Overview

The Dual MACD Trend Capture Strategy is an automated trading system that utilizes two independent MACD indicators working in tandem to enhance trading decision accuracy by capturing trend signals across different timeframes. The strategy employs a fast MACD to capture short-term micro-trends while using a slow MACD to confirm broader market momentum, creating a multi-dimensional trading signal system. When both MACD lines simultaneously show signal line crossovers in the same direction, the strategy automatically executes corresponding long or short trades, achieving fully automated position management.

Strategy Principles

The core principle of the Dual MACD Strategy is utilizing two MACD indicators with different parameter settings to filter false signals and confirm genuine trends. Specifically, the strategy includes the following key components:

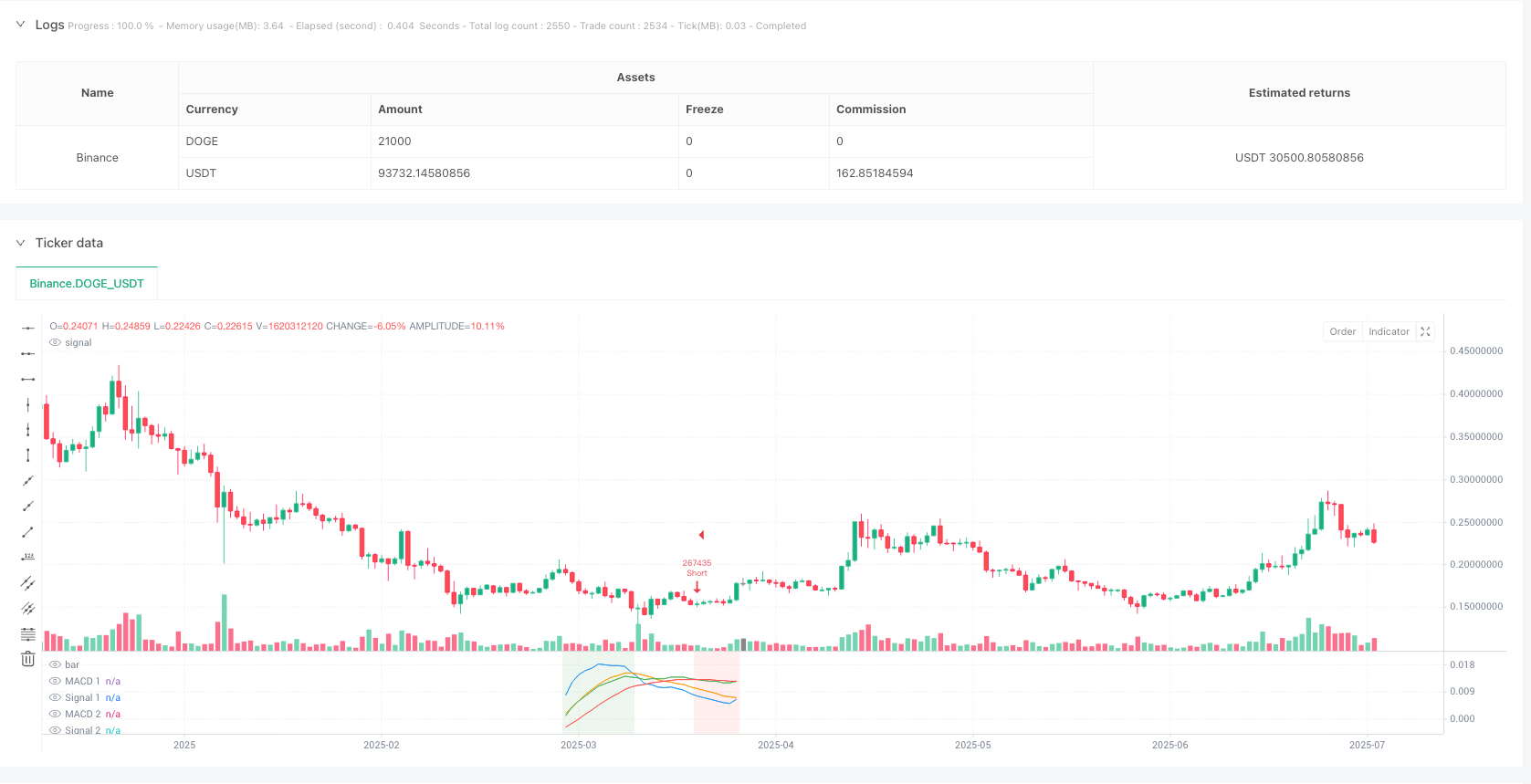

Fast MACD (MACD 1): Configured with relatively short-term parameters (fast length 12, slow length 26, signal length 9), using EMA as the moving average type. This component is primarily responsible for capturing short-term market fluctuations and micro-trend shifts.

Slow MACD (MACD 2): Configured with relatively long-term parameters (fast length 24, slow length 52, signal length 9), also using EMA as the moving average type. This component is responsible for confirming broader market momentum and medium to long-term trends.

Trade Signal Generation Mechanism:

- A long signal is generated when both the fast and slow MACD lines cross above their respective signal lines

- A short signal is generated when both the fast and slow MACD lines cross below their respective signal lines

Position Management: The strategy defaults to using 100% of available equity for trading while limiting to a maximum of one concurrent trade per direction. When a new opposing signal is generated, existing positions are closed before opening new trades, avoiding simultaneous long and short positions.

Visual Assistance: The strategy intuitively displays the current market bias through background shading (green for bullish signals, red for bearish signals), helping traders understand the strategy’s decision-making process.

From an implementation perspective, the strategy employs functional programming concepts by defining ma and macdCalc functions to enable flexible configuration of moving averages and MACD calculations, enhancing code maintainability and extensibility.

Strategy Advantages

Deep analysis of the Dual MACD Strategy reveals the following significant advantages:

Signal Confirmation Mechanism: By requiring both MACD indicators from different timeframes to generate signals in the same direction, the strategy significantly reduces the impact of false breakouts and spurious signals, improving the robustness of trading decisions.

Adaptation to Different Market Environments: The fast MACD captures short-term fluctuations while the slow MACD confirms long-term trends, enabling the strategy to maintain effectiveness in various market conditions, whether rapidly fluctuating or slowly trending.

Parameter Customizability: The strategy allows users to customize all parameters for both MACDs, including fast length, slow length, signal length, and moving average type, enabling traders to optimize based on specific markets and personal preferences.

High Degree of Automation: The strategy fully automates trading decisions, from signal generation to position management, reducing human intervention and emotional influence while improving trading discipline.

Intuitive Visual Feedback: Through background shading and MACD line plotting, traders can intuitively understand the current market state and strategy logic, facilitating monitoring and performance analysis.

Avoidance of Position Conflicts: The strategy design ensures that opposing positions are closed before opening new ones, avoiding the risk of simultaneously holding both long and short positions, simplifying position management.

Strategy Risks

Despite its many advantages, the Dual MACD Strategy also presents several potential risks that traders should fully understand and address when implementing:

Lag Risk: As a tracking indicator, MACD inherently has a certain lag, and the combination of two MACDs may miss important turning points in rapidly changing markets, leading to delayed entries or exits. The solution is to incorporate leading indicators or optimize MACD parameters to reduce lag.

Poor Performance in Range-Bound Markets: In sideways or trendless markets, the strategy may generate frequent false signals leading to consecutive losses. It is recommended to add trend filters or volatility indicators to reduce trading frequency in such markets.

Capital Management Risk: Using 100% of funds for trading by default may be too aggressive, potentially leading to severe losses during extreme market volatility. Traders should adjust position sizing according to their risk tolerance, preferably using fixed percentage or volatility-based position sizing strategies.

Lack of Stop-Loss Mechanism: The current strategy lacks built-in stop-loss mechanisms, relying solely on signal reversals for position closure, which may lead to significant losses in extreme market conditions. Adding fixed stop-losses, trailing stops, or ATR-based stop-loss mechanisms is recommended to control single-trade risk.

Parameter Sensitivity: Strategy performance heavily depends on MACD parameter selection, and inappropriate parameters may lead to over-optimization and curve-fitting issues. Parameters should be validated through backtesting across different time periods and markets to avoid overfitting to specific historical data.

Strategy Optimization Directions

Based on in-depth analysis of the Dual MACD Strategy, here are several potential optimization directions to further enhance the strategy’s robustness and profitability:

Add Trend Filters: Introduce additional trend determination indicators, such as ADX or long-term moving averages, to trade only in confirmed trend directions. This avoids frequent trading in range-bound markets and improves win rates. The optimization rationale is that MACD performs better in trending markets.

Dynamic Parameter Adjustment: Automatically adjust MACD parameters based on market volatility, for example, using longer parameters in high-volatility environments to reduce noise and shorter parameters in low-volatility environments to increase sensitivity. This adaptive mechanism allows the strategy to better adapt to different market conditions.

Integrate Profit-Taking and Stop-Loss Mechanisms: Add ATR-based or fixed percentage stop-loss and take-profit rules to protect capital and lock in profits. Reasonable risk management mechanisms are key to long-term profitability, especially during trend reversals or extreme market volatility.

Time Filtering: Implement trading time window restrictions to avoid trading during periods of low liquidity or abnormal volatility. For example, avoiding high-volatility periods around important economic data releases or market openings/closings.

Multi-Timeframe Analysis: Extend the strategy to consider MACD signals across multiple timeframes, forming a hierarchical confirmation mechanism. For example, entering trades only when daily, 4-hour, and 1-hour MACD all show signals in the same direction, further reducing false signal risk.

Introduce Machine Learning Optimization: Utilize machine learning algorithms to dynamically evaluate optimal MACD parameter combinations in different market environments, achieving adaptive adjustment of strategy parameters, reducing manual intervention, and improving strategy adaptability.

Add Volume Confirmation: Incorporate volume indicators to confirm the validity of MACD signals, executing trades only when price movements are accompanied by significant volume changes, improving signal quality.

Summary

The Dual MACD Trend Capture Strategy is an automated trading system that combines short-term and long-term market momentum through the collaborative action of two independent MACD indicators, effectively filtering false signals and capturing genuine trends. The strategy’s core advantages lie in its signal confirmation mechanism and high customizability, enabling it to adapt to different market environments and trading styles.

However, traders need to be aware of the strategy’s inherent lag and potential for false signals in range-bound markets. By adding trend filters, improving risk management mechanisms, implementing multi-timeframe analysis, and other optimization measures, the strategy’s robustness and long-term profitability can be significantly enhanced.

Ultimately, the Dual MACD Strategy provides an excellent quantitative trading framework suitable for experienced traders to further customize and optimize based on personal risk preferences and specific market characteristics. Whether as a standalone trading system or as a component of more complex strategies, this approach demonstrates potential for capturing market trends effectively.

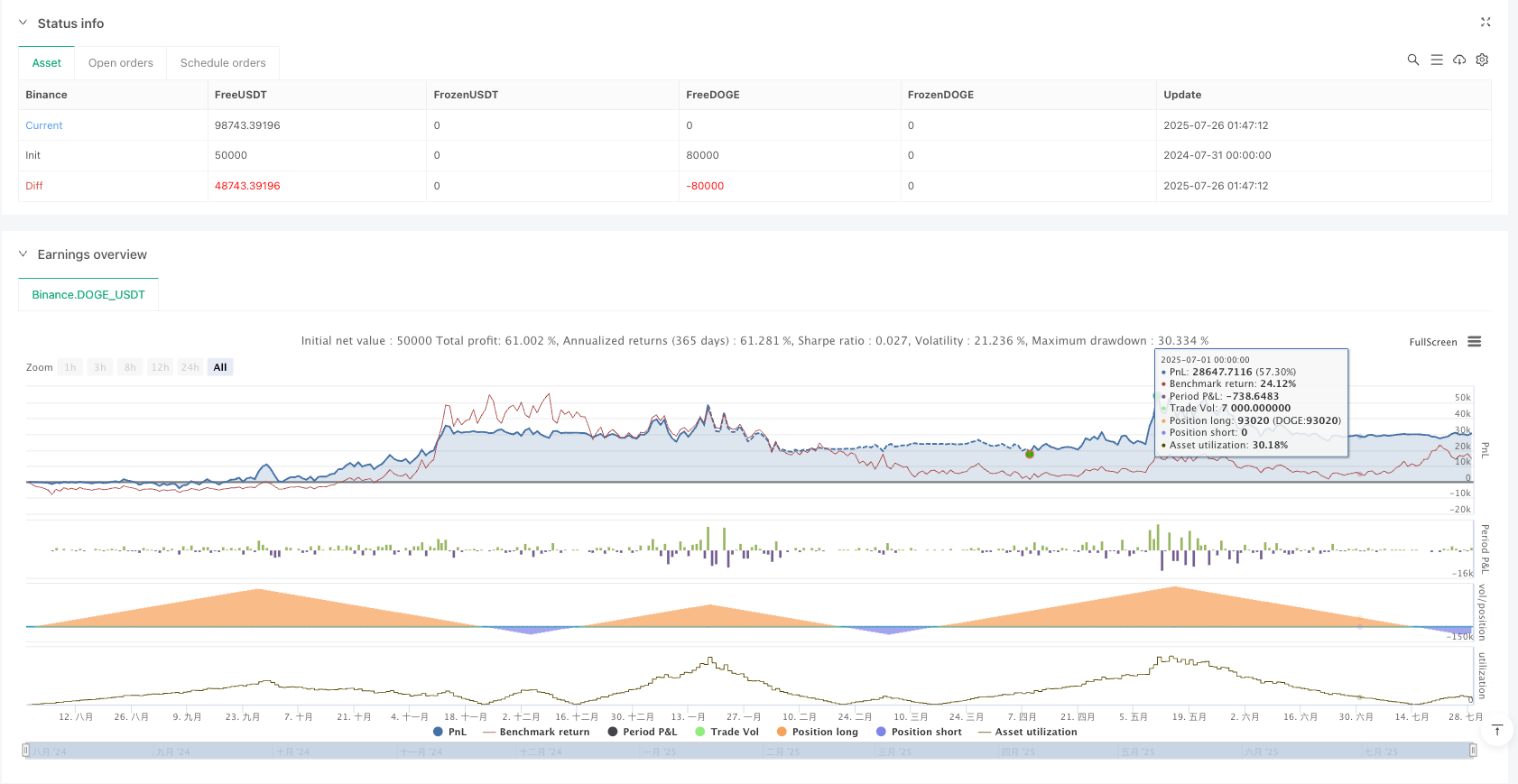

/*backtest

start: 2024-07-31 00:00:00

end: 2025-07-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Double MACD Strategy", overlay=false, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// First MACD settings (fast)

fast_len1 = input.int(12, "Fast Length 1", minval=1)

slow_len1 = input.int(26, "Slow Length 1", minval=1)

signal_len1 = input.int(9, "Signal Length 1", minval=1)

ma_type1 = input.string("EMA", "MA Type for MACD 1", options=["EMA", "SMA"])

// Second MACD settings (slow)

fast_len2 = input.int(24, "Fast Length 2", minval=1)

slow_len2 = input.int(52, "Slow Length 2", minval=1)

signal_len2 = input.int(9, "Signal Length 2", minval=1)

ma_type2 = input.string("EMA", "MA Type for MACD 2", options=["EMA", "SMA"])

// MA selector function

ma(src, len, type) => type == "EMA" ? ta.ema(src, len) : ta.sma(src, len)

// MACD calculation function

macdCalc(src, fast_length, slow_length, signal_length, ma_type) =>

fastMA = ma(src, fast_length, ma_type)

slowMA = ma(src, slow_length, ma_type)

macdLine = fastMA - slowMA

signalLine = ma(macdLine, signal_length, ma_type)

[macdLine, signalLine]

// Calculate both MACDs

[macd1, signal1] = macdCalc(close, fast_len1, slow_len1, signal_len1, ma_type1)

[macd2, signal2] = macdCalc(close, fast_len2, slow_len2, signal_len2, ma_type2)

// Entry and exit signals

longSignal = (macd1 > signal1) and (macd2 > signal2)

shortSignal = (macd1 < signal1) and (macd2 < signal2)

// Execute entries and flips

if (longSignal)

strategy.entry("Long", strategy.long)

strategy.close("Short")

if (shortSignal)

strategy.entry("Short", strategy.short)

strategy.close("Long")

// Plot MACD lines and signals

plot(macd1, color=color.blue, title="MACD 1")

plot(signal1, color=color.orange, title="Signal 1")

plot(macd2, color=color.green, title="MACD 2")

plot(signal2, color=color.red, title="Signal 2")

// Background shading

bgcolor(longSignal ? color.new(color.green, 90) : na, title="Buy Background")

bgcolor(shortSignal ? color.new(color.red, 90) : na, title="Sell Background")