First 30-Minute Price Range Breakout Strategy: A Multi-Timeframe Momentum-Based Market Trend Following System

ATR Range Breakout SESSION ANALYSIS momentum Risk-Reward Ratio R:R TIME-BASED TRADING SINGLE ENTRY SYSTEM

Overview

The First 30-Minute Price Range Breakout Strategy is a time-based trading system designed for trading on a 15-minute chart. This strategy utilizes the price range formed during the first 30 minutes of the trading day (09:15-09:44:59) as a key reference to determine breakout levels for trade execution. The core concept is to capture early session price momentum, following the market direction once established, while limiting overtrading through a strict one-trade-per-day rule to improve overall win rate.

Strategy Principle

This strategy is based on the concept that the price range established during the early market session often reflects important support and resistance levels for the day’s trading activity. The execution process is as follows:

Reference Range Formation: The system monitors and aggregates data from the first two 15-minute candles of the trading day (09:15:00-09:44:59), recording the highest and lowest prices during this period to establish the “reference high” and “reference low.”

Trade Setup: After the 09:45 candle completes, the reference range is locked in. Throughout the rest of the trading session (including morning 09:15-12:00 and afternoon 13:00-16:00), the strategy looks for price breakouts beyond the reference range.

Entry Rules:

- Long Entry: A buy signal is triggered when the price rises to or above the reference high.

- Short Entry: A sell signal is triggered when the price falls to or below the reference low.

- Daily Trade Limit: Once any trade is executed, no new positions are opened for the remainder of the day.

Exit Rules:

- Take Profit Target: Set at a distance equal to the initial range added to (for longs) or subtracted from (for shorts) the entry price.

- Stop Loss Placement: Stop loss for long trades is set at the reference low, while stop loss for short trades is set at the reference high.

Trade Direction Control:

- Users can restrict trading direction to “Buy Only,” “Sell Only,” or “Both” through input parameters, adapting to personal market bias or trend judgment.

The strategy code ensures accurate capture of breakout signals and strict execution of risk management rules through precise time control and price condition detection.

Strategy Advantages

After in-depth code analysis, this strategy demonstrates the following significant advantages:

Strong Discipline: By executing only one trade per trading day, the strategy effectively avoids overtrading and emotional decision-making, reducing costs and psychological pressure associated with high-frequency trading.

Clear Rules: Entry and exit conditions are transparent, requiring no subjective judgment, which reduces hesitation and errors during the trading process.

High Flexibility: Through the “trade_direction” parameter, users can bias the system toward long positions, short positions, or maintain bidirectional trading based on macro trends or personal analysis, enhancing the strategy’s adaptability.

Comprehensive Risk Control: Each trade has predefined stop loss and take profit targets with a clear risk-reward ratio, contributing to long-term stable capital management.

Time Efficiency: By focusing on the first 30-minute range after market opening, the strategy leverages the tendency for early sessions to exhibit greater volatility and directionality, improving trading efficiency.

Clear Code Structure: The strategy implementation uses variable resets and condition checks, with tight logic that is easy to understand and maintain.

Strategy Risks

Despite its well-designed structure, the strategy has the following potential risks:

False Breakout Risk: The market may quickly reverse after breaking the reference range, triggering stop losses. A solution could be to add confirmation mechanisms, such as requiring the price to maintain a certain level for a specified time or break through by a certain magnitude before executing trades.

Wide Range Risk: If the market volatility is excessive during the first 30 minutes, it may lead to stop losses being set too far away, violating sound risk management principles. Consider setting maximum range limits or dynamically adjusting based on historical volatility.

Narrow Range Risk: Conversely, if early session volatility is too low, take profit targets may be too close to entry points, making it difficult to cover trading costs. A solution is to establish minimum range requirements or choose to skip trading on low volatility days.

Single Market Dependency: The strategy is designed for a specific market and may not perform well in other markets or under different market conditions. It is recommended to conduct thorough backtesting and market adaptability analysis before application.

Limitations of Fixed Risk-Reward Ratio: The code uses a fixed risk-reward ratio (risk_reward = 1.0), which may not adapt to different market conditions. Consider dynamically adjusting based on market volatility or trend strength.

Optimization Directions

Based on code analysis, the strategy can be optimized in the following directions:

Dynamic Range Adjustment: Currently, the strategy uses a fixed time window (first 30 minutes) to determine the trading range. Consider dynamically adjusting the reference range formation based on market volatility (such as ATR indicator) to adapt to different market environments.

Multiple Confirmation Mechanisms: Add additional technical indicators or price pattern confirmations, such as only executing trades when the breakout direction aligns with the trend of short-term moving averages, to reduce false breakout risk.

Partial Position Management: Modify the code to implement partial take profit and partial stop loss strategies. For example, close part of the position upon reaching a certain profit target, with the remainder set to trailing stop loss, to maximize capture of trending markets.

Time Decay Factor: Introduce a time decay factor that gradually increases the requirements for breakout signals as the trading day progresses, as early session breakouts generally carry more significance than late session ones.

Adaptive Risk-Reward Ratio: Dynamically adjust the risk-reward ratio based on market conditions (such as volatility, trend strength) rather than using a fixed value, better adapting to different market environments.

Volume Filtering: Add volume confirmation mechanisms, only confirming valid breakouts when accompanied by significant volume increases, further reducing false breakout risk.

Summary

The First 30-Minute Price Range Breakout Strategy is a concise yet effective trading system that executes trades by capturing key price ranges established during the early market session and tracking their breakouts. The strategy emphasizes discipline, clear rules, and strict risk control, making it particularly suitable for traders seeking systematic trading methods.

The core strengths of the strategy lie in its clear entry and exit rules, daily trade limit, and adjustable trading direction preference, maintaining the discipline of systematic trading while providing flexibility to adapt to different market environments.

While false breakout risks and range setting challenges exist, these risks can be effectively mitigated through the suggested optimization directions, such as dynamic range adjustment, multiple confirmation mechanisms, and adaptive risk management.

Overall, this is a well-designed strategy framework with clear logic, suitable for traders to apply to actual trading after thorough understanding and appropriate adjustments, especially for capturing momentum and directional market movements during the early session.

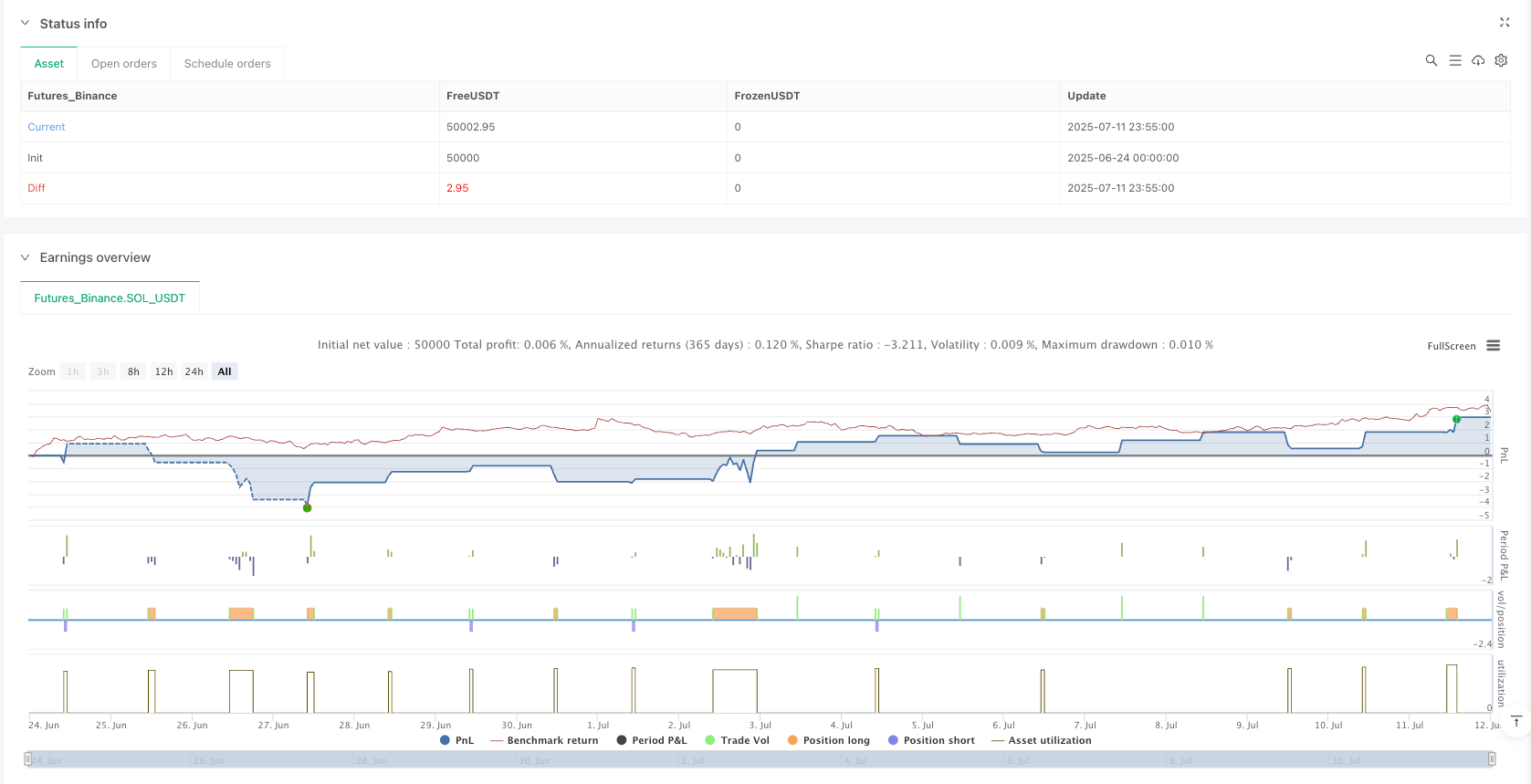

/*backtest

start: 2025-06-24 00:00:00

end: 2025-07-12 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("HSI1! First 30m Candle Strategy (15m Chart)", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1, calc_on_every_tick=true)

// === CONFIGURATION ===

risk_reward = 1.0

trade_size = 1

// User input to choose direction

trade_direction = input.string("Both", title="Trade Direction", options=["Buy Only", "Sell Only", "Both"])

// === SESSION TIME ===

time_in_session = (time >= timestamp("Asia/Hong_Kong", year, month, dayofmonth, 9, 15) and time <= timestamp("Asia/Hong_Kong", year, month, dayofmonth, 12, 0)) or (time >= timestamp("Asia/Hong_Kong", year, month, dayofmonth, 13, 0) and time <= timestamp("Asia/Hong_Kong", year, month, dayofmonth, 16, 0))

// === FIRST 30-MIN CANDLE AGGREGATION ===

// The first 30m period: 09:15:00 to 09:44:59

start_30m = timestamp("Asia/Hong_Kong", year, month, dayofmonth, 9, 15)

end_30m = timestamp("Asia/Hong_Kong", year, month, dayofmonth, 9, 45)

// Identify the first bar of a new day for reset

curr_ymd = year * 10000 + month * 100 + dayofmonth

var int first_30m_ymd = na

var float first_30m_high = na

var float first_30m_low = na

var bool range_locked = false

// Reset all at the start of a new day

if na(first_30m_ymd) or first_30m_ymd != curr_ymd

first_30m_ymd := curr_ymd

first_30m_high := na

first_30m_low := na

range_locked := false

// If within first 30m window, keep updating highs/lows

if time >= start_30m and time < end_30m

first_30m_high := na(first_30m_high) ? high : math.max(first_30m_high, high)

first_30m_low := na(first_30m_low) ? low : math.min(first_30m_low, low)

// Lock the range after the 09:45 bar starts

if not range_locked and time >= end_30m and not na(first_30m_high) and not na(first_30m_low)

range_locked := true

carry_high = range_locked ? first_30m_high : na

carry_low = range_locked ? first_30m_low : na

// === SINGLE TRADE PER DAY LOGIC ===

var int last_trade_ymd = na

var bool traded_today = false

if na(last_trade_ymd) or last_trade_ymd != curr_ymd

traded_today := false // New day, reset flag

can_trade = time_in_session and not na(carry_high) and not traded_today

// === TRADE ENTRY/EXIT CONDITIONS ===

long_condition = can_trade and strategy.position_size == 0 and high >= carry_high and (trade_direction == "Buy Only" or trade_direction == "Both")

short_condition = can_trade and strategy.position_size == 0 and low <= carry_low and (trade_direction == "Sell Only" or trade_direction == "Both")

stop_long = carry_low

take_long = carry_high + (carry_high - carry_low) * risk_reward

stop_short = carry_high

take_short = carry_low - (carry_high - carry_low) * risk_reward

if long_condition

strategy.entry("Long", strategy.long, qty=trade_size, stop=carry_high)

strategy.exit("TP/SL Long", "Long", stop=stop_long, limit=take_long)

last_trade_ymd := curr_ymd

traded_today := true

if short_condition

strategy.entry("Short", strategy.short, qty=trade_size, stop=carry_low)

strategy.exit("TP/SL Short", "Short", stop=stop_short, limit=take_short)

last_trade_ymd := curr_ymd

traded_today := true

// === PLOTS ===

plot(carry_high, title="First 30m High", color=color.green, linewidth=2, display=display.none)

plot(carry_low, title="First 30m Low", color=color.red, linewidth=2, display=display.none)