Overview

This strategy is an advanced day trading system that combines multiple technical indicators to determine market entry and exit points. It primarily relies on the crossover signals of two Exponential Moving Averages (EMAs), while incorporating the Relative Strength Index (RSI), Supertrend indicator, and Average True Range (ATR) for trade confirmation. The strategy applies take-profit and stop-loss mechanisms under certain conditions, helping traders control risk and lock in profits.

Strategy Principles

The core logic of the strategy is based on the combined judgment of the following indicators:

Dual EMA System: The strategy uses a short-term EMA (default 9 periods) and a long-term EMA (default 21 periods). When the short-term EMA crosses above the long-term EMA, it generates a long signal; when the short-term EMA crosses below the long-term EMA, it generates a short signal.

RSI Filter: The Relative Strength Index (RSI) is used to confirm trend direction. It uses a default 14-period RSI with 50 set as the neutral threshold. An RSI greater than 50 supports going long, while an RSI less than 50 supports going short.

Supertrend Confirmation: The Supertrend indicator provides additional trend confirmation. When the Supertrend direction is positive (1), it supports going long; when the direction is negative (-1), it supports going short.

ATR Volatility Filter: The strategy requires sufficient market volatility to execute trades, implemented by checking if the ATR value is greater than 0.5% of the price. This helps avoid trading in market environments with too little volatility.

Buy conditions must satisfy: short-term EMA crosses above long-term EMA, RSI value is greater than the set threshold, Supertrend direction is positive, and ATR value is greater than 0.5% of the closing price.

Sell conditions must satisfy: short-term EMA crosses below long-term EMA, RSI value is less than the set threshold, Supertrend direction is negative, and ATR value is greater than 0.5% of the closing price.

The strategy sets percentage-based take-profit and stop-loss levels, with defaults at 2% for take-profit and 1% for stop-loss, automatically closing positions when prices reach these levels.

Strategy Advantages

Multiple Confirmation Mechanism: Combines multiple technical indicators (EMA, RSI, Supertrend, ATR) to form trading signals, reducing the risk of false breakouts and improving trading accuracy.

Strong Adaptability: Various indicator parameters can be adjusted according to different market environments, giving the strategy strong adaptability. For example, EMA lengths, RSI thresholds, and Supertrend factors can all be optimized based on market characteristics.

Comprehensive Risk Management: Integrates take-profit and stop-loss mechanisms, set as percentages, adaptable to financial products at different price levels, helping traders protect capital and lock in profits.

Volatility Filtering: Uses the ATR indicator to ensure trading only occurs in market conditions with sufficient volatility, avoiding ineffective trades in low-volatility environments and improving capital efficiency.

Clear Signals: The entry and exit conditions of the strategy are clear and easy to understand and execute, reducing interference from subjective judgment.

Full Position Operation: The strategy defaults to using 100% of the account’s funds for trading, maximizing capital utilization and potential returns when effective signals appear.

Strategy Risks

Multiple Conditions Limit Trading Frequency: While multiple confirmation mechanisms improve accuracy, they may also cause traders to miss some profitable opportunities. When markets change rapidly, situations where all conditions are simultaneously met may be rare.

Limitations of Fixed Take-Profit and Stop-Loss: The strategy uses fixed percentage take-profit and stop-loss levels without considering actual market volatility characteristics and support/resistance levels. This may lead to premature stopping out in high-volatility markets or premature profit-taking in strong trend markets.

EMA Lag: As lagging indicators, EMAs may not respond in time during rapid market reversals, leading to delayed entries or exits.

RSI and Supertrend Parameter Sensitivity: The performance of these indicators is highly dependent on parameter settings, and inappropriate parameters may cause the strategy to perform poorly under specific market conditions.

Volatility Requirements: The strategy requires ATR to be greater than 0.5% of the closing price, which may result in no trading signals for extended periods in low-volatility markets, affecting capital utilization efficiency.

Solutions: - Regularly backtest and optimize parameters to adapt to different market phases - Consider introducing dynamic take-profit and stop-loss mechanisms that automatically adjust based on market volatility - Add market state judgment logic to apply different trading rules in different market environments - Consider implementing partial position management rather than always trading with the full account

Strategy Optimization Directions

Dynamic Parameter Adjustment: Consider dynamically adjusting EMA lengths, RSI thresholds, and Supertrend parameters based on market volatility. For example, use shorter EMA periods and stricter RSI thresholds in high-volatility markets, while relaxing conditions in low-volatility markets.

Improve Take-Profit and Stop-Loss Mechanisms: Introduce ATR-based dynamic take-profit and stop-loss levels to adapt to actual market volatility, rather than fixed percentages. For example, set stop-loss at 1.5 times ATR and take-profit at 3 times ATR.

Add Time Filtering: Consider adding trading time window restrictions to avoid high-volatility, low-liquidity periods around market opening and closing, or focus on specific trading sessions.

Add Volume Confirmation: Include volume analysis in trading signals to ensure price movements are supported by sufficient volume, improving signal reliability.

Introduce Trend Strength Assessment: Add indicators like ADX (Average Directional Index) to evaluate trend strength and only trade in strong trend environments, further improving win rates.

Optimize Position Management: The current strategy uses 100% of funds for trading; consider dynamically adjusting position size based on signal strength, market volatility, or account risk tolerance.

Add Trading Filters: Such as support/resistance analysis, important price level identification, or market structure analysis, only trading on breakouts of key levels.

These optimization directions primarily aim to improve the strategy’s adaptability, reduce false signals, enhance risk management, and improve overall performance. In particular, dynamic parameter adjustments and ATR-based take-profit and stop-loss levels may bring significant improvements as they can better adapt to changing market conditions.

Summary

The Advanced Dual EMA + RSI + Trend Breakout Day Trading Strategy is a comprehensive technical analysis trading system that creates a strict set of trading conditions by integrating multiple technical indicators, designed to capture intraday trend opportunities. The core advantages of this strategy lie in its multiple confirmation mechanism and comprehensive risk management, generating high-quality trading signals through the crossover of short-term and long-term EMAs, RSI levels, Supertrend direction, and ATR volatility filtering.

Although the strategy’s multiple conditions may limit trading frequency, this strict screening helps improve signal quality and reduce erroneous trades. The strategy is suitable for traders pursuing stable returns, especially those who prefer trend following rather than counter-trend trading.

Through further optimization, such as introducing dynamic parameter adjustments, improving take-profit and stop-loss mechanisms, adding time and volume filters, and optimizing position management, the strategy has the potential to achieve more stable performance across different market environments. Overall, this is a well-designed, logically clear day trading strategy suitable for experienced technical analysis traders to apply in day trading.

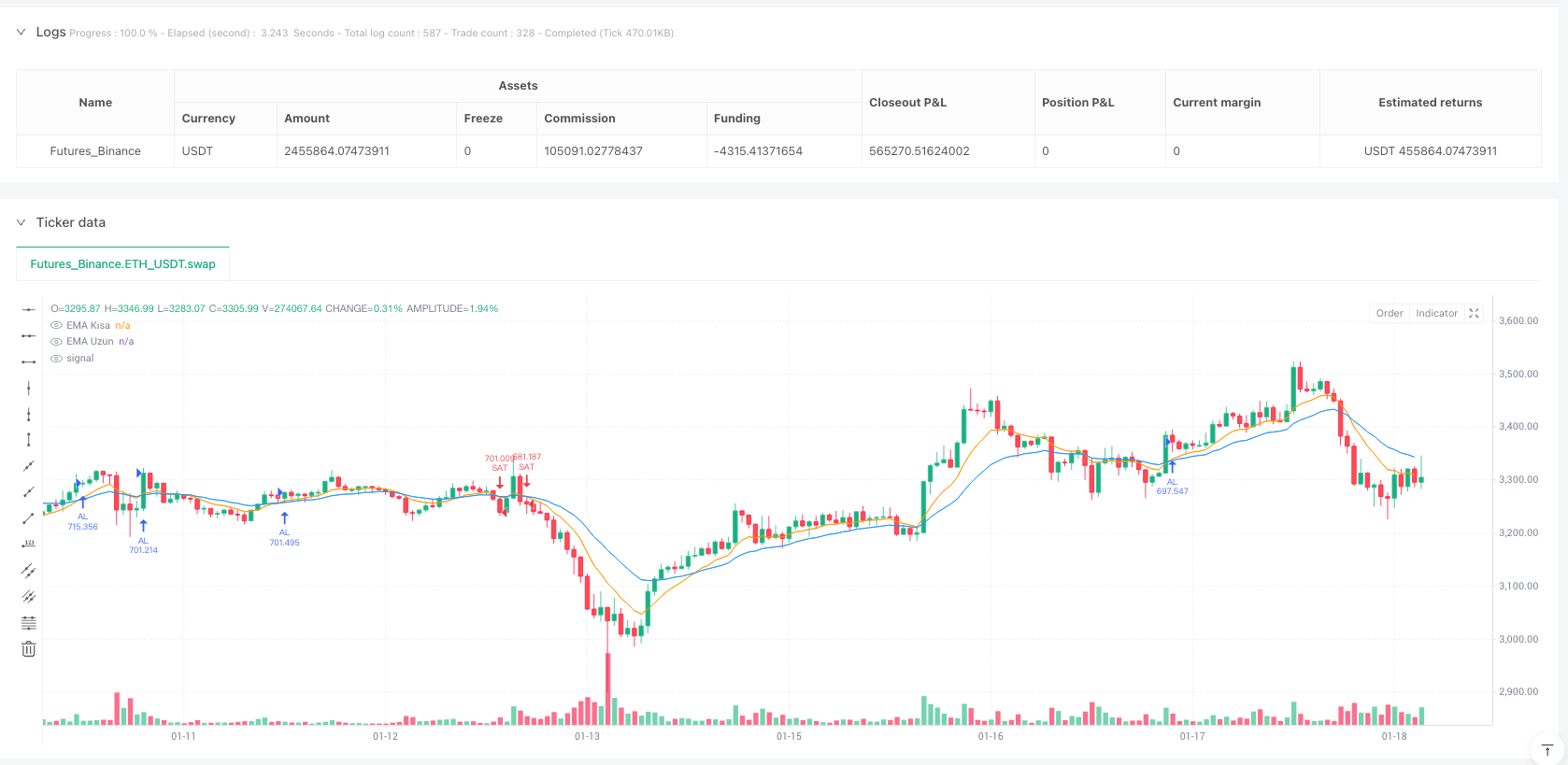

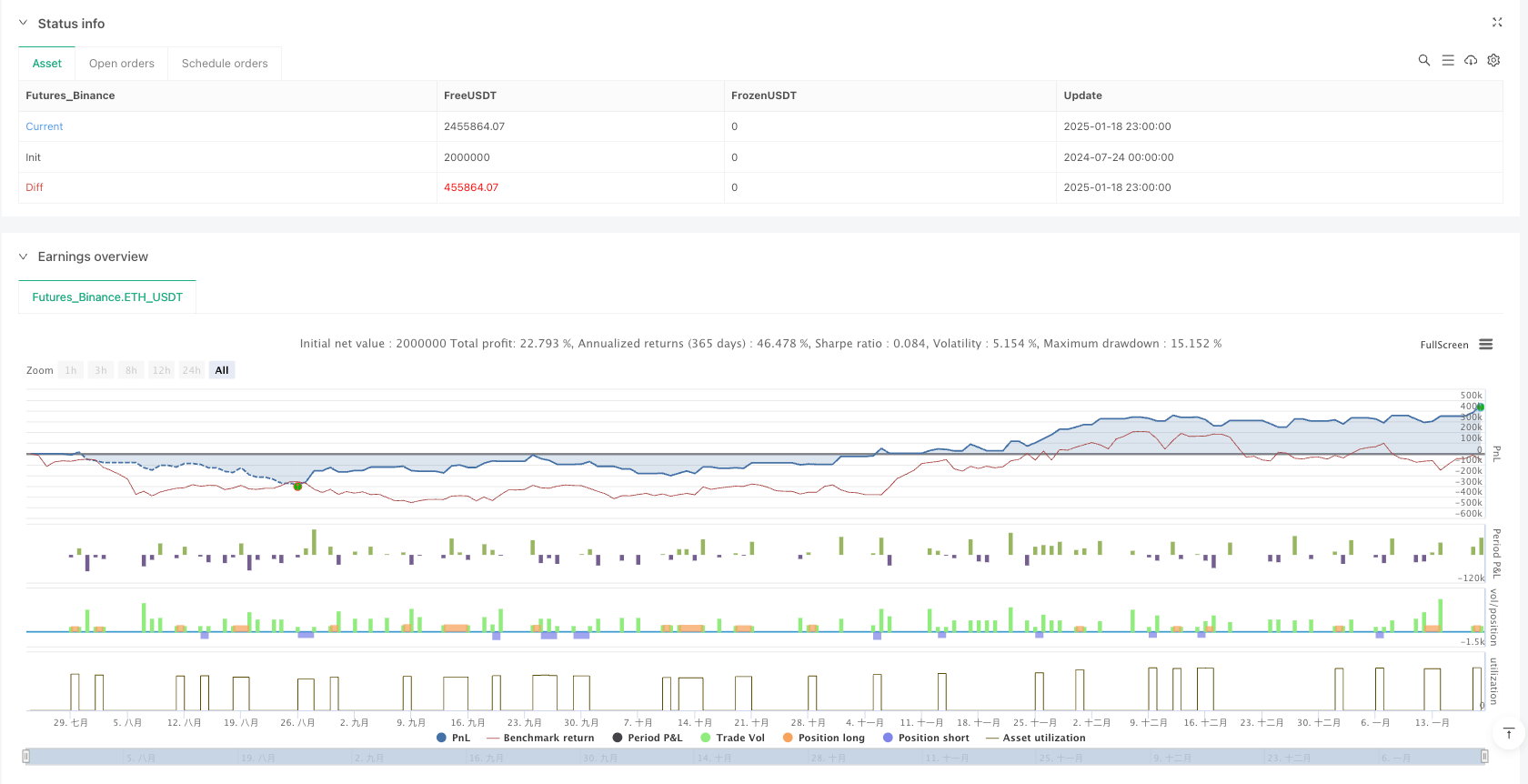

/*backtest

start: 2024-07-24 00:00:00

end: 2025-01-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":2000000}]

*/

//@version=5

strategy("Test Sürümü: Gelişmiş Günlük Al-Sat", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === GİRİŞLER ===

emaShortLen = input.int(9, "EMA Kısa", minval=5, maxval=30)

emaLongLen = input.int(21, "EMA Uzun", minval=10, maxval=50)

rsiPeriod = input.int(14, "RSI Periyot")

rsiThreshold = input.int(50, "RSI Eşiği", minval=40, maxval=60)

supertrendFactor = input.float(3.0, "Supertrend Faktörü", step=0.1)

supertrendATRPeriod = input.int(10, "Supertrend ATR Periyodu")

takeProfit = input.float(2.0, "Kar Alma (%)", step=0.1)

stopLoss = input.float(1.0, "Zarar Kes (%)", step=0.1)

// === HESAPLAMALAR ===

emaShort = ta.ema(close, emaShortLen)

emaLong = ta.ema(close, emaLongLen)

rsi = ta.rsi(close, rsiPeriod)

[supertrend, trendDir] = ta.supertrend(supertrendFactor, supertrendATRPeriod)

atr = ta.atr(14)

// === AL/SAT KOŞULLARI (KIRILIMLAR OLMADAN) ===

buyCond = ta.crossover(emaShort, emaLong) and rsi > rsiThreshold and trendDir == 1 and atr > close * 0.005

sellCond = ta.crossunder(emaShort, emaLong) and rsi < rsiThreshold and trendDir == -1 and atr > close * 0.005

// === EMİR GİRİŞİ ===

if (buyCond)

strategy.entry("AL", strategy.long)

if (sellCond)

strategy.entry("SAT", strategy.short)

// === TP / SL ===

longTP = close * (1 + takeProfit / 100)

longSL = close * (1 - stopLoss / 100)

shortTP = close * (1 - takeProfit / 100)

shortSL = close * (1 + stopLoss / 100)

strategy.exit("AL TP/SL", from_entry="AL", limit=longTP, stop=longSL)

strategy.exit("SAT TP/SL", from_entry="SAT", limit=shortTP, stop=shortSL)

// === GRAFİKTE EMA GÖSTER ===

plot(emaShort, title="EMA Kısa", color=color.orange)

plot(emaLong, title="EMA Uzun", color=color.blue)