Overview

This is a quantitative trading strategy based on Fair Value Gaps (FVG), inspired by Smart Money Concepts (SMC) and institutional price inefficiency theories. The strategy identifies micro-imbalances in the market and triggers trading signals when price re-enters these zones. With fixed 0.10% stop-loss and take-profit settings, it’s designed for scalpers and algorithmic traders seeking to capture subtle market movements with strict risk control.

Strategy Principles

The core of this strategy is identifying and utilizing Fair Value Gaps (FVG). An FVG represents an area that price has skipped over in a short period, indicating a price level that hasn’t been adequately traded and is likely to be revisited.

The strategy recognizes two types of FVGs: 1. Bullish FVG: Forms when the current candle’s low is higher than the high of the candle two periods back, and the middle candle’s close is above the high of the candle two periods back. 2. Bearish FVG: Forms when the current candle’s high is lower than the low of the candle two periods back, and the middle candle’s close is below the low of the candle two periods back.

The trading logic works as follows: - A long entry is triggered when price re-enters a bullish FVG zone. - A short entry is triggered when price re-enters a bearish FVG zone. - A fixed 0.10% stop-loss and take-profit level is set for each trade.

The strategy also includes a threshold filter to screen for gaps of significant size, avoiding minor market noise. Users can set the threshold percentage manually or choose an automatic mode that dynamically adjusts the threshold based on historical volatility.

Strategy Advantages

Micro Market Structure Recognition: The strategy captures micro market structures and imbalances that conventional technical analysis might miss, often representing institutional money footprints.

Precise Entry Points: Through clearly defined FVG conditions, the strategy provides objective, precise entry signals, reducing errors from subjective judgment.

Strict Risk Control: The fixed 0.10% stop-loss setting ensures that risk is strictly controlled for each trade, suitable for traders with rigorous money management.

High Scalability: The strategy framework is flexible and can be adapted to different market conditions by adding additional filters or adjusting parameters.

No Repainting Issues: The code implementation avoids repainting problems, ensuring consistency between historical backtest results and live performance.

Multi-Timeframe Adaptability: Users can customize the timeframe parameter, making the strategy adaptable to different trading environments from 1-minute to higher timeframes.

Strategy Risks

High Frequency of Short-Term Trades: Since the strategy targets micro imbalances, it may generate numerous trading signals, increasing trading costs, especially in high-frequency trading environments.

Noise Interference: In low-volatility or ranging markets, FVG signals may contain more noise, leading to an increase in false signals.

Fixed Stop-Loss Risk: While the fixed 0.10% stop-loss provides strict risk control, it may be too tight in highly volatile markets, causing frequent triggers.

Trend Reversal Risk: In strong trending markets, counter-trend FVG signals may lead to trades against the main trend, increasing the probability of losses.

Parameter Sensitivity: The threshold parameter setting significantly impacts strategy performance; inappropriate parameters may lead to over-optimization or missing effective signals.

Methods to reduce risks include: - Incorporating trend direction filters from higher timeframes - Increasing threshold requirements in low-volatility markets - Dynamically adjusting stop-loss and take-profit levels based on market volatility - Implementing volume filters to avoid trading in low-liquidity environments

Strategy Optimization Directions

Adaptive Threshold System: The current strategy already includes an automatic threshold option, but it could be further optimized to an adaptive system based on market volatility indicators (such as ATR), making FVG identification more precisely adapted to the current market state.

Multi-Timeframe Confirmation: Introduce multi-timeframe analysis to execute trades only when the higher timeframe trend direction aligns with the FVG signal, improving win rates.

Dynamic Stop-Loss/Take-Profit: Replace the fixed 0.10% stop-loss/take-profit with dynamic settings based on market volatility, automatically widening the stop-loss range when volatility increases and narrowing it when volatility decreases.

Volume Confirmation: Add volume analysis during FVG formation and price re-entry, executing trades only when supported by sufficient volume, reducing false signals.

Market State Classification: Implement an automatic recognition system for market states (trending, ranging, high/low volatility) to adjust strategy parameters or pause trading according to different market conditions.

Machine Learning Enhancement: Use machine learning algorithms to analyze the success rate of historical FVG patterns and build predictive models to evaluate the potential success probability of current FVG signals.

These optimization directions not only enhance the strategy’s robustness but also improve its adaptability to different market environments, potentially increasing overall returns and reducing drawdowns.

Summary

The Fair Value Gap strategy is a technically sophisticated quantitative trading system focused on capturing price imbalances in market microstructure. Through accurate identification of FVGs and precise execution, the strategy provides a trading framework with clear rules and strict risk control for scalpers and algorithmic traders.

While the strategy demonstrates the ability to capture micro price imbalances in its basic version, its performance can be further enhanced by implementing the proposed optimization directions, especially adaptive parameter systems and multi-timeframe confirmation. For traders seeking to execute disciplined quantitative trading strategies in short timeframes, this is a method worth considering.

Ultimately, the success of this strategy depends on the trader’s deep understanding of the FVG concept and the ability to adjust parameters according to different market conditions. Combined with appropriate risk management and continuous optimization, the Fair Value Gap strategy can be an effective tool in a quantitative trading portfolio.

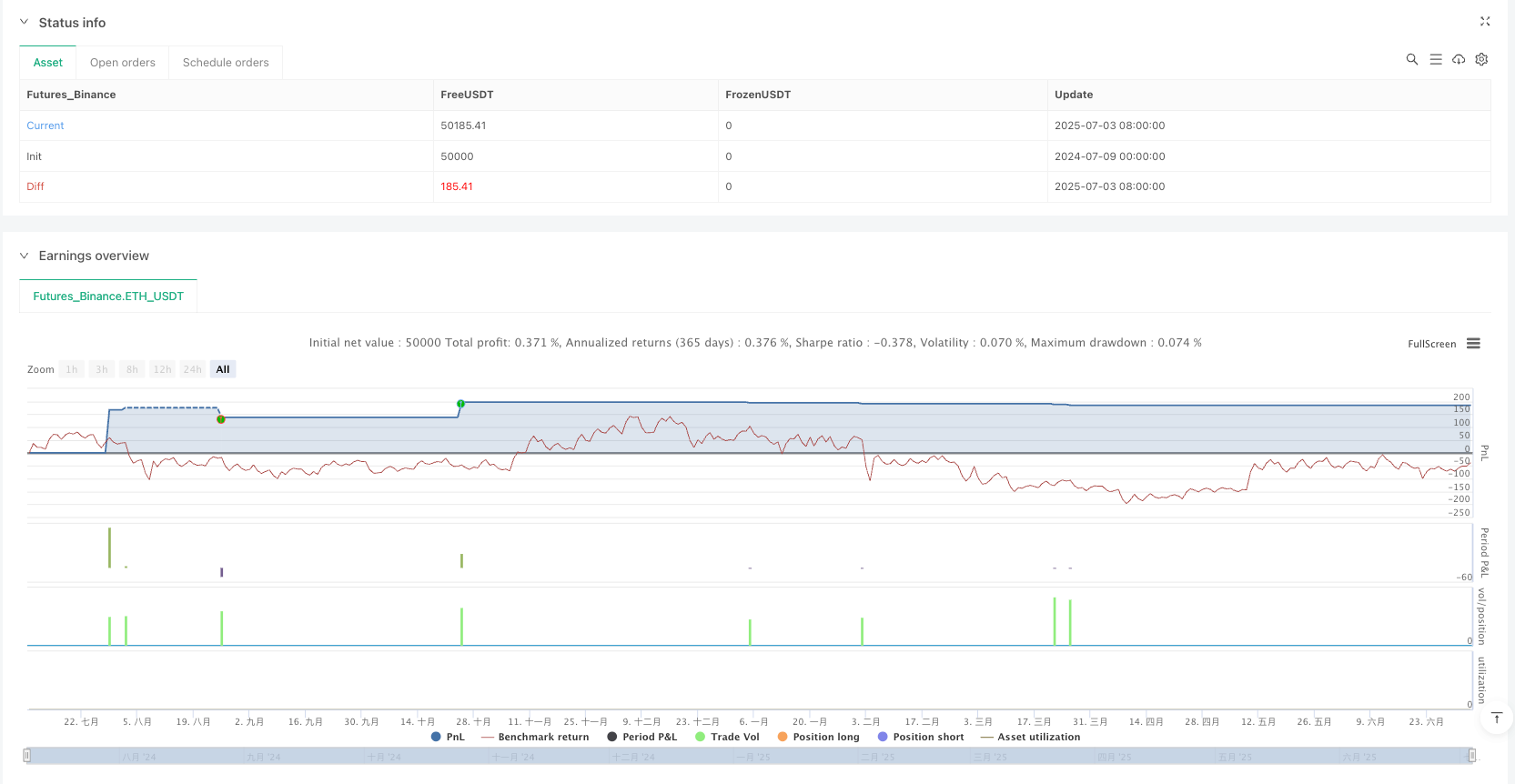

/*backtest

start: 2024-07-09 00:00:00

end: 2025-07-04 08:00:00

period: 4d

basePeriod: 4d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("FVG Strategy [algo ] - 0.10% TP/SL", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

thresholdPer = input.float(0, "Threshold %", minval = 0, maxval = 100, step = .1, inline = 'threshold')

auto = input(false, "Auto", inline = 'threshold')

tf = input.timeframe("", "Timeframe")

// SL/TP settings (0.10% each)

sl_pct = 0.10

tp_pct = 0.10

// === TYPE ===

type fvg

float max

float min

bool isbull

int t = time

// === DETECTION FUNCTION ===

detect() =>

var new_fvg = fvg.new(na, na, na, na)

threshold = auto ? ta.cum((high - low) / low) / bar_index : thresholdPer / 100

bull_fvg = low > high[2] and close[1] > high[2] and (low - high[2]) / high[2] > threshold

bear_fvg = high < low[2] and close[1] < low[2] and (low[2] - high) / high > threshold

if bull_fvg

new_fvg := fvg.new(low, high[2], true)

else if bear_fvg

new_fvg := fvg.new(low[2], high, false)

[bull_fvg, bear_fvg, new_fvg]

// === FVG Detection ===

[bull_fvg, bear_fvg, new_fvg] = request.security(syminfo.tickerid, tf, detect())

var fvg_records = array.new<fvg>(0)

var t = 0

if (bull_fvg or bear_fvg) and new_fvg.t != t

array.unshift(fvg_records, new_fvg)

t := new_fvg.t

// === ENTRY STRATEGY ===

if array.size(fvg_records) > 0

latest = array.get(fvg_records, 0)

// BUY Logic

if latest.isbull and close <= latest.max and close >= latest.min and strategy.position_size <= 0

sl = close * (1 - sl_pct / 100)

tp = close * (1 + tp_pct / 100)

strategy.entry("Buy FVG", strategy.long)

strategy.exit("TP/SL Long", from_entry="Buy FVG", stop=sl, limit=tp)

// SELL Logic

if not latest.isbull and close >= latest.min and close <= latest.max and strategy.position_size >= 0

sl = close * (1 + sl_pct / 100)

tp = close * (1 - tp_pct / 100)

strategy.entry("Sell FVG", strategy.short)

strategy.exit("TP/SL Short", from_entry="Sell FVG", stop=sl, limit=tp)

// === VISUALIZE FVG ZONES ===

plotshape(bull_fvg, title="Bullish FVG", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(bear_fvg, title="Bearish FVG", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)