Overview

The Dynamic Risk Management ATR Multiplier Crossover Strategy is a quantitative trading system based on moving average crossovers and Average True Range (ATR). This strategy determines entry signals through crossovers between short-term and long-term Simple Moving Averages (SMA) while utilizing ATR to dynamically calculate stop-loss, take-profit, and trailing stop levels for automated and precise risk management. The strategy is designed for accounts with an initial capital of \(25,000, targeting a daily profit of \)4,167, and employs dynamic position sizing to balance returns and risk.

Strategy Principles

The core principles of this strategy combine technical indicator crossover signals with a dynamic risk management system:

Entry Signal Generation:

- Long signals are generated when the 14-period SMA crosses above the 28-period SMA

- Short signals are generated when the 14-period SMA crosses below the 28-period SMA

Dynamic Risk Parameter Calculation:

- 14-period ATR is used to calculate market volatility

- Stop-loss level = Current price ± (ATR × 1.5)

- Take-profit level = Current price ± (ATR × 3.0)

- Trailing stop distance = ATR × 1.0

Exit Mechanisms:

- Primary exits are automatically executed through stop-loss, take-profit, or trailing stop

- Secondary exit signal: optional position closure when price crosses the 10-period SMA

Trade Execution and Notification:

- Trading signals and parameters are transmitted through JSON-formatted alert messages

- Messages include action type, trading instrument, quantity, order type, and risk management parameters

This strategy particularly emphasizes the risk-to-reward ratio, adopting a 3:1.5 profit-to-risk (TP:SL) ratio, adhering to sound risk management principles.

Strategy Advantages

Dynamic Risk Adaptability:

- Dynamic adjustment of stop-loss and take-profit levels through ATR enables the strategy to adapt to changing market volatility

- Automatically widens stop distances in high-volatility environments and narrows them in low-volatility conditions

Clear Entry and Exit Rules:

- Definitive entry signals based on moving average crossovers reduce subjective judgment

- Multiple exit mechanisms ensure profit protection and risk control

Comprehensive Risk Management Framework:

- Combined application of stop-loss, take-profit, and trailing stop provides comprehensive protection for trading capital

- Risk parameters can be customized through input variables to meet different risk preferences

High Automation:

- JSON-formatted alert system integrates seamlessly with other trading platforms and tools

- Strategy parameters are encapsulated in alerts, facilitating automated execution or API connection

Visual Assistance:

- Moving averages are plotted on the chart, providing intuitive reference for trading signals

- Helps traders understand strategy logic and market conditions

Strategy Risks

False Signals in Ranging Markets:

- Moving average crossovers may generate frequent false signals in sideways or choppy markets

- Mitigation: Consider adding filtering conditions such as trend confirmation indicators or volatility filters

ATR Parameter Sensitivity:

- The choice of ATR calculation period (14) and multipliers (1.5⁄3.0/1.0) significantly impacts strategy performance

- Mitigation: Find optimal configurations through backtesting different parameter combinations or adjust based on specific market characteristics

Trend Reversal Risk:

- Simple moving average systems may respond with lag during sudden trend reversals

- Mitigation: Consider integrating oscillator or momentum indicators as auxiliary signals

Money Management Challenges:

- A fixed percentage of account equity (10%) may be too aggressive or conservative under different market conditions

- Mitigation: Dynamically adjust position size percentage based on volatility and win rate

Execution Slippage Risk:

- Market order execution may face slippage, affecting actual stop-loss and take-profit levels

- Mitigation: Trade during high liquidity sessions and consider including slippage buffer in calculations

Strategy Optimization Directions

Entry Signal Optimization:

- Integrate additional confirmation indicators such as Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD)

- Implementation: Add conditional filters requiring primary trend direction confirmation before executing trades

Adaptive Parameter Adjustment:

- Make ATR multipliers dynamically change based on historical volatility or market state

- Implementation: Calculate volatility ratios (comparing current ATR to historical ATR) to dynamically adjust multipliers

Position Management Optimization:

- Dynamically adjust position size based on win rate and risk-reward ratio

- Implementation: Write functions to calculate optimal Kelly Criterion or consider recent trading performance

Time-based Strategy Adjustments:

- Adjust strategy parameters based on volatility characteristics of different trading sessions

- Implementation: Add time filters to apply different ATR multipliers or signal filtering rules during different sessions

Market Structure Analysis Integration:

- Incorporate support/resistance and market structure high/low points analysis

- Implementation: Identify key price levels and only execute trades in the respective direction when price approaches support or resistance

Summary

The Dynamic Risk Management ATR Multiplier Crossover Strategy is a quantitative trading system that combines classical technical analysis with modern risk management. Its core advantage lies in dynamically adjusting risk parameters through ATR, enabling the strategy to adapt to different market environments. This strategy is particularly suitable for markets with relatively stable volatility and clear trends, generating trading signals through simple moving average crossovers while ensuring that each trade has predefined risk control parameters.

Although risks such as false signals in ranging markets and parameter sensitivity exist, through the optimization directions proposed above—such as integrating additional confirmation indicators, adaptive parameter adjustment, and optimized position management—the strategy’s robustness and adaptability can be significantly enhanced. Ultimately, this strategy provides a trading framework that balances simplicity and effectiveness, suitable as a foundation model for systematic trading, and can be further customized and optimized according to individual needs and market characteristics.

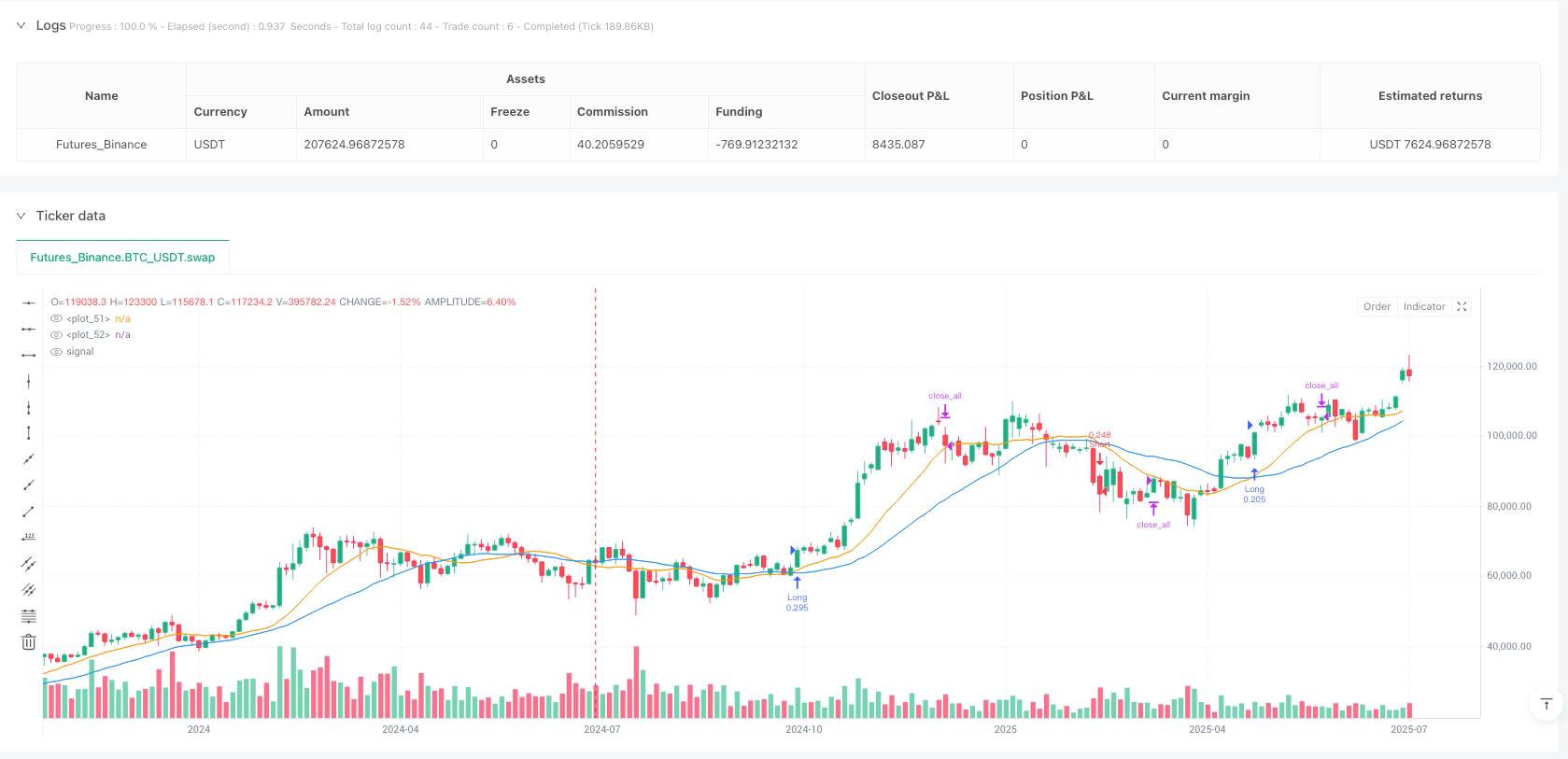

/*backtest

start: 2024-07-17 00:00:00

end: 2025-07-15 08:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

//@version=5

strategy("MYM Strategy for TradersPost", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

atrLength = input.int(14, "ATR Length")

slMultiplier = input.float(1.5, "Stop Loss Multiplier")

tpMultiplier = input.float(3.0, "Take Profit Multiplier")

tsMultiplier = input.float(1.0, "Trailing Stop Multiplier")

// === ATR Calculation ===

atr = ta.atr(atrLength)

stopPts = atr * slMultiplier

takePts = atr * tpMultiplier

trailPts = atr * tsMultiplier

// === Example Entry Logic (crossover example) ===

shortSMA = ta.sma(close, 14)

longSMA = ta.sma(close, 28)

longCondition = ta.crossover(shortSMA, longSMA)

shortCondition = ta.crossunder(shortSMA, longSMA)

// === Example Exit Condition (optional close signal) ===

exitCondition = ta.cross(close, ta.sma(close, 10))

// === Entry & Alerts ===

if (longCondition)

// Build JSON message

stopVal = str.tostring(close - stopPts)

tpVal = str.tostring(close + takePts)

trailVal = str.tostring(trailPts)

longMessage = '{"action":"buy","symbol":"MYM","quantity":1,"order_type":"market","stop_loss":' + stopVal + ',"take_profit":' + tpVal + ',"trailing_stop":' + trailVal + ',"comment":"MYM Long Entry"}'

alert(longMessage, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

if (shortCondition)

stopVal = str.tostring(close + stopPts)

tpVal = str.tostring(close - takePts)

trailVal = str.tostring(trailPts)

shortMessage = '{"action":"sell","symbol":"MYM","quantity":1,"order_type":"market","stop_loss":' + stopVal + ',"take_profit":' + tpVal + ',"trailing_stop":' + trailVal + ',"comment":"MYM Short Entry"}'

alert(shortMessage, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

// === Optional Close Alert ===

if (exitCondition)

closeMessage = '{"action":"close_position","ticker":"MYM","comment":"MYM Close Position"}'

alert(closeMessage, alert.freq_once_per_bar_close)

strategy.close_all(comment="Exit Signal")

// === Visual aids ===

plot(shortSMA, color=color.orange)

plot(longSMA, color=color.blue)