Overview

The Dual Exponential Moving Average Crossover Swing Trading System Strategy is a professional swing trading strategy designed for the Forex market and other highly liquid assets. The core of this strategy is based on crossover signals between two Exponential Moving Averages (EMAs) of different periods, capturing market trend reversal points to generate precise entry signals. The strategy also includes an interactive performance panel that displays real-time key metrics including initial capital, risk percentage per trade, number of trades within a specific timeframe, profit and loss statistics, Return on Investment (ROI), maximum drawdown, and win ratio, providing traders with comprehensive performance monitoring.

Strategy Principles

The core logic of this strategy revolves around the crossover events between two Exponential Moving Averages (EMAs) - a 20-period EMA and a 50-period EMA. Specifically, when the fast EMA (20-period) crosses above the slow EMA (50-period), the system generates a long signal; conversely, when the fast EMA crosses below the slow EMA, the system generates a short signal. These crossover signals are generally considered effective indicators of market trend changes.

The strategy also sets fixed profit and stop-loss levels - with a profit target of 300 points and a stop-loss of 150 points, reflecting a 2:1 risk-reward ratio. This setup ensures that each trade potentially yields greater returns than potential losses under ideal conditions.

The risk management component allows users to set the initial capital (default €1000) and risk percentage per trade (default 2%), enabling traders to adjust the strategy according to their risk preferences and capital size.

Strategy Advantages

Trend Identification Capability: Through EMA crossover signals, the strategy effectively identifies changes in market trends, helping traders enter at the early stages of trends and capture most of the trend movements.

Clear Risk Management: The strategy has built-in clear risk control mechanisms, including risk percentage settings per trade and fixed stop-loss levels, helping to protect capital safety.

Optimized Risk-Reward Ratio: The 2:1 risk-reward setup (300 points profit target vs 150 points stop-loss) means the strategy can potentially achieve overall profitability even with a lower win rate.

Real-Time Performance Monitoring: The interactive panel provides real-time updates of key performance indicators, including ROI, maximum drawdown, and win ratio, allowing traders to promptly evaluate strategy effectiveness and make necessary adjustments.

Wide Applicability: While primarily designed for the Forex market, this strategy is equally applicable to other highly liquid markets, demonstrating good cross-market adaptability.

Strategy Risks

False Signal Risk: In oscillating markets, EMA crossovers may generate frequent false signals, leading to consecutive losses. Solutions include adding confirmation indicators such as RSI or MACD, or pausing trading in low-volatility environments.

Limitations of Fixed Stop-Loss: Using a fixed point stop-loss (150 points) rather than a dynamic stop-loss based on market volatility may cause premature stop-loss triggers during high volatility periods. It is recommended to dynamically adjust stop-loss levels according to market conditions, such as setting stops based on ATR (Average True Range).

Period Parameter Sensitivity: The 20 and 50 period EMA parameters may not be suitable for all market environments. Different markets and timeframes may require different parameter settings. It is advisable to optimize these parameters through backtesting under various market conditions.

Capital Management Risk: The default 2% risk per trade may be too high or too low for some traders. Risk parameters should be adjusted according to individual risk tolerance and capital size.

Trend Reversal Delayed Recognition: As lagging indicators, EMAs may provide delayed signals during trend reversals, leading to suboptimal entry timing. Consider incorporating leading indicators to identify potential trend reversals earlier.

Strategy Optimization Directions

Add Filtering Conditions: Consider adding volume indicators as confirmation for crossover signals, or using oscillating indicators such as Relative Strength Index (RSI) to filter out false signals in oscillating markets. This can significantly improve strategy adaptability across different market environments.

Dynamic Stop-Loss Mechanism: Replace fixed point stop-losses with dynamic stops based on ATR (Average True Range) to better adapt to changes in market volatility. For example, setting stops at 1.5 times the ATR distance to match current market volatility.

Time Filters: Add trading time filtering functionality to avoid major economic data releases or periods of low market liquidity, reducing risks brought by abnormal volatility.

Parameter Optimization Framework: Introduce adaptive parameter adjustment mechanisms to automatically adjust EMA periods based on market conditions, such as using shorter periods in low-volatility environments and longer periods in high-volatility environments.

Capital Management Optimization: Implement more sophisticated capital management algorithms, such as dynamically adjusting risk proportions based on strategy performance, appropriately increasing position sizes after consecutive profits and reducing after consecutive losses.

Multi-Timeframe Analysis: Introduce multi-timeframe confirmation mechanisms, executing trades only when the trend direction in larger timeframes aligns with trading signals, improving signal quality and success rate.

Summary

The Dual Exponential Moving Average Crossover Swing Trading System Strategy is a clear-structured and practical trading system that identifies market trend changes and generates trading signals by capturing EMA crossover signals. This strategy combines core principles of technical analysis and risk management, providing real-time performance monitoring through an interactive panel.

While the strategy has issues such as false signal risks and limitations of fixed parameters, these risks can be effectively mitigated through optimization directions including adding filtering conditions, implementing dynamic stop-losses, and introducing adaptive parameters. Through these optimizations, the strategy can better adapt to different market environments and improve overall performance.

For traders, understanding the principles and limitations of this strategy, and making appropriate adjustments according to their trading style, is key to successfully applying this strategy. Whether for beginners or experienced traders, this strategy provides a solid foundational framework that can be further customized and refined according to individual needs.

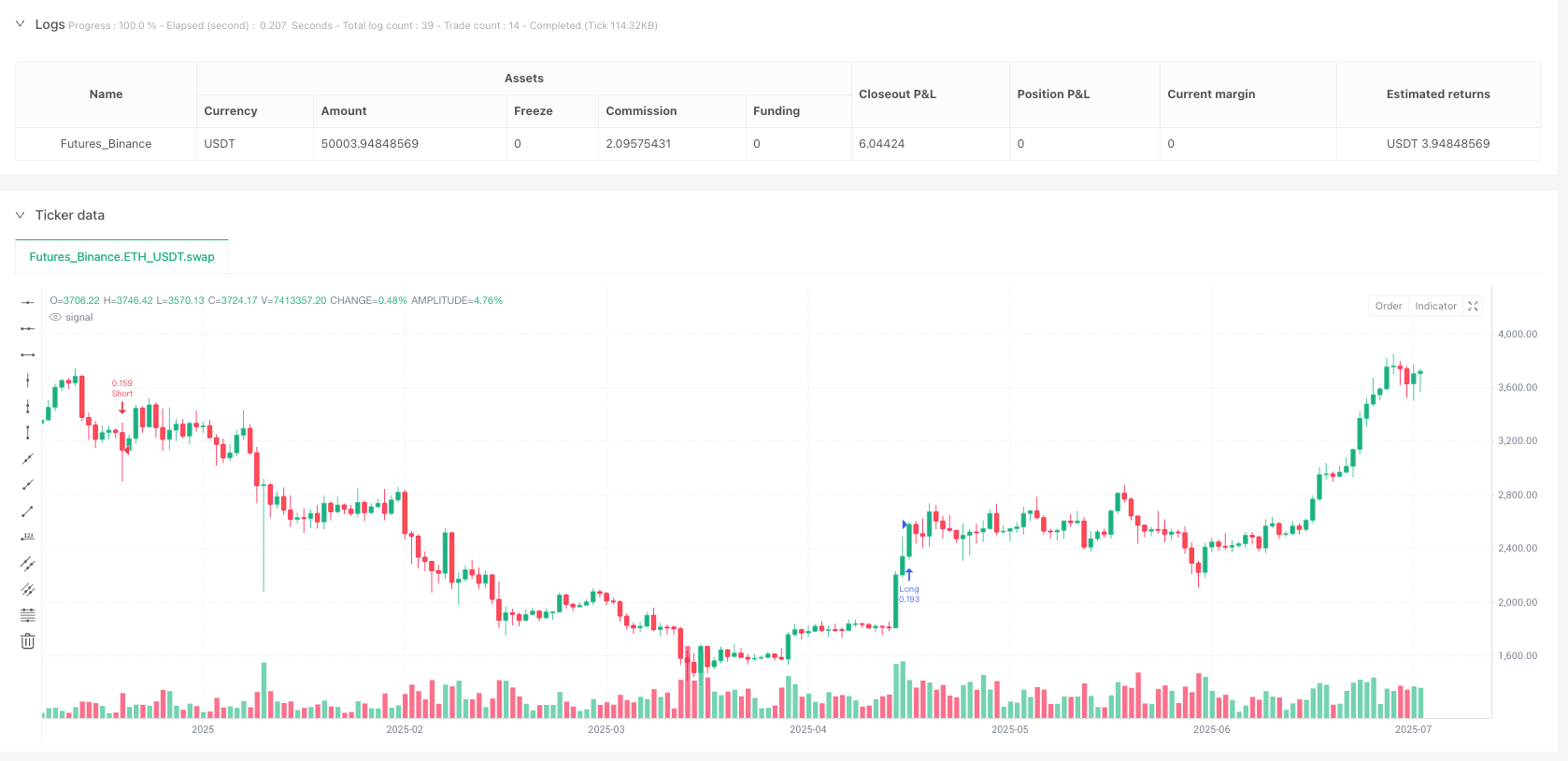

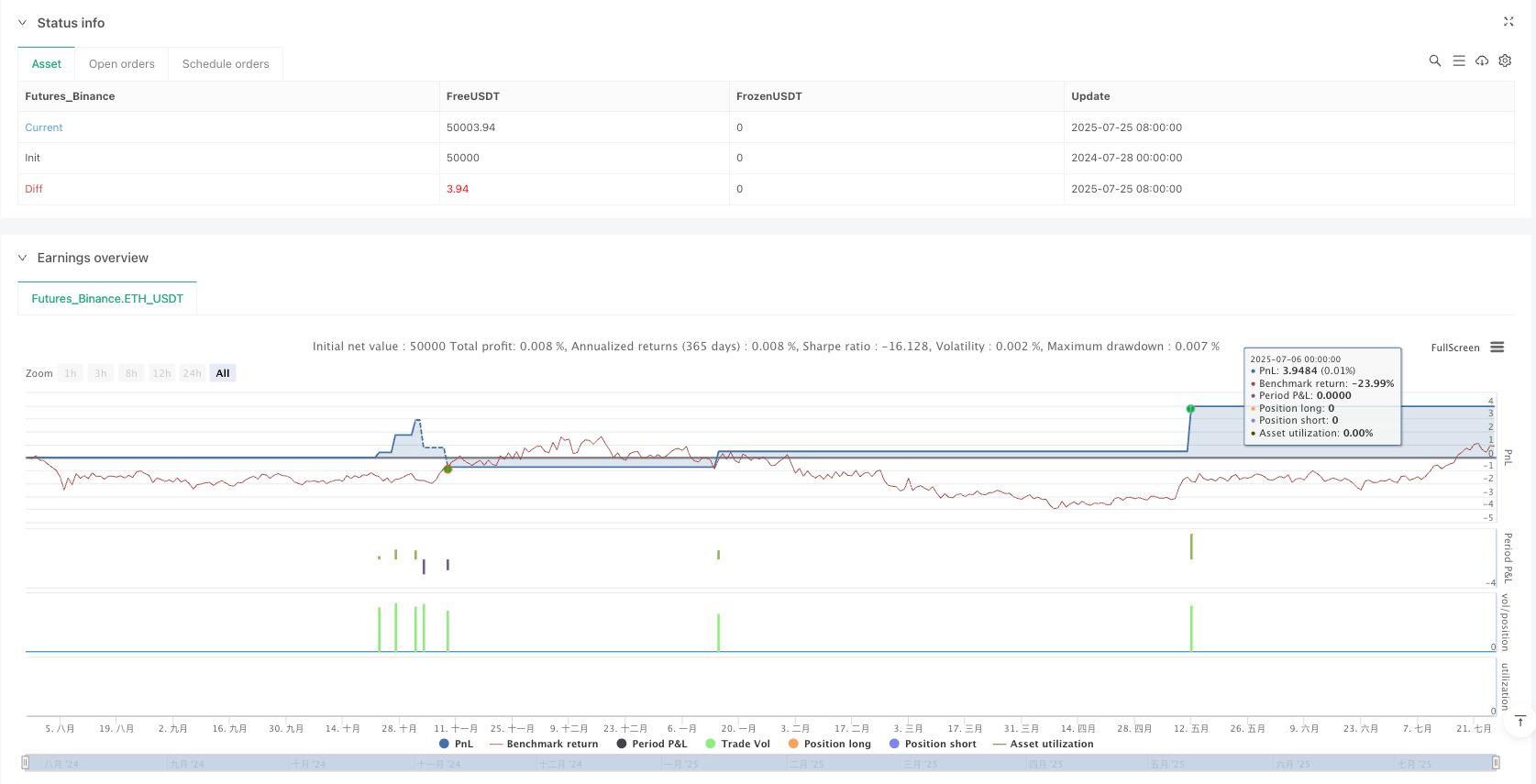

/*backtest

start: 2024-07-28 00:00:00

end: 2025-07-26 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Swing FX Pro Panel v1", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// === INPUTY ===

initialCapital = input.float(1000, "Initial Capital (€)")

riskPerTrade = input.float(2, "Risk per Trade (%)")

periodMonths = input.int(6, "Analysis Period (months)")

// === STRATEGIA DEMO (np. EMA CROSS) ===

emaFast = ta.ema(close, 20)

emaSlow = ta.ema(close, 50)

longSignal = ta.crossover(emaFast, emaSlow)

shortSignal = ta.crossunder(emaFast, emaSlow)

if (longSignal)

strategy.entry("Long", strategy.long)

if (shortSignal)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Long", from_entry="Long", profit=300, loss=150)

strategy.exit("Exit Short", from_entry="Short", profit=300, loss=150)