Overview

The Multi-Timeframe Liquidity Trap Reversal Quantitative Strategy is a lightweight, precision-focused tool designed to identify institutional and market maker liquidity manipulation tactics. This strategy leverages price action analysis to detect key liquidity sweeps and subsequent reversals, effectively capturing market turning points. The core concept revolves around identifying sweeps of prior swing highs/lows and confirming trap reversals when price closes back inside the swept range—a signature move of smart money designed to trap retail breakout traders. The strategy doesn’t rely on complex indicators but instead directly analyzes raw price action and market intent, making it particularly suitable for disciplined traders seeking to trade around liquidity events.

Strategy Principles

This strategy is built on market structure and liquidity principles, relying on several key components:

Liquidity Sweep Detection: Utilizes a custom lookback period (

swingLookback = 10) to determine previous price highs and lows. The strategy calculates the highest high (prevHigh) and lowest low (prevLow) over the past 10 periods, then identifies liquidity sweep events (sweepHighandsweepLow) by comparing current price action against these levels.Trap Confirmation Mechanism: When price retraces back into the previous range after breaking out, the strategy considers this a market maker trap. Specifically, for a short trap (

trapShort), price must first break above the previous high and then close below it; for a long trap (trapLong), price must first break below the previous low and then close above it.Session Filtering: The strategy offers a New York session filter option (

useSessionFilter), enabled by default. The session is defined as UTC hours 13 to 20, which typically covers the most liquid market periods, helping to avoid false signals during low liquidity times.Trade Execution Logic: When long conditions (

longCondition) are met, the strategy enters a long position; when short conditions (shortCondition) are met, it enters a short position. All trades use 5% of account equity as position size.

The core philosophy is to mirror market maker operational logic, avoid false breakouts, and establish trades with real conviction around liquidity events. By identifying when price breaks key levels and quickly retraces, the strategy can capture market reversals, particularly targeting price movements that are often misinterpreted by retail traders as trend confirmations.

Strategy Advantages

Simplicity and Clarity: The strategy doesn’t rely on complex technical indicators but is directly based on price action and market structure, making it easy to understand and implement. This simplicity reduces the risk of overfitting and enhances strategy robustness.

Institution-Based Approach: The strategy mimics the operational logic of institutions and market makers, focusing on liquidity traps—a proven market pattern. By understanding and identifying the behavior of large market participants, retail investors can avoid becoming victims of these traps.

Precise Trading Conditions: The strategy provides clear entry conditions, reducing the need for subjective judgment. Price must first break key levels and then retrace, a double confirmation mechanism that significantly reduces false signals.

Session Optimization: Through New York session filtering, the strategy focuses on trading during the most active and liquid market periods, improving signal quality and execution efficiency.

Position Management Integration: The strategy defaults to using a fixed percentage (5%) of account equity as position size, incorporating a basic risk management mechanism that prevents excessive leverage-induced losses.

Adaptability: Through adjustable parameters such as swing lookback period (

swingLookback) and trap confirmation period (retestBars), the strategy can adapt to different market conditions and trading instruments.Visualization Support: The strategy includes clear graphical indications, plotting key price levels and trade signals, helping traders better understand market dynamics and strategy logic.

Strategy Risks

False Breakout Risk: While the strategy is designed to identify false breakouts, the market may experience genuine breakouts after multiple false ones, in which case the strategy might incorrectly enter counter positions. The solution is to incorporate additional confirmation indicators or implement stricter confirmation conditions.

Parameter Sensitivity: Strategy performance heavily depends on parameter settings such as

swingLookbackandretestBars. Inappropriate parameters may result in excessive trading signals or missed opportunities. It’s recommended to optimize these parameters through backtesting under different market conditions.Market Environment Dependency: In strong trending markets, liquidity traps may be less frequent or effective. This strategy performs best in ranging or transitional markets and may underperform in one-directional trending markets. Consider adding trend filters to avoid counter-trend trading in strong trends.

Timeframe Limitation: The strategy, in its current implementation, applies to a single timeframe and may miss important liquidity levels from larger timeframes. Integrating multi-timeframe analysis can enhance strategy robustness.

Stop Loss Absence: The current strategy lacks explicit stop loss mechanisms, which could lead to excessive losses on incorrect signals. Appropriate stop loss and take profit logic should be added to protect capital.

Execution Slippage: In highly volatile markets, actual execution prices may differ significantly from expected prices at signal triggering. Slippage factors should be considered in live trading and strategy adjustments made accordingly.

Strategy Optimization Directions

Multi-Timeframe Integration: The strategy can be enhanced by analyzing liquidity levels across multiple timeframes, ensuring trades align with larger market structure. For example, adding checks for the dominant trend in larger timeframes and only accepting trap signals in the trend direction.

Volume Confirmation: Adding volume analysis can significantly improve strategy quality. Liquidity sweeps are often accompanied by sudden volume increases, while genuine reversals typically have sustained volume support. Adding volume filters can reduce false signals.

Dynamic Parameter Adjustment: Implement adaptive parameter mechanisms that automatically adjust

swingLookbackand other key parameters based on market volatility. Longer lookback periods may be needed in high-volatility markets, while shorter ones work better in low-volatility environments.Stop Loss/Take Profit Mechanisms: Add intelligent stop loss strategies, such as setting stops beyond sweep highs/lows, or using ATR (Average True Range) to dynamically determine stop levels. Similarly, implement structure-based take profit targets, such as the next significant support/resistance level.

Market State Filtering: Develop a market state classifier to distinguish between trending, ranging, and transitional market environments, and adjust strategy parameters or pause trading based on the current market state. This can be achieved by adding trend indicators like moving averages or ADX.

Signal Quality Scoring: Implement a signal quality scoring system considering factors such as price retracement degree, candle pattern strength, and price momentum. Execute trades only on high-quality signals or adjust position sizing based on signal quality.

Correlated Asset Synergy: Look for confirmation signals across correlated assets. For example, in forex trading, correlations between currency pairs can provide additional layers of confirmation, enhancing strategy reliability.

Conclusion

The Multi-Timeframe Liquidity Trap Reversal Quantitative Strategy offers a concise yet powerful approach to identifying institutional market maker liquidity manipulation behaviors and profiting from them. By focusing on price patterns that break key support/resistance levels and then retrace, the strategy can capture significant market reversals. Its core strength lies in being directly based on raw price action and market structure without complex indicators, while improving trading quality through session filtering.

However, the strategy also faces challenges such as false breakout risks, parameter sensitivity, and lack of comprehensive risk management. By integrating multi-timeframe analysis, adding volume confirmation, implementing dynamic parameter adjustment, and establishing robust stop loss/take profit mechanisms, strategy performance and robustness can be significantly enhanced.

Ultimately, this strategy represents an effective approach to understanding market microstructure, offering traders a framework to align with “smart money” in the market by understanding and identifying the intentions of large market participants. With the suggested optimizations implemented, the strategy has the potential to become a powerful weapon in a trader’s toolkit, especially for those focusing on market structure and liquidity events.

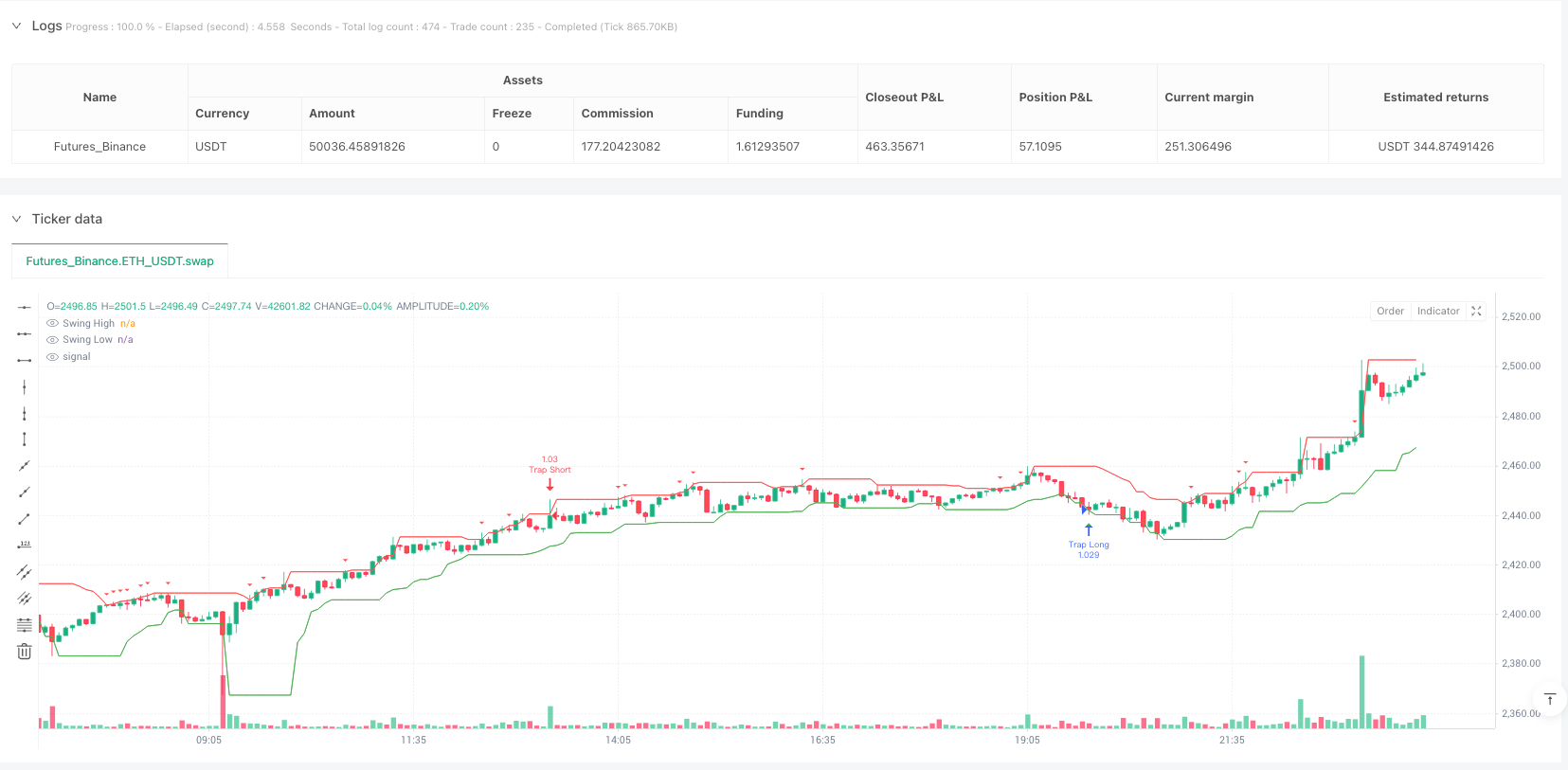

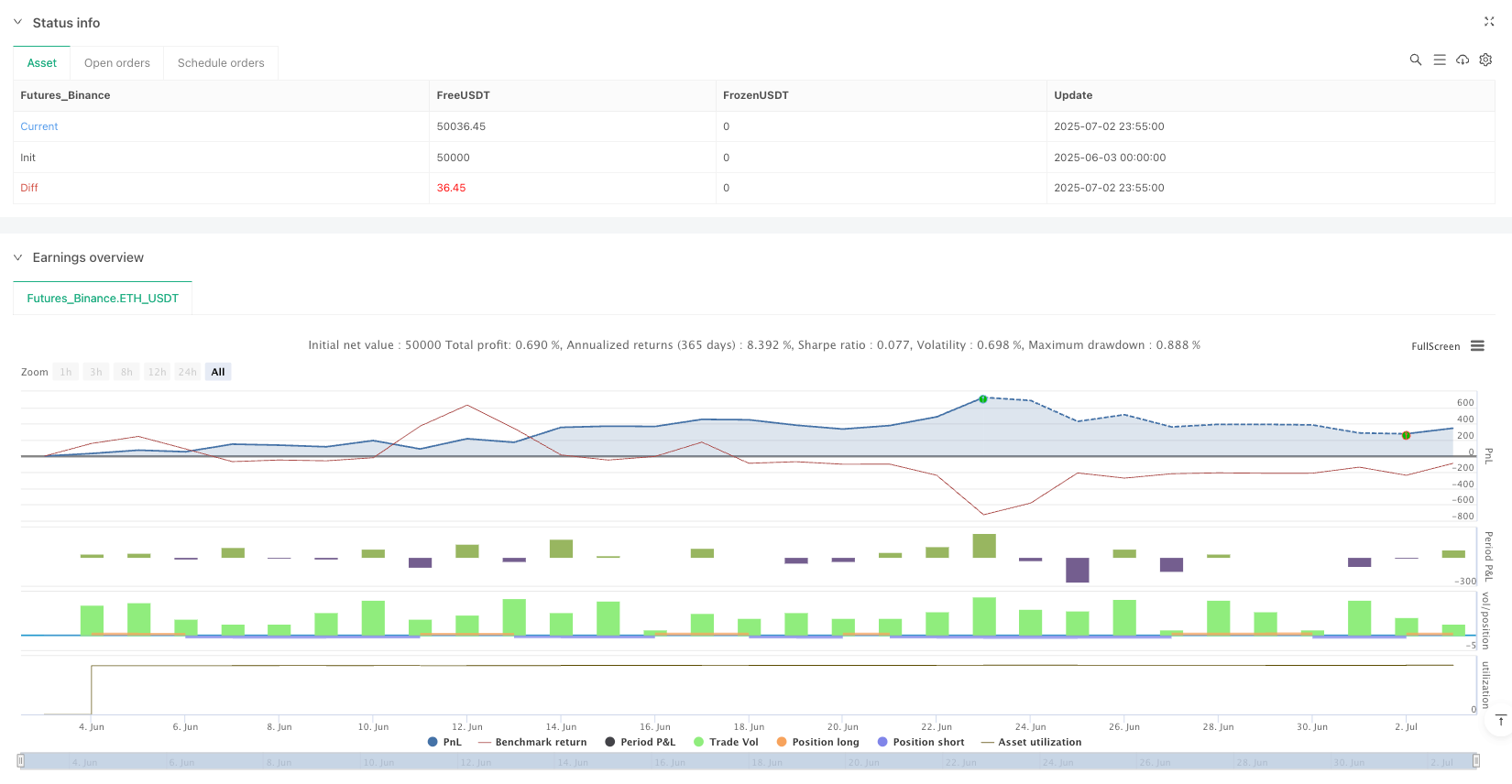

/*backtest

start: 2025-06-03 00:00:00

end: 2025-07-03 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Market Maker Trap Reversal V1", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=5)

// === INPUTS === //

swingLookback = input.int(10, "Swing High/Low Lookback")

retestBars = input.int(5, "Bars to Confirm Trap After Sweep")

sessionStart = input.int(13, "Session Start Hour (UTC)")

sessionEnd = input.int(20, "Session End Hour (UTC)")

useSessionFilter = input.bool(true, "Use NY Session Only")

// === SESSION LOGIC === //

inSession = (hour >= sessionStart and hour < sessionEnd)

// === SWEEP LOGIC === //

prevHigh = ta.highest(high[1], swingLookback)

prevLow = ta.lowest(low[1], swingLookback)

sweepHigh = high > prevHigh

sweepLow = low < prevLow

// === TRAP CONFIRMATION === //

// After sweep, price must close back inside the range (fakeout)

trapShort = sweepHigh and close < prevHigh

trapLong = sweepLow and close > prevLow

// === TRIGGER LOGIC === //

longCondition = trapLong and (not useSessionFilter or inSession)

shortCondition = trapShort and (not useSessionFilter or inSession)

// === EXECUTE TRADES === //

if longCondition

strategy.entry("Trap Long", strategy.long)

if shortCondition

strategy.entry("Trap Short", strategy.short)

// === PLOT ZONES === //

plotshape(trapLong, title="Trap Long", location=location.belowbar, style=shape.triangleup, color=color.green, size=size.small)

plotshape(trapShort, title="Trap Short", location=location.abovebar, style=shape.triangledown, color=color.red, size=size.small)

plot(prevHigh, "Swing High", color=color.red, linewidth=1, style=plot.style_linebr)

plot(prevLow, "Swing Low", color=color.green, linewidth=1, style=plot.style_linebr)