Overview

The New York Opening Range Breakout Strategy is a quantitative trading approach based on the principle of market opening range breakouts, designed to capitalize on the high volatility characteristics of the New York market opening session. This strategy captures breakout signals formed during the first 30 minutes after opening (at 8:30), establishing strict entry rules and risk management mechanisms to secure efficient trading opportunities. The core of the strategy lies in identifying the high and low points of the Opening Range (ORB), triggering trade signals when price breaks through these key levels, and implementing dynamic stop-loss and profit target settings to optimize the risk-reward ratio.

Strategy Principles

The core principle of this strategy is based on the high volatility and directionality often exhibited by markets during opening sessions, implemented through the following key steps:

- Range Determination: At 8:30 (New York opening session) each trading day, the strategy records the high and low of the current candle as the upper and lower boundaries of the Opening Range (ORB).

- Breakout Signals: When price closes above the ORB high, a long signal is triggered; when price closes below the ORB low, a short signal is triggered.

- Risk Management: The strategy establishes precise risk control mechanisms, with the risk unit defined as the distance between the ORB high and low.

- Dynamic Stop Loss: Initial stop loss is set at the corresponding ORB boundary (long stop at ORB low, short stop at ORB high).

- Profit Targets: Target profits are set using an adjustable risk-reward ratio (default 2.0), calculated as multiples of the risk unit.

- Moving Stop Loss: When price reaches a certain profit level (1:1 risk-reward ratio), the stop loss is moved to breakeven, protecting accrued profits.

- Trade Limitations: The strategy sets a maximum number of trades per day (default 8) to avoid overtrading.

- Sequence Management: Implements trade sequence control logic to prevent repetitive triggering of trades in the same direction within the same range.

The strategy achieves efficient trade execution and risk control through strict condition evaluations and state management. The code employs multiple boolean variables and conditional checks to track trade status, ensuring accuracy and consistency in trade execution.

Strategy Advantages

Through in-depth code analysis, this strategy demonstrates the following significant advantages:

- Clear and Intuitive: Strategy rules are clear and specific, easy to understand and execute, suitable for traders of all levels.

- Volatility Utilization: Specifically designed to target the high volatility characteristics of the New York opening session, effectively capturing profit opportunities from significant price movements.

- Precise Risk Control: Achieves precise risk management through clearly defined risk units and dynamic stop-loss strategies.

- Dynamic Stop Loss Optimization: Automatically moves stop loss to breakeven when a 1:1 risk-reward ratio is achieved, both securing partial profits and allowing for continued market development.

- Flexible Parameter Adjustment: Risk-reward ratio can be adjusted through input parameters, adapting the strategy to different market environments and personal risk preferences.

- Trade Frequency Control: Sets maximum daily trade count limits to avoid overtrading and excessive exposure to market risk.

- Automated Execution: Fully coded strategy logic enables automated trade execution, reducing human intervention and emotional influence.

- Visualization Support: Provides visualization of key price levels and trade signal markers, facilitating strategy monitoring and backtesting analysis.

- Alert Functionality: Built-in trade signal alert conditions for real-time monitoring and notifications.

Strategy Risks

Despite its sophisticated design, the strategy still faces the following potential risks and challenges:

- False Breakout Risk: After an opening range breakout, false breakouts and price retracements may occur, triggering stop losses. Consider adding confirmation indicators or delayed entry logic as a solution.

- Volatility Dependency: Strategy effectiveness is highly dependent on market volatility, potentially underperforming in low-volatility market environments. Consider adding volatility filters to enable the strategy only when minimum volatility conditions are met.

- Fixed Timeframe Limitations: The strategy is based solely on the 8:30 opening range, potentially missing effective trading opportunities at other time periods. Consider extending to multiple time windows or dynamic time windows.

- Market Noise Interference: Short-term price fluctuations may trigger unnecessary trades. Consider adding price filters or using higher timeframe confirmation signals.

- Parameter Sensitivity: Strategy performance may be highly sensitive to parameter settings such as risk-reward ratio. Comprehensive parameter optimization and robustness testing are recommended.

- Trading Cost Impact: Failure to consider trading costs may lead to discrepancies between backtesting results and actual performance. Trading costs should be incorporated into strategy evaluation for practical application.

- Insufficient Fund Management: While the strategy includes risk control mechanisms, it lacks a complete fund management system. Consider adding dynamic position management functionality to adjust trading size based on account size and market conditions.

Strategy Optimization Directions

Based on code analysis, the following are potential strategy optimization directions:

- Multiple Timeframe Analysis: Integrate market trend information from higher timeframes, executing trades only when trend direction is consistent, improving success rates.

- Dynamic Risk-Reward Settings: Dynamically adjust risk-reward ratios based on market volatility or other market state indicators to optimize performance in different market environments.

- Additional Filtering Conditions: Introduce additional technical indicators or market sentiment indicators as trade filters, such as moving averages, Relative Strength Index (RSI), or Volume Weighted Average Price (VWAP).

- Entry Timing Optimization: Consider using price action patterns or candlestick formations as additional entry confirmations to reduce losses from false breakouts.

- Improved Stop Loss Strategy: Implement more sophisticated trailing stop mechanisms, such as ATR (Average True Range) based dynamic stops or stops adjusted according to market noise levels.

- Enhanced Fund Management: Implement dynamic position management systems based on volatility and win rates to optimize capital efficiency and risk control.

- Seasonal Adjustments: Analyze and utilize market seasonality patterns, adjusting strategy parameters or trading conditions under different market seasonal conditions.

- Diversified Exit Strategies: Implement partial profit-taking mechanisms, allowing for phased position closing at different price levels to optimize overall profit performance.

- Machine Learning Optimization: Consider using machine learning algorithms to predict breakout effectiveness or optimize strategy parameters, enhancing strategy adaptability and robustness.

Conclusion

The New York Opening Range Breakout Strategy is a well-designed, rule-clear quantitative trading strategy that captures market opening session high volatility characteristics, combining strict risk management and trade execution rules to provide traders with a reliable trading method. The core advantages of this strategy lie in its clear, intuitive logic and precise risk control mechanisms, effectively balancing risk and reward through dynamic stop loss and profit target settings.

However, the strategy also faces challenges such as false breakouts, volatility dependency, and parameter sensitivity. By introducing multiple timeframe analysis, dynamic risk-reward settings, optimizing entry timing, and improving stop-loss strategies, the robustness and profitability of the strategy can be further enhanced. Particularly, combining technical indicator filters and machine learning methods holds promise for significantly improving the strategy’s adaptability across different market environments.

For traders looking to leverage market opening high volatility characteristics, this strategy provides a structured framework. By strictly following strategy rules and adjusting parameters according to personal risk preferences, traders can build an efficient, robust trading system.

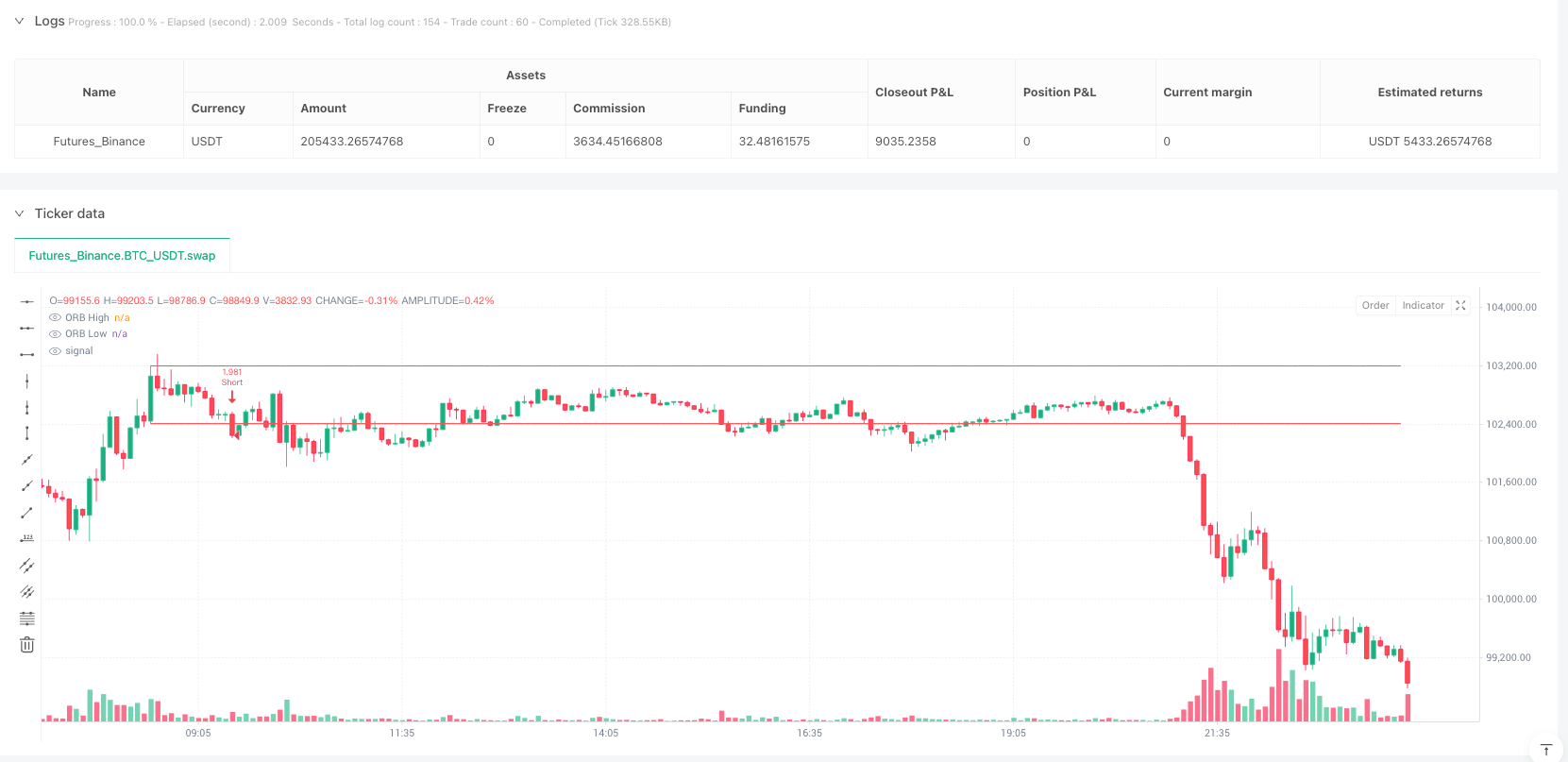

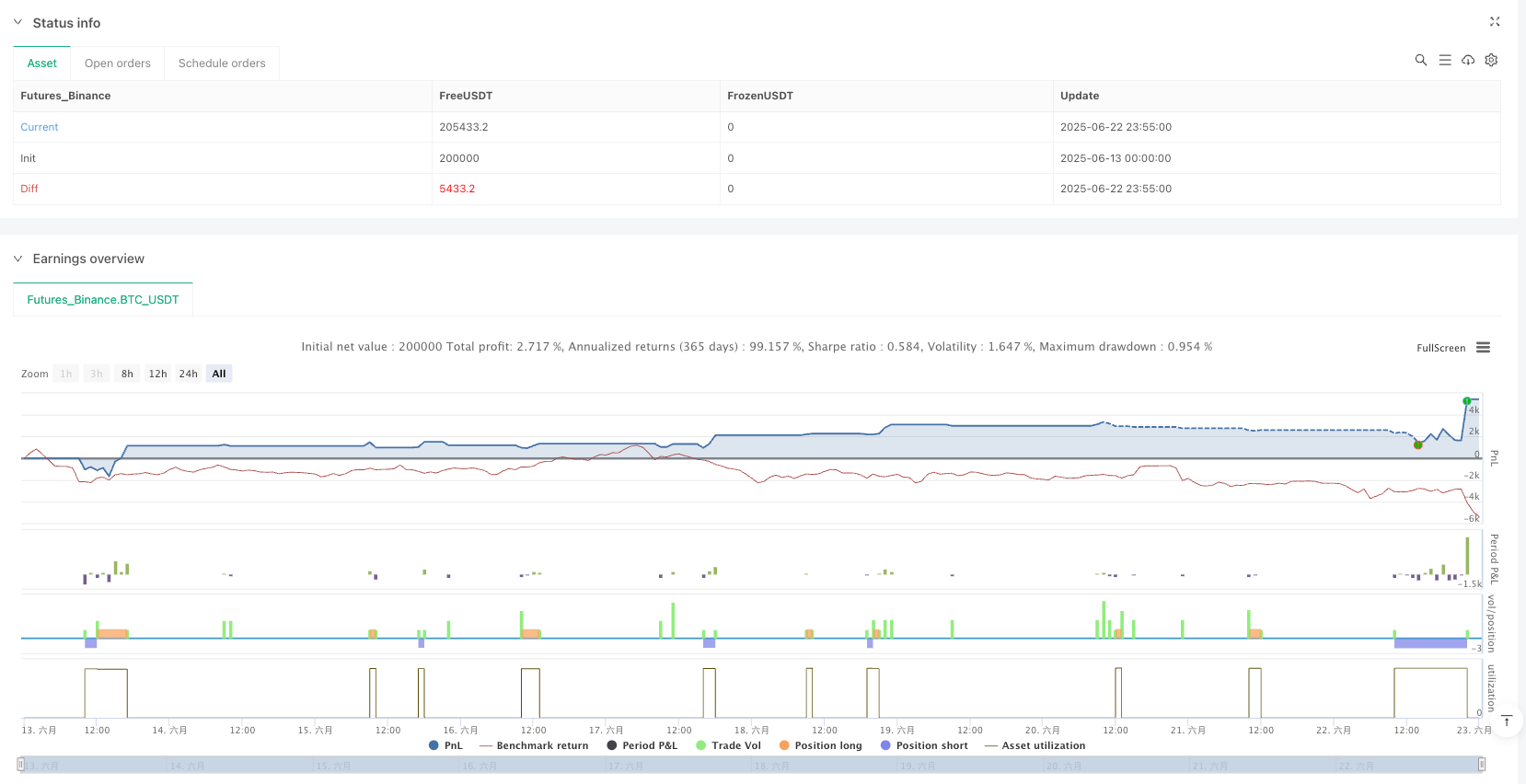

/*backtest

start: 2025-06-13 00:00:00

end: 2025-06-23 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

//@version=5

strategy("The Price Model", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

rrRatio = input.float(2.0, "Take Profit RR", minval=1.0)

showLevels = input.bool(true, "Show ORB High/Low Levels")

maxTradesPerDay = 8

// === TIME SETUP ===

isNewDay = ta.change(time("D"))

is830 = (hour == 8 and minute == 30)

// === ORB VARIABLES ===

var float orbHigh = na

var float orbLow = na

var bool orbSet = false

var int tradeCount = 0

var bool longSequenceDone = false

var bool shortSequenceDone = false

if isNewDay

orbHigh := na

orbLow := na

orbSet := false

tradeCount := 0

longSequenceDone := false

shortSequenceDone := false

if is830

orbHigh := high

orbLow := low

orbSet := true

// === RISK/REWARD SETTINGS ===

risk = orbHigh - orbLow

longTP = orbHigh + (risk * rrRatio)

shortTP = orbLow - (risk * rrRatio)

longSL = orbLow

shortSL = orbHigh

longBE = orbHigh + risk

shortBE = orbLow - risk

// === ENTRY CONDITIONS ===

validLongBreak = not longSequenceDone and close > orbHigh

validShortBreak = not shortSequenceDone and close < orbLow

longCond = orbSet and validLongBreak and strategy.opentrades == 0 and tradeCount < maxTradesPerDay

shortCond = orbSet and validShortBreak and strategy.opentrades == 0 and tradeCount < maxTradesPerDay

// === TRADE TRACKING ===

var bool inLong = false

var bool inShort = false

var bool longMovedToBE = false

var bool shortMovedToBE = false

// === STRATEGY ENTRIES ===

if longCond

strategy.entry("Long", strategy.long)

inLong := true

inShort := false

longMovedToBE := false

shortMovedToBE := false

tradeCount += 1

longSequenceDone := true

shortSequenceDone := false

if shortCond

strategy.entry("Short", strategy.short)

inShort := true

inLong := false

longMovedToBE := false

shortMovedToBE := false

tradeCount += 1

shortSequenceDone := true

longSequenceDone := false

// === LONG MANAGEMENT ===

if inLong

if not longMovedToBE and close >= longBE

longMovedToBE := true

if longMovedToBE

strategy.exit("Long Exit BE", from_entry="Long", stop=orbHigh, limit=longTP)

else

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if longMovedToBE and close <= orbHigh

inLong := false

// === SHORT MANAGEMENT ===

if inShort

if not shortMovedToBE and close <= shortBE

shortMovedToBE := true

if shortMovedToBE

strategy.exit("Short Exit BE", from_entry="Short", stop=orbLow, limit=shortTP)

else

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

if shortMovedToBE and close >= orbLow

inShort := false

// === BLOCK RE-ENTRIES INSIDE ORB ===

if close < orbHigh and close > orbLow

if longSequenceDone

longSequenceDone := true

if shortSequenceDone

shortSequenceDone := true

// === PLOTTING ===

plotshape(longCond, title="Buy", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCond, title="Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plot(showLevels and orbSet ? orbHigh : na, title="ORB High", color=color.green, linewidth=1)

plot(showLevels and orbSet ? orbLow : na, title="ORB Low", color=color.red, linewidth=1)

// === ALERTS ===

alertcondition(longCond, title="Long Entry", message="ORB Long Entry Triggered")

alertcondition(shortCond, title="Short Entry", message="ORB Short Entry Triggered")