Multi-Indicator Hybrid RSI Scalping Strategy

RSI EMA VOLUME TREND DETECTION Price Action SCALPING Trailing Stop

Overview

The Multi-Indicator Hybrid RSI Scalping Strategy is a comprehensive trading system that combines multiple technical indicators designed specifically for short-term traders. This strategy integrates RSI indicators, moving averages, volume analysis, and price action patterns to form a multidimensional trading decision framework. At its core, the strategy employs a signal filtering mechanism with different sensitivity levels, allowing traders to adjust trading frequency and signal quality according to their risk preferences and market conditions. The strategy particularly emphasizes quick entries and precise exits, effectively controlling risk while securing profits through multiple exit mechanisms including take profit, stop loss, trailing stop, and quick exit functionalities.

Strategy Principles

The core principles of this strategy are based on the synergistic action of several key technical elements:

RSI Overbought/Oversold Signals: Uses the 14-period RSI indicator to identify overbought (>70) and oversold (<30) regions as the primary conditions for triggering trading signals.

Moving Average Trend Confirmation: The strategy incorporates 9, 21, and 50-period EMA moving averages to build a trend identification system. Market trend direction and strength are determined by observing the relationships between these moving averages. When EMA9>EMA21>EMA50, a strong uptrend is confirmed; when EMA9

Volume Verification: Compares current volume with the 10-period average volume to ensure trades occur in sufficiently active market environments, improving signal quality.

Price Action Patterns: Analyzes candlestick patterns, particularly strong bullish and bearish candles, by calculating the ratio of body to shadow to measure price momentum.

Multi-level Signal Sensitivity: The strategy features four different levels of signal sensitivity (“Very Easy”, “Easy”, “Medium”, “Strong”), allowing traders to adjust trading frequency and precision based on market conditions and risk preferences.

Intelligent Exit Mechanisms: The strategy implements multiple exit mechanisms, including fixed take profit and stop loss, RSI reversal quick exit signals, and trailing stop functionality that dynamically adjusts stop prices to lock in profits.

Daily Trade Limit: Built-in daily trade count limit function to prevent overtrading while maintaining the short-term trading style characteristics.

Strategy Advantages

Flexible Signal Sensitivity Adjustment: The strategy’s greatest advantage lies in its adjustable signal sensitivity system, where traders can choose from four levels ranging from “Very Easy” to “Strong,” finding a balance between trading frequency and signal quality. This allows the strategy to adapt to different market environments and personal trading styles.

Multiple Risk Management Mechanisms: The strategy integrates various risk control methods including fixed stop loss, trailing stop, and RSI-based quick exit, providing a comprehensive risk management framework. The trailing stop feature is particularly valuable as it progressively locks in gained profits while maintaining room for profit growth.

Comprehensive Technical Indicator Integration: By combining RSI, EMA, volume, and price action analysis, the strategy can assess market conditions from multiple dimensions, reducing false signals and improving trading accuracy.

Automated Trading Execution: The strategy is fully automated from signal generation and entry decisions to exit management, reducing emotional interference and ensuring trading discipline execution.

Real-time Visual Feedback: Through the built-in dashboard display function, traders can intuitively monitor strategy performance, current market conditions, and trading status, facilitating real-time decision adjustments.

Communication Integration Capability: The strategy supports Telegram message push functionality, enabling remote trade monitoring and signal notifications, enhancing operational convenience.

Strategy Risks

RSI Indicator Limitations: As the main signal source, RSI has inherent lag and false signal risks, especially in oscillating markets where frequent erroneous signals may occur. The solution is to combine trend filters and price action confirmation, or increase signal sensitivity requirements in sideways markets.

Overfitting Risk: The strategy contains numerous parameters, including RSI thresholds, EMA periods, and take profit/stop loss percentages, which can easily lead to overfitting. It is recommended to validate parameter robustness through historical data backtesting and forward testing, avoiding parameter combinations that only fit historical data.

Rapid Market Risk: In high volatility or market gap scenarios, fixed stop losses may not execute effectively, resulting in actual losses exceeding expectations. Consider using volatility-adjusted stop loss levels or adding market volatility filtering conditions to address this risk.

Trading Frequency Risk: Especially under low sensitivity settings, the strategy may generate too many trading signals, increasing transaction costs. Control trading frequency by reasonably setting daily trade limits and adjusting signal sensitivity.

Delayed Trend Reversal Response: Relying on EMA for trend judgment may not react quickly enough during the initial stages of trend reversals. Consider incorporating other trend confirmation indicators such as ADX or Parabolic SAR to enhance trend identification capabilities.

Strategy Optimization Directions

Adaptive Parameter Adjustment: The current strategy uses fixed RSI thresholds and EMA periods; an adaptive parameter system based on market volatility could be introduced. For example, automatically adjusting RSI overbought/oversold thresholds in high-volatility markets, or dynamically adjusting EMA period lengths based on different timeframes, improving the strategy’s adaptability to various market environments.

Enhanced Signal Filtering Mechanism: More dimensional market environment identification indicators could be introduced, such as ATR (Average True Range) for volatility assessment, ADX (Average Directional Index) for trend strength confirmation, or multi-timeframe analysis to improve signal quality. These additional filters can reduce false signals and increase trading success rates.

Optimized Capital Management System: The current position management is relatively simple; dynamic position adjustment based on account equity percentage or Kelly criterion-based fund allocation methods could be introduced. This would automatically adjust risk exposure for each trade based on historical trading performance and current market conditions.

Machine Learning Integration: Machine learning algorithms could be utilized to analyze historical trading data and automatically identify optimal parameter combinations for different market environments. Through supervised learning or reinforcement learning methods, models that can predict signal reliability could be established, further enhancing trading decision quality.

Expanded Market State Classification: A more detailed market state classification system could be developed, such as trending, range-bound oscillation, high volatility, etc., with customized trading rules and parameters for each market state. This layered strategy framework would better respond to different market environments.

Conclusion

The Multi-Indicator Hybrid RSI Scalping Strategy is a comprehensive and flexible short-term trading system that builds a multidimensional trading decision framework by integrating RSI, moving averages, volume, and price action analysis. Its greatest strengths lie in the flexible and adjustable signal sensitivity system and multiple risk management mechanisms, allowing traders to customize their trading strategy based on market environment and personal risk preferences.

Despite potential risks such as RSI indicator limitations and parameter optimization challenges, these risks can be effectively controlled through appropriate risk management and continuous optimization. Future optimization directions should focus on parameter adaptability, signal filtering enhancement, capital management optimization, and the introduction of advanced technologies such as machine learning to further improve the strategy’s robustness and adaptability.

Overall, this is a well-designed, structurally complete quantitative trading strategy with high practical value and flexibility. For traders seeking short-term trading opportunities with a focus on risk control, this system provides an excellent starting point that can be developed into a stable and reliable trading tool through continuous testing and adjustment.

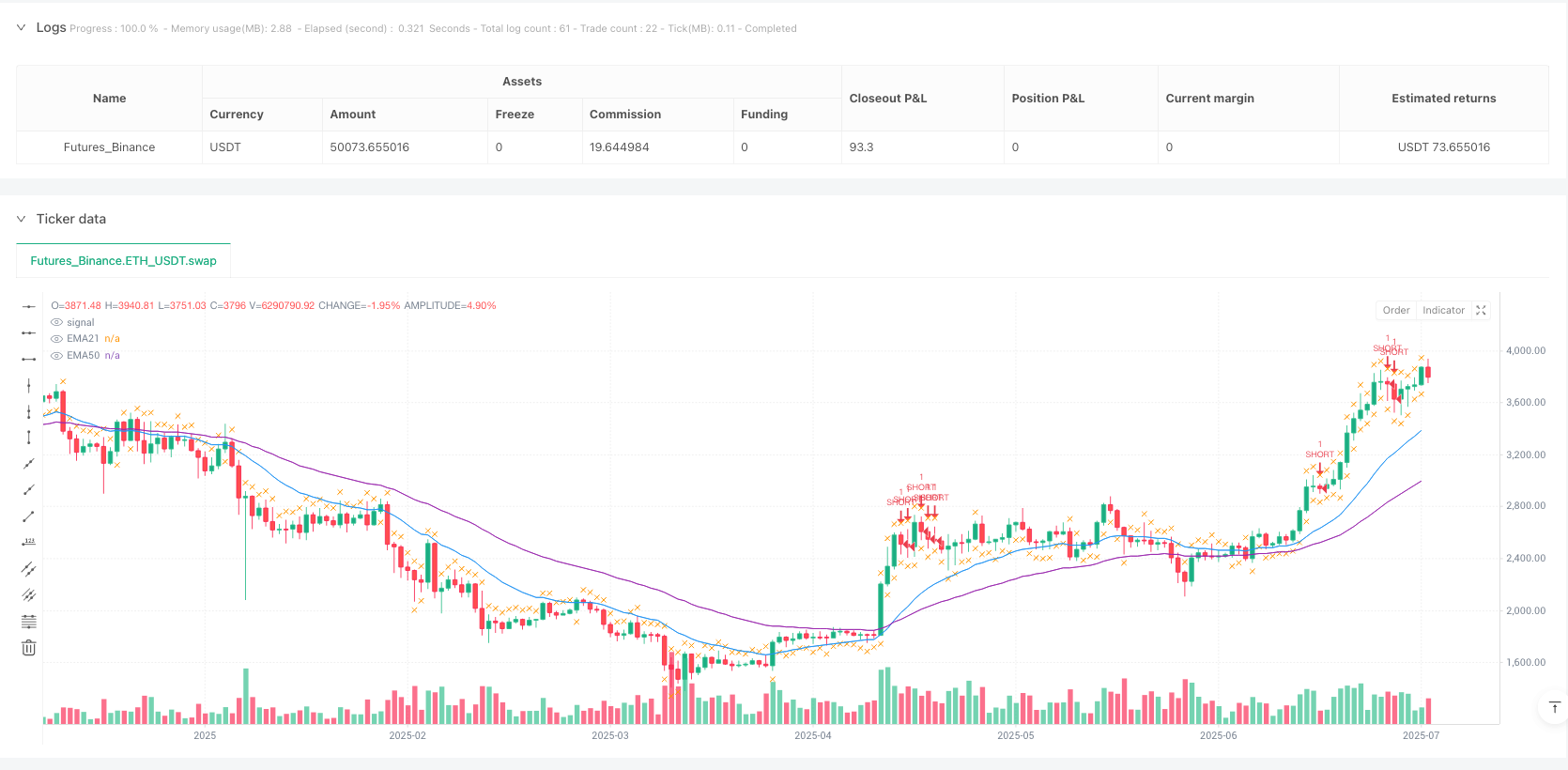

/*backtest

start: 2024-07-31 00:00:00

end: 2025-07-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("🔥 HYBRID SCALPING Bot - เข้าง่าย ออกแม่น", overlay=true, max_labels_count=50, calc_on_order_fills=false, process_orders_on_close=true, pyramiding=0)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📋 การตั้งค่าแบบ Hybrid - รวมจุดเด่นทั้งสอง

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// การตั้งค่าเทรด - Scalping Style

group_trading = "⚡ การตั้งค่า Scalping"

daily_trade_limit = input.int(15, "ลิมิตเทรดต่อวัน", minval=5, maxval=50, tooltip="Scalping = เทรดบ่อย", group=group_trading)

tp_percent = input.float(0.8, "Take Profit %", minval=0.3, maxval=3.0, tooltip="เล็กแต่ชัวร์", group=group_trading)

sl_percent = input.float(0.6, "Stop Loss %", minval=0.3, maxval=2.0, tooltip="ตัดขาดทุนเร็ว", group=group_trading)

// การตั้งค่าการออกเทรด - จาก Scalping Bot

use_quick_exit = input.bool(true, "ออกเทรดเร็ว", tooltip="ออกเมื่อ RSI กลับตัว", group=group_trading)

use_trailing_stop = input.bool(true, "ใช้ Trailing Stop", tooltip="ล็อคกำไรเมื่อขึ้น", group=group_trading)

trailing_percent = input.float(0.4, "Trailing Stop %", minval=0.2, maxval=1.0, group=group_trading)

// ความยากง่ายในการเข้าเทรด - จาก Debug Bot

group_sensitivity = "🎯 ความยากง่ายการเข้าเทรด"

signal_sensitivity = input.string("อ่อน", "ระดับความรุนแรง", options=["ง่ายมาก", "อ่อน", "กลาง", "แรง"],

tooltip="ง่ายมาก=เข้าเทรดบ่อยสุด, แรง=แม่นยำสุด", group=group_sensitivity)

// ฟิลเตอร์เสริม - ปรับได้ตามระดับ

use_trend_filter = input.bool(true, "ใช้ฟิลเตอร์เทรนด์", tooltip="เทรดตามเทรนด์เท่านั้น", group=group_sensitivity)

use_volume_filter = input.bool(false, "ใช้ฟิลเตอร์ Volume", tooltip="ต้องมี Volume สูง", group=group_sensitivity)

// การแสดงผล

group_display = "🎨 การแสดงผล"

show_signals = input.bool(true, "แสดงสัญญาณ", group=group_display)

show_exit_signals = input.bool(true, "แสดงสัญญาณออก", group=group_display)

show_dashboard = input.bool(true, "แสดง Dashboard", group=group_display)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📱 การตั้งค่า Telegram - แบบง่าย (จาก Debug Bot)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

group_telegram = "📱 Telegram"

enable_telegram = input.bool(false, "เปิด Telegram", group=group_telegram)

telegram_bot_token = input.string("", "Bot Token", group=group_telegram)

telegram_chat_id = input.string("", "Chat ID", group=group_telegram)

send_test_message = input.bool(false, "ส่งข้อความทดสอบ", group=group_telegram)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🧮 ตัวชี้วัดเทคนิค - Hybrid

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// RSI

rsi = ta.rsi(close, 14)

rsi_oversold = 30

rsi_overbought = 70

// Moving Averages

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

ema50 = ta.ema(close, 50)

// Trend

uptrend = ema21 > ema50

downtrend = ema21 < ema50

strong_uptrend = ema9 > ema21 and ema21 > ema50

strong_downtrend = ema9 < ema21 and ema21 < ema50

// Volume

avg_volume = ta.sma(volume, 10)

high_volume = volume > avg_volume * 1.2

volume_ok = use_volume_filter ? high_volume : true

// Price Action

bullish_candle = close > open

bearish_candle = close < open

strong_bullish_candle = close > open and (close - open) / (high - low) > 0.6

strong_bearish_candle = close < open and (open - close) / (high - low) > 0.6

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🎯 ระบบสัญญาณแบบ Hybrid

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// ระดับ "ง่ายมาก" - เข้าเทรดง่ายสุด

very_easy_buy = rsi < 60 and bullish_candle

very_easy_sell = rsi > 40 and bearish_candle

// ระดับ "อ่อน" - ใช้ RSI หลัก

easy_buy = rsi < rsi_oversold and bullish_candle

easy_sell = rsi > rsi_overbought and bearish_candle

// ระดับ "กลาง" - เพิ่มเงื่อนไข Trend

medium_buy = rsi < rsi_oversold and bullish_candle and (use_trend_filter ? uptrend : true)

medium_sell = rsi > rsi_overbought and bearish_candle and (use_trend_filter ? downtrend : true)

// ระดับ "แรง" - เงื่อนไขครบ (เหมือน Scalping Bot เดิม)

strong_buy = rsi < rsi_oversold and

strong_bullish_candle and

(use_trend_filter ? strong_uptrend : true) and

volume_ok and

close > ema21

strong_sell = rsi > rsi_overbought and

strong_bearish_candle and

(use_trend_filter ? strong_downtrend : true) and

volume_ok and

close < ema21

// เลือกสัญญาณตามระดับที่ตั้งค่า

buy_signal = signal_sensitivity == "ง่ายมาก" ? very_easy_buy :

signal_sensitivity == "อ่อน" ? easy_buy :

signal_sensitivity == "กลาง" ? medium_buy :

strong_buy

sell_signal = signal_sensitivity == "ง่ายมาก" ? very_easy_sell :

signal_sensitivity == "อ่อน" ? easy_sell :

signal_sensitivity == "กลาง" ? medium_sell :

strong_sell

// Exit Signals - ใช้จาก Scalping Bot

rsi_exit_long = rsi > 70 or rsi < 25

rsi_exit_short = rsi < 30 or rsi > 75

quick_exit_long = use_quick_exit and (rsi_exit_long or close < ema21)

quick_exit_short = use_quick_exit and (rsi_exit_short or close > ema21)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 📊 การจัดการเทรด

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

var int trades_today = 0

var bool test_sent = false

// รีเซ็ตทุกวัน

if dayofweek != dayofweek[1]

trades_today := 0

can_trade = trades_today < daily_trade_limit and strategy.position_size == 0

// ส่งข้อความทดสอบ Telegram - ใช้ format จาก Debug Bot

if enable_telegram and send_test_message and not test_sent and barstate.islast

test_message = "🧪 ทดสอบ HYBRID SCALPING Bot\n\n" +

"✅ การเชื่อมต่อสำเร็จ!\n" +

"📊 Symbol: " + syminfo.ticker + "\n" +

"💲 ราคาปัจจุบัน: $" + str.tostring(close, "#.####") + "\n" +

"⚡ ระดับ: " + signal_sensitivity + "\n" +

"⏰ เวลา: " + str.tostring(hour, "00") + ":" + str.tostring(minute, "00") + "\n\n" +

"🎯 Bot พร้อมทำงาน!"

alert(test_message, alert.freq_once_per_bar)

test_sent := true

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 💰 การดำเนินการเทรด - Scalping Logic

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// Variables for Scalping

var float entry_price = 0

var float highest_profit = 0

var float trailing_stop_price = 0

// Entry Long

if buy_signal and can_trade

strategy.entry("LONG", strategy.long)

trades_today := trades_today + 1

entry_price := close

highest_profit := 0

trailing_stop_price := close * (1 - sl_percent / 100)

// Set exits

strategy.exit("SL/TP", "LONG",

stop=close * (1 - sl_percent / 100),

limit=close * (1 + tp_percent / 100))

// Telegram Alert - ใช้ format ง่าย

if enable_telegram

entry_message = "🚀 HYBRID LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Entry: $" + str.tostring(close, "#.####") + "\n" +

"🛑 SL: $" + str.tostring(close * (1 - sl_percent / 100), "#.####") + "\n" +

"🎯 TP: $" + str.tostring(close * (1 + tp_percent / 100), "#.####") + "\n" +

"📈 RSI: " + str.tostring(rsi, "#.#") + "\n" +

"⚡ Level: " + signal_sensitivity + "\n" +

"📊 เทรดที่: " + str.tostring(trades_today)

alert(entry_message, alert.freq_once_per_bar)

// Entry Short

if sell_signal and can_trade

strategy.entry("SHORT", strategy.short)

trades_today := trades_today + 1

entry_price := close

highest_profit := 0

trailing_stop_price := close * (1 + sl_percent / 100)

// Set exits

strategy.exit("SL/TP", "SHORT",

stop=close * (1 + sl_percent / 100),

limit=close * (1 - tp_percent / 100))

// Telegram Alert

if enable_telegram

entry_message = "📉 HYBRID SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Entry: $" + str.tostring(close, "#.####") + "\n" +

"🛑 SL: $" + str.tostring(close * (1 + sl_percent / 100), "#.####") + "\n" +

"🎯 TP: $" + str.tostring(close * (1 - tp_percent / 100), "#.####") + "\n" +

"📈 RSI: " + str.tostring(rsi, "#.#") + "\n" +

"⚡ Level: " + signal_sensitivity + "\n" +

"📊 เทรดที่: " + str.tostring(trades_today)

alert(entry_message, alert.freq_once_per_bar)

// Trailing Stop Logic - จาก Scalping Bot

if strategy.position_size > 0 and use_trailing_stop // Long position

current_profit = (close - entry_price) / entry_price * 100

if current_profit > highest_profit

highest_profit := current_profit

trailing_stop_price := close * (1 - trailing_percent / 100)

if close <= trailing_stop_price

strategy.close("LONG", comment="Trailing Stop")

if enable_telegram

exit_message = "🔒 TRAILING STOP LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 Profit: +" + str.tostring(current_profit, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

if strategy.position_size < 0 and use_trailing_stop // Short position

current_profit = (entry_price - close) / entry_price * 100

if current_profit > highest_profit

highest_profit := current_profit

trailing_stop_price := close * (1 + trailing_percent / 100)

if close >= trailing_stop_price

strategy.close("SHORT", comment="Trailing Stop")

if enable_telegram

exit_message = "🔒 TRAILING STOP SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 Profit: +" + str.tostring(current_profit, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

// Quick Exit Logic - จาก Scalping Bot

if strategy.position_size > 0 and quick_exit_long

strategy.close("LONG", comment="Quick Exit")

if enable_telegram

current_pnl = (close - entry_price) / entry_price * 100

exit_message = "⚡ QUICK EXIT LONG!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 P&L: " + str.tostring(current_pnl, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

if strategy.position_size < 0 and quick_exit_short

strategy.close("SHORT", comment="Quick Exit")

if enable_telegram

current_pnl = (entry_price - close) / entry_price * 100

exit_message = "⚡ QUICK EXIT SHORT!\n" +

"📊 " + syminfo.ticker + "\n" +

"💰 Exit: $" + str.tostring(close, "#.####") + "\n" +

"📈 P&L: " + str.tostring(current_pnl, "#.##") + "%"

alert(exit_message, alert.freq_once_per_bar)

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// 🎨 การแสดงผลบนชาร์ต

// ═══════════════════════════════════════════════════════════════════════════════════════════════════════════════════

// Plot signals

plotshape(buy_signal and show_signals, "Buy", shape.triangleup, location.belowbar, color.lime, size=size.small)

plotshape(sell_signal and show_signals, "Sell", shape.triangledown, location.abovebar, color.red, size=size.small)

// Plot exit signals

plotshape(quick_exit_long and show_exit_signals, "Quick Exit Long", shape.xcross, location.abovebar, color.orange, size=size.tiny)

plotshape(quick_exit_short and show_exit_signals, "Quick Exit Short", shape.xcross, location.belowbar, color.orange, size=size.tiny)

// Plot EMAs

plot(ema21, "EMA21", color.blue, linewidth=1)

plot(ema50, "EMA50", color.purple, linewidth=1)

// Dashboard - ปรับปรุงให้ปลอดภัย

if show_dashboard and barstate.islast

var table dashboard = table.new(position.top_right, 2, 7, bgcolor=color.white, border_width=1)

table.cell(dashboard, 0, 0, "🔥 HYBRID", text_color=color.white, bgcolor=color.orange, text_size=size.small)

table.cell(dashboard, 1, 0, syminfo.ticker, text_color=color.white, bgcolor=color.orange, text_size=size.small)

table.cell(dashboard, 0, 1, "💰 P&L", text_color=color.black, text_size=size.small)

pnl_value = strategy.netprofit

pnl_color = pnl_value >= 0 ? color.green : color.red

table.cell(dashboard, 1, 1, "$" + str.tostring(pnl_value, "#.##"), text_color=pnl_color, text_size=size.small)

table.cell(dashboard, 0, 2, "⚡ Level", text_color=color.black, text_size=size.small)

table.cell(dashboard, 1, 2, signal_sensitivity, text_color=color.purple, text_size=size.small)

table.cell(dashboard, 0, 3, "📈 RSI", text_color=color.black, text_size=size.small)

rsi_color = rsi < 30 ? color.green : rsi > 70 ? color.red : color.gray

table.cell(dashboard, 1, 3, str.tostring(rsi, "#.#"), text_color=rsi_color, text_size=size.small)

table.cell(dashboard, 0, 4, "📊 เทรด", text_color=color.black, text_size=size.small)

table.cell(dashboard, 1, 4, str.tostring(trades_today) + "/" + str.tostring(daily_trade_limit), text_color=color.navy, text_size=size.small)

table.cell(dashboard, 0, 5, "📍 สถานะ", text_color=color.black, text_size=size.small)

position_text = strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "ว่าง"

position_color = strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.gray

table.cell(dashboard, 1, 5, position_text, text_color=position_color, text_size=size.small)

table.cell(dashboard, 0, 6, "🎯 Trend", text_color=color.black, text_size=size.small)

trend_text = uptrend ? "UP" : downtrend ? "DOWN" : "SIDE"

trend_color = uptrend ? color.green : downtrend ? color.red : color.gray

table.cell(dashboard, 1, 6, trend_text, text_color=trend_color, text_size=size.small)