Opening Range Breakout Limit-Order Trading Strategy

ORB BREAKOUT LIMIT ORDER TAKEPROFIT STOPLOSS RANGE TRADING 5-Min Timeframe

Overview

This strategy leverages the price range formed during the first 15 minutes after market open as a foundation for identifying trading opportunities through breakouts of this range. Operating on a 5-minute timeframe, it employs limit orders for entry at range breakout positions and sets fixed take-profit and stop-loss levels. This approach effectively utilizes the volatility typically present during the opening session while employing a limit order mechanism to secure more favorable entry points when prices retrace.

Strategy Principles

The core logic of this strategy is based on the price range formed during the initial market opening period. Specifically, it identifies the high and low points of the first 15 minutes after market open (9:30-9:45) by calculating the highest and lowest points of the first three candles on a 5-minute timeframe. Once this range is established, the strategy monitors for price breakouts from this range.

When the closing price breaks above the upper limit of the range, the strategy places a long limit order at the breakout position; when the closing price breaks below the lower limit of the range, it places a short limit order at the breakout position. The characteristic of limit orders is that they only trigger when the price falls back (or rises back) to the specified level, effectively waiting for price retracement confirmation.

The strategy employs fixed take-profit levels (100 points) and stop-loss levels (50 points). This translates to a risk-reward ratio of 1:2, which is a relatively conservative risk management setting. The code uses strategy exit functions to automatically manage these take-profit and stop-loss levels.

Strategy Advantages

Utilizes Opening Volatility: The first 15 minutes after market open typically come with higher volatility and volume, providing favorable conditions for breakout trading. This strategy is specifically designed for this time period, effectively capturing the initial market momentum.

Limit Order Mechanism: Compared to market orders, using limit orders can secure more favorable entry prices. When prices retrace after a breakout (a common phenomenon), the strategy can enter at more ideal price levels, thereby reducing slippage and improving trade execution quality.

Clear Risk Management: The strategy sets fixed take-profit and stop-loss levels with a risk-reward ratio of 1:2. This clear risk management approach contributes to long-term consistency in performance and prevents large losses from individual trades.

Simple and Repeatable: The strategy logic is straightforward, without complex indicators or calculations, making it easy to understand and implement. This simplicity also reduces the risk of overfitting and improves the strategy’s adaptability across different market conditions.

Automated Execution: The entire strategy can be fully automated, reducing human emotional interference and execution delays. Once parameters are set, the system can automatically identify ranges, place orders, and manage take-profit and stop-loss levels.

Strategy Risks

False Breakout Risk: Market volatility during the opening session can lead to false breakouts, where prices briefly break out of the range only to return within it. While the limit order mechanism mitigates this risk to some extent, it can still result in unnecessary trades. A possible solution is to add confirmation mechanisms, such as requiring prices to maintain the breakout for a period or using other technical indicators for confirmation.

Limitations of Fixed Take-Profit and Stop-Loss: Using fixed point values for take-profit and stop-loss may not be suitable for all market conditions. In high-volatility environments, stop-losses might be too small; in low-volatility environments, take-profits might be too large. A more flexible approach would be to dynamically adjust these parameters based on market volatility or the Average True Range (ATR) of the previous trading day.

Dependency on a Single Time Period: The strategy only focuses on the first 15 minutes after market open, ignoring other time periods that might provide valuable signals. This narrow focus may result in missed trading opportunities. Expanding the strategy to consider other key time periods (such as before market close) might help increase trading opportunities.

Lack of Market Environment Filtering: The strategy does not consider the overall market environment, such as trend direction or volatility conditions. Breakout trading may not be as effective under certain market conditions. Introducing market environment filters, such as trend indicators or volatility thresholds, might help avoid trading in unfavorable conditions.

Insufficient Capital Management Considerations: The position size calculation method in the code is simple and may lead to inconsistent risk exposure. Implementing a more sophisticated capital management system, such as a percentage risk model based on account size, would help maintain consistent risk levels.

Strategy Optimization Directions

Dynamic Take-Profit and Stop-Loss: Change the fixed point values for take-profit and stop-loss to dynamic parameters based on market volatility. For example, the ATR multiplied by a coefficient could be used to set take-profit and stop-loss levels, allowing these levels to expand or contract with changes in market volatility. This approach would better adapt to different market conditions.

Add Confirmation Indicators: Introduce additional technical indicators to confirm the validity of breakouts, such as volume increases, momentum indicators, or moving average directions. This can reduce the risk of false breakouts and improve the quality of trading signals.

Optimize Entry Timing: The current strategy sets limit orders immediately after price closes beyond the range. Consider waiting for additional confirmation, such as retesting the breakout level or specific price patterns, to improve the accuracy of entry timing.

Add Market Environment Filters: Introduce mechanisms to assess the overall market environment, such as trend strength, volatility levels, or specific market phases. In unfavorable conditions, the strategy could opt not to trade or adjust parameters to suit the current market characteristics.

Improve Capital Management: Implement more sophisticated capital management strategies, such as a percentage risk model based on account size or volatility-based position sizing adjustments. This would ensure consistent risk exposure regardless of account size.

Expand to Other Time Periods: Explore applying similar range breakout logic to other key time periods, such as mid-market open, before/after important economic data releases, or before market close. This might provide additional trading opportunities and diversify the strategy’s risk.

Summary

The Opening Range Breakout Limit-Order Trading Strategy is a quantitative trading approach that focuses on the initial market opening period, capturing market momentum by identifying the price range in the first 15 minutes and trading breakouts. It uses limit orders and fixed risk-reward settings to provide traders with a disciplined and easy-to-implement method.

The strategy’s main advantages lie in its simplicity, level of automation, and effective use of opening volatility. However, it also faces challenges such as the risk of false breakouts, limitations of fixed parameters, and dependency on a single time period.

By implementing dynamic take-profit and stop-loss levels, adding confirmation indicators, optimizing entry timing, introducing market environment filters, and improving capital management, the strategy can be significantly enhanced. These optimizations will help improve the strategy’s robustness, enabling it to better adapt to different market conditions.

For quantitative traders, this strategy provides a good starting point that can be further customized and improved based on individual risk preferences and market characteristics. Through continuous backtesting and optimization, this opening range breakout strategy can become an effective tool in a trading portfolio.

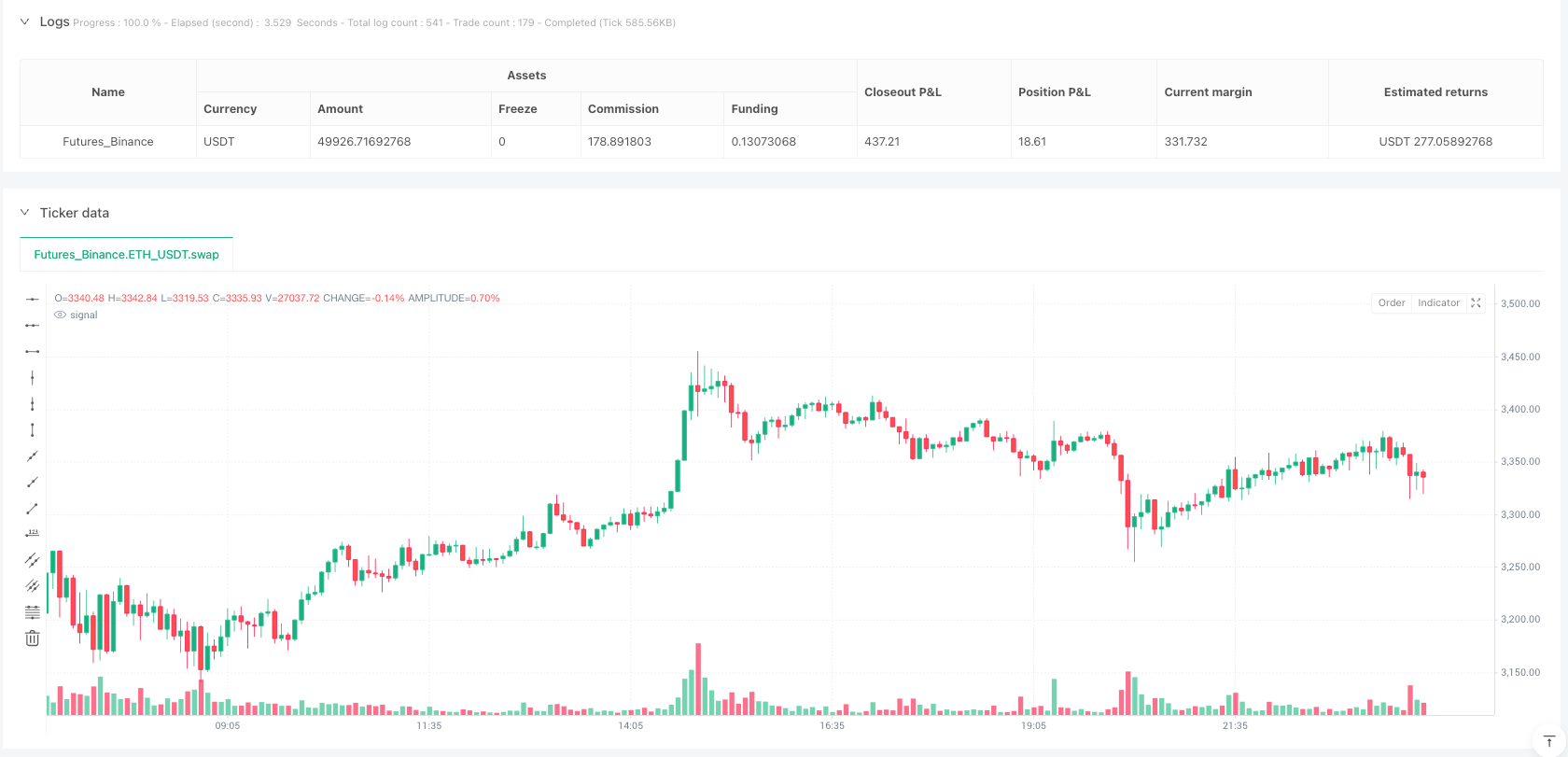

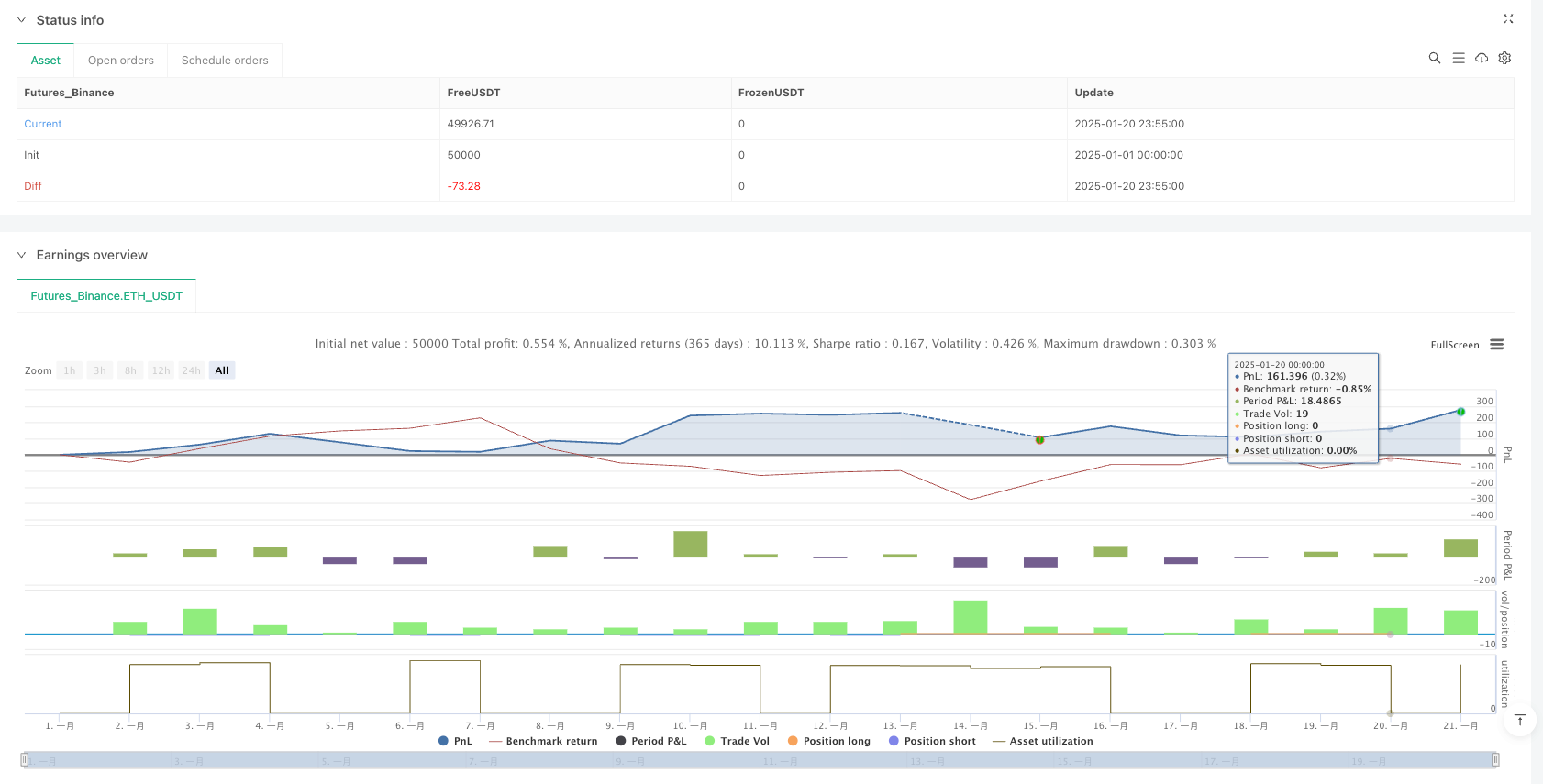

/*backtest

start: 2025-01-01 00:00:00

end: 2025-01-21 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gghezzar5

//@version=6

//initialize your code as a strategy or indicator, if you want to take entries you need to use a strategy

//NOTE: if your trades dont show up on the chart sometimes its cuz your initial capital is too low

//hovering over a label shows a description of what it does and the required inputs but lmk if youre still confused on anything

strategy("tiktok strat", overlay=true, initial_capital=1000000)

//get times

currenthour=hour(time, "America/New_York")

currentminute=minute(time, "America/New_York")

//quantity increases in proportion to my profit to simulate reinvesting (not using it)

qty=int(((strategy.netprofit+100000)/close)/2)

//var command initializes the variables, float identifier is like int but it can hold decimals as well

var float m15high=0

var float m15low=0

var float limit=0

//boolean true/false variables (entry conditions)

long=false

short=false

//since we're on the 5 minute timeframe, to identify the range of the 15 minute 9:30-9:45 candle we have to get the highest and lowest value of the past three 5 minute candles

//btw

if currenthour==9 and currentminute==45

//4th bar starts at 9:45, finalizing the 15 minute candle

//high[1]=the previous high of the 9:40-9:45 bar, high[2]=the high before that, etc

m15high:=math.max(high[3], high[2], high[1])

m15low:=math.min(low[3],low[2],low[1])

//NOTE: the := operator is super important and easy to use: it allows you to change the value of a global variable while in local scope

//For example if I were to use = instead of :=, m15high would return 0 at 9:50 since the local scope of the if statement only covers 9:45 (try it yourself in strategy tester)

//And if we were to set currentminute>=45 to extend the scope, the relative highs would also shift with the following bars

//ALWAYS use the := operator whenevere youre changing the value of a variable because if = works then := will work but if := works = doesnt always work.

//returns true once a bar closes above the high or below the low of the 15 minute candle. if so, entry condition is set to true and the limit is set at the high or low, which i'll explain next

if close>m15high

limit:=m15high

long:=true

if close<m15low

limit:=m15low

short:=true

tp=100

sl=50

//these are only for the plots

entry_price=strategy.opentrades.entry_price(0)

takeprofit=entry_price+tp

stoploss=entry_price-sl

takeprofits=entry_price-tp

stoplosss=entry_price+sl

//entries: once the long condition becomes true, we enter. But since we placed a limit order we dont enter immediately. When we break out of the range

//a limit is placed where we broke out and only triggers if the price then comes back down (or up) and hits that level again. (in this case it usually happens right away anyway)

if long

strategy.entry('long', strategy.long, 1, limit=limit)

strategy.exit('exitlong', 'long', stop=stoploss, limit=takeprofit)

if short

strategy.entry('short', strategy.short, 1, limit=limit)

strategy.exit('exitshort', 'short', stop=stoplosss, limit=takeprofits)