Overview

The VWAP-Enhanced Bollinger Bands Momentum Reversal Strategy is a quantitative trading system designed specifically for short-term cryptocurrency trading, primarily applied to 1-hour to 4-hour timeframes. This strategy cleverly combines three major technical indicators: Relative Strength Index (RSI), Bollinger Bands (BB), and Volume Weighted Average Price (VWAP) to form a comprehensive trading signal system. The core of the strategy is to capture potential reversal points during market overbought and oversold conditions, using VWAP as a trend confirmation tool, while incorporating precise risk control mechanisms to achieve efficient short-term trading.

Strategy Principles

The trading logic of this strategy is based on a multi-indicator confirmation mechanism, with specific principles as follows:

Buy Signal Conditions:

- Price crosses above the lower Bollinger Band (ta.crossover(close, bb_lower)) or RSI below 25 (oversold level)

- Current closing price is above VWAP, confirming effective uptrend

Sell Signal Conditions:

- Price crosses above the upper Bollinger Band (ta.crossover(close, bb_upper)) or RSI above 75 (overbought level)

- Current closing price is below VWAP, confirming effective downtrend

Position Management:

- Risk control for each trade is limited to 1% of total account funds

- Position size is dynamically calculated based on the preset 1.5% stop-loss rate

Money Management:

- Stop-loss is set at 1.5% of the entry price

- Take-profit target is set at 2.25% of the entry price (1.5 times the stop-loss), maintaining a favorable risk-reward ratio

The strategy uses precise parameter settings internally: RSI period of 14, Bollinger Bands period of 20, standard deviation multiplier of 2.0, overbought threshold of 75, and oversold threshold of 25. This parameter combination ensures that the strategy can capture important turning points in short-term price fluctuations.

Strategy Advantages

Multiple Confirmation Mechanism: The strategy combines RSI, Bollinger Bands, and VWAP indicators to form a multiple confirmation mechanism, effectively reducing false signals and improving trading success rates. When multiple indicators point to the same trading direction simultaneously, the reliability of the signal is significantly enhanced.

Flexible Market Adaptability: Through adjustable parameter settings (such as RSI overbought/oversold levels, Bollinger Bands length and multiplier), the strategy can adapt to different market environments and volatility characteristics, making it perform well across different cryptocurrencies and timeframes.

Strict Risk Control: Each trade risk is limited to 1% of the total account funds, coupled with a precise 1.5% stop-loss setting, effectively controlling the maximum loss per trade and protecting trading capital.

Optimized Risk-Reward Ratio: The strategy sets the take-profit target at 1.5 times the stop-loss (2.25%), ensuring a positive risk-reward ratio and increasing the probability of long-term profitability.

Quantified Position Management: The dynamic position calculation method based on risk percentage ensures that risk exposure remains consistent regardless of account size, achieving effective fund management.

Trend Confirmation Mechanism: Using VWAP as a trend confirmation tool helps avoid entering positions against the main trend, reducing the risk of counter-trend trading.

Strategy Risks

Short-term Volatility Risk: As an active short-term trading strategy, it may trigger frequent trades in highly volatile markets, increasing transaction costs and potentially facing more false breakout signals. Consider adding additional filtering conditions or extending confirmation time.

Parameter Sensitivity: Strategy performance is highly dependent on the parameter settings of RSI, Bollinger Bands, and VWAP. Inappropriate parameters may lead to overtrading or missing important signals. It is recommended to optimize parameter settings for different market environments through historical backtesting.

Market Sudden Change Risk: During major news events or black swan events, cryptocurrency markets may experience gaps or extreme volatility, and fixed stop-losses may not execute effectively, resulting in actual losses exceeding expectations. Consider implementing dynamic stop-losses or market volatility filters.

Liquidity Risk: When trading small-cap cryptocurrencies or during low liquidity periods, slippage issues may arise, affecting actual execution prices. It is recommended to prioritize testing and applying this strategy on mainstream cryptocurrencies with high liquidity (such as BTC/ETH).

Technical Indicator Lag: Both RSI and Bollinger Bands have certain lag, which may cause signal delays in rapidly changing markets. Consider introducing more sensitive indicators or reducing calculation periods to improve response speed.

Strategy Optimization Directions

Add Market Environment Filters: Introduce trend strength indicators (such as ADX) or volatility indicators (such as ATR) to dynamically adjust strategy parameters or selectively execute trading signals in different market environments. This will help the strategy better adapt to the different characteristics of ranging and trending markets.

Optimize Indicator Parameters: Based on historical data from different timeframes and different cryptocurrencies, optimize RSI periods and Bollinger Bands parameters to find the best parameter combinations for various market environments. Consider implementing an adaptive parameter adjustment mechanism.

Enhanced Stop-Loss Mechanism: Implement trailing stop-loss functionality to protect realized profits in profitable trades while allowing trends to continue developing. Dynamic stop-loss levels can be designed based on ATR or volatility percentages.

Integrate Volume Analysis: Add volume confirmation conditions to ensure sufficient market participation when signals occur, reducing low-quality signals. Volume expansion, especially when breaking through Bollinger Band boundaries, can increase signal reliability.

Add Time Filters: Analyze market performance during different time periods, avoid unfavorable trading sessions with low activity or high volatility, and focus on time windows where the strategy has historically performed best.

Develop Signal Quality Scoring System: Score the quality of each signal based on multiple factors (such as indicator divergence degree, market structure, volume support, etc.), only execute high-quality signals or dynamically adjust position size according to signal quality.

Implement Machine Learning Enhancement: Use machine learning algorithms to analyze historical trading data, identify characteristic patterns of the most successful signals, and dynamically optimize the trading decision process.

Summary

The VWAP-Enhanced Bollinger Bands Momentum Reversal Strategy is a well-structured, logically clear short-term cryptocurrency trading system. By capturing potential reversal points through RSI and Bollinger Bands, and using VWAP as a trend confirmation tool, it forms a multi-layered trading signal system. The built-in risk control mechanisms ensure capital safety, while the dynamic position calculation method guarantees consistency in risk exposure.

Although this strategy demonstrates good capture ability in short-term price fluctuations, users still need to be aware of potential risks such as market environment changes, parameter sensitivity, and liquidity issues. Performance can be further improved by adding market environment filters, optimizing indicator parameters, and enhancing stop-loss mechanisms.

For traders, it is recommended to first conduct thorough testing in high-liquidity markets such as BTC/ETH, and consider applying it to other crypto assets after becoming familiar with the strategy characteristics. Meanwhile, maintaining continuous observation of the market and regular optimization of the strategy will help maintain a competitive edge in the ever-changing cryptocurrency market.

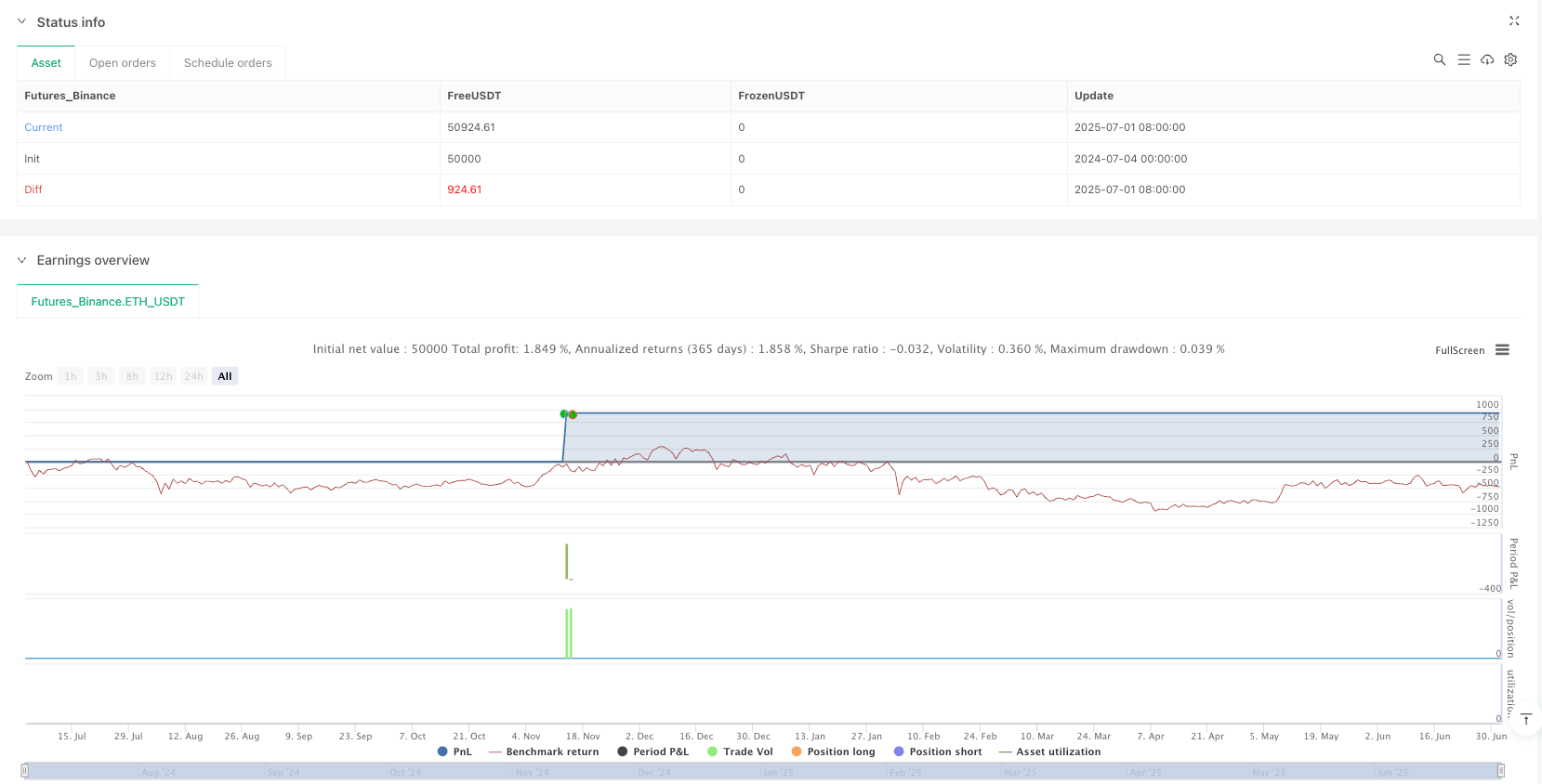

/*backtest

start: 2024-07-04 00:00:00

end: 2025-07-02 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// @version=5

// @title Crypto Pulse Strategy Active

// @description A more active short-term trading strategy for cryptocurrencies using RSI, Bollinger Bands, and VWAP on 1h to 4h timeframes.

strategy("Crypto Pulse Strategy Active", overlay=true)

// === INPUTS ===

overbought = input.int(75, title="RSI Overbought Level", minval=60, maxval=90)

oversold = input.int(25, title="RSI Oversold Level", minval=10, maxval=40)

length_rsi = input.int(14, title="RSI Length", minval=5, maxval=30)

length_bb = input.int(20, title="Bollinger Bands Length", minval=10, maxval=50)

mult_bb = input.float(2.0, title="Bollinger Bands Multiplier", minval=1.0, maxval=5.0, step=0.1)

vwap_source = input.source(close, title="VWAP Source")

risk_per_trade = input.float(1.0, title="Risk Per Trade (%)", minval=0.1, maxval=5.0, step=0.1)

stop_loss = input.float(0.015, title="Stop Loss (%)", minval=0.001, maxval=0.05, step=0.001)

// === INDICATORS ===

rsi = ta.rsi(close, length_rsi)

[bb_middle, bb_upper, bb_lower] = ta.bb(close, length_bb, mult_bb)

vwap = ta.vwap(vwap_source)

// === CONDITIONS ===

buy_signal = (ta.crossover(close, bb_lower) or rsi < oversold) and close > vwap // Buy with VWAP confirmation

sell_signal = (ta.crossover(close, bb_upper) or rsi > overbought) and close < vwap // Sell with VWAP confirmation

// === POSITION SIZING ===

account_balance = strategy.equity

risk_amount = account_balance * (risk_per_trade / 100)

position_size = risk_amount / (stop_loss * close)

// === ENTRY LOGIC ===

if (buy_signal)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Exit Long", "Long", stop=close * (1 - stop_loss), limit=close * (1 + stop_loss * 1.5))

if (sell_signal)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Exit Short", "Short", stop=close * (1 + stop_loss), limit=close * (1 - stop_loss * 1.5))

// === PLOTTING ===

plot(rsi, title="RSI", color=color.blue)

plot(bb_upper, title="BB Upper", color=color.red)

plot(bb_middle, title="BB Middle", color=color.gray)

plot(bb_lower, title="BB Lower", color=color.green)

plot(vwap, title="VWAP", color=color.purple)

hline(overbought, "Overbought", color=color.red, linestyle=hline.style_dashed)

hline(oversold, "Oversold", color=color.green, linestyle=hline.style_dashed)

plotshape(buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)