Overview

The Volatility Momentum and Volume-Weighted Trend Crossover Strategy is a quantitative trading system based on market entropy, designed to identify transition points from low to high volatility for trading decisions. This strategy combines two key indicators: the Volatility Momentum Index (VMI) and the Volume-Weighted Price Center (VWPC). VMI measures volatility acceleration to time entries during market transitions from calm to active phases and exits when volatility reaches chaos thresholds; while VWPC serves as a volume-based trend filter using typical price to determine overall market direction. This combination approach aims to capture market transitions from low to high volatility while ensuring trade direction aligns with the overall trend.

Strategy Principles

The core principle of this strategy is to leverage market volatility cycle changes and trend direction for trading decisions. Specifically:

Volatility Momentum Index (VMI) Calculation:

- First calculates the current Average True Range (ATR) and its change

- Distinguishes between upward acceleration (ATR rising) and downward acceleration (ATR falling)

- Smooths these acceleration values using a moving average (RMA)

- Calculates relative strength and converts it to a VMI value in the 0-100 range

Volume-Weighted Price Center (VWPC) Calculation:

- Based on typical price (average of high, low, and close) and volume

- Weights typical price with corresponding volume to create an indicator that emphasizes price levels with high trading volume

- This indicator can be viewed as the market’s “center of gravity,” helping determine overall trend direction

Trading Logic Implemented in Two Phases:

- Setup Phase (“Armed” condition): Checks if VMI has been in the calm zone (below the set calm zone threshold) recently

- Trigger Phase (“Fire” condition): Triggered when VMI crosses above the calm zone threshold

- Entry conditions: Simultaneously satisfies trend direction (price above VWPC for uptrend, vice versa for downtrend) and the above two phase conditions

- Exit conditions: Closes positions when VMI reaches the chaos zone threshold (indicating peak volatility)

The strategy allows configuration of trading direction (long-only, short-only, or bidirectional) and optimization of various parameters to adapt to different market environments.

Strategy Advantages

Deep analysis of the strategy code reveals the following advantages:

Market Cycle-Based Trade Timing: The strategy identifies market transition points from low to high volatility through the VMI indicator, often representing the beginning of new price movements, helping to enter at the early stages of trends.

Volume-Enhanced Trend Confirmation: VWPC provides a more representative trend indicator than simple moving averages by incorporating volume weight, reducing false signals.

Clear Entry and Exit Conditions: The strategy has well-defined entry logic (volatility beginning to increase) and exit logic (volatility reaching extremes), avoiding subjective judgment.

High Adaptability: Through parameter optimization, the strategy can adapt to different market environments and trading instruments. In particular, the VMI calm zone and chaos zone thresholds can be adjusted according to market characteristics.

Integrated Risk Management: The strategy incorporates position management (default using 15% of account equity) and reverse trade restrictions (pyramiding=0), helping to control risk.

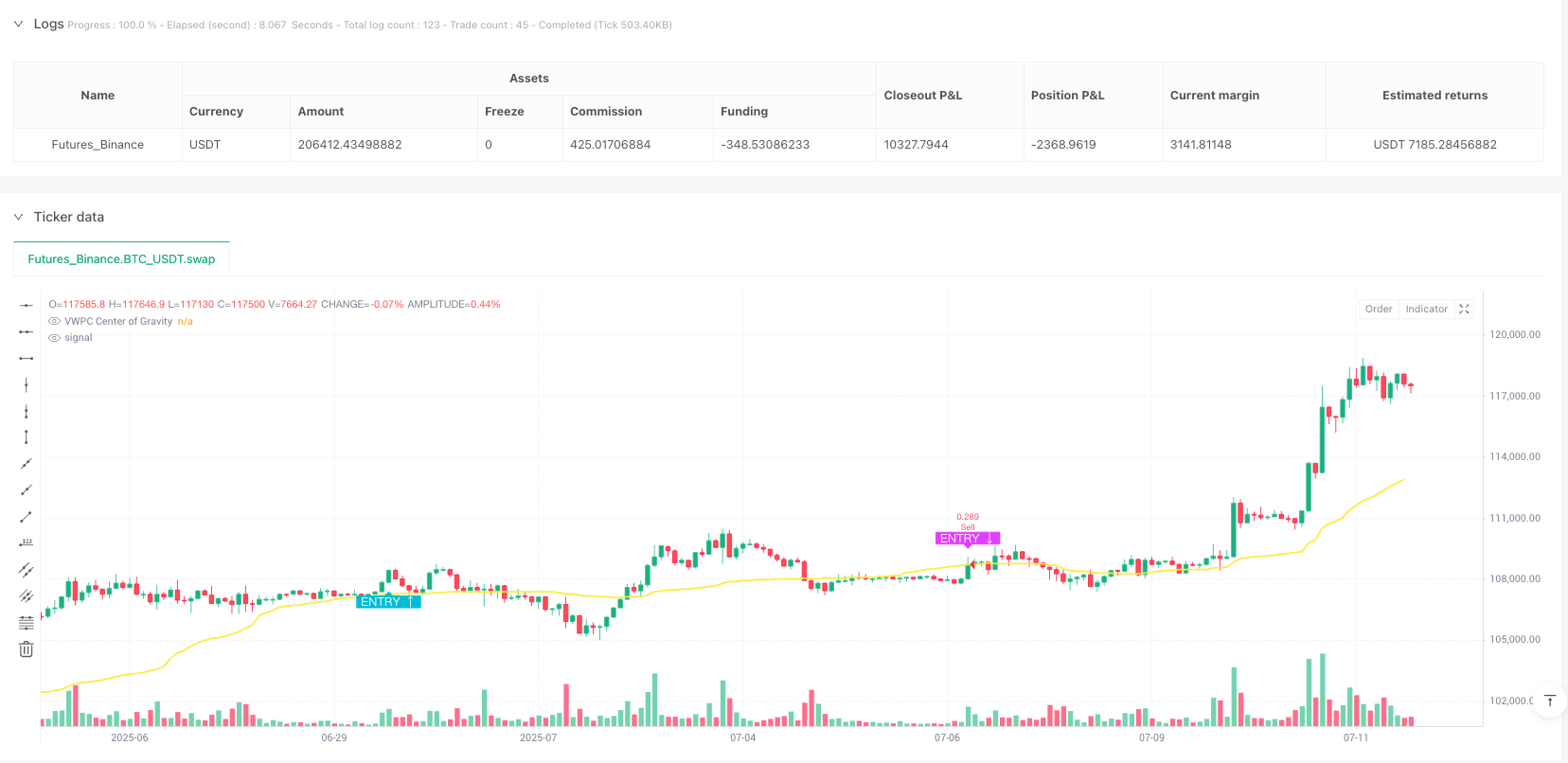

Visual Assistance: The strategy plots the VWPC trend line and entry/exit signals on the chart, allowing traders to intuitively understand market conditions and strategy logic.

High Computational Efficiency: By using built-in functions such as ta.rma and ta.barssince, the strategy achieves high computational efficiency, suitable for real-time trading applications.

Strategy Risks

Despite its many advantages, the strategy also has the following potential risks:

Volatility False Breakout Risk: Markets may exhibit brief increases in volatility followed by rapid declines, leading to false signals. The solution is to adjust the VMI calm zone threshold or add confirmation conditions.

Trend Judgment Delay: VWPC as a trend indicator may have a certain lag, potentially failing to respond timely during rapid market reversals. Consider incorporating short-term momentum indicators for auxiliary judgment.

Parameter Sensitivity: Strategy performance is relatively sensitive to parameter settings (especially VMI length and thresholds), and different market environments may require different parameter combinations. Parameter optimization through backtesting for different market environments is recommended.

Trading Frequency Uncertainty: As the strategy is based on volatility changes, the frequency of trading signals may vary greatly in different market phases, affecting overall returns and drawdown control.

Trading Cost Impact: Although the strategy considers trading commissions (0.075%), in actual trading, slippage and other trading costs may further impact strategy performance.

Dependence on Volume Data: The VWPC indicator relies on volume data, which may be inaccurate or unreliable in certain markets or time periods, affecting indicator accuracy.

Strategy Optimization Directions

Through in-depth analysis of the code, the following optimization directions can be proposed:

Add Volatility Filter: Introduce a dynamic threshold adjustment mechanism based on historical volatility, allowing VMI’s calm zone and chaos zone thresholds to automatically adjust according to overall market volatility levels, improving strategy adaptability.

Enhance Trend Confirmation Mechanism: Add multi-timeframe trend confirmation on top of VWPC, or combine with other trend indicators (such as the Directional Movement Index ADX) to improve trend judgment accuracy.

Optimize Exit Mechanism: The current strategy only exits when VMI reaches the chaos zone. Consider adding stop-loss and profit target levels, or implementing dynamic stop-loss strategies based on volatility to better control risk and lock in profits.

Add Volume Filter: Add volume confirmation conditions to only enter when volume increases, avoiding trading in low liquidity environments.

Incorporate Time Filter: Some markets may exhibit volatility patterns during specific time periods. Adding time filtering conditions can help avoid known inefficient trading periods.

Parameter Self-Adaptive Mechanism: Develop a mechanism that automatically adjusts parameters based on recent market performance, allowing the strategy to better adapt to market changes.

Optimize Capital Management: Implement volatility-based dynamic position sizing to adjust trading size in different volatility environments, balancing risk and return.

Summary

The Volatility Momentum and Volume-Weighted Trend Crossover Strategy is a quantitative trading system combining volatility analysis and trend following. It uses the VMI indicator to capture market transition points from calm to active for entry and exits when volatility peaks; while using the VWPC indicator to ensure trade direction aligns with the overall trend. The core advantage of this strategy lies in its ability to capture critical turning points in market volatility cycles while filtering trend direction with volume information to improve trade quality.

However, the strategy also faces challenges such as volatility false breakouts, trend judgment delays, and parameter sensitivity. By introducing dynamic threshold adjustments, enhancing trend confirmation mechanisms, optimizing exit logic, and implementing adaptive parameters, the strategy’s robustness and adaptability can be further improved.

Ultimately, this strategy provides a trading framework based on market entropy and volatility cycles, suitable for application in various market environments. Traders still need to optimize parameters and adjust the strategy according to specific trading instruments and market characteristics to achieve optimal results.

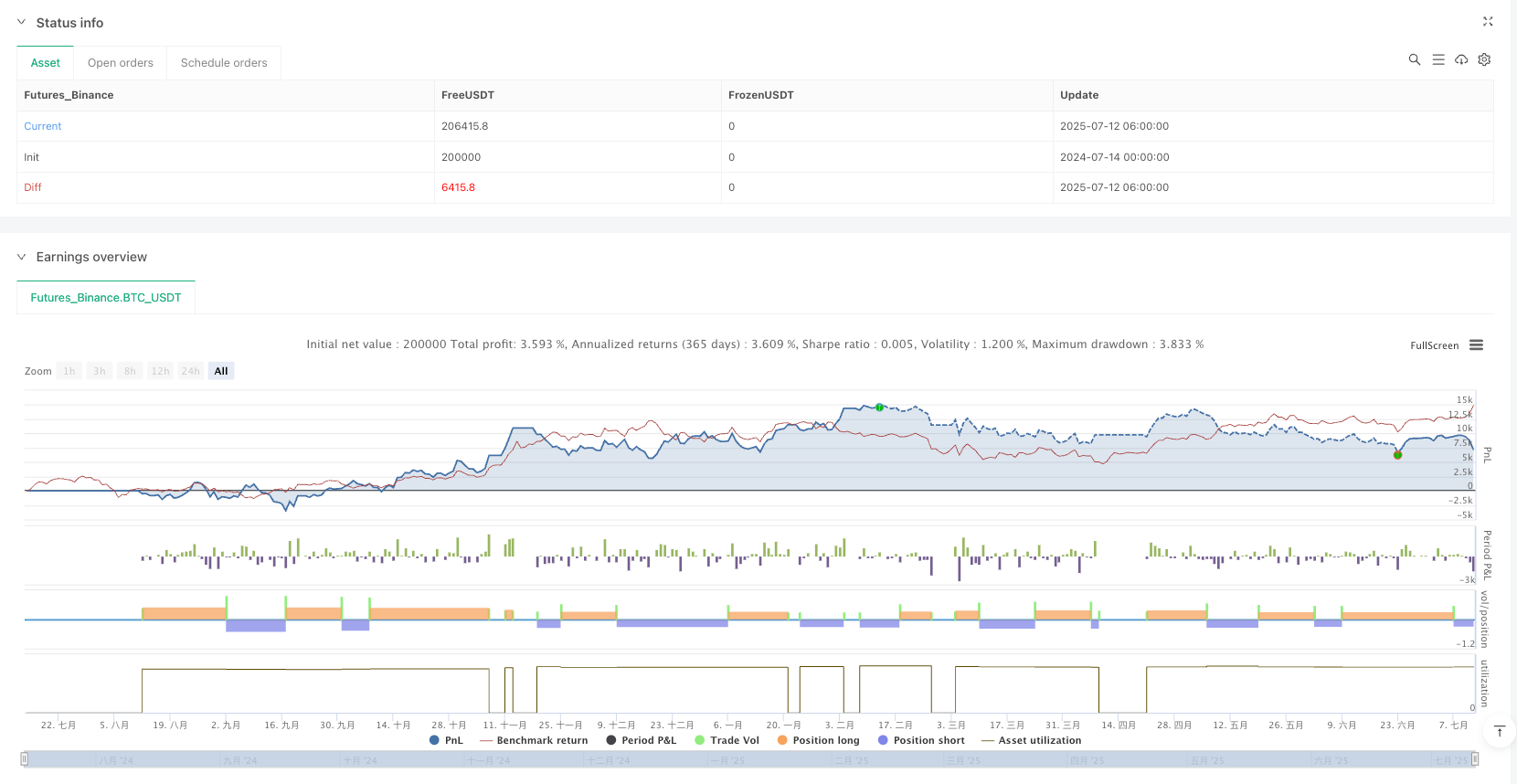

/*backtest

start: 2024-07-14 00:00:00

end: 2025-07-12 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TiamatCrypto

//@version=5

strategy("Market Entropy Strategy V2.5",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=15, // Slightly more aggressive allocation

commission_type=strategy.commission.percent,

commission_value=0.075,

pyramiding=0) // Allow only one trade in one direction

// --- General Settings ---

trade_direction = input.string("Both", "Trade Direction", options=["Long", "Short", "Both"], group="General Settings")

// --- Inputs for Optimization ---

// VMI Settings

vmi_length = input.int(14, "VMI Length", group="VMI Settings")

atr_period = input.int(10, "ATR Period for VMI", group="VMI Settings")

vmi_calm_zone = input.int(25, "VMI Calm Zone (Entry Level)", group="VMI Settings", step=5)

vmi_chaos_zone = input.int(85, "VMI Chaos Zone (Exit Level)", group="VMI Settings", step=5)

// VWPC Settings

vwpc_length = input.int(50, "VWPC Filter Length", group="VWPC Trend Filter")

setup_lookback = input.int(10, "How far to look for 'Armed' (candles)", group="Entry Logic")

// --- Indicator #1: Volatility Momentum Index (VMI) ---

current_atr = ta.atr(atr_period)

atr_change = current_atr - current_atr[1]

up_accel = atr_change > 0 ? atr_change : 0

down_accel = atr_change < 0 ? -atr_change : 0

avg_up_accel = ta.rma(up_accel, vmi_length)

avg_down_accel = ta.rma(down_accel, vmi_length)

rs_vmi = avg_down_accel == 0 ? 0 : avg_up_accel / avg_down_accel

vmi = avg_down_accel == 0 ? 100 : avg_up_accel == 0 ? 0 : 100 - (100 / (1 + rs_vmi))

// --- Indicator #2: Volume-Weighted Price Center (VWPC) ---

// Function to calculate VWPC

f_vwpc(length) =>

sum_price_volume = 0.0

sum_volume = 0.0

// We use the typical price, which better represents the candle

typical_price = (high + low + close) / 3

for i = 0 to length - 1

sum_price_volume += typical_price[i] * nz(volume[i])

sum_volume += nz(volume[i])

sum_volume == 0 ? typical_price : sum_price_volume / sum_volume

vwpc = f_vwpc(vwpc_length)

// --- Strategy Logic ---

// Trend Definition

is_uptrend = close > vwpc

is_downtrend = close < vwpc

// Phase 1: "Armed" Condition (Setup)

// We check if VMI WAS in the calm zone in the recent past

was_calm_recently = ta.barssince(vmi < vmi_calm_zone) < setup_lookback

// Phase 2: "Fire" Condition (Trigger)

// VMI is currently crossing the Calm Zone upwards

trigger_fire = ta.crossover(vmi, vmi_calm_zone)

// Combination for ENTRY

buy_signal = is_uptrend and was_calm_recently and trigger_fire

sell_signal = is_downtrend and was_calm_recently and trigger_fire

// Condition for EXIT ("Exhaustion")

// The same condition applies for both long and short - peak chaos

exit_signal = ta.crossover(vmi, vmi_chaos_zone)

// --- Executing Orders ---

// Entry Conditions

allow_longs = trade_direction == "Long" or trade_direction == "Both"

allow_shorts = trade_direction == "Short" or trade_direction == "Both"

// Entries

if (buy_signal and allow_longs)

strategy.entry("Buy", strategy.long, comment="Enter LONG (Armed->Fire)")

if (sell_signal and allow_shorts)

strategy.entry("Sell", strategy.short, comment="Enter SHORT (Armed->Fire)")

// Exits

if (strategy.position_size > 0 and exit_signal)

strategy.close("Buy", comment="Exit LONG (Chaos)")

if (strategy.position_size < 0 and exit_signal)

strategy.close("Sell", comment="Exit SHORT (Chaos)")

// --- Plotting on the chart for visual inspection ---

plot(vwpc, "VWPC Center of Gravity", color=color.new(color.yellow, 0), linewidth=2)

plotshape(buy_signal and allow_longs, "LONG Entry", shape.labelup, location.belowbar, color=color.new(color.aqua, 0), text="ENTRY ↑", textcolor=color.white, size=size.small)

plotshape(sell_signal and allow_shorts, "SHORT Entry", shape.labeldown, location.abovebar, color=color.new(color.fuchsia, 0), text="ENTRY ↓", textcolor=color.white, size=size.small)

// Plotting the exit signal for a better overview

exit_marker_y_pos = strategy.position_size > 0 ? high : low

plotshape(series=(exit_signal and strategy.position_size != 0 ? exit_marker_y_pos : na), title="Exit", style=shape.xcross, location=location.absolute, color=color.new(color.orange, 0), size=size.tiny, text="END")