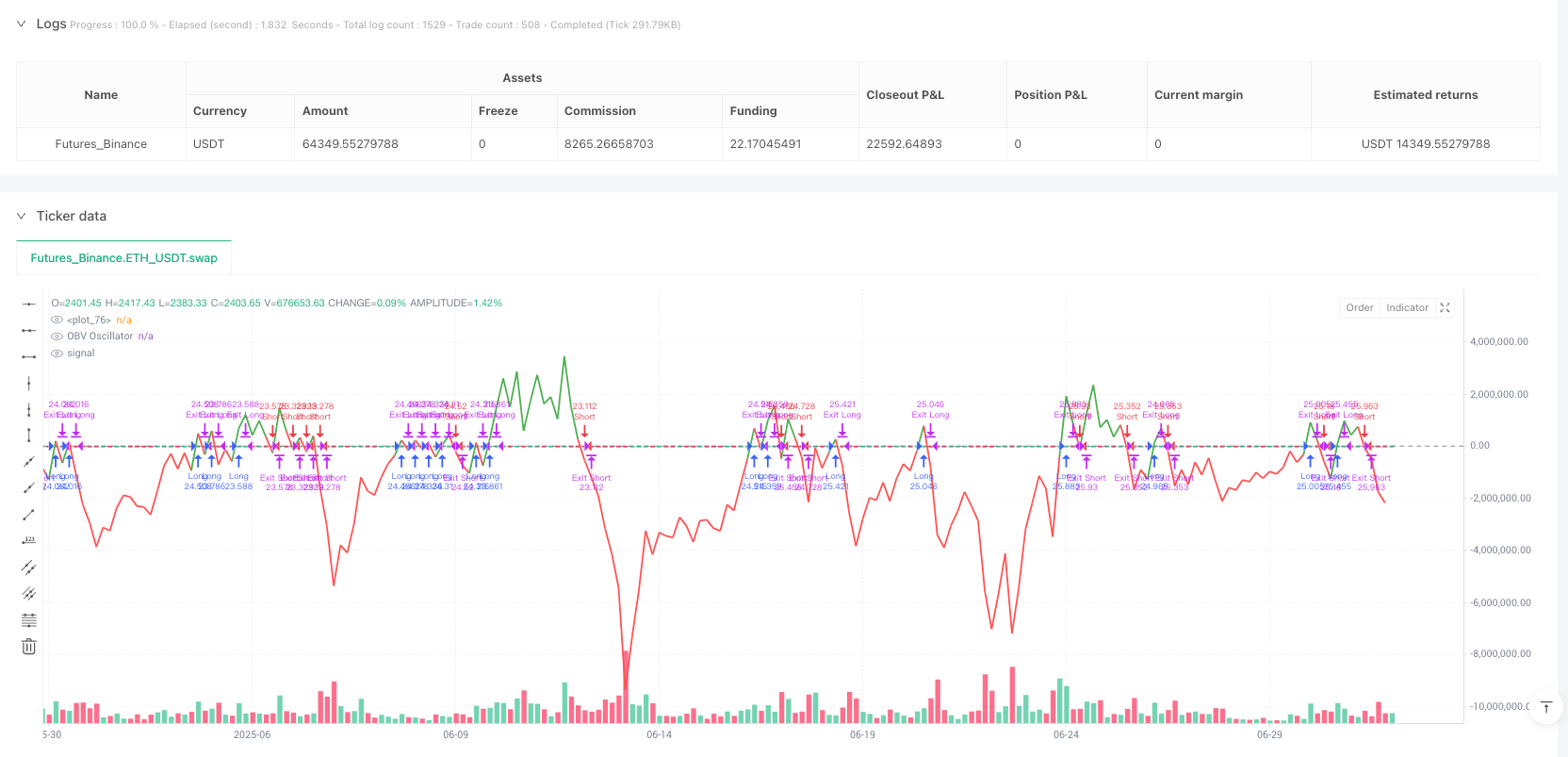

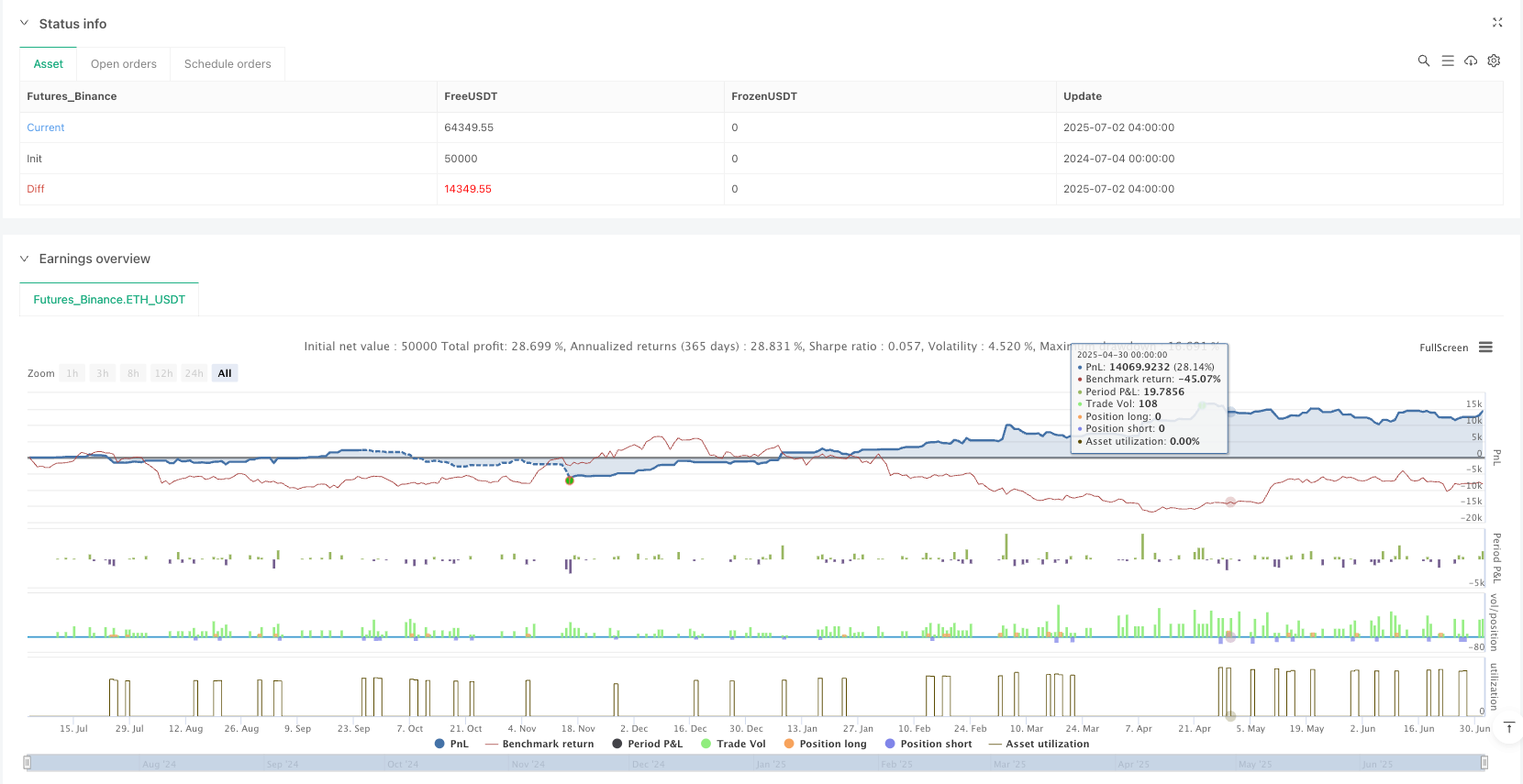

/*backtest

start: 2024-07-04 00:00:00

end: 2025-07-02 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("OBV Osc (No Same-Bar Exit)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === JSON ALERT STRINGS ===

callBuyJSON = 'ANSHUL \n[{"TT":"BUY","E":"NFO","TS":"NIFTY2570326200CE","Q":"75","OT":"MARKET","P":"NRML","VL":"DAY","AT":"DHANHQ"}]'

callExtJSON = 'ANSHUL \n[{"TT":"SELL","E":"NFO","TS":"NIFTY2570326200CE","Q":"75","OT":"MARKET","P":"NRML","VL":"DAY","AT":"DHANHQ"}]'

putBuyJSON = 'ANSHUL \n[{"TT":"BUY","E":"NFO","TS":"NIFTY2570325000PE","Q":"75","OT":"MARKET","P":"NRML","VL":"DAY","AT":"DHANHQ"}]'

putExtJSON = 'ANSHUL \n[{"TT":"SELL","E":"NFO","TS":"NIFTY2570325000PE","Q":"75","OT":"MARKET","P":"NRML","VL":"DAY","AT":"DHANHQ"}]'

// === INPUTS ===

length = input.int(20, title="OBV EMA Length")

sl_pct = input.float(1.0, title="Stop Loss %", minval=0.1)

tp_pct = input.float(2.0, title="Take Profit %", minval=0.1)

trail_pct = input.float(0.5, title="Trailing Stop %", minval=0.1)

// === OBV OSCILLATOR CALC ===

src = close

obv = ta.cum(ta.change(src) > 0 ? volume : ta.change(src) < 0 ? -volume : 0)

obv_ema = ta.ema(obv, length)

obv_osc = obv - obv_ema

// === SIGNALS ===

longCondition = ta.crossover(obv_osc, 0) and strategy.position_size == 0

shortCondition = ta.crossunder(obv_osc, 0) and strategy.position_size == 0

// === RISK SETTINGS ===

longStop = close * (1 - sl_pct / 100)

longTarget = close * (1 + tp_pct / 100)

shortStop = close * (1 + sl_pct / 100)

shortTarget = close * (1 - tp_pct / 100)

trailPoints = close * trail_pct / 100

// === ENTRY BAR TRACKING TO PREVENT SAME-BAR EXIT ===

var int entryBar = na

// === STRATEGY ENTRY ===

if longCondition

strategy.entry("Long", strategy.long)

entryBar := bar_index

alert(callBuyJSON, alert.freq_all)

label.new(bar_index, low, text="BUY CALL", style=label.style_label_up, color=color.new(color.green, 85), textcolor=color.black)

if shortCondition

strategy.entry("Short", strategy.short)

entryBar := bar_index

alert(putBuyJSON, alert.freq_all)

label.new(bar_index, high, text="BUY PUT", style=label.style_label_down, color=color.new(color.red, 85), textcolor=color.black)

// === EXIT ONLY IF BAR_INDEX > entryBar (NO SAME-BAR EXIT) ===

canExitLong = strategy.position_size > 0 and bar_index > entryBar

canExitShort = strategy.position_size < 0 and bar_index > entryBar

if canExitLong

strategy.exit("Exit Long", from_entry="Long", stop=longStop, limit=longTarget, trail_points=trailPoints, trail_offset=trailPoints)

if canExitShort

strategy.exit("Exit Short", from_entry="Short", stop=shortStop, limit=shortTarget, trail_points=trailPoints, trail_offset=trailPoints)

// === TRACK ENTRY/EXIT FOR ALERTS ===

posNow = strategy.position_size

posPrev = nz(strategy.position_size[1])

longExit = posPrev == 1 and posNow == 0

shortExit = posPrev == -1 and posNow == 0

if longExit

alert(callExtJSON, alert.freq_all)

label.new(bar_index, high, text="EXIT CALL", style=label.style_label_down, color=color.new(color.blue, 85), textcolor=color.black)

if shortExit

alert(putExtJSON, alert.freq_all)

label.new(bar_index, low, text="EXIT PUT", style=label.style_label_up, color=color.new(color.orange, 85), textcolor=color.black)

// === PLOTS ===

plot(obv_osc, title="OBV Oscillator", color=obv_osc > 0 ? color.green : color.red, linewidth=2)

hline(0, color=color.gray)