Overview

The Dynamic ATR Breakout EMA Crossover Strategy is a trend-following system combining technical indicators and volatility measurements, designed specifically for futures markets. This strategy utilizes crossover points between fast and slow Exponential Moving Averages (EMAs) to determine market trend direction, while incorporating Average True Range (ATR) to dynamically set stop-loss and take-profit levels that adapt to changing market volatility. The core philosophy is to enter trends in their early stages while protecting capital through risk management measures based on current market volatility.

Strategy Principles

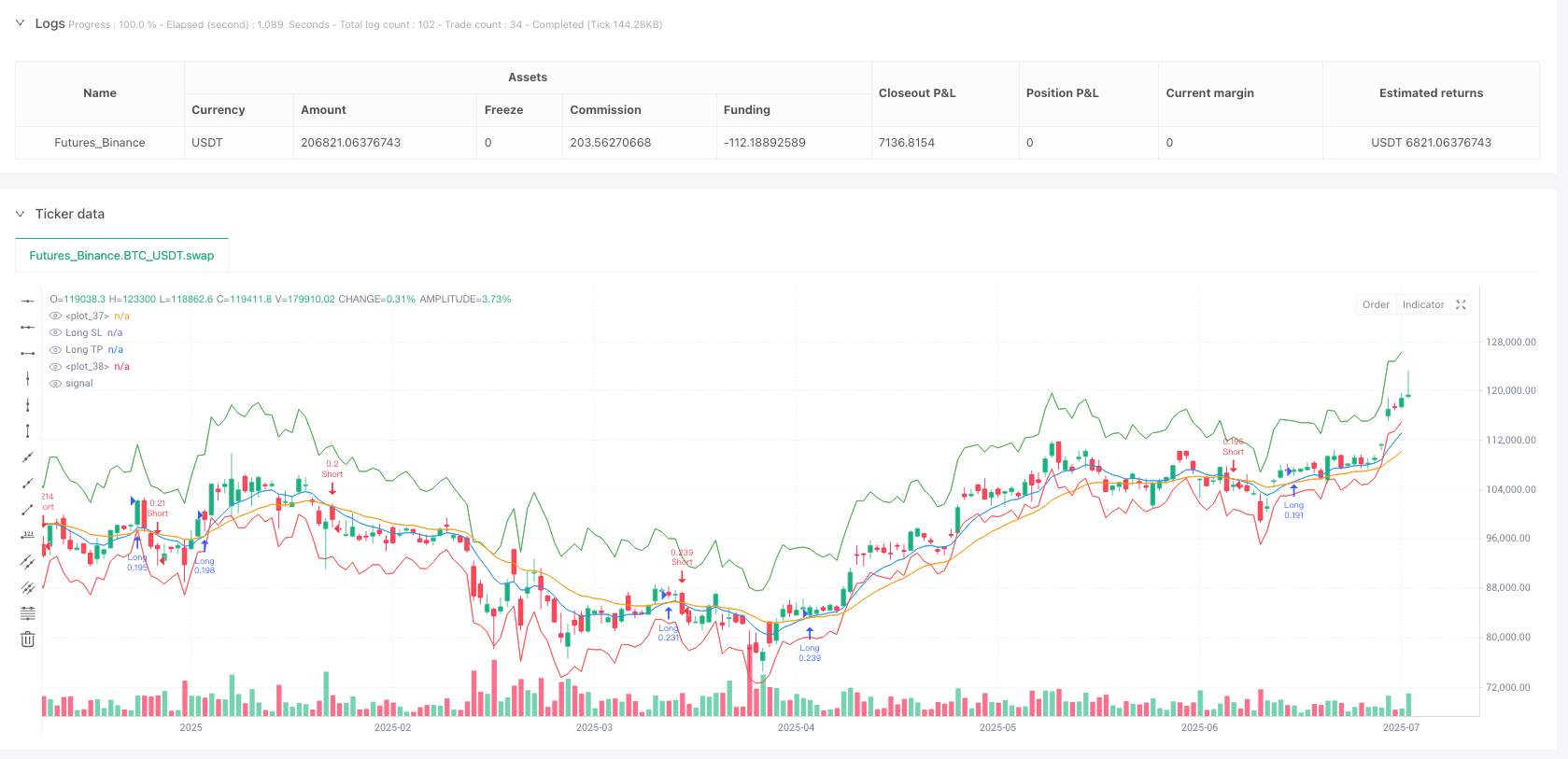

The core trading logic of this strategy is based on two Exponential Moving Averages with different periods: - Fast EMA (9-period) - Slow EMA (21-period)

When the fast EMA crosses above the slow EMA, the system generates a buy signal and enters a long position; when the fast EMA crosses below the slow EMA, the system generates a sell signal and enters a short position. These crossover signals are widely considered indicators of momentum changes and potential trend reversals in the market.

The uniqueness of the strategy lies in its risk management framework: 1. Using a 14-period ATR to quantify market volatility 2. Dynamically calculating stop-loss positions: current price minus (or plus) ATR multiplied by a factor of 1.5 3. Dynamically calculating take-profit positions: current price plus (or minus) ATR multiplied by a factor of 3.0 4. Controlling risk at 2% of account capital per trade

This design ensures that risk management parameters automatically adjust with changes in market volatility, providing wider stops when volatility increases and tighter stops when volatility decreases.

Strategy Advantages

High Adaptability: By linking stop-loss and take-profit levels to ATR, the strategy can adapt to market conditions, avoiding being shaken out due to tight stops during high volatility periods while maintaining reasonable risk control during low volatility periods.

Optimized Risk-Reward Ratio: The strategy sets take-profit at twice the stop-loss distance (3.0x ATR compared to 1.5x ATR), ensuring a favorable risk-reward ratio that contributes to positive expectancy over the long term.

Clear Execution: Trading signals are explicit with no room for subjective judgment, making the strategy easy to follow and automate.

Strict Risk Control: Risk is limited to 2% of account capital per trade, conforming to professional money management principles.

Flexible Capital Management: The strategy uses a percentage risk model rather than fixed contract quantities, ensuring that risk exposure adjusts correspondingly as account size changes.

Transparent Operational Logic: All trading conditions, entry points, and exit points are clearly defined with no “black box” elements, facilitating strategy review and optimization.

Strategy Risks

False Breakout Risk: EMA crossover strategies are susceptible to market noise and false breakouts, especially in ranging markets. In such situations, a series of small losing trades may occur, eroding account capital.

Slippage and Execution Risk: In highly volatile markets, actual execution prices may differ significantly from prices at signal generation, affecting the actual performance of the strategy.

Parameter Sensitivity: Strategy performance highly depends on the chosen EMA periods and ATR multipliers. Different market environments may require different parameter settings, increasing the risk of overfitting.

Trend Market Dependency: This strategy performs best in clearly trending markets but may perform poorly in oscillating markets, leading to consecutive losses.

Excessively Wide Stop-Loss Risk: In high-volatility environments, ATR-based stop-losses may become too wide, leading to increased potential losses per trade, even with percentage risk controlled at 2%.

To mitigate these risks, it is recommended to: - Implement additional filters, such as trading session restrictions or trend strength confirmation - Consider using time exits or profit-to-loss ratio exits - Conduct extensive backtesting to determine optimal parameter combinations - Implement maximum loss limits to prevent overtrading or adverse market conditions

Strategy Optimization Directions

- Add Trend Filters: Integrate trend strength indicators (such as ADX or Directional Movement Index) to trade only in strong trend environments. This can be implemented by adding code like:

adx = ta.dmi(14, 14)

strong_trend = adx > 25

longCondition = longCondition and strong_trend

shortCondition = shortCondition and strong_trend

Optimize Entry Timing: Consider adding additional confirmation indicators, such as RSI or Stochastic, to reduce false signals. This can be achieved by requiring trades only when prices are in specific zones or indicators show overbought/oversold conditions.

Dynamically Adjust Risk Parameters: Adjust risk percentage dynamically based on market volatility or recent trading performance. For example, reduce risk after consecutive losses and increase risk during profitable periods.

Add Time Filters: Restrict trading to specific market sessions, avoiding low liquidity or high volatility periods, especially for futures markets.

Implement Partial Profit-Taking: Modify the strategy to allow for scaling out of positions, for example, exiting half the position at 1x ATR and letting the remainder run to the 3x ATR target.

Add Trailing Stop Functionality: Implement ATR-based trailing stops to lock in profits and allow trends to fully develop. This can be implemented as follows:

if (strategy.position_size > 0)

strategy.exit("Trailing Stop", from_entry="Long", trail_points=atr*1.0, trail_offset=atr*2.0)

Summary

The Dynamic ATR Breakout EMA Crossover Strategy represents a balanced trading approach combining fundamental principles of trend following with dynamic risk management. The strategy identifies potential trend changes using crossover points between 9-period and 21-period EMAs, and manages risk and reward through stop-loss and take-profit levels linked to ATR.

The main advantages of this strategy lie in its adaptability and discipline, enabling it to maintain consistent risk control across different market environments. However, like all trading systems, it faces challenges with false breakouts and market noise, especially in non-trending markets.

By implementing the suggested optimization measures, such as adding trend filters, optimizing entry confirmation, and implementing partial profit-taking or trailing stops, traders can further enhance the performance and robustness of the strategy. Most importantly, any strategy implementation should be preceded by comprehensive backtesting and forward testing to ensure its viability in actual trading environments.

Regardless of the trading strategy used, the keys to success always lie in strict risk management, emotional control, and continuous strategy improvement. The Dynamic ATR Breakout EMA Crossover Strategy provides a solid foundation upon which traders can build a personalized trading system that aligns with their risk tolerance and trading objectives.

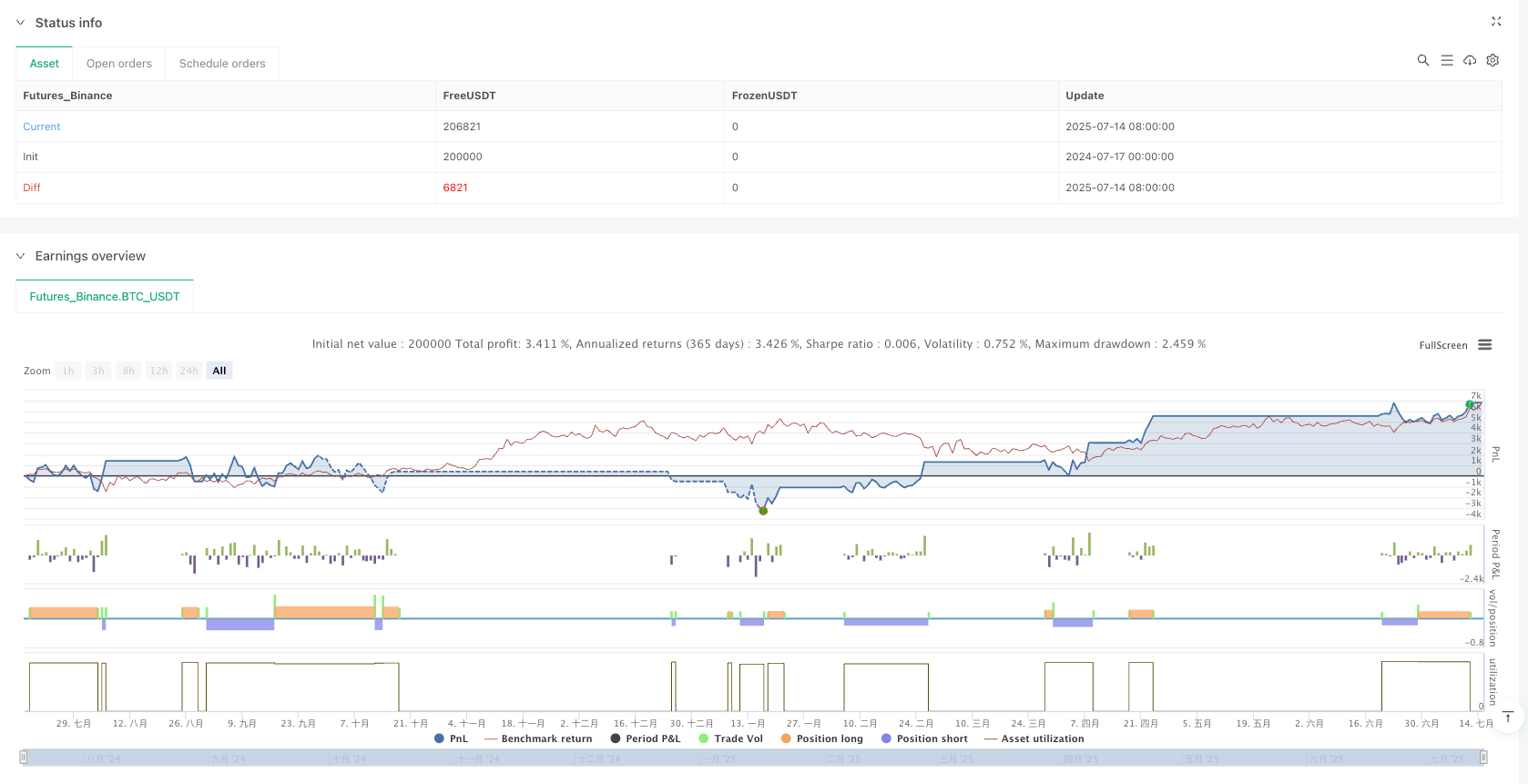

/*backtest

start: 2024-07-17 00:00:00

end: 2025-07-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

//@version=5

strategy("MYM Futures Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Settings ===

risk_pct = input.float(2, title="Risk % per Trade", minval=0.1, maxval=10)

sl_atr_mult = input.float(1.5, title="SL ATR Multiplier", minval=0.1)

tp_atr_mult = input.float(3.0, title="TP ATR Multiplier", minval=0.1)

atr_length = input.int(14, title="ATR Length")

// === Indicators ===

fast = ta.ema(close, 9)

slow = ta.ema(close, 21)

atr = ta.atr(atr_length)

// === Trade Conditions ===

longCondition = ta.crossover(fast, slow)

shortCondition = ta.crossunder(fast, slow)

// === SL/TP Calculations ===

long_sl = close - (sl_atr_mult * atr)

long_tp = close + (tp_atr_mult * atr)

short_sl = close + (sl_atr_mult * atr)

short_tp = close - (tp_atr_mult * atr)

// === Entry Logic ===

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=long_sl, limit=long_tp)

alert("BUY", alert.freq_once_per_bar)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=short_sl, limit=short_tp)

alert("SELL", alert.freq_once_per_bar)

// === Plotting ===

plot(fast, color=color.blue)

plot(slow, color=color.orange)

plot(long_sl, title="Long SL", color=color.red, style=plot.style_linebr, linewidth=1)

plot(long_tp, title="Long TP", color=color.green, style=plot.style_linebr, linewidth=1)