Overview

The Multi-Indicator Fusion Intelligent Trend Tracking Strategy is a quantitative trading system that combines multiple technical indicators, designed for clear and concise trading decisions. This strategy integrates EMA, MACD histogram, Volume Oscillator, and Donchian Channel to create a trading framework that is both beginner-friendly and professional. The core concept is to identify high-probability trend directions through multi-dimensional market confirmation and set up automated entry and exit signals to achieve disciplined trading.

Strategy Principles

The core principle of this strategy is multi-indicator resonance confirmation, combining trend following and momentum analysis methods:

Trend Confirmation Layer: Uses the 200-period Exponential Moving Average (EMA200) as the primary trend determination tool. Price above EMA200 indicates an uptrend suitable for long positions; conversely, it indicates a downtrend suitable for short positions.

Momentum Confirmation Layer: Employs MACD histogram (12,26,9) crossover as a momentum change signal. When the MACD histogram transitions from negative to positive, it indicates strengthening upward momentum, which is a key condition for going long; the opposite signals a short entry.

Volume Confirmation Layer: Incorporates the Volume Oscillator (5,10) as a trading volume verification tool. This indicator is calculated by comparing the percentage difference between short-term (5-period) and long-term (10-period) volume EMAs relative to the long-term EMA. A positive Volume Oscillator indicates increased recent trading activity, confirming trend validity.

Exit Management Layer: Utilizes the 20-period Donchian Channel to set objective take-profit and stop-loss levels. In long trades, the upper band serves as the take-profit point and the lower band as the stop-loss point; for short trades, the opposite applies.

The strategy operates with rigorous logic: trade signals are generated only when all entry conditions are simultaneously met, and only one active trade is allowed at a time, avoiding signal stacking and overtrading issues. Boolean variables (inPosition and exitAlertFired) control the trading status and alert triggering, ensuring system consistency and reliability.

Strategy Advantages

Multi-dimensional Confirmation Mechanism: Combines price trend (EMA200), momentum (MACD histogram), and volume (Volume Oscillator) dimensions for trade confirmation, significantly improving the reliability of trading signals and reducing false signals.

Objective Entry and Exit Standards: Trading decisions are entirely based on objective technical indicators, eliminating subjective emotional interference and helping traders maintain disciplined execution.

Automated Alert System: Integrates intelligent alert functionality that automatically notifies traders at key entry and exit points, improving the timeliness of trade execution.

Built-in Risk Management: Automatically sets take-profit and stop-loss levels through the Donchian Channel, implementing systematic risk control to prevent excessive losses in single trades.

Clear Trading Process: The strategy design logic is clear and intuitive, particularly suitable for beginners to understand and apply, while its rigorous structure also meets the needs of professional traders.

Trade Congestion Prevention: Uses the inPosition flag to ensure only one trade at a time, avoiding repeated signal triggering and position stacking problems.

Visualization of Trading Signals: The strategy includes graphical display of trading signals, allowing traders to intuitively identify entry points.

Strategy Risks

Trend Reversal Risk: Although EMA200 is used as a trend filter, sudden trend reversals may occur during severe market fluctuations, triggering stop-losses. A mitigation method is to consider adding trend strength confirmation indicators, such as ADX or slope indicators.

Lag Issue: Indicators like EMA and MACD inherently have a certain lag, which may lead to less than ideal entry points. The solution is to consider combining more sensitive short-term indicators as auxiliary confirmation.

Fixed Period Limitation: The strategy uses fixed parameter settings (such as EMA200, MACD 12,26,9, etc.), which may not be applicable to all market conditions and time periods. Parameter optimization testing in different market environments is recommended.

Donchian Channel Volatility: In highly volatile markets, the 20-period Donchian Channel may set stop-loss levels that are too wide, resulting in larger single trade losses. Consider dynamically adjusting stop-loss ranges based on ATR.

Volume Anomaly Impact: Abnormally large volumes may cause the Volume Oscillator to produce misleading signals. Stability can be improved by adding a volume anomaly filtering mechanism.

Inadequate Single Filter Mechanism: Relying solely on EMA200 to judge trend direction may generate too many false signals in consolidating markets. Consider adding range-bound market identification mechanisms to avoid trading when trends are not clearly evident.

Strategy Optimization Directions

Adaptive Parameter Optimization: The current strategy uses fixed parameters; an adaptive parameter mechanism can be introduced to dynamically adjust EMA periods, MACD parameters, and Donchian Channel length based on market volatility. This can better adapt to different market environments and improve strategy robustness.

Enhanced Market Environment Filtering: Introduce volatility indicators (such as ATR or historical volatility) to identify the current market environment, adjust position size or pause trading during high volatility periods to avoid entering under unfavorable conditions.

Multi-timeframe Confirmation: Integrate trend confirmation from higher time frames, only trading when the trend direction is consistent in larger time frames, thereby increasing trade success rates.

Partial Position Management: The current strategy adopts a full position entry and exit approach. This can be improved to partial position management based on signal strength or risk assessment, increasing positions with high-confidence signals and reducing them otherwise.

Added Reversal Confirmation Mechanism: On the basis of MACD histogram crossover signals, add additional reversal confirmation indicators, such as RSI extremes or candlestick patterns, to reduce losses from false breakouts.

Intelligent Take-Profit Mechanism: The current strategy uses the fixed Donchian Channel as take-profit points. A trailing stop mechanism can be introduced to secure more profits in strong trends.

Trading Time Filtering: Certain market sessions have significantly different volatility and liquidity characteristics. Time filters can be added to avoid unfavorable trading periods.

Summary

The Multi-Indicator Fusion Intelligent Trend Tracking Strategy integrates multiple technical indicators to build a trading system with rigorous logic and clear operations. Its core advantages lie in multi-dimensional market confirmation mechanisms and strict risk management systems, particularly suitable for investors seeking disciplined trading methods.

This strategy combines trend following with momentum analysis, using EMA200 to confirm overall trend direction, MACD histogram to capture momentum changes, Volume Oscillator to verify trading activity, and finally Donchian Channel to manage exit points. This multi-layered confirmation mechanism effectively improves the reliability of trading signals.

While the strategy has certain limitations such as lag and fixed parameters, through the suggested optimization directions like adaptive parameters, market environment filtering, and multi-timeframe analysis, its adaptability and robustness can be further enhanced.

Overall, this is a professional quantitative strategy that balances simplicity and effectiveness, suitable for beginners learning systematic trading and providing experienced traders with a reliable trading framework foundation. With proper risk control and disciplined execution, this strategy has the potential to achieve stable returns in long-term trading.

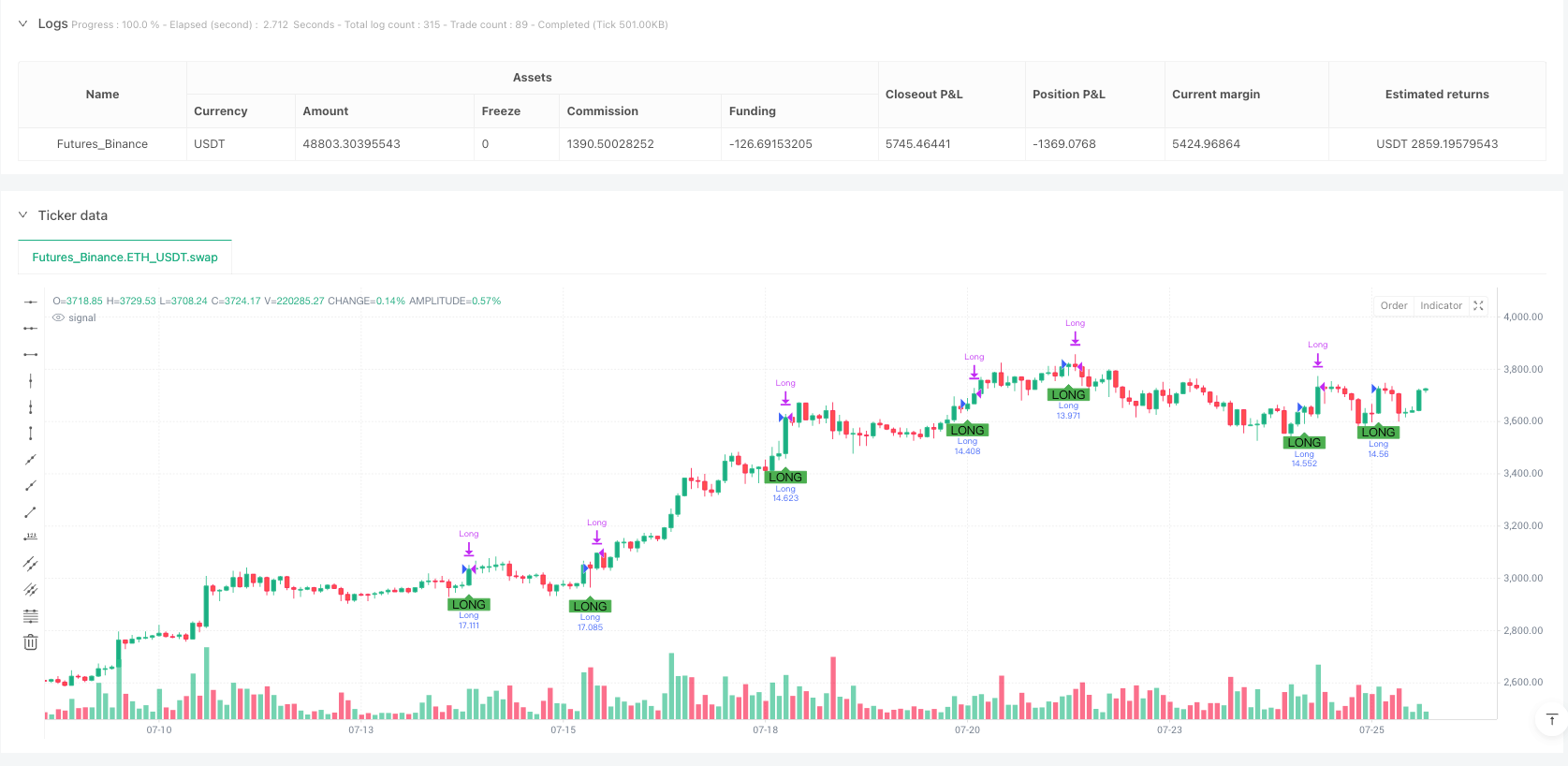

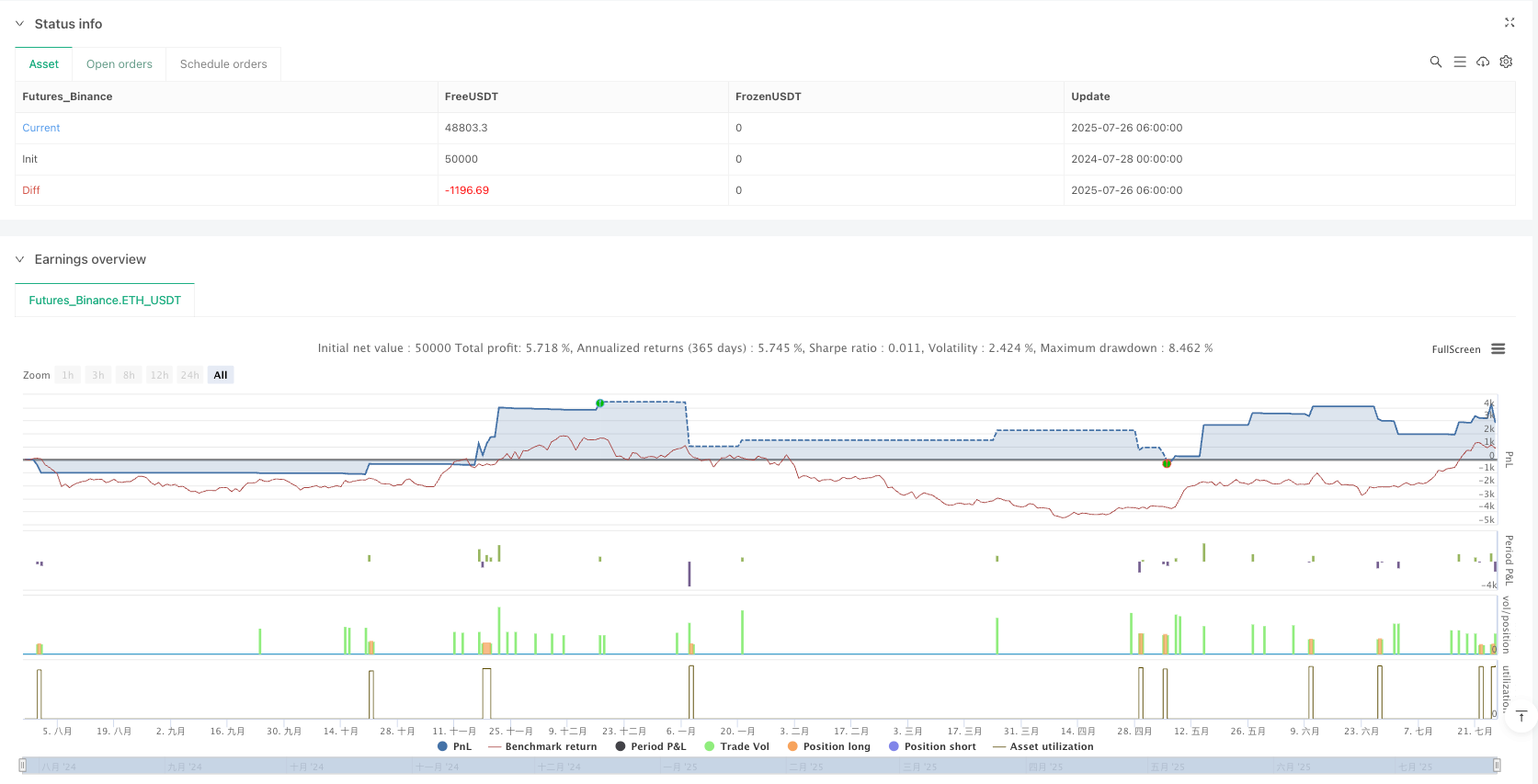

/*backtest

start: 2024-07-28 00:00:00

end: 2025-07-26 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Universal Trading Strategy; Entry + Exit", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === EMA 200 ===

ema200 = ta.ema(close, 200)

// === Volume Oscillator (5, 10) ===

volShort = ta.ema(volume, 5)

volLong = ta.ema(volume, 10)

volumeOsc = ((volShort - volLong) / volLong) * 100

// === MACD Histogramm (12, 26, 9) ===

[macdLine, signalLine, macdHist] = ta.macd(close, 12, 26, 9)

macdWechseltNachOben = macdHist[1] < 0 and macdHist > 0

// === Donchian Channel (Exit-Linie)

dcLength = 20

dcUpper = ta.highest(high, dcLength)

dcLower = ta.lowest(low, dcLength)

// === Flags zur Steuerung ===

var bool inPosition = false

var bool exitAlertFired = false

// === Entry-Bedingung ===

longCondition = not inPosition and close > ema200 and volumeOsc > 0 and macdWechseltNachOben

// === Entry ausführen ===

if (longCondition)

strategy.entry("Long", strategy.long)

inPosition := true

exitAlertFired := false

alert("LONG ENTRY SIGNAL", alert.freq_once_per_bar)

// === Exit-Bedingungen ===

tpHit = inPosition and not exitAlertFired and high >= dcUpper

slHit = inPosition and not exitAlertFired and low <= dcLower

if (tpHit)

strategy.close("Long", comment="TP (Donchian High)")

alert("TAKE PROFIT erreicht", alert.freq_once_per_bar)

inPosition := false

exitAlertFired := true

else if (slHit)

strategy.close("Long", comment="SL (Donchian Low)")

alert("STOP LOSS erreicht", alert.freq_once_per_bar)

inPosition := false

exitAlertFired := true

// === Visualisierung: Entry Signal

plotshape(longCondition, title="Long Entry", location=location.belowbar, style=shape.labelup, color=color.green, text="LONG")