Strategy Overview

The Opening Range Breakout ATR Trailing Stop Loss Strategy is a quantitative trading system that combines Opening Range Breakout principles with Smart Money Concepts. This strategy focuses on capturing price breakouts from the range formed during the first 5 minutes of the US market opening (09:30-09:35 EST), incorporating multiple filtering conditions to ensure signal quality. The system supports instant or retracement entries, implements a dynamic risk-to-reward adjustment mechanism, and offers an optional ATR (Average True Range) trailing stop loss to optimize profit management. The strategy also features a “second chance” trading functionality, allowing traders to capture reverse breakout opportunities after an initial trade failure, while providing comprehensive visualization tools to help traders better understand market dynamics.

Strategy Principles

The Opening Range Breakout ATR Trailing Stop Loss Strategy’s core logic is built on the significance of the initial price range after market opening. The strategy first captures and records the highest and lowest prices during a specific time window (09:30-09:35 EST), forming the “Opening Range.” Subsequently, the system monitors price breakouts from this range, combining the following key mechanisms to ensure trade quality:

Opening Range Identification and Breakout Validation: The system records price highs and lows within the specified time window, then monitors breakouts. Each breakout must pass through two filtering mechanisms:

- Candlestick wick percentage filter: Ensures that the upper/lower shadow of the breakout candle does not exceed a specified percentage of the candle body, avoiding false breakouts.

- Breakout distance filter: Ensures that the breakout magnitude is reasonable, neither too small (avoiding minor breakouts) nor too large (avoiding overextended movements).

Entry Mechanism: The strategy supports two entry methods:

- Instant entry: Direct entry at the closing price of the same candle that confirms a valid breakout.

- Retracement entry: Waiting for price to retrace to a specified percentage position of the breakout candle body before entering, typically set at a 50% retracement level.

Stop Loss Setup: The system provides two types of stop loss:

- Breakout candle stop loss: Setting the stop loss just beyond the extreme point of the breakout candle.

- Opposite range stop loss: Setting the stop loss beyond the opposite boundary of the opening range, allowing more room for price fluctuation.

Risk Management: The system uses a Risk:Reward Multiplier to automatically calculate take profit positions, implementing dynamic risk management. For example, setting a 2:1 risk-to-reward ratio means the potential profit is twice the potential loss.

ATR Trailing Stop Loss: Once profit reaches a preset risk-to-reward ratio, the system can activate an ATR-based trailing stop loss, locking in partial profits while allowing trends to continue.

Second Chance Trading: When the initial trade triggers a stop loss or fails, the system can automatically look for breakout opportunities in the opposite direction of the opening range, enabling the possibility of bidirectional trading within the same day.

Strategy Advantages

Focus on High-Quality Trading Opportunities: Through multiple validation mechanisms (wick filtering, distance filtering), the strategy significantly reduces false breakout trades, improving win rates.

Flexible Entry Mechanisms: Supporting both instant and retracement entries to adapt to different trading styles and market conditions. Instant entries are suitable for strong trends, while retracement entries can provide more favorable entry prices.

Adaptive Risk Management: Dynamic take-profit settings based on risk-to-reward multipliers ensure that each trade has consistent risk characteristics, achieving standardized capital management.

Profit Maximization: The ATR trailing stop loss feature allows strong market movements to develop while protecting realized profits, avoiding premature exits.

High Visualization: The system provides comprehensive visual aids, including range markers, breakout validation labels, trade status indicators, entry/stop-loss/take-profit markers, enhancing the intuitiveness of trading decisions.

Bias-Free Backtesting Design: The strategy fully adopts

barstate.isconfirmedto ensure all decisions are based on confirmed price data, avoiding look-ahead bias and conforming to real trading environments.Second Chance Mechanism: By enabling the second chance trading feature, the strategy can quickly adapt to market changes when the initial direction judgment is incorrect, capturing reverse opportunities and improving capital utilization efficiency.

Session Management Optimization: Built-in session-end automatic position closing functionality ensures no overnight positions, reducing overnight risk.

Strategy Risks

Range Formation Period Volatility Risk: During the opening range formation period (09:30-09:35), the market may experience abnormal volatility, resulting in ranges that are too wide or too narrow. Excessively wide ranges may lead to large stop losses, while narrow ranges may frequently trigger false breakouts. Solution: Consider adding filtering conditions for opening range size, excluding abnormal ranges; or adjust the trading date filter to avoid specific high-volatility days (such as important economic data release days).

Severe Retracement Risk After Breakout: After a valid breakout, the market may experience severe retracements, causing stop losses to be triggered before the market continues in the original direction. Solution: Consider using more relaxed stop loss settings, such as opposite range stop losses; or adjust the entry mechanism to retracement entry to obtain better entry prices and smaller risk exposure.

Signal Quality Dependence on Filter Settings: The wick filter and distance filter parameters for breakout validation significantly impact signal quality. Inappropriate parameters may filter out good trading opportunities or accept too many low-quality signals. Solution: Optimize filter parameters through historical backtesting to find the best settings for specific markets and instruments; consider using adaptive parameters to dynamically adjust filtering criteria based on market volatility.

Trailing Stop Loss Parameter Sensitivity: ATR trailing stop loss parameters set too tight may lead to premature exits during small retracements, while settings that are too loose may result in excessive profit giveback. Solution: Adjust ATR periods and multipliers based on the historical volatility characteristics of the target instrument; consider implementing partial position closing strategies, with some positions using fixed take profits and others using trailing stops.

Trading Frequency Limitations: The strategy executes a maximum of two trades per day (initial trade and second chance trade), potentially unable to fully utilize all intraday opportunities. Solution: Consider expanding the strategy to monitor important price ranges during other intraday time periods; or combine with other technical indicators to form a composite strategy, increasing trading signal sources.

Strategy Optimization Directions

Adaptive Opening Range Period: The current strategy uses a fixed 5-minute opening range. Consider dynamically adjusting the range duration based on market volatility. In low-volatility markets, the range time could be shortened to 3 minutes, while in high-volatility markets, it could be extended to 10 minutes, better adapting to different market states.

Volume Confirmation Integration: Add volume filtering conditions to the breakout validation mechanism, requiring significantly higher volume during breakouts compared to the average volume of previous periods, enhancing breakout validity. This can be implemented by calculating the ratio of breakout candle volume to the average volume of the previous N periods.

Multi-Timeframe Analysis: Introduce higher timeframe trend direction filtering, only entering when the daily or hourly trend direction aligns with the breakout direction, improving trade win rates. Higher timeframe trends can be determined through simple moving average slopes or more advanced trend indicators.

Optimized Capital Management: Implement a dynamic position sizing adjustment mechanism that automatically adjusts contract quantities based on historical volatility, current account size, and recent performance, achieving more refined risk control. For example, gradually increase positions after consecutive profitable trades and decrease positions after consecutive losses.

Machine Learning Model Integration: Introduce machine learning models to evaluate breakout quality, training models to identify the most likely successful breakout patterns using historical data. Features may include opening range size, market volatility, previous trading day price movements, specific time patterns, etc.

Enhanced Second Chance Trading Logic: Optimize the triggering conditions for second chance trades, considering not only initial trade failures but also market structure changes and emerging momentum indicators, improving the success rate of second trades.

Personalized Instrument Parameters: Develop optimized parameter sets for different trading instruments, taking into account each instrument’s unique volatility characteristics and price behavior. For example, more volatile instruments may require more relaxed filter settings and more conservative risk-reward ratios.

Market Sentiment Indicator Integration: Introduce the VIX index or other market sentiment indicators to adjust strategy parameters or temporarily disable trading during extreme market sentiment periods, avoiding high-uncertainty environments.

Conclusion

The Opening Range Breakout ATR Trailing Stop Loss Strategy is a well-structured quantitative trading system that cleverly combines opening range breakouts, intelligent filtering mechanisms, flexible entry options, and advanced risk management features. This strategy is particularly suitable for intraday trading in US stock and futures markets, achieving profits by capturing directional breakouts after market opening.

The core value of the strategy lies in its multi-layer validation mechanisms and risk management system, significantly reducing false breakout trades through wick and distance filters, while using risk-reward multipliers and ATR trailing stops to ensure consistent risk exposure and profit protection. The second chance trading feature adds adaptability and additional profit opportunities to the strategy.

Despite its numerous advantages, users should note the importance of parameter optimization, as different markets and instruments may require targeted adjustments to achieve optimal results. Simultaneously, traders are advised to use this strategy as part of a complete trading system, in conjunction with broader market analysis and risk management principles.

By implementing the suggested optimization directions, particularly adaptive parameters, multi-timeframe analysis, and enhanced capital management systems, this strategy has the potential to further improve its stability and profitability, becoming a powerful tool in the professional trader’s toolkit.

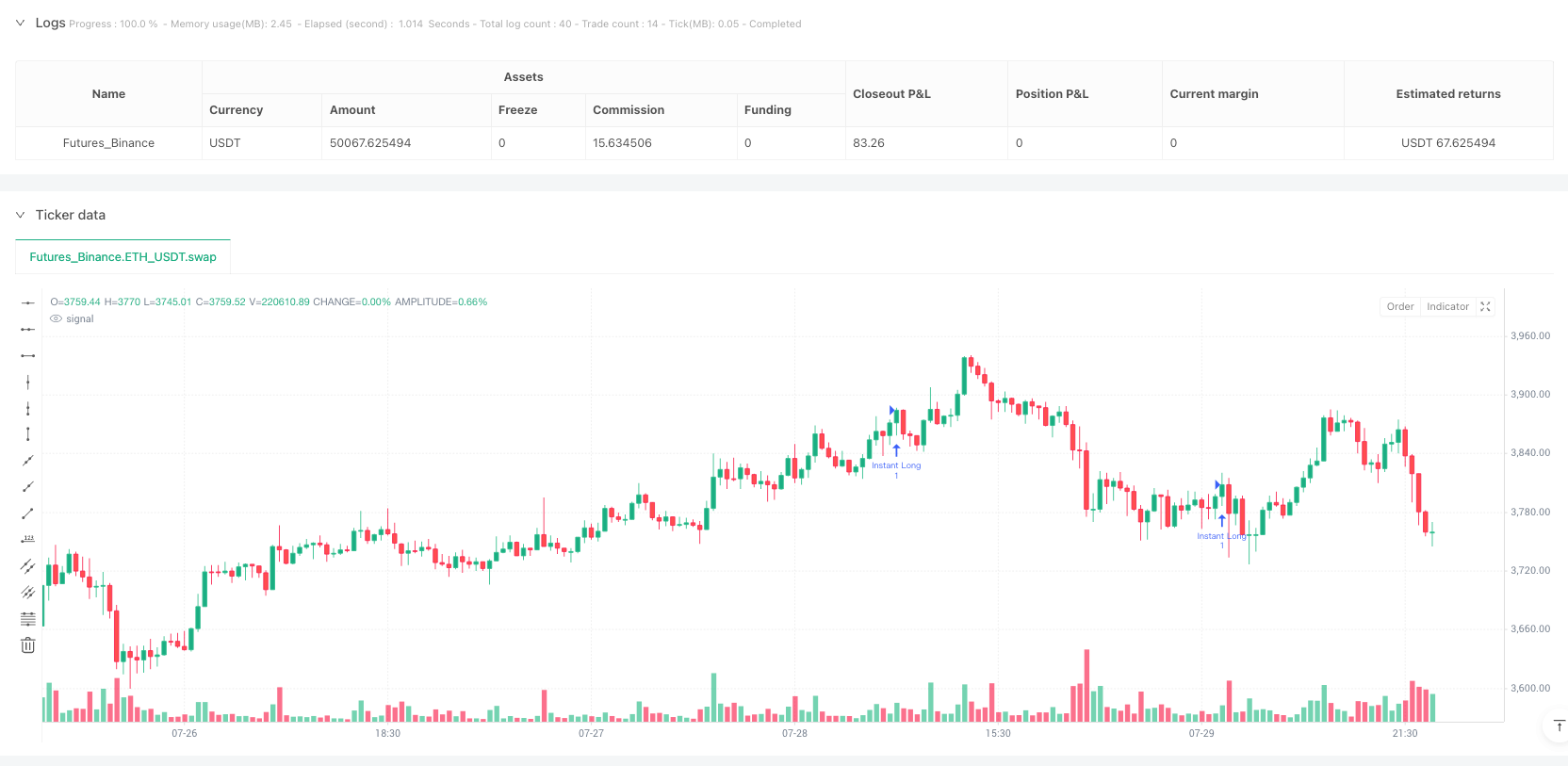

/*backtest

start: 2025-07-18 00:00:00

end: 2025-07-30 00:00:00

period: 30m

basePeriod: 30m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Casper SMC 5min ORB - Roboquant AI", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1, max_bars_back=500, calc_on_order_fills=true, calc_on_every_tick=false, initial_capital=50000, currency=currency.USD)

// === STRATEGY SETTINGS ===

// Risk Management

contracts = input.int(1, "Contracts", minval=1, group="Risk Management")

risk_multiplier = input.float(2.0, "Risk:Reward Multiplier", minval=0.5, maxval=10.0, group="Risk Management")

sl_points = input.int(2, "Stop Loss Points Below/Above Breakout Candle", minval=1, group="Risk Management")

// Entry Settings

entry_type = input.string("Instant", "Entry Type", options=["Retracement", "Instant"], group="Entry Settings")

retracement_percent = input.float(50.0, "Retracement % of Breakout Candle Body", minval=10.0, maxval=90.0, group="Entry Settings")

// Stop Loss Settings

sl_type = input.string("Opposite Range", "Stop Loss Type", options=["Breakout Candle", "Opposite Range"], group="Stop Loss Settings")

// Second Chance Trade Settings

enable_second_chance = input.bool(false, "Enable Second Chance Trade", group="Second Chance Trade")

second_chance_info = input.string("If initial SL is hit, allow opposite breakout trade", "Info: Second Chance Logic", group="Second Chance Trade")

// Breakout Filter Settings

use_wick_filter = input.bool(false, "Use Wick Filter", group="Breakout Filter")

max_wick_percent = input.float(50.0, "Max Wick % of Candle Body", minval=10.0, maxval=200.0, group="Breakout Filter")

// Breakout Distance Filters

use_breakout_distance_filter = input.bool(true, "Use Breakout Distance Filter", group="Breakout Distance Filter")

min_breakout_multiplier = input.float(0.1, "Min Breakout Distance (OR Size * X)", minval=0.0, maxval=3.0, group="Breakout Distance Filter")

max_breakout_multiplier = input.float(1.6, "Max Breakout Distance (OR Size * X)", minval=0.5, maxval=5.0, group="Breakout Distance Filter")

// Trailing Stop Loss Settings

use_trailing_sl = input.bool(false, "Use Trailing Stop Loss", group="Trailing Stop Loss")

profit_r_multiplier = input.float(1.0, "Start Trailing After X R Profit", minval=0.5, maxval=5.0, group="Trailing Stop Loss")

atr_length = input.int(14, "ATR Length", minval=1, maxval=50, group="Trailing Stop Loss")

atr_multiplier = input.float(1.0, "ATR Multiplier for Trailing", minval=0.5, maxval=5.0, group="Trailing Stop Loss")

// Session Management

or_start_hour = input.int(9, "Opening Range Start Hour", minval=0, maxval=23, group="Session Management")

or_start_minute = input.int(30, "Opening Range Start Minute", minval=0, maxval=59, group="Session Management")

or_end_minute = input.int(35, "Opening Range End Minute", minval=0, maxval=59, group="Session Management")

session_timezone = input.string("America/New_York", "Session Timezone", group="Session Management")

force_session_close = input.bool(true, "Force Close at Session End", group="Session Management")

session_end_hour = input.int(16, "Session End Hour", minval=0, maxval=23, group="Session Management")

session_end_minute = input.int(0, "Session End Minute", minval=0, maxval=59, group="Session Management")

// Day of Week Trading Filters

trade_monday = input.bool(true, "Trade on Monday", group="Day of Week Filters")

trade_tuesday = input.bool(true, "Trade on Tuesday", group="Day of Week Filters")

trade_wednesday = input.bool(true, "Trade on Wednesday", group="Day of Week Filters")

trade_thursday = input.bool(true, "Trade on Thursday", group="Day of Week Filters")

trade_friday = input.bool(true, "Trade on Friday", group="Day of Week Filters")

// Visual Settings

high_line_color = input.color(color.green, title="Opening Range High Line Color", group="Visual Settings")

low_line_color = input.color(color.red, title="Opening Range Low Line Color", group="Visual Settings")

// Label Control Settings

show_trading_disabled_labels = input.bool(false, "Show Trading Disabled Labels", group="Label Controls")

show_breakout_validation_labels = input.bool(true, "Show Breakout Validation Labels", group="Label Controls")

show_second_chance_labels = input.bool(false, "Show Second Chance Labels", group="Label Controls")

show_trade_status_labels = input.bool(false, "Show Trade Status Labels", group="Label Controls")

show_entry_labels = input.bool(false, "Show Entry Labels", group="Label Controls")

show_sl_tp_labels = input.bool(false, "Show Stop Loss / Take Profit Labels", group="Label Controls")

// === VARIABLES ===

// ATR for trailing stop loss

atr = ta.atr(atr_length)

// === NYSE OPENING RANGE LOGIC ===

// FIXED: Using configurable hour/minute inputs with timezone

current_time = time(timeframe.period, "0000-2400:23456", session_timezone)

current_hour = hour(current_time, session_timezone)

current_minute = minute(current_time, session_timezone)

is_opening_range = current_hour == or_start_hour and current_minute >= or_start_minute and current_minute <= or_end_minute

// Check if we're at the start of a new trading day - FIXED: More reliable detection

is_new_day = ta.change(time("1D"))

// ADDED: Check if trading is allowed on current day of week (using session timezone)

current_day = dayofweek(current_time, session_timezone)

is_trading_day_allowed = (current_day == dayofweek.monday and trade_monday) or (current_day == dayofweek.tuesday and trade_tuesday) or (current_day == dayofweek.wednesday and trade_wednesday) or (current_day == dayofweek.thursday and trade_thursday) or (current_day == dayofweek.friday and trade_friday)

// Variables to store opening range high and low for current day

var float or_high = na

var float or_low = na

var bool lines_drawn = false

var bool breakout_occurred = false

var float breakout_candle_high = na

var float breakout_candle_low = na

var float breakout_price = na

var string breakout_direction = na

var int or_start_bar = na // ADDED: Store the bar index when opening range starts

// ADDED: Second chance trade variables

var bool first_trade_sl_hit = false

var string first_trade_direction = na

var bool second_chance_available = false

var bool second_trade_taken = false

var bool daily_trades_complete = false // ADDED: Prevent more than 2 trades per day

// Reset variables at the start of each trading day

if is_new_day

or_high := na

or_low := na

lines_drawn := false

breakout_occurred := false

breakout_candle_high := na

breakout_candle_low := na

breakout_price := na

breakout_direction := na

or_start_bar := na // ADDED: Reset opening range start bar

// ADDED: Reset second chance variables

first_trade_sl_hit := false

first_trade_direction := na

second_chance_available := false

second_trade_taken := false

daily_trades_complete := false // ADDED: Reset trade limit

// Capture opening range data during 09:30-09:35 EST

if is_opening_range

if na(or_high) or na(or_low)

or_high := high

or_low := low

or_start_bar := bar_index // ADDED: Store the bar index when opening range starts

else

or_high := math.max(or_high, high)

or_low := math.min(or_low, low)

// Draw lines when we're past the opening range and haven't drawn yet

if not is_opening_range and not na(or_high) and not na(or_low) and not na(or_start_bar) and not lines_drawn

// FIXED: Lines start from the actual opening range start time and extend forward

start_x = or_start_bar

end_x = bar_index + 50 // Extend lines forward for visibility

lines_drawn := true

// ADDED: Show visual indicator if trading is disabled for current day

if not is_trading_day_allowed and show_trading_disabled_labels

day_name = current_day == dayofweek.monday ? "Monday" :

current_day == dayofweek.tuesday ? "Tuesday" :

current_day == dayofweek.wednesday ? "Wednesday" :

current_day == dayofweek.thursday ? "Thursday" :

current_day == dayofweek.friday ? "Friday" : "Weekend"

label.new(x=bar_index, y=(or_high + or_low) / 2, text="Trading Disabled\n" + day_name, color=color.gray, textcolor=color.white, style=label.style_label_center, size=size.normal)

// Check for breakouts after opening range is complete (only first breakout of the day)

// FIXED: Added barstate.isconfirmed to avoid lookahead bias

if barstate.isconfirmed and not is_opening_range and not na(or_high) and not na(or_low) and lines_drawn and not breakout_occurred and not daily_trades_complete and is_trading_day_allowed

// Calculate candle body and wick percentages

candle_body = math.abs(close - open)

top_wick = high - math.max(open, close)

bottom_wick = math.min(open, close) - low

top_wick_percent = candle_body > 0 ? (top_wick / candle_body) * 100 : 0

bottom_wick_percent = candle_body > 0 ? (bottom_wick / candle_body) * 100 : 0

// ADDED: Calculate opening range size for distance filters

or_size = or_high - or_low

// Check for first breakout above opening range high

if close > or_high

// FIXED: Mark breakout as occurred FIRST (this is THE breakout candle)

breakout_occurred := true

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "long"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_high + (or_size * min_breakout_multiplier)

max_breakout_level = or_high + (or_size * max_breakout_multiplier)

breakout_distance_valid := close >= min_breakout_level and close <= max_breakout_level

// Apply wick filter for long breakouts

wick_filter_valid = not use_wick_filter or top_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_breakout_validation_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=high, text="VALID", color=high_line_color, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=high, text="INVALID", color=color.gray, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// Check for first breakout below opening range low

else if close < or_low

// FIXED: Mark breakout as occurred FIRST (this is THE breakout candle)

breakout_occurred := true

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "short"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_low - (or_size * min_breakout_multiplier)

max_breakout_level = or_low - (or_size * max_breakout_multiplier)

breakout_distance_valid := close <= min_breakout_level and close >= max_breakout_level

// Apply wick filter for short breakouts

wick_filter_valid = not use_wick_filter or bottom_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_breakout_validation_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=low, text="VALID", color=low_line_color, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

label.new(x=bar_index, y=low, text="INVALID", color=color.gray, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// ADDED: Check for second chance breakout (opposite direction after initial SL hit)

// FIXED: Added barstate.isconfirmed to avoid lookahead bias

if barstate.isconfirmed and not is_opening_range and not na(or_high) and not na(or_low) and lines_drawn and second_chance_available and not second_trade_taken and not daily_trades_complete and is_trading_day_allowed

// Calculate candle body and wick percentages

candle_body = math.abs(close - open)

top_wick = high - math.max(open, close)

bottom_wick = math.min(open, close) - low

top_wick_percent = candle_body > 0 ? (top_wick / candle_body) * 100 : 0

bottom_wick_percent = candle_body > 0 ? (bottom_wick / candle_body) * 100 : 0

// ADDED: Calculate opening range size for distance filters

or_size = or_high - or_low

// If first trade was LONG and failed, look for SHORT breakout

if first_trade_direction == "long" and close < or_low

// FIXED: Mark second chance breakout as taken FIRST

second_trade_taken := true

second_chance_available := false

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "short"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_low - (or_size * min_breakout_multiplier)

max_breakout_level = or_low - (or_size * max_breakout_multiplier)

breakout_distance_valid := close <= min_breakout_level and close >= max_breakout_level

// Apply wick filter for short breakouts

wick_filter_valid = not use_wick_filter or bottom_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_second_chance_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=low, text="2nd Chance\nOR Low Break\nVALID", color=color.orange, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

label.new(x=bar_index, y=low, text="2nd Chance\nOR Low Break\nINVALID", color=color.gray, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// If first trade was SHORT and failed, look for LONG breakout

else if first_trade_direction == "short" and close > or_high

// FIXED: Mark second chance breakout as taken FIRST

second_trade_taken := true

second_chance_available := false

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "long"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_high + (or_size * min_breakout_multiplier)

max_breakout_level = or_high + (or_size * max_breakout_multiplier)

breakout_distance_valid := close >= min_breakout_level and close <= max_breakout_level

// Apply wick filter for long breakouts

wick_filter_valid = not use_wick_filter or top_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_second_chance_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=high, text="2nd Chance\nOR High Break\nVALID", color=color.orange, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=high, text="2nd Chance\nOR High Break\nINVALID", color=color.gray, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// === STRATEGY LOGIC ===

// Check if we have a breakout and place retracement entry orders

var bool entry_placed = false

var bool second_entry_placed = false // ADDED: Track second trade entry separately

var float entry_price = na

var float stop_loss = na

var float take_profit = na

var float trailing_stop = na

var bool trailing_active = false

var float initial_risk = na

var bool trailing_started = false

var string current_entry_id = na // FIXED: Track which entry ID we're using

// Arrays to store historical trade boxes

var array<box> historical_trade_boxes = array.new<box>()

var array<box> historical_sl_boxes = array.new<box>()

var array<box> historical_tp_boxes = array.new<box>()

// Variables to track current active trade boxes for extending to exit

var box current_profit_box = na

var box current_sl_box = na

// ADDED: General position close detection for extending boxes - Handle timing issues

if barstate.isconfirmed and strategy.position_size == 0 and strategy.position_size[1] != 0

// Extend trade visualization boxes to exact exit point when any position closes

if not na(current_profit_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na // Clear reference after extending

if not na(current_sl_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na // Clear reference after extending

// ADDED: Backup safety check - extend boxes if position is closed but boxes still active

if not na(current_profit_box) and strategy.position_size == 0

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na

if not na(current_sl_box) and strategy.position_size == 0

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na

// Reset entry flag on new day

if is_new_day

entry_placed := false

second_entry_placed := false // ADDED: Reset second entry flag

entry_price := na

stop_loss := na

take_profit := na

trailing_stop := na

trailing_active := false

initial_risk := na

trailing_started := false

current_entry_id := na // FIXED: Reset entry ID

current_profit_box := na // ADDED: Reset current trade boxes

current_sl_box := na

// SIMPLIFIED: Detect when position closes to enable second chance (FIXED for lookahead bias)

if barstate.isconfirmed and strategy.position_size == 0 and strategy.position_size[1] != 0 and entry_placed and not first_trade_sl_hit

// A position just closed and we had an active trade

if enable_second_chance and not second_trade_taken

// Simplified logic - if position closed, enable second chance

first_trade_sl_hit := true

first_trade_direction := breakout_direction

second_chance_available := true

// Reset variables for potential second trade

entry_price := na

trailing_stop := na

trailing_active := false

initial_risk := na

trailing_started := false

current_entry_id := na

// Add visual marker

if show_trade_status_labels

label.new(x=bar_index, y=close, text="Trade Closed\nSecond Chance Available", color=color.yellow, textcolor=color.black, style=label.style_label_down, size=size.tiny)

else

// Second chance not enabled or already taken - mark day complete

daily_trades_complete := true

// ADDED: Handle case where first breakout was invalid (no trade placed)

if breakout_occurred and breakout_direction == "invalid" and enable_second_chance and not first_trade_sl_hit

// First breakout was invalid, enable second chance immediately

first_trade_sl_hit := true

// Determine what direction the invalid breakout was

first_trade_direction := breakout_price > or_high ? "long" : "short"

second_chance_available := true

if show_trade_status_labels

label.new(x=bar_index + 1, y=(or_high + or_low) / 2, text="First Breakout Invalid\nSecond Chance Available", color=color.yellow, textcolor=color.black, style=label.style_label_center, size=size.tiny)

// REMOVED: Complex historical box cleanup to avoid lookahead bias

// Historical boxes will be cleaned up automatically by Pine Script's runtime

// Place entry orders after breakout - FIXED: Add barstate.isconfirmed for consistency

if barstate.isconfirmed and not daily_trades_complete and is_trading_day_allowed and ((breakout_occurred and not entry_placed and not na(breakout_candle_high) and breakout_direction != "invalid") or (second_trade_taken and not second_entry_placed and not na(breakout_candle_high) and breakout_direction != "invalid"))

// For long breakout

if breakout_direction == "long"

// Calculate stop loss based on selected method

if sl_type == "Breakout Candle"

stop_loss := breakout_candle_low - (sl_points * syminfo.mintick)

else

// Use opposite side of opening range (below opening range low)

stop_loss := or_low - (sl_points * syminfo.mintick)

if entry_type == "Retracement"

// Calculate retracement entry price (x% of breakout candle body)

breakout_candle_body = breakout_candle_high - breakout_candle_low

retracement_amount = breakout_candle_body * (retracement_percent / 100)

entry_price := breakout_candle_high - retracement_amount

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Long Retracement 2nd" : "Long Retracement"

// Place buy limit order at retracement level

strategy.entry(current_entry_id, strategy.long, limit=entry_price, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "BUY LIMIT (2nd)\n" + str.tostring(entry_price, "#.##") : "BUY LIMIT\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.green, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

// Immediate entry at breakout candle close

entry_price := breakout_price

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Instant Long 2nd" : "Instant Long"

// Place buy market order

strategy.entry(current_entry_id, strategy.long, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "BUY MARKET (2nd)\n" + str.tostring(entry_price, "#.##") : "BUY MARKET\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.green, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Calculate take profit based on risk:reward

risk_size = entry_price - stop_loss

take_profit := entry_price + (risk_size * risk_multiplier)

// FIXED: Set exit orders with proper entry ID and always include initial stop loss

if use_trailing_sl

// Initialize trailing stop and calculate initial risk

trailing_stop := stop_loss

trailing_active := true

initial_risk := math.abs(entry_price - stop_loss)

trailing_started := false

// FIXED: Always set initial stop loss, even with trailing enabled

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

else

// FIXED: Use stored entry ID

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

// Create trade visualization boxes (TradingView style) - FIXED: Minimum 8 bars width

// Blue profit zone box (from entry to take profit)

// Store trade boxes for historical display - FIXED: Remove time usage

array.push(historical_trade_boxes, current_profit_box)

array.push(historical_sl_boxes, current_sl_box)

array.push(historical_tp_boxes, na) // No TP box for long trades

// Add stop loss and take profit markers

if show_sl_tp_labels

label.new(x=bar_index, y=stop_loss, text="SL\n" + str.tostring(stop_loss, "#.##"), color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

label.new(x=bar_index, y=take_profit, text="TP\n" + str.tostring(take_profit, "#.##"), color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// ADDED: Set the appropriate entry flag based on which trade this is

if second_trade_taken

second_entry_placed := true

daily_trades_complete := true

else

entry_placed := true

// For short breakout

else if breakout_direction == "short"

// Calculate stop loss based on selected method

if sl_type == "Breakout Candle"

stop_loss := breakout_candle_high + (sl_points * syminfo.mintick)

else

// Use opposite side of opening range (above opening range high)

stop_loss := or_high + (sl_points * syminfo.mintick)

if entry_type == "Retracement"

// Calculate retracement entry price (x% of breakout candle body)

breakout_candle_body = breakout_candle_high - breakout_candle_low

retracement_amount = breakout_candle_body * (retracement_percent / 100)

entry_price := breakout_candle_low + retracement_amount

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Short Retracement 2nd" : "Short Retracement"

// Place sell limit order at retracement level

strategy.entry(current_entry_id, strategy.short, limit=entry_price, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "SELL LIMIT (2nd)\n" + str.tostring(entry_price, "#.##") : "SELL LIMIT\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

// Immediate entry at breakout candle close

entry_price := breakout_price

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Instant 2nd" : "Instant Short"

// Place sell market order

strategy.entry(current_entry_id, strategy.short, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "SELL MARKET (2nd)\n" + str.tostring(entry_price, "#.##") : "SELL MARKET\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Calculate take profit based on risk:reward

risk_size = stop_loss - entry_price

take_profit := entry_price - (risk_size * risk_multiplier)

// FIXED: Set exit orders with proper entry ID and always include initial stop loss

if use_trailing_sl

// Initialize trailing stop and calculate initial risk

trailing_stop := stop_loss

trailing_active := true

initial_risk := math.abs(entry_price - stop_loss)

trailing_started := false

// FIXED: Always set initial stop loss, even with trailing enabled

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

else

// FIXED: Use stored entry ID

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

// Create trade visualization boxes (TradingView style) - FIXED: Minimum 8 bars width

// Store trade boxes for historical display - FIXED: Remove time usage

array.push(historical_trade_boxes, current_profit_box)

array.push(historical_sl_boxes, current_sl_box)

array.push(historical_tp_boxes, na) // No TP box for short trades

// Add stop loss and take profit markers

if show_sl_tp_labels

label.new(x=bar_index, y=stop_loss, text="SL\n" + str.tostring(stop_loss, "#.##"), color=color.red, textcolor=color.white, style=label.style_label_up, size=size.tiny)

label.new(x=bar_index, y=take_profit, text="TP\n" + str.tostring(take_profit, "#.##"), color=color.blue, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// ADDED: Set the appropriate entry flag based on which trade this is

if second_trade_taken

second_entry_placed := true

daily_trades_complete := true

else

entry_placed := true

// === TRAILING STOP LOGIC ===

// FIXED: Proper trailing stop loss management

if use_trailing_sl and trailing_active and strategy.position_size != 0 and not na(current_entry_id)

if strategy.position_size > 0 // Long position

// Calculate current unrealized profit in points

current_profit = close - entry_price

profit_r = current_profit / initial_risk

// Check if we should start trailing (after X R profit)

if not trailing_started and profit_r >= profit_r_multiplier

trailing_started := true

// Start trailing from a level that's better than the initial stop

trailing_stop := math.max(trailing_stop, close - (atr * atr_multiplier))

// Update trailing stop if trailing has started

if trailing_started

// Calculate new trailing stop using ATR

potential_new_stop = close - (atr * atr_multiplier)

// Only move stop loss up (never down) and ensure it's better than initial SL

if potential_new_stop > trailing_stop and potential_new_stop > stop_loss

trailing_stop := potential_new_stop

// Update the exit order with new trailing stop

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=trailing_stop, limit=take_profit)

else if strategy.position_size < 0 // Short position

// Calculate current unrealized profit in points

current_profit = entry_price - close

profit_r = current_profit / initial_risk

// Check if we should start trailing (after X R profit)

if not trailing_started and profit_r >= profit_r_multiplier

trailing_started := true

// Start trailing from a level that's better than the initial stop

trailing_stop := math.min(trailing_stop, close + (atr * atr_multiplier))

// Update trailing stop if trailing has started

if trailing_started

// Calculate new trailing stop using ATR

potential_new_stop = close + (atr * atr_multiplier)

// Only move stop loss down (never up) and ensure it's better than initial SL

if potential_new_stop < trailing_stop and potential_new_stop < stop_loss

trailing_stop := potential_new_stop

// Update the exit order with new trailing stop

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=trailing_stop, limit=take_profit)

// === SESSION END CLOSE ===

// Force close all positions at configured session end time (optional)

// FIXED: Using configurable hour/minute with timezone

if force_session_close and current_hour == session_end_hour and current_minute == session_end_minute

// ADDED: Extend boxes immediately before session close to prevent timing issues

if not na(current_profit_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na // Clear reference after extending

if not na(current_sl_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na // Clear reference after extending

strategy.close_all(comment="Session End Close")

// === ALERTS ===

alert_once_long = (strategy.position_size > 0) and (strategy.position_size[1] == 0)

alert_once_short = (strategy.position_size < 0) and (strategy.position_size[1] == 0)

alertcondition(alert_once_long, title="Long Entry (Once)", message="Long Entry Signal")

alertcondition(alert_once_short, title="Short Entry (Once)", message="Short Entry Signal")