Overview

The Multi-Factor EMA-RSI-VWAP Intraday Momentum Strategy is a sophisticated intraday trading system that combines multiple technical indicators designed to capture short-term market momentum shifts. This strategy cleverly integrates moving average crossovers, relative strength index filtering, and volume-weighted average price support/resistance validation, while incorporating strict trading session controls and risk management mechanisms. By determining trend direction through the crossover relationship between a fast EMA (9-period) and a slow EMA (21-period), utilizing RSI to avoid entries in overbought or oversold regions, and confirming price position relative to VWAP as dynamic support/resistance, it forms a multi-layered trading decision system. The strategy is particularly suitable for markets with moderate volatility, aiming to capture intraday price momentum while eliminating overnight risk through mandatory position closure at session end.

Strategy Principles

The core principles of this strategy are based on the synergistic action of three main technical indicators and strict time control:

EMA Crossover Signals: The crossover between 9-period EMA and 21-period EMA forms the primary basis for trend determination. When the fast EMA crosses above the slow EMA, a long signal is generated; when the fast EMA crosses below the slow EMA, a short signal is produced. These crossover signals are key indicators for capturing price momentum changes.

RSI Filter: The 14-period RSI is used to filter out potentially reversal-prone overbought or oversold conditions. The strategy only considers long entries when RSI is below 70 (not overbought) and short entries when RSI is above 30 (not oversold), effectively avoiding entries in extreme zones.

VWAP Confirmation: Volume-Weighted Average Price serves as a dynamic support/resistance line, providing additional confirmation for entries. Long entries require the price to be above VWAP, while short entries require the price to be below VWAP, enhancing the reliability of trading signals.

Trading Session Control: The strategy operates only within a user-defined trading session (default 9:30 to 15:45, suitable for US markets). This ensures that trading activities are concentrated during periods of optimal market liquidity and eliminates overnight risk by forcing position closure at session end.

Risk Management Mechanisms: The strategy incorporates built-in stop-loss and take-profit mechanisms, with default settings of 1% stop-loss from entry price and 2% take-profit from entry price. This 2:1 risk-reward ratio helps maintain long-term profitability.

From the code implementation perspective, the strategy uses a combination of conditions to determine precise entry timing:

longCondition = ta.crossover(emaFast, emaSlow) and rsi < rsiOverbought and close > vwapValue and inSession

shortCondition = ta.crossunder(emaFast, emaSlow) and rsi > rsiOversold and close < vwapValue and inSession

This multi-condition approach ensures high-quality trading signals, triggering trades only when all indicators are in alignment and within the valid trading session.

Advantage Analysis

Through in-depth analysis of the strategy’s code structure and logic, we can identify the following significant advantages:

Multiple Confirmation Mechanism: The triple-verification system combining EMA crossovers, RSI filtering, and VWAP confirmation significantly enhances the reliability of trading signals, reducing false signals and unnecessary trades.

Strong Adaptability: Various parameters in the strategy, such as EMA periods, RSI thresholds, and risk management ratios, can be adjusted through input parameters, allowing the strategy to adapt to different market environments and instrument characteristics.

Comprehensive Risk Control: The built-in stop-loss/take-profit mechanisms and session-end forced closure form a multi-layered risk protection system, effectively controlling single-trade risk and systemic risk.

Avoidance of Overnight Risk: By forcing position closure at the end of the trading session, the strategy completely eliminates overnight holding risks, including gap risk and uncontrollable factors.

Clear and Concise Logic: The strategy logic is intuitive and straightforward, with reasonable condition settings, showing no signs of over-optimization or curve-fitting, enhancing stability across different market conditions.

Complete Visualization Support: The code includes visualization of key indicators, allowing traders to intuitively understand market conditions and strategy signals, improving operational feasibility.

Precise Momentum Capture: The strategy focuses on capturing short-term price momentum changes, particularly suitable for markets with relatively regular intraday fluctuations, enabling timely entry at the initial stage of trends.

Flexible Position Management: While using a fixed lot size by default, the code structure allows traders to easily adjust position sizes based on account size and risk tolerance.

Risk Analysis

Despite its well-designed structure, like any trading strategy, this one has potential risks. Through analysis of the code implementation, we can identify the following risk points and possible solutions:

Frequent Trading in Ranging Markets: In sideways, choppy markets, EMA crossovers may occur frequently, leading to overtrading and unnecessary commission losses. Solution: Consider adding additional trend strength filters, such as ADX, trading only when trends are clearly established.

Limitations of Fixed Percentage Risk Settings: Using the same stop-loss and take-profit percentages for all markets and sessions may not be flexible enough to adapt to the volatility characteristics of different instruments. Solution: Consider dynamic adjustment of stop-loss and take-profit levels based on ATR (Average True Range).

VWAP Dependency: In some low-liquidity markets or special sessions, VWAP may not be as reliable as in regular markets. Solution: Consider setting switchable confirmation indicators for different market environments.

Lack of Volatility Adjustment: The strategy does not account for changes in market volatility, which may result in overly tight stop-losses during high-volatility periods. Solution: Implement risk parameters that automatically adjust based on recent volatility.

No Re-entry Mechanism: Once a stop-loss is triggered or positions are closed at session end, the strategy does not consider re-entry logic when conditions remain favorable. Solution: Add re-entry rules based on the same conditions, possibly with a cooldown period.

Fixed Trading Session Limitations: Fixed trading sessions may miss important market opportunities, especially during different seasons or special market events. Solution: Consider dynamically adjusting trading sessions based on market volatility and liquidity.

Single Position Size: The fixed lot size setting cannot automatically adjust risk exposure based on market conditions or account equity changes. Solution: Implement dynamic position sizing calculations based on account percentage or risk percentage.

Delayed Entry Due to Multiple Indicator Dependency: While the multiple confirmation mechanism improves signal quality, it may also cause delayed entries, missing optimal price points. Solution: Consider optimizing indicator parameters or setting different confirmation requirements for different market phases.

Optimization Directions

Based on in-depth analysis of the strategy code, here are several valuable optimization directions:

Adaptive Parameter System: Convert fixed EMA periods and RSI thresholds to parameters that automatically adjust based on market volatility. This is necessary because market states frequently change, and fixed parameters perform differently across various market environments. Consider using volatility indicators (such as ATR) to dynamically adjust EMA periods, using longer periods in high-volatility markets and shorter periods in low-volatility markets.

Add Trend Strength Filter: Introduce ADX or similar trend strength indicators, trading only when trends are clearly established. This will effectively reduce false signal trades in ranging markets, improving the system’s win rate and capital efficiency.

ATR-Based Risk Management: Replace fixed percentage settings with dynamic stop-loss/take-profit based on ATR, making risk management more aligned with current market volatility characteristics. For example, stop-loss could be set at entry price minus 1.5 times ATR, while take-profit could be set at entry price plus 3 times ATR, maintaining a favorable risk-reward ratio.

Time Filter Optimization: In addition to fixed trading sessions, consider adding time filters for specific market situations, such as avoiding high-volatility periods during important economic data releases or market opening/closing times.

Dynamic Position Management: Implement dynamic position calculations based on account size and current risk, such as the Kelly criterion or fixed fractional risk models, to maximize capital growth while controlling drawdowns.

Add Trailing Stop-Loss: To maximize profit capture from trends, add trailing stop-loss functionality, allowing stop-loss levels to adjust as price moves favorably in profitable trades.

Optimize VWAP Application: Consider incorporating VWAP deviation or VWAP band channels for more refined support/resistance determination, improving the precision of entry and exit decisions.

Market State Classification: Implement a market state classification system based on volatility and price structure, allowing the strategy to use different parameter combinations and trading rules in different market states.

Multi-Timeframe Confirmation: Introduce higher timeframe trend confirmation, trading only when the intraday trend aligns with the higher timeframe trend direction, improving the accuracy of trend capture.

These optimization directions can not only enhance the strategy’s robustness and adaptability but also better manage risk and improve long-term performance. Each optimization should be verified through rigorous backtesting to validate its effectiveness and avoid over-optimization issues leading to curve-fitting problems.

Summary

The Multi-Factor EMA-RSI-VWAP Intraday Momentum Strategy is a well-designed, logically clear intraday trading system that focuses on capturing short-term market momentum changes through the combination of multiple technical indicators and strict risk management mechanisms. Its core strengths lie in its multiple confirmation mechanisms, comprehensive risk control, and session-based management that avoids overnight risk, making it a relatively robust intraday trading framework.

The strategy skillfully balances signal quality and trading frequency, capturing trend inception points through EMA crossovers while utilizing RSI and VWAP for filtering and confirmation, reducing false signals. The built-in stop-loss/take-profit mechanisms and session-end forced closure provide multi-layered risk protection for the strategy, contributing to the maintenance of a long-term stable equity curve.

However, the strategy also has some potential risks, such as adaptability issues with fixed parameters across different market environments, overtrading risk in ranging markets, and limitations of fixed percentage risk settings. These can be addressed by introducing adaptive parameter systems, adding trend strength filters, implementing ATR-based dynamic risk management, and optimizing position management, further enhancing the strategy’s robustness and adaptability.

Overall, the Multi-Factor EMA-RSI-VWAP Intraday Momentum Strategy provides intraday traders with a structured, quantifiable trading framework whose clear logic and flexible parameter settings give it broad application potential. With targeted optimization and appropriate parameter adjustments, the strategy can maintain stable performance across different market environments, offering traders a reliable method for intraday trading.

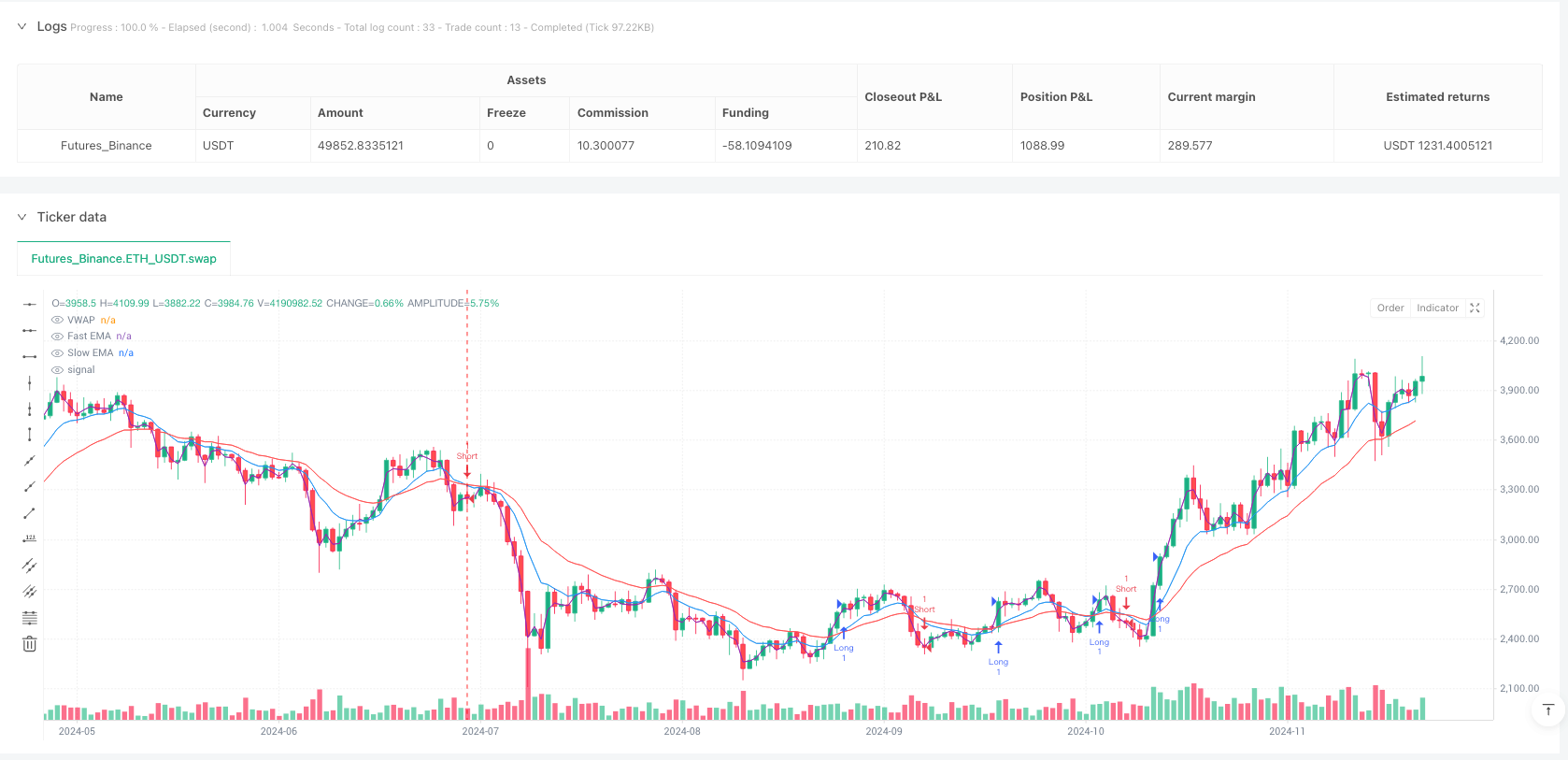

/*backtest

start: 2024-07-28 00:00:00

end: 2024-12-17 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Intraday Momentum Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters

emaFastLength = input.int(9, "Fast EMA Length", minval=1)

emaSlowLength = input.int(21, "Slow EMA Length", minval=1)

rsiLength = input.int(14, "RSI Length", minval=1)

rsiOverbought = input.int(70, "RSI Overbought", minval=0, maxval=100)

rsiOversold = input.int(30, "RSI Oversold", minval=0, maxval=100)

stopLossPerc = input.float(1.0, "Stop Loss %", minval=0.1, step=0.1)

takeProfitPerc = input.float(2.0, "Take Profit %", minval=0.1, step=0.1)

startHour = input.int(9, "Session Start Hour", minval=0, maxval=23)

startMinute = input.int(30, "Session Start Minute", minval=0, maxval=59)

endHour = input.int(15, "Session End Hour", minval=0, maxval=23)

endMinute = input.int(45, "Session End Minute", minval=0, maxval=59)

// Calculate indicators

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

rsi = ta.rsi(close, rsiLength)

vwapValue = ta.vwap(hlc3)

// Define trading session

sessionString = str.tostring(startHour, "00") + str.tostring(startMinute, "00") + "-" + str.tostring(endHour, "00") + str.tostring(endMinute, "00")

inSession = time(timeframe.period, sessionString)

// Entry conditions

longCondition = ta.crossover(emaFast, emaSlow) and rsi < rsiOverbought and close > vwapValue and inSession

shortCondition = ta.crossunder(emaFast, emaSlow) and rsi > rsiOversold and close < vwapValue and inSession

// Exit conditions (time-based)

exitTime = not inSession

// Position sizing and risk management

lotSize = 1 // Fixed lot size (adjust based on account size in backtesting)

// Strategy logic

if (longCondition)

strategy.entry("Long", strategy.long, qty=lotSize)

strategy.exit("Long Exit", "Long", stop=strategy.position_avg_price * (1 - stopLossPerc / 100), limit=strategy.position_avg_price * (1 + takeProfitPerc / 100))

if (shortCondition)

strategy.entry("Short", strategy.short, qty=lotSize)

strategy.exit("Short Exit", "Short", stop=strategy.position_avg_price * (1 + stopLossPerc / 100), limit=strategy.position_avg_price * (1 - takeProfitPerc / 100))

// Close all positions at session end

if (exitTime)

strategy.close_all("Session End")

// Plot indicators

plot(emaFast, color=color.blue, title="Fast EMA")

plot(emaSlow, color=color.red, title="Slow EMA")

plot(vwapValue, color=color.purple, title="VWAP")