Overview

The Multi-Timeframe RSI Divergence & Trend Integration Strategy is a sophisticated quantitative trading approach that combines advanced technical analysis concepts. Its core philosophy centers around utilizing a multi-timeframe analytical framework to capture market trends and momentum shifts. The strategy integrates Higher Timeframe (HTF) trend analysis with Lower Timeframe (LTF) precise entry signals, particularly leveraging Relative Strength Index (RSI) divergences as key trading triggers. The strategy further incorporates Moving Average Convergence Divergence (MACD) as a confirmation signal and Exponential Moving Average (EMA) as a trend filter, forming a comprehensive trading system designed to identify high-probability trading opportunities while managing risk.

Strategy Principles

The core principles of this strategy are built on several key technical analysis concepts:

RSI Divergence Identification: The strategy uses the Relative Strength Index to identify hidden momentum shifts in the market. Specifically:

- Bullish Divergence: When price makes a lower low but RSI fails to make a lower low, indicating weakening downward momentum and potential upward reversal

- Bearish Divergence: When price makes a higher high but RSI fails to make a higher high, indicating weakening upward momentum and potential downward reversal

Multi-Timeframe Analytical Framework:

- Higher Timeframe Analysis: Utilizes price action, key support/resistance levels, and trend confirmation (e.g., 50EMA on 1H/4H charts) to determine the dominant trend

- Lower Timeframe Entry: Seeks precise entry points in the direction of the main trend, such as momentum breakdowns or support reversions

Trend Filtering:

- Uses 200-period EMA as a trend determination criterion

- Only takes long positions in uptrends (price > EMA) and short positions in downtrends (price < EMA)

MACD Confirmation:

- Long signals require positive MACD histogram

- Short signals require negative MACD histogram

Refined Entry Conditions:

- Long: RSI bullish divergence + uptrend + positive MACD histogram

- Short: RSI bearish divergence + downtrend + negative MACD histogram

In code implementation, the strategy employs a lookback parameter (default 30) to identify swing highs and lows, and uses precise conditional logic to confirm divergence patterns. Combined with EMA filtering and MACD confirmation, this significantly enhances signal quality.

Strategy Advantages

Multi-level Confirmation Mechanism: By combining RSI divergence, trend filtering, and MACD confirmation, the strategy forms a multi-validation system that significantly reduces the risk of false signals.

Balance Between Trend and Reversal: The strategy can both follow major trends and capture short-term reversals, providing flexibility and adaptability in trading.

Precise Signal Identification: Through strictly defined conditions in the code (such as

bullishDiv = low == swingLow and rsi > rsiLow and low[1] > low and rsi[1] < rsi), the strategy ensures that only genuinely qualifying divergences trigger trades.Intuitive Visualization: The strategy uses the

plotshapefunction to clearly mark buy and sell signals on the chart, helping traders visually understand and verify trading logic.Emotional and Error Tracking: The strategy emphasizes journaling trades, tracking emotions and mistakes, which is crucial for long-term improvement.

Effective Combination of Technical Indicators: The strategy integrates multiple complementary technical indicators (RSI, EMA, MACD), forming a comprehensive and balanced analytical framework.

Strategy Risks

Inadequate Stop-Loss Strategy: The current use of fixed tick stops (e.g., 7-13 points) may not adapt to changing market volatility, particularly in high-volatility markets where tight stops can lead to frequent stop-outs.

Fixed Contract Size Issue: Using a fixed number of contracts (e.g., 10 per trade) rather than position sizing based on capital percentage can create excessive risk during losing periods.

Divergence Failure Risk: In strongly trending markets, RSI divergences may appear consecutively without leading to actual reversals, causing sequential losses.

Over-reliance on Technical Indicators: Complete dependence on technical indicators while ignoring fundamental factors and market structure may fail in special market environments.

Parameter Sensitivity: The choice of parameters such as RSI length, lookback period, and EMA length significantly impacts strategy performance; inappropriate parameters may lead to poor strategy performance.

Solutions: - Use dynamic stop-losses: Based on 1.5x ATR(14) or beyond recent swing high/low - Implement capital management: Control risk to 1-2% of total capital per trade, adjusting position size based on stop-loss distance - Add filtering conditions: Such as volume confirmation or key price level breakouts as additional conditions - Regularly optimize parameters: Analyze the performance of different parameter combinations in various market environments

Optimization Directions

Dynamic Stop-Loss and Tiered Profit-Taking Strategy:

- Change from fixed tick stops to ATR-based dynamic stops (e.g., 1.5x ATR)

- Implement tiered profit-taking: 50% position at 1:1 risk-reward ratio, trailing stop for the remainder

Capital Management Optimization:

- Transition from fixed contract quantities to position sizing based on capital percentage (1-2% risk per trade)

- Dynamically adjust trade size based on market volatility and stop-loss distance

Signal Quality Enhancement:

- Add volume confirmation conditions to verify RSI divergence validity

- Consider adding price pattern recognition (e.g., reversal candlestick patterns) as additional confirmation

- Implement RSI divergence strength scoring, prioritizing high-strength signals

Multi-Timeframe Coordination:

- Program the integration of HTF and LTF data, rather than relying solely on manual analysis

- Add HTF trend strength assessment, adjusting divergence signal filtering criteria in strong trends

Market Environment Adaptation:

- Add volatility filters to adjust strategy parameters in different volatility environments

- Implement market state classification (trending, ranging, transitional), applying different trading logic for different states

These optimization directions can not only improve the strategy’s robustness and profitability but also enhance its adaptability to different market environments. By transforming fixed parameters into dynamic parameters, the strategy can better respond to market changes and improve long-term performance.

Conclusion

The Multi-Timeframe RSI Divergence & Trend Integration Strategy is a well-structured, logically sound quantitative trading system. Its core strength lies in organically integrating multiple key concepts from technical analysis (RSI divergence, trend following, multi-timeframe analysis). The strategy captures potential reversals through RSI divergence while using EMA and MACD to ensure alignment with the main trend, thereby increasing trading success rates.

Despite some risks and limitations, such as inadequacies in stop-loss strategy and position management, these issues can be effectively addressed through the proposed optimization directions. In particular, dynamic stop-losses, tiered profit-taking, and percentage-based position sizing will significantly improve the strategy’s risk-adjusted returns.

The greatest value of this strategy lies in its adaptability and scalability. By continuously recording and analyzing trading results, traders can gradually refine strategy parameters and rules to better suit personal risk preferences and market conditions. For experienced technical analysts, this strategy provides a powerful framework that can be further customized and optimized based on individual needs.

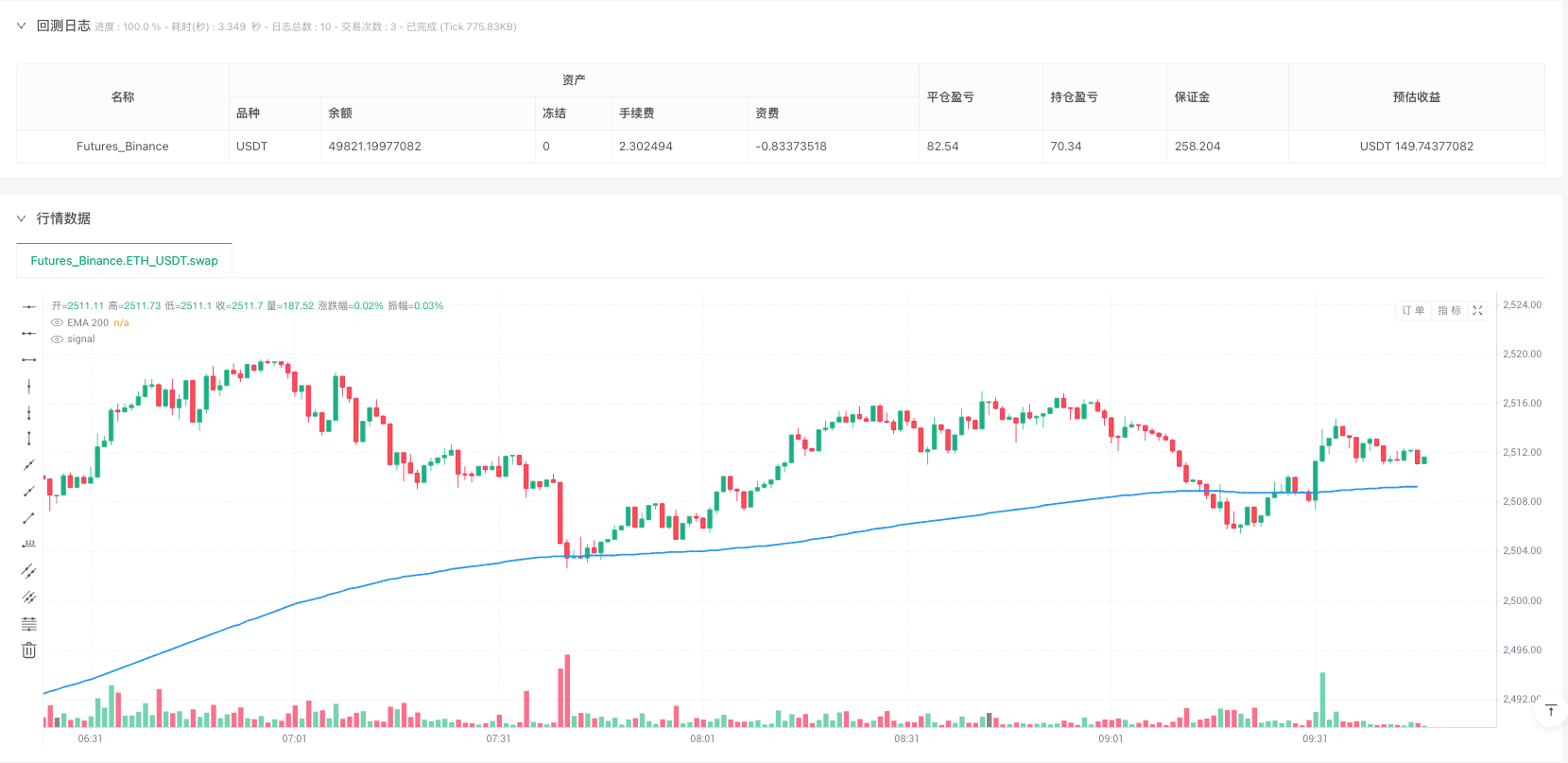

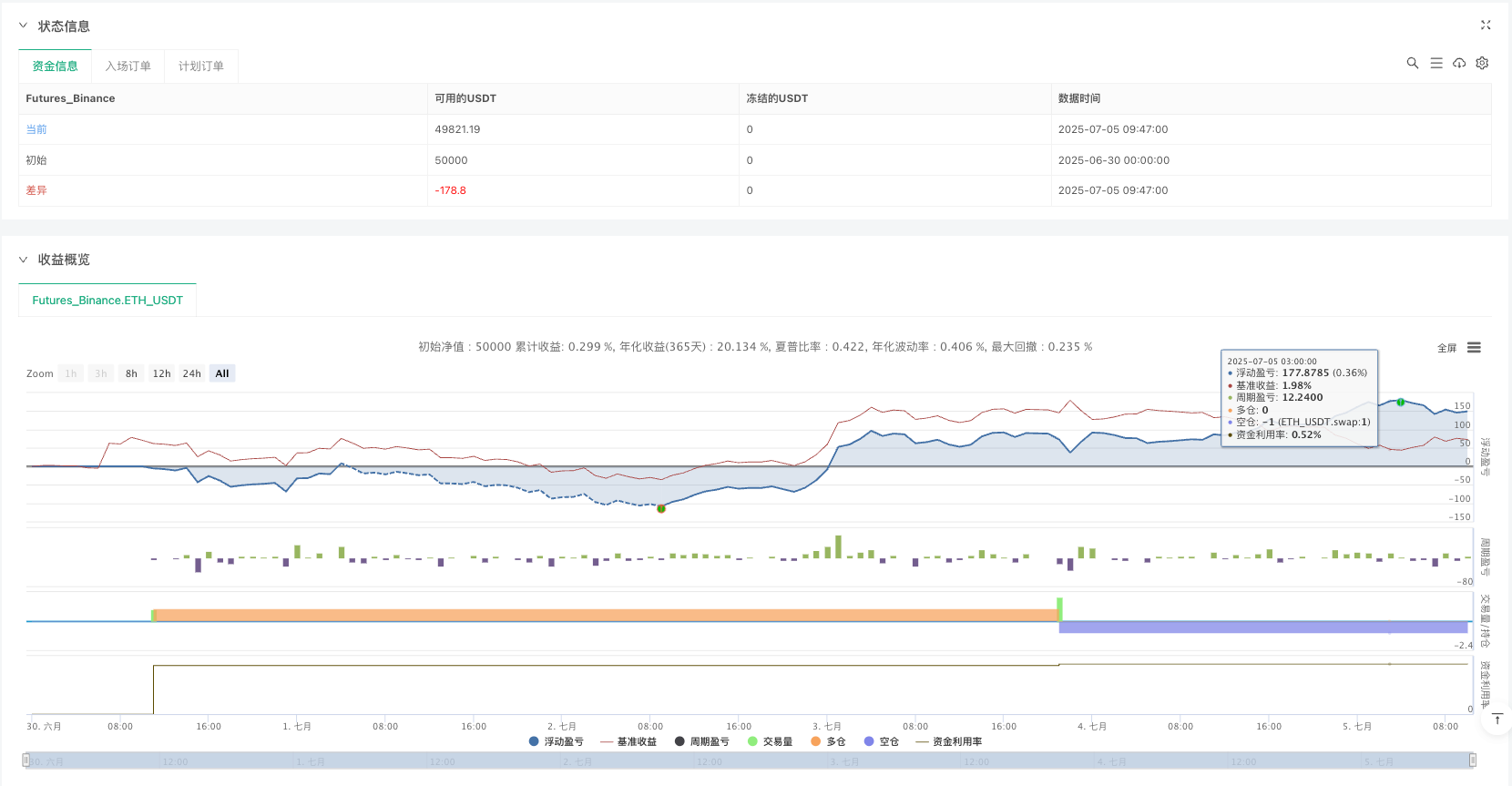

/*backtest

start: 2025-06-30 00:00:00

end: 2025-07-05 10:18:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Enhanced RSI Divergence Strategy", overlay=true, margin_long=100, margin_short=100)

// Inputs

rsiLength = input(14, "RSI Length")

lookback = input(30, "Divergence Lookback Period")

emaLength = input(200, "EMA Length")

showLabels = input(true, "Show Signal Labels")

// Indicators

rsi = ta.rsi(close, rsiLength)

ema = ta.ema(close, emaLength)

[macdLine, signalLine, hist] = ta.macd(close, 12, 26, 9)

// Detecting Swing Highs/Lows

swingHigh = ta.highest(high, lookback)

swingLow = ta.lowest(low, lookback)

rsiHigh = ta.highest(rsi, lookback)

rsiLow = ta.lowest(rsi, lookback)

// Bullish Divergence (Price Lower Low + RSI Higher Low)

bullishDiv = low == swingLow and rsi > rsiLow and

low[1] > low and rsi[1] < rsi

// Bearish Divergence (Price Higher High + RSI Lower High)

bearishDiv = high == swingHigh and rsi < rsiHigh and

high[1] < high and rsi[1] > rsi

// Trend Filter

uptrend = close > ema

downtrend = close < ema

// Entry Conditions

longCondition = bullishDiv and uptrend and hist > 0

shortCondition = bearishDiv and downtrend and hist < 0

// Plotting

plotshape(showLabels and longCondition, title="Buy Signal",

location=location.belowbar, color=color.green,

style=shape.triangleup, size=size.small, text="BUY")

plotshape(showLabels and shortCondition, title="Sell Signal",

location=location.abovebar, color=color.red,

style=shape.triangledown, size=size.small, text="SELL")

// Strategy Execution

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Optional: Plot EMA for reference

plot(ema, "EMA 200", color=color.blue, linewidth=2)