Overview

The Multi-Indicator Comprehensive Micropulse Reversal Strategy is a high-frequency quantitative trading strategy designed specifically for 1-minute cryptocurrency charts. This strategy captures rapid market reversal opportunities through a scientific combination of price action, volume dynamics, and volatility filtering. The core of the strategy lies in the integrated use of multiple technical indicators including RSI (Relative Strength Index), Bollinger Bands, Hull Moving Average, and OBV (On-Balance Volume) to construct an efficient signal scoring system, ensuring that only high-confidence signals trigger trades. The strategy also incorporates an ATR (Average True Range) filter to avoid trading in insufficient volatility market conditions, while supporting both long and short operations with automatic position reversal logic.

Strategy Principles

The core principle of this strategy is based on a signal scoring system with multiple indicator confirmations. Specifically:

RSI Application: Uses a 9-period RSI to identify overbought and oversold areas, with RSI below 40 considered oversold (favorable for long positions) and above 60 considered overbought (favorable for short positions).

Bollinger Bands Breakout Assessment: Employs 20-period Bollinger Bands with 2 standard deviations, where price breaking below the lower band supports long signals, and breaking above the upper band supports short signals.

Hull Moving Average (HMA) Price Relationship: When price is above 99.5% of the HMA (13-period), it’s considered a potential long condition; when price is below 100.5% of the HMA, it’s considered a potential short condition.

OBV Volume Analysis: Compares short-term (3-period) and long-term (8-period) OBV moving averages to evaluate whether volume supports the current price movement. Short-term OBV above long-term OBV supports long positions, while the opposite supports short positions.

Volatility Filtering: Uses the ATR indicator to ensure sufficient market volatility (ATR/price > 0.1%), avoiding trades in sideways, choppy markets.

Signal Scoring Mechanism: For each trading direction, the strategy calculates a score from the above 5 conditions. Only when the score reaches or exceeds the preset threshold (4 points) will a trading signal be triggered.

Profit and Loss Management: The strategy sets fixed percentage take-profit (+0.8%) and stop-loss (-0.6%) levels to control the risk-reward ratio of each trade.

Strategy Advantages

Multi-dimensional Confirmation: By combining multiple different types of technical indicators (momentum indicator RSI, volatility indicator Bollinger Bands, trend indicator HMA, and volume indicator OBV), the signal reliability is greatly improved, reducing false signals.

Scoring System Design: The strategy uses a scoring system rather than simple indicator crossovers, requiring multiple conditions to be met simultaneously to trigger a trade, significantly reducing the probability of erroneous trades.

Intelligent Volatility Filtering: The ATR indicator filters low volatility environments, avoiding opening positions in unsuitable market conditions, improving capital efficiency.

High Automation: The strategy includes complete entry and exit logic and position management, suitable for automated trading systems, reducing human intervention and emotional influence.

Parameter Optimization Lock: All parameters are optimized and hardcoded, avoiding overfitting and the complexity of parameter adjustment, making the strategy more stable and reliable.

Bidirectional Trading Capability: Supports both long and short trading with automatic reversal logic, fully utilizing bidirectional opportunities in volatile markets.

Precise Risk Control: Fixed take-profit and stop-loss ratios (0.8%:0.6%) create a favorable risk-reward ratio, ensuring long-term profitability.

Strategy Risks

High-Frequency Trading Risks: As a 1-minute timeframe short-term strategy, the trading frequency is relatively high, potentially facing more trading costs and slippage impact, requiring consideration of broker fee structures in practical application.

Market Noise Sensitivity: Despite multiple filtering mechanisms, market noise in extremely short time periods may still lead to erroneous signals, especially during low liquidity or high volatility events.

Fixed Parameter Risk: While parameter locking reduces the risk of overfitting, it also means the strategy lacks adaptability and may perform poorly when market characteristics change significantly.

Rapid Reversal Risk: The strategy relies on capturing small price reversals, but in strong trending markets, it may enter reversal positions too early, facing losses from trend continuation.

Timeframe Limitation: The strategy is optimized for 1-minute charts, and its performance on other timeframes may be unstable or not meet expectations.

Historical Optimization Bias: Strategy parameters may have been optimized for historical data, and future market condition changes may lead to strategy performance decline.

Strategy Optimization Directions

Dynamic Parameter Adjustment Mechanism: Consider introducing a dynamic parameter adjustment mechanism based on market volatility or trend strength, allowing the strategy to better adapt to different market environments. For example, increase take-profit and stop-loss percentages in high volatility markets, and reduce signal thresholds in low volatility markets.

Time Filter Enhancement: Add time filters to avoid known low liquidity or high volatility periods (such as around the opening times of Asian, European, and US markets), improving trading quality.

Trend Strength Identification: Integrate trend strength indicators (such as ADX) to adjust strategy behavior in strong trend environments, avoiding counter-trend trading or raising the threshold for counter-trend trades.

Multiple Timeframe Confirmation: Add filtering conditions from higher timeframes, for example, only executing 1-minute signals when the 5-minute or 15-minute trend direction is consistent, reducing counter-trend trading risk.

Machine Learning Optimization: Use machine learning algorithms to dynamically evaluate the weights of various indicators, allowing the scoring system to adapt to market conditions, enhancing strategy robustness.

Volume-Weighted Adjustment: Adjust signal strength based on the relative size of trading volume, giving higher signal confidence in high volume situations, improving trading quality.

Take-Profit Strategy Optimization: Implement segmented take-profit, moving the stop-loss to breakeven or slight profit position after reaching a certain profit, locking in partial profits while allowing the market to develop further.

Summary

The Multi-Indicator Comprehensive Micropulse Reversal Strategy is a high-frequency quantitative trading system that integrates multiple technical analysis tools, effectively capturing short-term market reversal opportunities through a carefully designed scoring mechanism and risk management process. The main advantage of this strategy lies in its multi-dimensional signal confirmation mechanism and strict trade condition screening, significantly improving the quality of trading signals. At the same time, the strategy’s risk control system is relatively comprehensive, including volatility filtering, fixed take-profit and stop-loss, and automatic position management.

However, as a high-frequency strategy, it also faces challenges such as high trading costs, market noise interference, and fixed parameters. By introducing dynamic parameter adjustment, multiple timeframe analysis, and trend strength identification, the strategy’s robustness and adaptability can be further enhanced. For quantitative traders, this strategy provides a scientific, systematic short-term trading framework, particularly suitable for investors seeking to capture short-term opportunities in highly liquid cryptocurrency markets.

Finally, it should be emphasized that although the strategy is well-designed and has performed well historically, market environments are constantly changing. Investors should remain cautious in practical application, conduct thorough backtesting and forward validation, and strictly control the risk exposure of each trade.

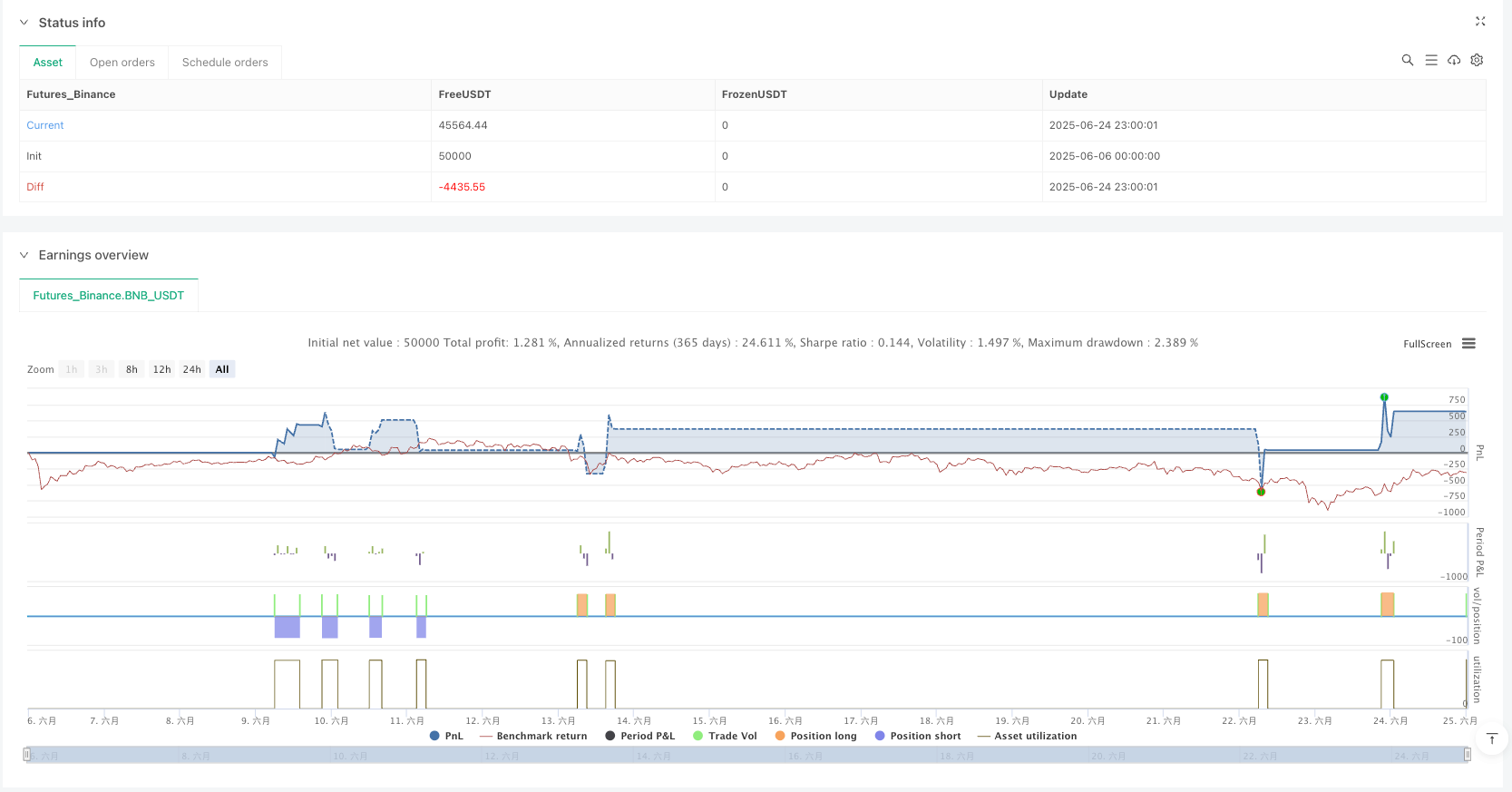

/*backtest

start: 2025-06-06 00:00:00

end: 2025-06-25 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("Micropulse Crypto Reversal – 1 Minute", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === SABİT AYARLAR ===

rsiLen = 9

rsiOversold = 40

rsiOverbought = 60

bbLen = 20

bbMult = 2.0

hmaLen = 13

obvShortLen = 3

obvLongLen = 8

atrFilterRatio = 0.001

requiredScore = 4

tpPerc = 0.8

slPerc = 0.6

// === GÖSTERGELER ===

rsi = ta.rsi(close, rsiLen)

basis = ta.sma(close, bbLen)

dev = bbMult * ta.stdev(close, bbLen)

bbLower = basis - dev

bbUpper = basis + dev

hma = ta.wma(2 * ta.wma(close, hmaLen / 2) - ta.wma(close, hmaLen), math.round(math.sqrt(hmaLen)))

obv = ta.cum(math.sign(close - close[1]) * volume)

obvShort = ta.sma(obv, obvShortLen)

obvLong = ta.sma(obv, obvLongLen)

atr = ta.atr(14)

volatilityOK = atr / close > atrFilterRatio

// === SKORLAMA ===

scoreLong = 0

scoreLong += rsi < rsiOversold ? 1 : 0

scoreLong += close < bbLower ? 1 : 0

scoreLong += close > hma * 0.995 ? 1 : 0

scoreLong += obvShort > obvLong ? 1 : 0

scoreLong += volatilityOK ? 1 : 0

scoreShort = 0

scoreShort += rsi > rsiOverbought ? 1 : 0

scoreShort += close > bbUpper ? 1 : 0

scoreShort += close < hma * 1.005 ? 1 : 0

scoreShort += obvShort < obvLong ? 1 : 0

scoreShort += volatilityOK ? 1 : 0

// === GİRİŞ & POZİSYON YÖNETİMİ ===

if (scoreLong >= requiredScore)

strategy.close("Short")

strategy.entry("Long", strategy.long)

if (scoreShort >= requiredScore)

strategy.close("Long")

strategy.entry("Short", strategy.short)

// === ÇIKIŞ ===

longTP = strategy.position_avg_price * (1 + tpPerc / 100)

longSL = strategy.position_avg_price * (1 - slPerc / 100)

shortTP = strategy.position_avg_price * (1 - tpPerc / 100)

shortSL = strategy.position_avg_price * (1 + slPerc / 100)

strategy.exit("TP/SL Long", from_entry="Long", limit=longTP, stop=longSL)

strategy.exit("TP/SL Short", from_entry="Short", limit=shortTP, stop=shortSL)

// === GÖRSELLER ===

plot(hma, title="Hull MA", color=color.orange)

plot(bbUpper, title="BB Upper", color=color.gray)

plot(bbLower, title="BB Lower", color=color.gray)

hline(rsiOversold, "RSI Oversold", color=color.green)

hline(rsiOverbought, "RSI Overbought", color=color.red)