5 EMA Dynamic Breakout Strategy with Time-Filtered Optimization System

EMA BREAKOUT Signal Candle RISK-REWARD Time Filter STOP-LOSS TAKE-PROFIT

Overview

The 5 EMA Dynamic Breakout Strategy with Time-Filtered Optimization System is a quantitative trading strategy based on the Exponential Moving Average indicator. This strategy utilizes the 5-period EMA to identify potential market breakout points and optimizes trade execution through strict signal candle validation and time window filtering. The core concept lies in capturing momentum changes when price breaks through signal candle highs/lows, while applying independent risk management parameters to each trade. This strategy is particularly suitable for intraday and short-term traders, offering greater flexibility and realism within a structured system.

Strategy Principles

The strategy operates based on the following core principles:

Signal Generation Mechanism: The strategy employs a 5-period EMA as its primary indicator, identifying signal candles through the relationship between price and EMA. A buy signal is generated when both the closing price and the high are below the EMA; a sell signal is generated when both the closing price and the low are above the EMA.

Breakout Validation: The strategy only looks for valid breakouts within 3 candles after signal generation. Buy trades are triggered when price breaks above the signal candle’s high, while sell trades are triggered when price breaks below the signal candle’s low.

Risk Management Framework: Each trade is set with independent stop-loss and target levels. For buy trades, the stop-loss is placed at the signal candle’s low; for sell trades, the stop-loss is set at the signal candle’s high. Target price levels are calculated based on a user-defined risk-reward ratio, defaulted to 1:3.

Time Filtering System: The strategy implements two time management mechanisms: (a) blocking new trades during specific time windows (such as high volatility periods); and (b) automatically closing all positions at a designated time (such as before market close).

Multiple Trade Handling: The strategy allows for multiple trades in the same direction without closing previous positions, with each trade having its own independent ID, stop-loss, and target level.

Strategy Advantages

Through in-depth analysis, this strategy demonstrates the following distinct advantages:

Precise Signal Filtering: By requiring specific relationships between price and EMA to generate signals, the strategy reduces false signals and improves trade quality.

Flexible Execution Options: The “enter only on candle close” option allows traders to avoid false breakouts, enhancing the robustness of the strategy.

Independent Risk Management: Each trade has its own stop-loss and target levels, allowing traders to precisely control risk exposure for each position, avoiding whole-portfolio risk.

Time Intelligence: Through customizable time window filtering and automatic position closing, the strategy can adapt to market time characteristics and avoid inefficient or high-risk trading periods.

Strong Scalability: The strategy is designed in a modular way with adjustable parameters, making it applicable to different markets and timeframes, adaptable to various trading styles and requirements.

Strategy Risks

Despite its comprehensive design, the strategy still presents the following potential risks:

EMA Lag: As a lagging indicator, the 5-period EMA may generate delayed signals in rapidly changing markets, leading to suboptimal entry points. Solution: Use cautiously in high-volatility markets or combine with other indicators for confirmation.

Fixed Stop-Loss Risk: Using signal candle highs/lows as stop-loss points may result in wide stops, increasing the risk amount per trade. Consider implementing ATR or percentage-based stops to optimize stop-loss placement.

3-Candle Window Limitation: Only looking for breakouts within 3 candles may miss valid but delayed breakout opportunities. Consider adjusting this parameter based on different markets and timeframes.

Time Zone Dependency: The strategy uses IST (Indian Standard Time) for time filtering, requiring adjustments for traders in different time zones. Recommended code modification to support dynamic time zone settings.

Multiple Trade Accumulation: Allowing multiple entries in the same direction may lead to excessive leverage and concentrated risk. Implement total risk control mechanisms to limit the maximum number of same-direction trades or total risk exposure.

Strategy Optimization Directions

Based on strategy analysis, here are several possible optimization directions:

Dynamic EMA Period: Implement functionality to automatically adjust the EMA period based on market volatility (such as ATR), allowing the strategy to adapt to different market conditions. This will improve strategy adaptability across varying volatility environments.

Advanced Filter Integration: Introduce volume confirmation, market volatility filters, or trend strength indicators (such as ADX) to improve signal quality and reduce the possibility of false breakouts.

Adaptive Risk Management: Implement functionality to dynamically adjust risk-reward ratios and stop-loss widths based on market volatility, making risk management more intelligent and market-relevant.

Partial Profit Locking: Add functionality to move stops or take partial profits when reaching certain profit targets, protecting existing gains while allowing remaining positions to follow larger trends.

Machine Learning Optimization: Utilize machine learning algorithms to analyze historical data, identify optimal entry times and parameter combinations, and achieve adaptive optimization of strategy parameters.

Summary

The 5 EMA Dynamic Breakout Strategy with Time-Filtered Optimization System is a well-designed quantitative trading system that provides traders with a comprehensive and flexible trading framework by combining the EMA indicator, breakout validation, strict risk management, and time filtering functionality. This strategy is particularly suitable for intraday and short-term traders, effectively capturing momentum changes following price breakouts. While there are some inherent risks, the strategy’s robustness and adaptability can be further enhanced through the suggested optimization directions. Most importantly, this strategy provides clear trading rules and a risk management framework that helps traders maintain discipline and consistency in dynamic markets—key factors for long-term trading success.

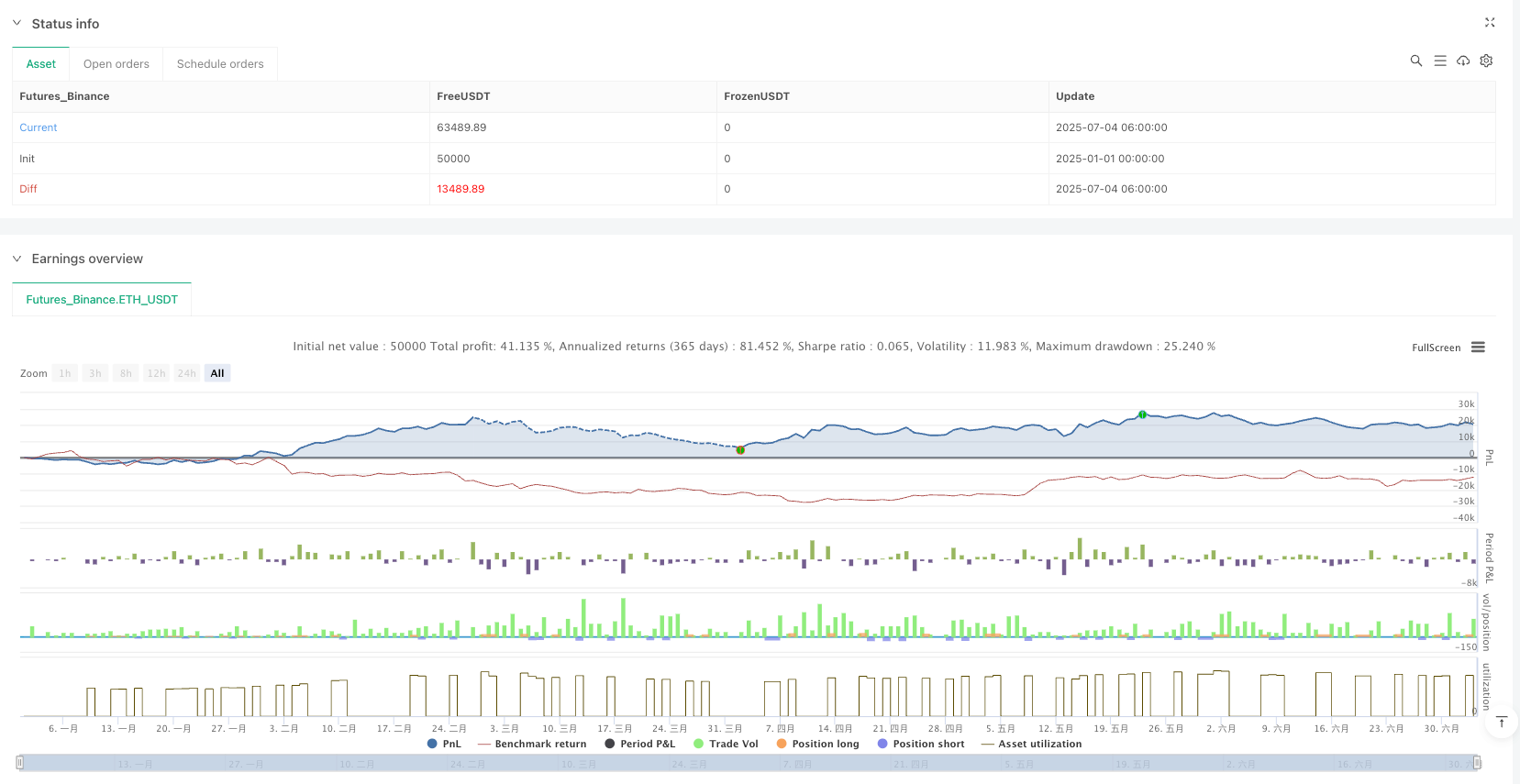

/*backtest

start: 2025-01-01 00:00:00

end: 2025-07-04 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("5 EMA STRATEGY by Power of Stocks(StockYogi)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

emaLen = input.int(5, title="EMA Length")

filterBuy = input.bool(true, title="Enable Buy Trades")

filterSell = input.bool(true, title="Enable Sell Trades")

targetRR = input.float(3.0, title="Target R:R (e.g. 3 = 1:3)")

entryOnCloseOnly = input.bool(false, title="Only Enter on Candle Close?")

// === TOGGLES ===

enableCustomExitTime = input.bool(true, title="Enable Custom Exit Time")

enableBlockTradeTime = input.bool(true, title="Enable Block Trade Time Window")

// === CUSTOM TIME SETTINGS ===

exitHour = input.int(15, title="Exit Hour (IST)", minval=0, maxval=23)

exitMinute = input.int(30, title="Exit Minute (IST)", minval=0, maxval=59)

blockStartHr = input.int(15, title="Block Start Hour (IST)", minval=0, maxval=23)

blockStartMn = input.int(0, title="Block Start Minute (IST)", minval=0, maxval=59)

blockEndHr = input.int(15, title="Block End Hour (IST)", minval=0, maxval=23)

blockEndMn = input.int(30, title="Block End Minute (IST)", minval=0, maxval=59)

// === TIME MANAGEMENT (IST) ===

ist = timestamp("Asia/Kolkata", year, month, dayofmonth, hour, minute)

istHour = hour(ist)

istMinute = minute(ist)

exitNow = enableCustomExitTime and (istHour == exitHour and istMinute == exitMinute)

// === ENTRY BLOCK ZONE LOGIC ===

afterBlockStart = istHour > blockStartHr or (istHour == blockStartHr and istMinute >= blockStartMn)

beforeBlockEnd = istHour < blockEndHr or (istHour == blockEndHr and istMinute < blockEndMn)

inBlockZone = enableBlockTradeTime and (afterBlockStart and beforeBlockEnd)

// === CALCULATE EMA ===

ema = ta.ema(close, emaLen)

plot(ema, color=color.orange, title="5 EMA")

// === SIGNAL CANDLE STORAGE ===

var float signalHigh = na

var float signalLow = na

var int signalIndex = na

var bool isBuySignal = false

var bool isSellSignal = false

// === SIGNAL CONDITIONS ===

newBuySignal = close < ema and high < ema

newSellSignal = close > ema and low > ema

if newBuySignal

signalHigh := high

signalLow := low

signalIndex := bar_index

isBuySignal := true

isSellSignal := false

if newSellSignal

signalHigh := high

signalLow := low

signalIndex := bar_index

isBuySignal := false

isSellSignal := true

// === HIGHLIGHT SIGNAL BAR ===

isSignalBar = bar_index == signalIndex

barcolor(isSignalBar ? color.blue : na)

// === TRIGGER CONDITIONS ===

withinWindow = bar_index > signalIndex and bar_index <= signalIndex + 3

buyTrigger = isBuySignal and withinWindow and high > signalHigh and not inBlockZone

sellTrigger = isSellSignal and withinWindow and low < signalLow and not inBlockZone

// === UNIQUE TRADE ID GENERATOR ===

getId(prefix) =>

var int counter = 0

counter += 1

prefix + "_" + str.tostring(counter)

// === BUY ENTRY ===

if buyTrigger and filterBuy

entry = signalHigh

sl = signalLow

risk = entry - sl

target = entry + risk * targetRR

tradeId = getId("Buy")

if entryOnCloseOnly

if close > signalHigh

strategy.entry(tradeId, strategy.long)

strategy.exit("TP_" + tradeId, from_entry=tradeId, limit=target, stop=sl)

else

strategy.entry(tradeId, strategy.long, stop=entry)

strategy.exit("TP_" + tradeId, from_entry=tradeId, limit=target, stop=sl)

// === SELL ENTRY ===

if sellTrigger and filterSell

entry = signalLow

sl = signalHigh

risk = sl - entry

target = entry - risk * targetRR

tradeId = getId("Sell")

if entryOnCloseOnly

if close < signalLow

strategy.entry(tradeId, strategy.short)

strategy.exit("TP_" + tradeId, from_entry=tradeId, limit=target, stop=sl)

else

strategy.entry(tradeId, strategy.short, stop=entry)

strategy.exit("TP_" + tradeId, from_entry=tradeId, limit=target, stop=sl)

// === TIME-BASED EXIT FOR ALL TRADES ===

if exitNow

strategy.close_all(comment="Exited at Custom Time")