Overview

The Multi-Indicator Integrated Momentum Trend Trading Strategy is a comprehensive trading system that combines three classic technical indicators, designed specifically for medium to long-term trend following and momentum capture. The core of this strategy lies in using EMA (Exponential Moving Average) to identify long-term trend direction, MACD (Moving Average Convergence Divergence) to confirm momentum shifts, and RSI (Relative Strength Index) to filter overbought and oversold regions, forming a triple confirmation system. This approach is particularly suitable for cryptocurrency trading on 1-hour, 4-hour, and daily timeframes, effectively identifying trend changes and providing clear entry and exit signals.

Strategy Principles

The core principle of this strategy is to confirm trading signals through three different dimensional indicators, reducing the possibility of false breakouts and erroneous signals:

Trend Identification (EMA Crossover): Uses the crossover of EMA 50 and EMA 200 to determine the long-term trend direction of the market. When EMA 50 crosses above EMA 200 forming a “Golden Cross,” it indicates an uptrend; when EMA 50 crosses below EMA 200 forming a “Death Cross,” it indicates a downtrend.

Momentum Confirmation (MACD Crossover): Employs the MACD indicator with standard parameters (12, 26, 9) as a confirmation tool for trend momentum. The MACD line crossing above the signal line indicates strengthening upward momentum, suitable for long positions; the MACD line crossing below the signal line indicates strengthening downward momentum, suitable for short positions.

Filter (RSI Range): Uses RSI(14) as a filter to avoid entering at extreme overbought or oversold areas. Buy conditions require RSI to be between 45 and 70, while sell conditions require RSI to be between 30 and 55, effectively avoiding poor entries in exhausted momentum zones.

Buy Signal Trigger Conditions: - EMA 50 > EMA 200 (Golden Cross confirming uptrend) - MACD line crosses above signal line (momentum turns positive) - RSI is between 45 and 70 (not overbought and has upward momentum)

Sell Signal Trigger Conditions: - EMA 50 < EMA 200 (Death Cross confirming downtrend) - MACD line crosses below signal line (momentum turns negative) - RSI is between 30 and 55 (not oversold and has downward momentum)

When executing the strategy, long positions are opened when all buy conditions are met, and short positions are opened when all sell conditions are met, while providing visual buy/sell signal markers and alert functions.

Strategy Advantages

Multi-level Confirmation System: By integrating trend indicators (EMA), momentum indicators (MACD), and oscillators (RSI), it forms a comprehensive market analysis framework that significantly reduces the risk of false signals.

Adaptability to Different Timeframes: The strategy is designed for multiple timeframes (1H, 4H, 1D), allowing traders to flexibly choose according to their trading style. Short-term traders can focus on 1-hour charts, medium-term traders can use 4-hour charts, and long-term investors can rely on daily charts.

Integrated Risk Management: The strategy includes take-profit and stop-loss settings, defaulting to 3% and 1.5% respectively, which can be adjusted according to different timeframes and asset volatility, providing a systematic approach to fund management.

Clear and Explicit Signals: By visually marking buy and sell signal points, traders can intuitively understand the operation of the strategy, facilitating backtesting and optimization.

Customizable Parameters: All key parameters (EMA length, RSI levels, etc.) can be adjusted through input fields, allowing the strategy to adapt to different market environments and personal preferences.

Balance Between Trend Following and Reversal Capture: While adhering to the major trend, the strategy can capture trend reversal points relatively early through the combination of MACD and RSI, improving the timeliness of trades.

Strategy Risks

Lag Risk: Both EMA and MACD are lagging indicators, which may lead to delayed entry or exit signals in rapidly changing markets. Especially EMA 200, as a long-term trend indicator, responds slowly in volatile markets and may miss important turning points.

Poor Performance in Ranging Markets: In oscillating markets without clear trends, the strategy may generate frequent false signals, leading to consecutive losing trades. When prices fluctuate frequently between EMA 50 and EMA 200, the strategy may face a “sawtooth effect.”

Parameter Sensitivity: Strategy performance is highly dependent on the selected parameters. For example, if RSI buy and sell thresholds are improperly set, they may cause missed opportunities or premature entries. Different markets and timeframes may require different parameter optimizations.

Indicator Conflicts: Under certain market conditions, the three indicators may give contradictory signals. For example, EMA may show an uptrend, while RSI has entered the overbought area, and MACD may be at a downward crossing point, requiring additional judgment from traders in such situations.

Liquidity Risk: In cryptocurrency markets with low liquidity, even if signals are accurate, slippage and execution risks may be encountered, affecting actual trading results.

To mitigate these risks, it is recommended to: - Adjust stop-loss levels according to different timeframes and asset characteristics - Consider adding volume indicators as additional confirmation - Pause automated trading before major market events - Regularly re-optimize parameters to adapt to market changes

Strategy Optimization Directions

Dynamic Parameter Adjustment Mechanism: The current strategy uses fixed EMA, MACD, and RSI parameters. Consider implementing an adaptive parameter system that automatically adjusts indicator parameters based on market volatility. For example, shortening EMA periods in high-volatility markets and lengthening them in low-volatility markets.

Add Volume Confirmation: Incorporate volume analysis into the strategy, confirming signals as valid only when supported by volume. Add Volume-Weighted Moving Average (VWMA) or volume change rate indicators as a fourth confirmation factor.

Market Environment Classification: Develop a market state recognition mechanism to distinguish between trending and ranging markets, applying different trading rules in different market environments. For example, tightening the RSI range or pausing trading when the market is identified as ranging.

Optimize Stop-Loss Strategy: Implement dynamic stop-loss based on ATR (Average True Range) rather than fixed percentage stops, better adapting to changes in market volatility. Also, consider introducing trailing stops to lock in more profits in trending markets.

Integrate Multi-Timeframe Analysis: Implement a multi-timeframe confirmation system, executing trades only when signals from higher timeframes and the current timeframe are consistent. For example, when trading on a 4-hour chart, the daily chart should also show the same trend direction.

Add Machine Learning Components: Train models using historical data to predict the success probability of various indicator combinations, providing an additional probability dimension for trading decisions. This can help the system identify the signal combinations most likely to succeed.

Optimize Position Management: Dynamically adjust position size based on signal strength and multi-indicator consistency level, rather than using fixed percentage fund management. The stronger the signal and the higher the indicator consistency, the larger the allocated fund proportion.

These optimization directions will make the strategy more comprehensive and adaptive, improving its robustness and profitability in different market environments.

Summary

The Multi-Indicator Integrated Momentum Trend Trading Strategy is a complete trading system that organically combines three classic technical indicators: EMA, MACD, and RSI. Through its triple mechanism of trend identification, momentum confirmation, and range filtering, the strategy effectively filters out noise and captures high-probability trading opportunities. Its core advantages lie in multi-level signal confirmation and flexible parameter settings, making it suitable for cryptocurrency trading across different timeframes.

Although the strategy faces challenges such as lag risk and poor performance in ranging markets, by implementing the suggested optimization directions—such as dynamic parameter adjustment, volume confirmation, market environment classification, and multi-timeframe analysis—its performance can be significantly enhanced. Particularly, integrating machine learning components and optimizing position management solutions will evolve this strategy from a rule-based system into a more intelligent and adaptive trading tool.

For traders, this strategy provides a structured analytical framework and clear trading rules, but ultimate success still depends on a deep understanding of market characteristics, reasonable parameter adjustments, and strict risk management execution. As a foundational framework, this strategy has high extensibility and optimization potential, allowing for continuous improvement based on personal trading style and market changes.

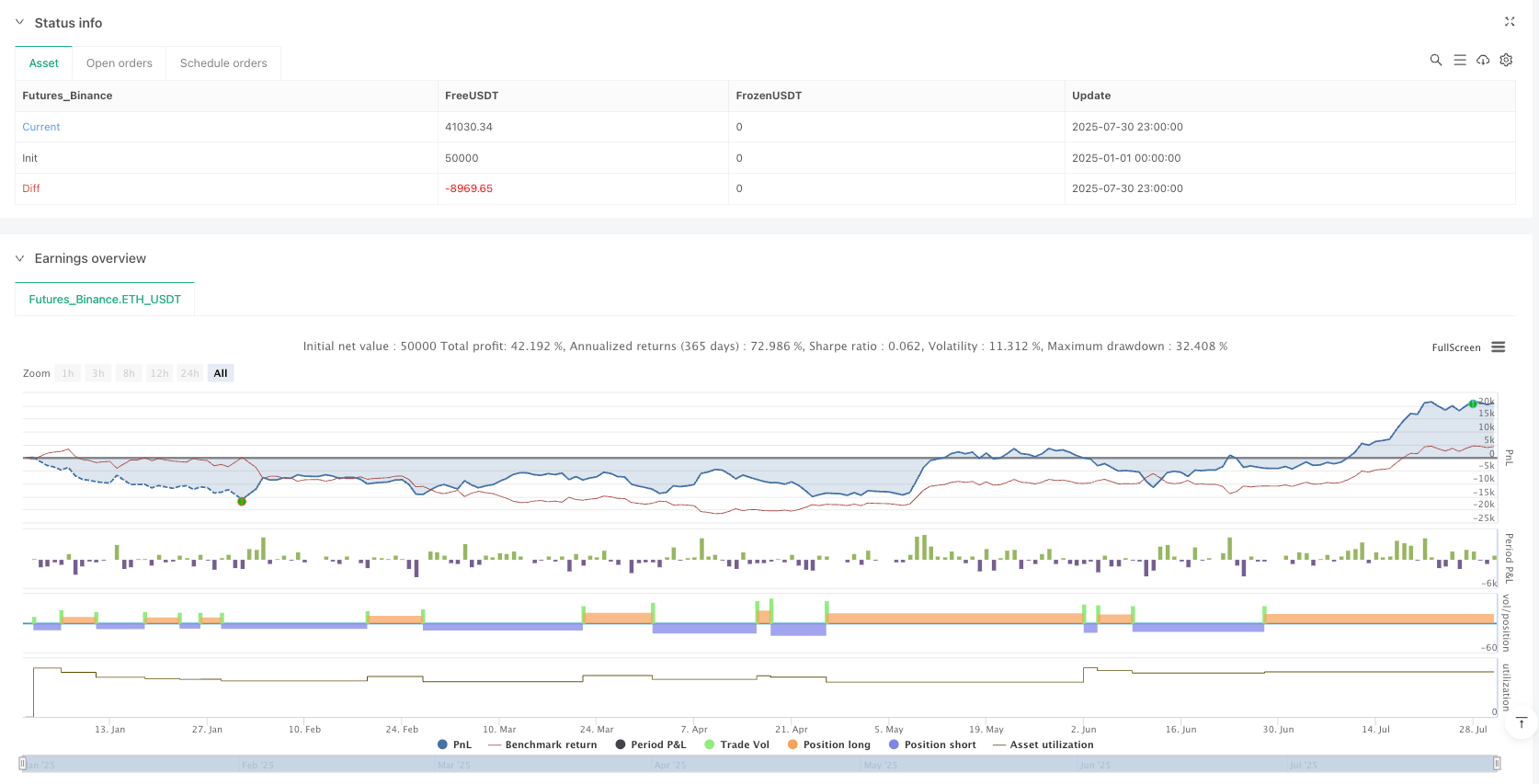

/*backtest

start: 2025-01-01 00:00:00

end: 2025-07-31 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA + MACD + RSI Crypto Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

/// === INPUTS === ///

emaFastLen = input.int(50, title="Fast EMA")

emaSlowLen = input.int(200, title="Slow EMA")

rsiLen = input.int(14, title="RSI Length")

rsiBuyLvl = input.int(45, title="Min RSI for Buy")

rsiSellLvl = input.int(55, title="Max RSI for Sell")

/// === INDICATORS === ///

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

rsi = ta.rsi(close, rsiLen)

/// === CONDITIONS === ///

isBullish = emaFast > emaSlow

isBearish = emaFast < emaSlow

macdBullish = ta.crossover(macdLine, signalLine)

macdBearish = ta.crossunder(macdLine, signalLine)

rsiBullish = rsi > rsiBuyLvl and rsi < 70

rsiBearish = rsi < rsiSellLvl and rsi > 30

buySignal = isBullish and macdBullish and rsiBullish

sellSignal = isBearish and macdBearish and rsiBearish

/// === STRATEGY EXECUTION === ///

if (buySignal)

strategy.entry("BUY", strategy.long)

if (sellSignal)

strategy.entry("SELL", strategy.short)

/// === PLOT SIGNALS === ///

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

/// === ALERTS === ///

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Triggered")