Overview

The Multi-Filter RSI(2) Reversal Trading Strategy is a quantitative trading approach that combines ultra-short-term Relative Strength Index (RSI) with multiple filtering conditions. This strategy primarily captures market rebounds after oversold conditions by identifying potential buying opportunities through RSI(2) readings below 20, while ensuring trade quality through a triple filter system incorporating trend, volume, and candlestick patterns. The strategy also features three exit mechanisms: profit at close, RSI overbought signal, and time limit, which protect profits and control risk under various market conditions.

Strategy Principles

The core principle of this strategy is based on the ultra-short-term reversal characteristics of RSI(2), implemented through the following logic:

Entry Conditions:

- RSI(2) indicator value below 20, indicating severe short-term oversold market conditions

- Price above both the 80-day Exponential Moving Average (EMA80) and 200-day Simple Moving Average (MA200), ensuring an uptrend

- Current volume greater than the 20-day average volume, providing sufficient market activity

- Reversal candle (close higher than open), indicating buying pressure starting to dominate

Exit Conditions:

- Profit at Close: When price is higher than the entry price

- RSI Overbought Signal: When RSI(2) value exceeds 70

- Time Limit: Automatic exit after holding for 7 trading days

By combining short-term oversold reversal signals with multiple filtering conditions, this strategy effectively identifies high-probability rebound opportunities while protecting profits and controlling position risk through multiple exit mechanisms.

Strategy Advantages

Multiple Filtering Mechanism: By combining trend, volume, and candlestick pattern filters, the strategy significantly improves the quality of entry signals and reduces false signals.

Flexible Exit Mechanism: The three exit conditions (profit at close, RSI overbought, and time limit) provide a comprehensive risk management framework adaptable to different market situations.

Ultra-Short-Term RSI Usage: RSI(2) is more sensitive than the traditional RSI(14), allowing for quicker detection of short-term oversold conditions and improving trading timeliness.

Trend Confirmation: Requiring price to be above key moving averages ensures trading occurs within an overall uptrend, increasing the success rate.

Volume Verification: Volume filtering ensures trades occur during active market periods, improving the reliability of price reversals.

Visual Assistance: The strategy includes visual markers for entry and exit signals, facilitating backtest analysis and real-time monitoring.

Strategy Risks

RSI Reversal False Signals: RSI(2) is extremely sensitive and may generate false signals under certain market conditions, especially in highly volatile environments. Solution: The triple filtering conditions mitigate this issue to some extent, but RSI thresholds may still need adjustment across different market environments.

Fixed Exit Mechanism Limitations: The fixed RSI exit threshold (70) and time limit (7 days) may not be suitable for all market conditions. Solution: Adjust these parameters based on different market characteristics and volatility, or consider adding dynamic threshold adjustment mechanisms.

Trend Change Risk: Even when price is above moving averages, market trends can suddenly reverse. Solution: Consider adding more trend indicators or price structure analysis to improve trend judgment accuracy.

Volume Misleading: Sometimes high volume may be driven by selling rather than buying pressure, leading to incorrect judgments. Solution: Consider combining other volume indicators such as OBV (On-Balance Volume) to further confirm the buying/selling power balance.

Parameter Sensitivity: The strategy relies on multiple fixed parameters that may require frequent adjustment in different market environments. Solution: Consider introducing adaptive parameter mechanisms that dynamically adjust parameter values based on market conditions.

Strategy Optimization Directions

Adaptive RSI Thresholds: The current strategy uses fixed RSI thresholds (20 and 70). Consider dynamically adjusting these thresholds based on market volatility. For example, use narrower threshold ranges in low-volatility markets and wider ranges in high-volatility markets to better adapt to different market environments.

Enhanced Trend Filtering: In addition to EMA80 and MA200, consider adding trend strength indicators (such as ADX) or price structure analysis (such as higher highs and higher lows) to more comprehensively assess trend conditions and reduce the risk of trading in weak trends.

Dynamic Position Time Management: The current 7-day exit mechanism could be adjusted based on market volatility or ATR (Average True Range), shortening holding time in high-volatility markets and extending it appropriately in low-volatility markets.

Add Price Target Exits: On top of existing exit mechanisms, add price target exit strategies based on ATR or support/resistance levels to provide more precise profit-locking mechanisms.

Volume Analysis Enhancement: Consider adding volume change rate or cumulative volume indicators (such as OBV) to more accurately identify the balance of buying and selling power, reducing the risk of volume misleading.

Partial Profit-Locking Mechanism: Implement partial position closing functionality, such as closing part of the position when reaching certain profit targets and setting trailing stops for the remaining position to maximize the potential to capture major trend opportunities.

Market Environment Filtering: Add market environment classification indicators (such as VIX or volatility indicators) to selectively enable or disable the strategy in different market environments, avoiding trading under unsuitable market conditions.

Summary

The Multi-Filter RSI(2) Reversal Trading Strategy is a quantitative trading method combining ultra-short-term RSI reversal signals with multiple filtering conditions and exit mechanisms. Through RSI(2) below 20 oversold signals combined with trend confirmation, volume verification, and candlestick reversal patterns, this strategy effectively identifies high-probability short-term rebound opportunities. Meanwhile, through profit at close, RSI overbought signals, and time limit exit mechanisms, it provides a comprehensive risk management framework.

The main advantages of this strategy lie in multiple filtering conditions significantly improving signal quality, triple exit mechanisms providing comprehensive risk management, and the use of ultra-short-term RSI improving signal timeliness. However, the strategy also faces risks such as RSI false signals, fixed parameter limitations, and market environment changes.

By introducing adaptive parameters, enhancing trend and volume analysis, dynamic position management, and partial position closing mechanisms, this strategy can further improve its adaptability and stability across different market environments. Overall, this is a clearly structured, logically rigorous short-term reversal trading strategy suitable for capturing rebound opportunities after short-term pullbacks within uptrends.

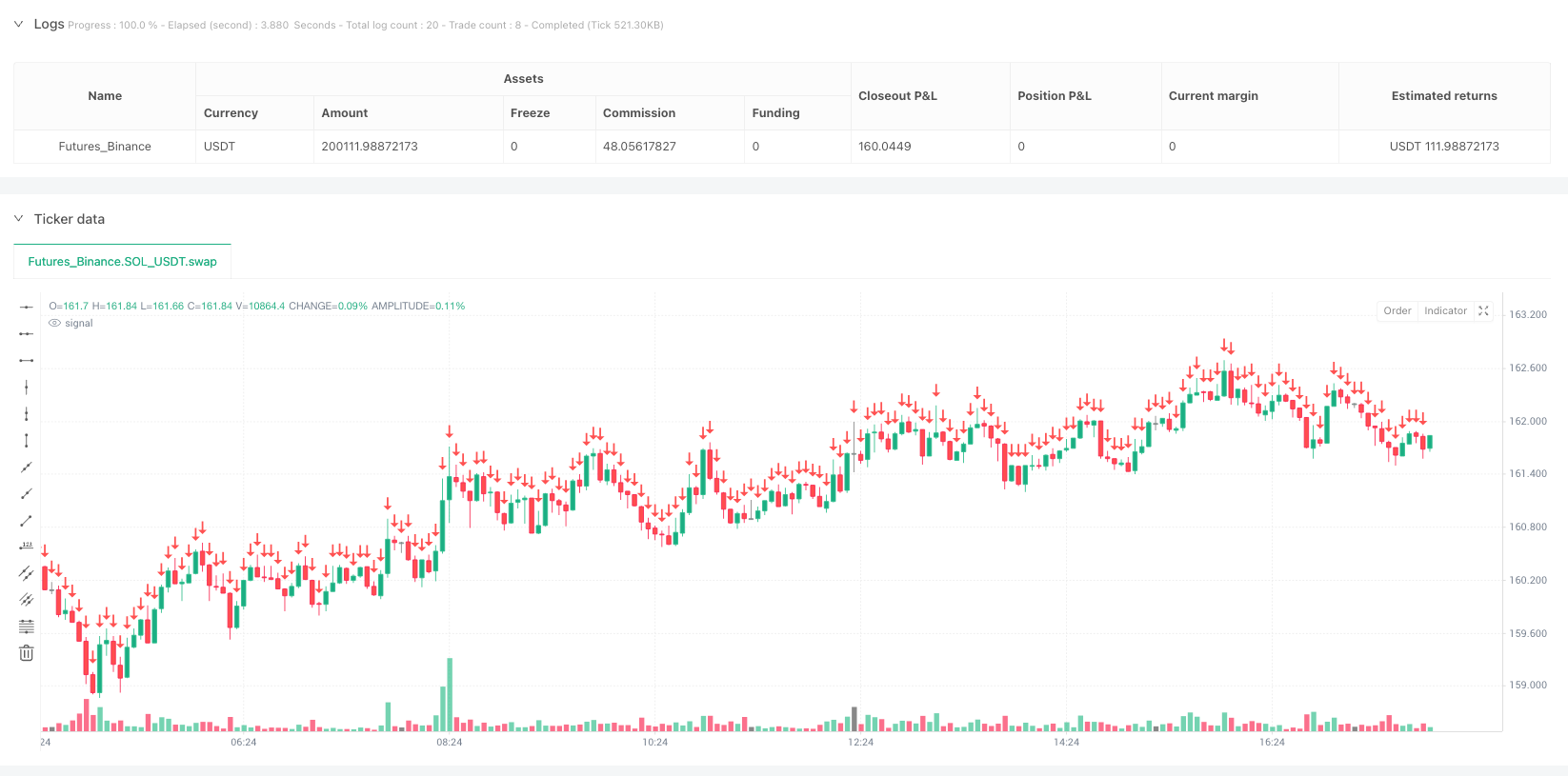

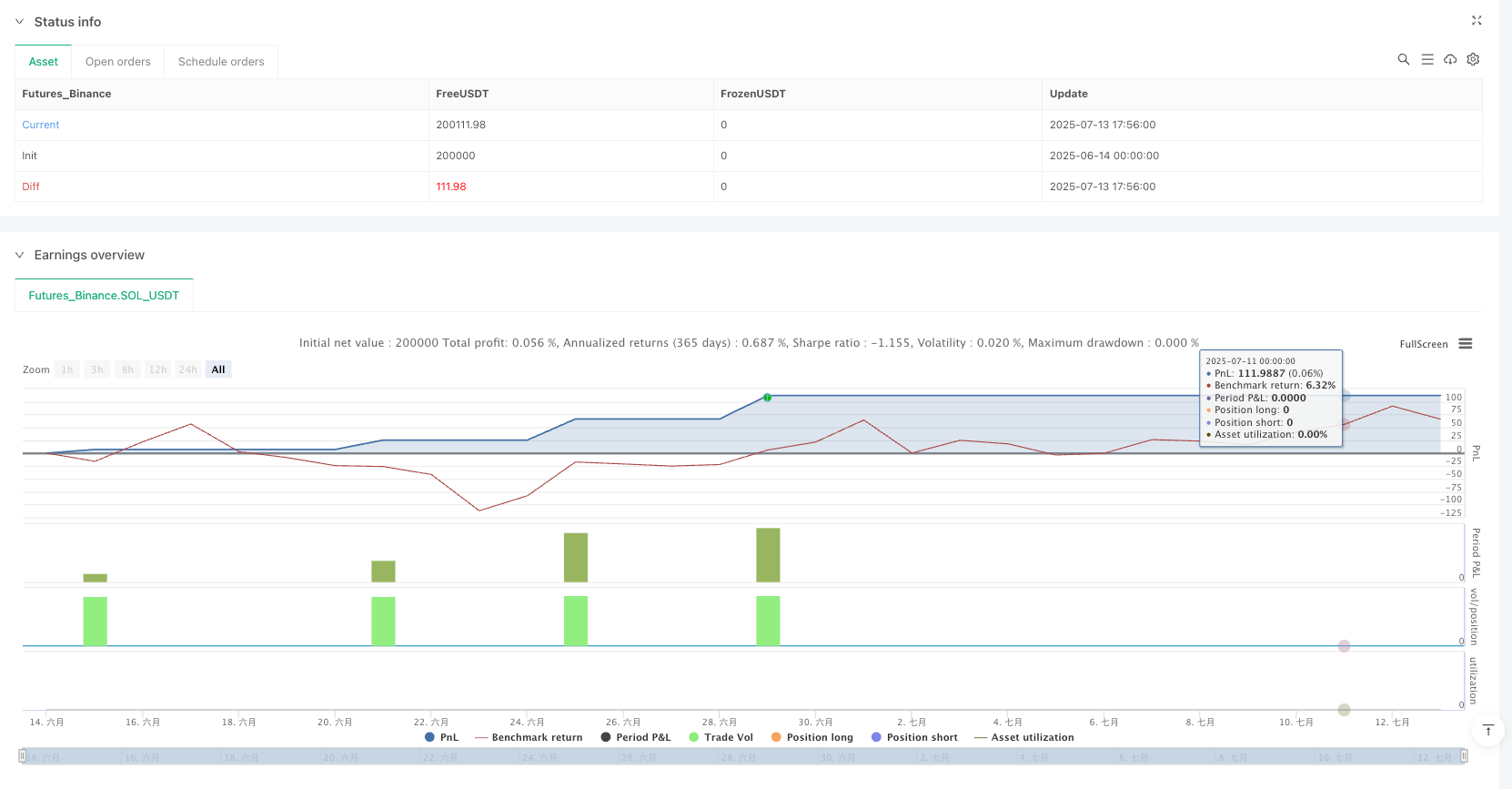

/*backtest

start: 2025-06-14 00:00:00

end: 2025-07-13 17:59:00

period: 4m

basePeriod: 4m

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT","balance":200000}]

*/

//@version=5

strategy("RSI(2) - Estratégia com 3 filtros e 3 saídas", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === PARÂMETROS ===

rsi_threshold = 20

rsi_period = 2

validade_dias = 7

// === CÁLCULOS BASE ===

rsi = ta.rsi(close, rsi_period)

ema80 = ta.ema(close, 80)

ma200 = ta.sma(close, 200)

media_volume = ta.sma(volume, 20)

trend_ok = close > ma200 and close > ema80

volume_ok = volume > media_volume

candle_reversao = close > open

entry_signal = rsi < rsi_threshold and trend_ok and volume_ok and candle_reversao

// === VARIÁVEIS PERSISTENTES ===

var int entrada_bar = na

var float preco_entrada = na

// === LÓGICA DE ENTRADA ===

if entry_signal

strategy.entry("Compra RSI", strategy.long)

entrada_bar := bar_index

preco_entrada := close

// === LÓGICA DE SAÍDA ===

dias_passados = not na(entrada_bar) and (bar_index - entrada_bar >= validade_dias)

lucro_no_fecho = not na(preco_entrada) and close > preco_entrada

rsi70 = rsi > 70

saida = lucro_no_fecho or rsi70 or dias_passados

if saida

strategy.close("Compra RSI")

// === VISUAL (OPCIONAL) ===

plotshape(entry_signal, title="Seta Entrada RSI<20", location=location.belowbar,

style=shape.arrowup, color=color.green, size=size.small, text="RSI<20")

plotshape(saida, title="Saída", location=location.abovebar,

style=shape.arrowdown, color=color.red, size=size.tiny)