Overview

The VixFix Dynamic Volatility Trading System is a quantitative trading strategy that combines market volatility monitoring, trend confirmation, and momentum filtering. The strategy primarily uses the Williams Vix Fix (WVF) indicator to identify market volatility spikes, while incorporating HMA200 (200-period Hull Moving Average) for trend confirmation and RSI (Relative Strength Index) to filter high-probability trading signals. The strategy is also equipped with an ATR-based dynamic trailing stop mechanism that activates after reaching a preset profit threshold, effectively balancing risk and reward. This strategy has been optimized for the 30-minute timeframe and employs different parameters for long and short trades to adapt to market directional bias.

Strategy Principles

The strategy operates based on the synergistic action of four core components:

Williams Vix Fix (WVF): As the core trigger of the strategy, WVF identifies market volatility spikes by calculating the percentage difference between the current price and the highest price over the past 22 periods. When the WVF value exceeds its Bollinger Band upper band or is higher than its historical percentile value, it is considered a volatility anomaly, typically representing market panic or oversold conditions, providing potential reversal trading opportunities.

Hull Moving Average (HMA200): Used as the primary trend filter, determining market trend direction by comparing price position relative to HMA200. The strategy only allows long entries when price is above HMA200, and short entries when price is below HMA200 with a negative HMA slope, ensuring trade direction aligns with the main trend.

Relative Strength Index (RSI): Provides momentum confirmation signals for the strategy. Long entries require an RSI value above 35, while short entries require an RSI value below 20, with the additional requirement that RSI is below its 21-period exponential moving average. Setting a lower RSI threshold for shorts helps capture high-momentum downtrends.

ATR Trailing Stop System: Activates the trailing stop mechanism when price reaches a specific profit level (2.5×ATR for longs, 1.2×ATR for shorts). Long positions use a 1.75×ATR trailing amount, while shorts use 1.0×ATR, with hard stop limits (2.5×ATR for longs, 3.0×ATR for shorts) to prevent excessive losses.

The entry logic requires: for longs - simultaneous WVF spike, RSI greater than 35, price above HMA200; for shorts - WVF spike, RSI less than 20, price below HMA200 with negative HMA slope, RSI below its EMA(21), price below EMA(100), and at least 10 candles since the last short signal.

Strategy Advantages

Multi-level Filtering Mechanism: The strategy constructs a triple filtering system by combining volatility identification (WVF), trend confirmation (HMA200), and momentum verification (RSI), significantly increasing the reliability of trading signals and reducing false breakouts and erroneous signals.

Market-Adaptive Differentiation: The strategy sets different parameters for long and short directions, acknowledging and adapting to the upward bias of the market. Short trades employ stricter entry conditions and more flexible stop-loss settings to accommodate the rapid and intense nature of downtrends.

Intelligent Risk Management: The ATR-based dynamic trailing stop system can adaptively adjust according to market volatility, protecting existing profits while giving price sufficient breathing room, avoiding being shaken out of favorable positions by normal market fluctuations.

Volatility Capture Capability: The Williams Vix Fix indicator excels at identifying market panic and oversold conditions, enabling the strategy to capture high-probability reversal opportunities during periods of extreme market sentiment, which is particularly valuable during sharp market volatility.

Prevention of Overtrading: By setting a minimum candle interval between short signals (10 candles), the strategy effectively avoids generating excessive signals in oscillating markets, reducing the risk of consecutive losses and saving on trading costs.

Strategy Risks

Lagged Identification of Trend Reversals: Reliance on long-period moving averages like HMA200 may lead to delayed reactions at trend turning points, causing the strategy to miss optimal entry timing or suffer initial losses when market direction suddenly changes. Consider adding short-period trend indicators as auxiliary confirmation.

Short-Side Success Rate Challenges: Backtest data shows that short trades have a significantly lower win rate than long trades (30.0% vs 49.6%). Although the average profit is higher, consecutive failed short trades may put psychological and financial pressure on the account. Consider cautious use or temporary disabling of short trades in strong bullish markets.

Parameter Sensitivity: The strategy uses multiple fixed parameters (such as RSI thresholds, ATR multiples, etc.), whose optimal values may change in different market environments. Excessive optimization may lead to decreased strategy performance on out-of-sample data. Regularly re-validate parameter effectiveness.

Volatility Dependence: The core trigger mechanism of the strategy relies on market volatility spikes. In prolonged low-volatility environments, it may generate fewer trading signals, affecting overall returns. Consider adding alternative entry logic during low-volatility periods.

Hard Stop Risk: Fixed ATR multiple hard stops may be easily triggered during violent market fluctuations, forcing position closure right before price reversal. Consider dynamically adjusting stop levels based on other technical indicators or implementing a phased position exit strategy.

Strategy Optimization Directions

Dynamic Parameter Adaptation: The strategy could introduce a dynamic parameter adjustment mechanism based on market volatility and trend strength. For example, automatically increasing RSI thresholds and stop distances in high-volatility environments while tightening parameters in low-volatility environments to improve the strategy’s environmental adaptability.

Volume and Time Filtering: Add volume confirmation and time filtering conditions, such as only executing trades during volume surges or specific time periods (like market opening sessions or before/after major economic data releases) to improve signal quality. The rationale is that market volatility often has more directionality and continuity during these periods.

Multi-timeframe Confirmation: Introducing trend and momentum confirmation from higher timeframes can significantly improve strategy stability. For example, only entering positions when the daily trend aligns with the 30-minute signal direction can reduce counter-trend trading risk.

Machine Learning Optimization: Apply machine learning algorithms to dynamically predict optimal entry parameters and stop levels, adjusting strategy parameters in real-time based on historical patterns and current market conditions to improve strategy adaptability and robustness.

Sentiment Indicator Integration: Integrating market sentiment indicators (such as volume ratios, bull/bear option ratios, etc.) can provide additional confirmation for WVF, improving the accuracy of predicting market reversal points. These indicators often reflect market sentiment changes in advance, complementing the lagging characteristics of WVF as leading indicators.

Summary

The VixFix Dynamic Volatility Trading System is a comprehensive trading strategy combining market volatility identification, trend confirmation, and momentum screening. It captures market volatility spike opportunities through the Williams Vix Fix indicator and uses HMA200 and RSI for direction and momentum confirmation, coupled with an ATR-based adaptive trailing stop mechanism for risk management. The strategy optimizes parameter settings separately for long and short directions, particularly strengthening the filtering conditions for short trades to address the upward bias of cryptocurrency markets.

The strategy’s greatest strengths lie in its multi-level signal filtering system and flexible risk management mechanism, which can capture reversal opportunities in high-volatility market environments while effectively controlling risk. Major risks include lagged trend identification, lower success rates for short trades, and parameter sensitivity issues. Future optimization directions could focus on dynamic parameter adjustment, multi-timeframe confirmation, and machine learning applications to further enhance the strategy’s adaptability and robustness.

Overall, this strategy demonstrates how to construct a complete trading system by combining different types of technical indicators with refined risk management mechanisms, particularly suitable for high-volatility market environments. In practical applications, combining fundamental and macroeconomic perspectives with reasonable money management rules can further enhance the strategy’s practical value.

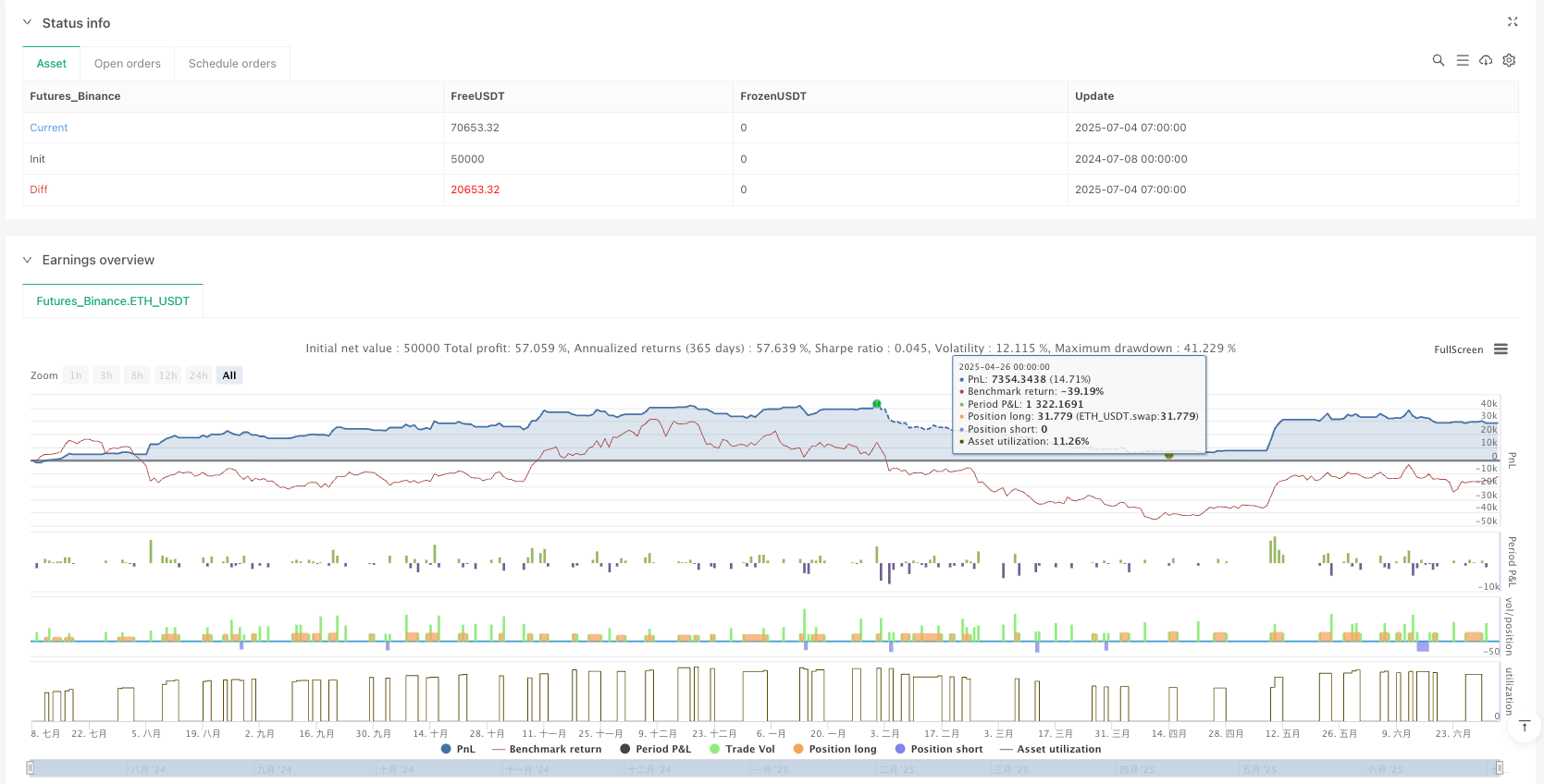

/*backtest

start: 2024-07-08 00:00:00

end: 2025-07-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("CM_VixFix_RSI_HMA200_TrailStop_vFinal", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

hmaLen = input.int(200, title="HMA Length")

rsiLen = input.int(14, title="RSI Length")

rsiLongTrigger = input.int(35, title="RSI Long Trigger Level")

rsiShortTrigger = input.int(20, title="RSI Short Trigger Level")

atrLen = input.int(14, title="ATR Length")

atr = ta.atr(atrLen)

// === Long Trailing Parameters

trailTriggerL = input.float(2.5, title="Long Trail Trigger (xATR)")

trailOffsetL = input.float(1.75, title="Long Trail Offset (xATR)")

hardStopL = input.float(2.5, title="Long Hard Stop (xATR)")

// === Short Trailing Parameters

trailTriggerS = input.float(1.2, title="Short Trail Trigger (xATR)")

trailOffsetS = input.float(1.0, title="Short Trail Offset (xATR)")

hardStopS = input.float(3.0, title="Short Hard Stop (xATR)")

maxBarsShort = input.int(10, title="Min Bars Between Short Signals")

// === VIX FIX Settings

pd = input.int(22, title="Lookback Period")

bbl = input.int(20, title="Bollinger Length")

mult = input.float(2.0, title="StdDev Multiplier")

lb = input.int(50, title="Percentile Lookback")

ph = input.float(0.97, title="Range High Percentile")

// === WVF VixFix

wvf = ((ta.highest(close, pd) - low) / ta.highest(close, pd)) * 100

rangeHigh = ta.percentile_nearest_rank(wvf, lb, ph)

upperBand = ta.sma(wvf, bbl) + ta.stdev(wvf, bbl) * mult

vixSpike = wvf >= upperBand or wvf >= rangeHigh

// === HMA & RSI & Filters

wma1 = ta.wma(close, hmaLen / 2)

wma2 = ta.wma(close, hmaLen)

diff = 2 * wma1 - wma2

hma = ta.wma(diff, math.round(math.sqrt(hmaLen)))

hmaSlope = hma - hma[5]

plot(hma, title="HMA", color=color.orange, linewidth=2)

rsi = ta.rsi(close, rsiLen)

rsiEMA = ta.ema(rsi, 21)

priceEMA = ta.ema(close, 100)

// === State Variables

var float entryL = na

var float peakL = na

var bool trailL = false

var float entryS = na

var float lowS = na

var bool trailS = false

var int lastShortBar = na

// === LONG ENTRY ===

longCondition = vixSpike and rsi > rsiLongTrigger and close > hma

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

entryL := close

trailL := false

peakL := close

if (strategy.position_size > 0)

peakL := math.max(peakL, high)

if not trailL and close >= entryL + trailTriggerL * atr

trailL := true

if not trailL and close <= entryL - hardStopL * atr

strategy.close("Long", comment="HardStopL")

if trailL and close <= peakL - trailOffsetL * atr

strategy.close("Long", comment="TrailStopL")

// === SHORT ENTRY ===

shortBase = vixSpike and rsi < rsiShortTrigger and close < hma and hmaSlope < 0

shortFilter = rsi < rsiEMA and close < priceEMA

canShort = na(lastShortBar) or (bar_index - lastShortBar > maxBarsShort)

shortCondition = shortBase and shortFilter and canShort

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

entryS := close

trailS := false

lowS := close

lastShortBar := bar_index

if (strategy.position_size < 0)

lowS := math.min(lowS, low)

if not trailS and close <= entryS - trailTriggerS * atr

trailS := true

if not trailS and close >= entryS + hardStopS * atr

strategy.close("Short", comment="HardStopS")

if trailS and close >= lowS + trailOffsetS * atr

strategy.close("Short", comment="TrailStopS")